Kentucky Unrestricted Charitable Contribution of Cash

Description

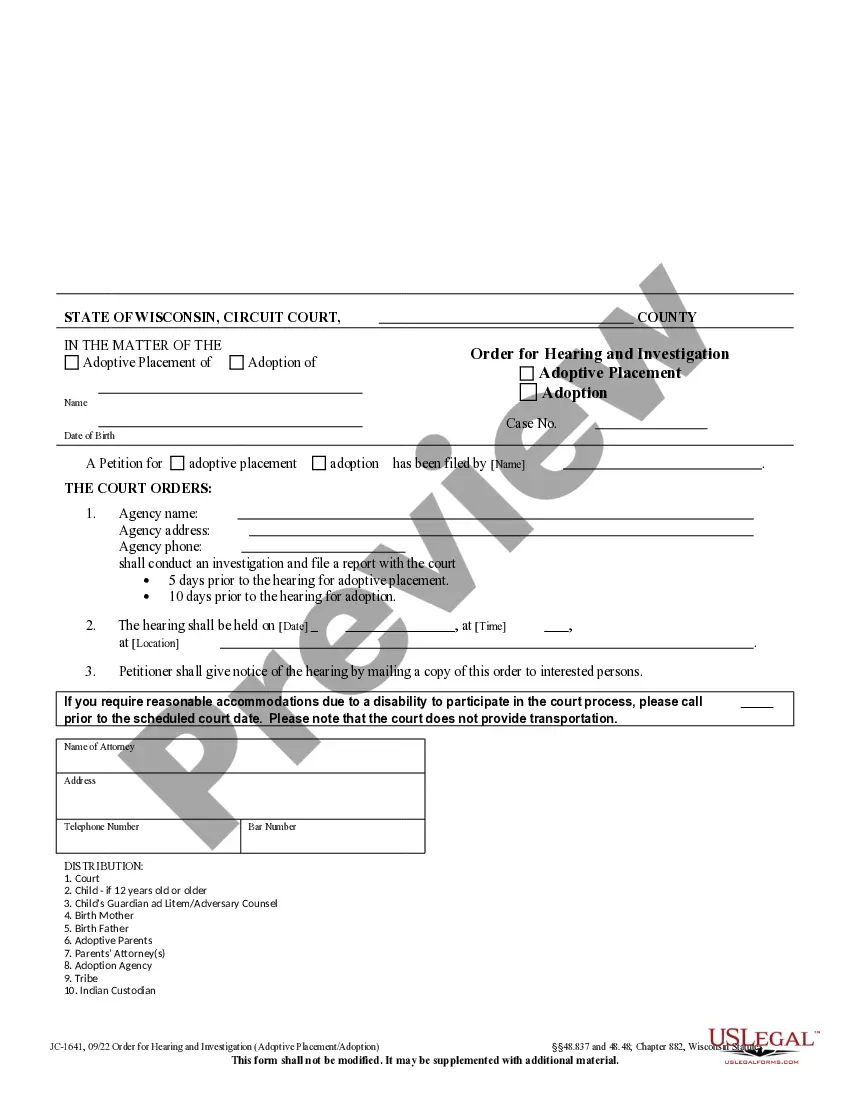

How to fill out Unrestricted Charitable Contribution Of Cash?

Have you been within a place where you need files for possibly enterprise or person purposes just about every working day? There are a lot of legitimate record templates available on the Internet, but finding types you can rely is not simple. US Legal Forms gives a huge number of develop templates, such as the Kentucky Unrestricted Charitable Contribution of Cash, which can be created to fulfill federal and state specifications.

Should you be previously familiar with US Legal Forms site and also have a merchant account, basically log in. After that, you can acquire the Kentucky Unrestricted Charitable Contribution of Cash design.

If you do not provide an bank account and want to begin to use US Legal Forms, abide by these steps:

- Discover the develop you will need and make sure it is for that proper metropolis/county.

- Use the Review option to examine the form.

- See the explanation to actually have chosen the correct develop.

- In case the develop is not what you are looking for, utilize the Research area to discover the develop that fits your needs and specifications.

- If you discover the proper develop, click on Get now.

- Pick the costs plan you want, fill in the desired information and facts to make your bank account, and pay money for the order using your PayPal or credit card.

- Decide on a handy file formatting and acquire your copy.

Locate all of the record templates you possess purchased in the My Forms menus. You can get a further copy of Kentucky Unrestricted Charitable Contribution of Cash any time, if necessary. Just click on the needed develop to acquire or printing the record design.

Use US Legal Forms, the most extensive variety of legitimate forms, in order to save efforts and stay away from faults. The assistance gives appropriately created legitimate record templates that can be used for a variety of purposes. Produce a merchant account on US Legal Forms and initiate producing your way of life easier.

Form popularity

FAQ

Campaign funds leftover after an election may be redesignated for a future election to seek the same office so long as the funds are not ?surplus funds.? In addition, campaign funds leftover after an election may be transferred to a new bank account for a future election to seek a different office so long as the funds ...

Federal law limits cash contributions to 60 percent of your federal adjusted gross income (AGI). California limits cash contributions to 50 percent of your federal AGI.

A candidate may not make a contribution over the $5,500 limit to another candidate in jursidictions subject to the default state contribution limit, with limited exceptions related to recall elections, legal defense funds, and candidate controlled ballot measure committees.

Kentucky does not prohibit a deduction for amounts contributed to any religious or denominational club, group or establishment or any organization that: operates solely for charitable or educational purposes; and.

It is important to know that you are choosing between taking the standard deduction and itemizing your donation deductions on Form 1040, Schedule A. You cannot do both.

You may deduct what you actually gave to organizations that are religious, charitable, educational, scientific or literary in purpose. You may also deduct what you gave to organizations that work to prevent cruelty to children or animals.

What are the limits on contributions that PACs may make to campaigns? PACs may contribute up to $2,100 to any candidate or slate of candidates per election. This means the PAC may contribute $2,100 in a primary and, if the candidate or slate wins the primary, the PAC may contribute $2,100 in the general election.

The new threshold is 60 percent of AGI for cash contributions held for over a year, and 30 percent of AGI for non-cash assets. The good news is that the standard deduction is now higher to account for inflation, rising to $12,950 for people who file individually and $25,900 for married couples who file joint returns.