The Kentucky Security Agreement for Promissory Note is a legally binding document that is designed to provide protection to the lender or creditor in a financial transaction. This agreement outlines the terms and conditions under which a borrower or debtor pledges collateral to secure a promissory note or loan. The main purpose of the Kentucky Security Agreement for Promissory Note is to establish a lien on personal property or other valuable assets owned by the borrower. By creating a security interest in these assets, the lender can have a legal claim on them in case of default or non-payment by the borrower. The Kentucky Security Agreement for Promissory Note typically includes essential information such as the names and addresses of both the creditor (lender) and debtor (borrower). It also describes in detail the assets being pledged as collateral, including their value, description, and identification number if applicable. The agreement may also designate the specific rights and responsibilities of both parties involved. In addition to the general Kentucky Security Agreement for Promissory Note, there are a few specific types that may be used in different circumstances. These include: 1. Floating Lien Security Agreement: This type of agreement involves collateral that may change over time, such as inventory or accounts receivable. The collateral "floats" as new assets are acquired, allowing the lender to maintain a security interest in all assets, both existing and future. 2. Real Estate Security Agreement: When the collateral being pledged is real estate, a separate agreement is necessary to establish the security interest. This type of agreement would outline the details of the property, including its legal description, address, and any other relevant information. 3. Agricultural Lien Security Agreement: For loans specifically related to agricultural activities, a separate security agreement may be used. This agreement would address the unique aspects of agricultural collateral, such as crops, livestock, or farming equipment. It is important to note that the specific requirements and provisions of the Kentucky Security Agreement for Promissory Note may vary depending on the nature of the loan and the preferences of the parties involved. It is advisable to consult with a legal professional to ensure that the agreement accurately reflects the intentions and protects the rights of both parties.

Kentucky Security Agreement for Promissory Note

Category:

State:

Multi-State

Control #:

US-00601-F

Format:

Word;

Rich Text

Instant download

Description

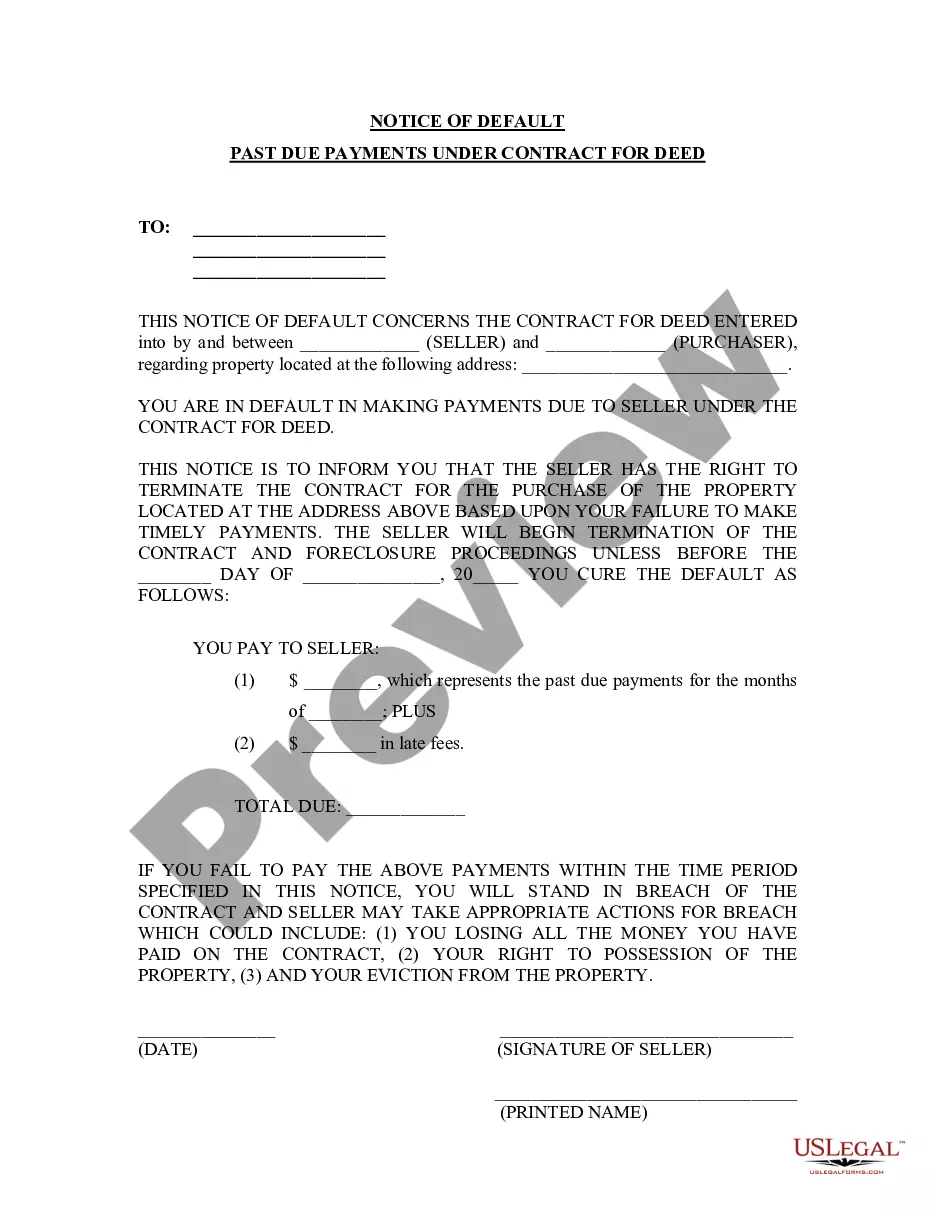

This Security Agreement for Promissory Note is an agreement that the Lender has required as a condition to making the Loan to the Borrower. The Borrower will offer collateral to the Lender in return for the advancing of the loan. This form can be used in all states.

The Kentucky Security Agreement for Promissory Note is a legally binding document that is designed to provide protection to the lender or creditor in a financial transaction. This agreement outlines the terms and conditions under which a borrower or debtor pledges collateral to secure a promissory note or loan. The main purpose of the Kentucky Security Agreement for Promissory Note is to establish a lien on personal property or other valuable assets owned by the borrower. By creating a security interest in these assets, the lender can have a legal claim on them in case of default or non-payment by the borrower. The Kentucky Security Agreement for Promissory Note typically includes essential information such as the names and addresses of both the creditor (lender) and debtor (borrower). It also describes in detail the assets being pledged as collateral, including their value, description, and identification number if applicable. The agreement may also designate the specific rights and responsibilities of both parties involved. In addition to the general Kentucky Security Agreement for Promissory Note, there are a few specific types that may be used in different circumstances. These include: 1. Floating Lien Security Agreement: This type of agreement involves collateral that may change over time, such as inventory or accounts receivable. The collateral "floats" as new assets are acquired, allowing the lender to maintain a security interest in all assets, both existing and future. 2. Real Estate Security Agreement: When the collateral being pledged is real estate, a separate agreement is necessary to establish the security interest. This type of agreement would outline the details of the property, including its legal description, address, and any other relevant information. 3. Agricultural Lien Security Agreement: For loans specifically related to agricultural activities, a separate security agreement may be used. This agreement would address the unique aspects of agricultural collateral, such as crops, livestock, or farming equipment. It is important to note that the specific requirements and provisions of the Kentucky Security Agreement for Promissory Note may vary depending on the nature of the loan and the preferences of the parties involved. It is advisable to consult with a legal professional to ensure that the agreement accurately reflects the intentions and protects the rights of both parties.

Free preview

How to fill out Kentucky Security Agreement For Promissory Note?

It is feasible to spend hours online trying to locate the legal document format that meets the state and federal requirements you require.

US Legal Forms offers thousands of legal forms that are evaluated by experts.

You can easily download or print the Kentucky Security Agreement for Promissory Note from my service.

Once you have discovered the format you need, simply click Purchase now to proceed.

- If you already possess a US Legal Forms account, you may Log In and click on the Download button.

- Subsequently, you can complete, modify, print, or sign the Kentucky Security Agreement for Promissory Note.

- Every legal document format you obtain is yours indefinitely.

- To receive another copy of any secured form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- Firstly, ensure that you have selected the correct document format for the state/city of your choice.

- Examine the form description to verify that you have chosen the appropriate form.

- If available, utilize the Review button to view the document format as well.

- If you wish to find another version of the form, utilize the Lookup section to search for the format that fulfills your requirements and needs.