A Kentucky Balloon Unsecured Promissory Note is a legally binding document that outlines the terms and conditions of a loan between two parties in Kentucky. This promissory note is commonly used when the borrower requests a larger loan amount and prefers to make smaller monthly payments over a set period with a larger payment due at the end, which is known as the "balloon payment." Unlike a secured promissory note, an unsecured promissory note does not require any collateral to secure the loan. Instead, it relies solely on the borrower's creditworthiness and trustworthiness to ensure repayment. The absence of collateral provides more flexibility to the borrower, but it also means that the lender accepts a higher level of risk. The Kentucky Balloon Unsecured Promissory Note contains essential details such as the names and contact information of the borrower and lender, the loan amount, the interest rate, and the loan term. Additionally, it specifies the repayment schedule, including the monthly installment amounts and the due date for the balloon payment. This note also includes provisions for late payment penalties and any other relevant terms agreed upon by the parties. While Kentucky Balloon Unsecured Promissory Notes share similar features, there may be variations based on specific loan requirements or borrower-lender agreements. Some different types of Kentucky Balloon Unsecured Promissory Notes include: 1. Personal Loan Balloon Unsecured Promissory Note: This note is used when an individual borrows money for personal purposes, such as debt consolidation, home improvement, or unexpected expenses. The terms are typically more flexible but still adhere to the Kentucky state laws governing loan agreements. 2. Business Loan Balloon Unsecured Promissory Note: This note is suitable for small business owners seeking funding without pledging collateral. It allows entrepreneurs to obtain additional capital for business expansion, equipment purchase, or working capital needs while maintaining their financial flexibility. 3. Medical Loan Balloon Unsecured Promissory Note: Specifically designed for medical expenses, this note helps individuals cover costs related to medical procedures, treatments, or other healthcare services. It offers options for manageable monthly payments and a balloon payment at the end of the agreed-upon term. 4. Education Loan Balloon Unsecured Promissory Note: This note assists students or their parents in financing educational expenses, including tuition fees, books, and living costs. It grants the borrowers an extended repayment period while giving them the ability to make smaller monthly payments. In conclusion, a Kentucky Balloon Unsecured Promissory Note is a flexible and convenient tool for borrowing or lending funds in Kentucky without requiring collateral. It provides clear terms and conditions for repayment, including a larger balloon payment due at the end of the loan term. Various types of such promissory notes, including personal, business, medical, and education-focused, cater to different borrowing needs in the state.

Kentucky Balloon Unsecured Promissory Note

Description

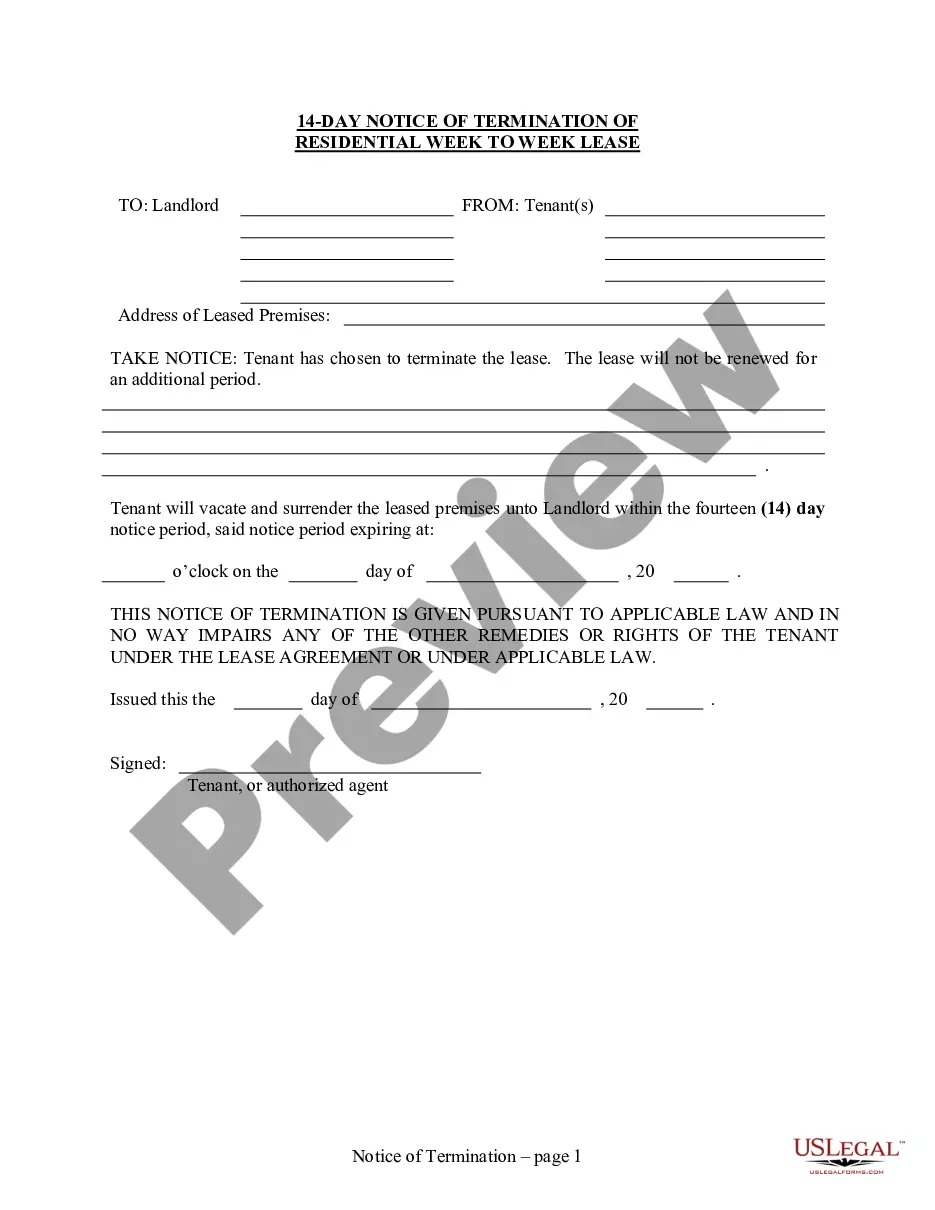

How to fill out Balloon Unsecured Promissory Note?

US Legal Forms - one of the biggest collections of legal documents in the United States - offers a wide array of legal document templates available for download or printing.

By utilizing the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the most recent versions of forms such as the Kentucky Balloon Unsecured Promissory Note within minutes.

If you have an account, Log In to download the Kentucky Balloon Unsecured Promissory Note from your US Legal Forms library. The Acquire button will appear on each document you view. You have access to all previously downloaded forms in the My documents section of your account.

Process the payment. Use your Visa, Mastercard, or PayPal account to complete the transaction.

Select the format and download the document to your device. Make changes. Fill, modify, print, and sign the downloaded Kentucky Balloon Unsecured Promissory Note. Every document you save in your account has no expiration date and belongs to you indefinitely. So, if you want to download or print another copy, just visit the My documents section and click on the document you need. Access the Kentucky Balloon Unsecured Promissory Note with US Legal Forms, one of the largest collections of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the right form for your area/region.

- Click the Preview button to review the form's details.

- Examine the form summary to ensure that you have chosen the correct document.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the payment option you prefer and provide your information to register for an account.

Form popularity

FAQ

The primary difference between a secured and unsecured promissory note lies in collateral. A secured promissory note is backed by assets, meaning that the lender can seize collateral if the borrower defaults. In contrast, an unsecured promissory note, like the Kentucky Balloon Unsecured Promissory Note, relies solely on the borrower's promise, thus presenting a higher risk for lenders.

No, an unsecured promissory note is generally not considered a security. It is a straightforward debt agreement between a lender and a borrower without any investment characteristics commonly associated with securities. However, understanding the legal framework around Kentucky Balloon Unsecured Promissory Notes can provide clarity on your obligations.

Promissory notes often qualify as exempt securities, particularly if they meet certain criteria outlined by the SEC. For a Kentucky Balloon Unsecured Promissory Note, the exemption may apply if it is issued for less than nine months or cannot be readily resold. Reviewing the specifics of your note with a legal professional can help you fully understand its status.

Promissory notes, including Kentucky Balloon Unsecured Promissory Notes, generally fall under the category of debt instruments rather than traditional debt securities. They represent a promise to repay a specific amount rather than being traded on the open market. This distinction is essential for borrowers and lenders to understand as they navigate their financial obligations.

An unsecured promissory note, such as a Kentucky Balloon Unsecured Promissory Note, generally does not qualify as a security under the Securities Act. Instead, it functions as a private agreement between the borrower and lender without specific collateral backing it. Exploring this distinction can provide clarity as you engage in lending or borrowing practices.

A promissory note can be considered a type of security depending on the context and jurisdiction. Specifically, a Kentucky Balloon Unsecured Promissory Note may not meet the strict definitions of a security under federal law, but it is still a legally binding financial instrument. Understanding the nuances of this classification can help you navigate your financial transactions more confidently.

Companies often issue unsecured notes like the Kentucky Balloon Unsecured Promissory Note to raise capital without tying up physical assets as collateral. This approach allows them to access funds quickly while maintaining flexibility in their financial structure. Additionally, unsecured notes can attract more investors since they typically offer higher interest rates as compensation for the increased risk. This strategy can be advantageous in managing short-term financial needs.

Yes, a promissory note, including a Kentucky Balloon Unsecured Promissory Note, is a legally binding document that can hold up in court. When properly executed, it serves as evidence of a debt that obligates the borrower to repay under the agreed terms. Courts generally favor clear agreements, making it crucial to ensure your note is well-drafted. Having the right legal support can further solidify your position.