A Kentucky Secured Promissory Note is a legally-binding document that outlines the terms and conditions of a loan agreement between two parties in the state of Kentucky. It serves as evidence of a debt owed by the borrower to the lender and ensures that the borrower commits to repay the loan in a timely manner. A secured promissory note in Kentucky involves the inclusion of collateral to secure the loan, providing additional protection for the lender in case the borrower fails to make the required payments. The collateral could be any valuable asset owned by the borrower, such as real estate, vehicles, or valuable personal belongings. By pledging collateral, the borrower reduces the lender's risk and may be able to secure a more favorable interest rate or loan terms. Several types of secured promissory notes exist in Kentucky, including real estate secured promissory notes, vehicle secured promissory notes, and personal property secured promissory notes. Real estate secured promissory notes involve the use of real property or land as collateral, ensuring that if the borrower defaults, the lender has the right to seize and sell the property to recoup the outstanding debt. Vehicle secured promissory notes use vehicles, such as cars, motorcycles, or boats, as collateral. Similarly, personal property secured promissory notes involve securing the loan with valuable personal belongings, such as jewelry or electronics. When drafting a Kentucky Secured Promissory Note, it is crucial to include specific details such as the names and contact information of both parties, the loan amount, the repayment schedule, the interest rate, and any penalties or fees related to late or missed payments. Additionally, the note should clearly state the collateral being pledged and outline the process for default, repossession, and sale of the collateral to satisfy the remaining debt. By utilizing a Kentucky Secured Promissory Note, both borrowers and lenders can establish a clear understanding of the loan terms and ensure that both parties are protected in the event of default or non-payment. It is advisable to seek legal counsel or use templates provided by reputable sources to ensure the note complies with Kentucky state laws and regulations.

Kentucky Secured Promissory Note

Description

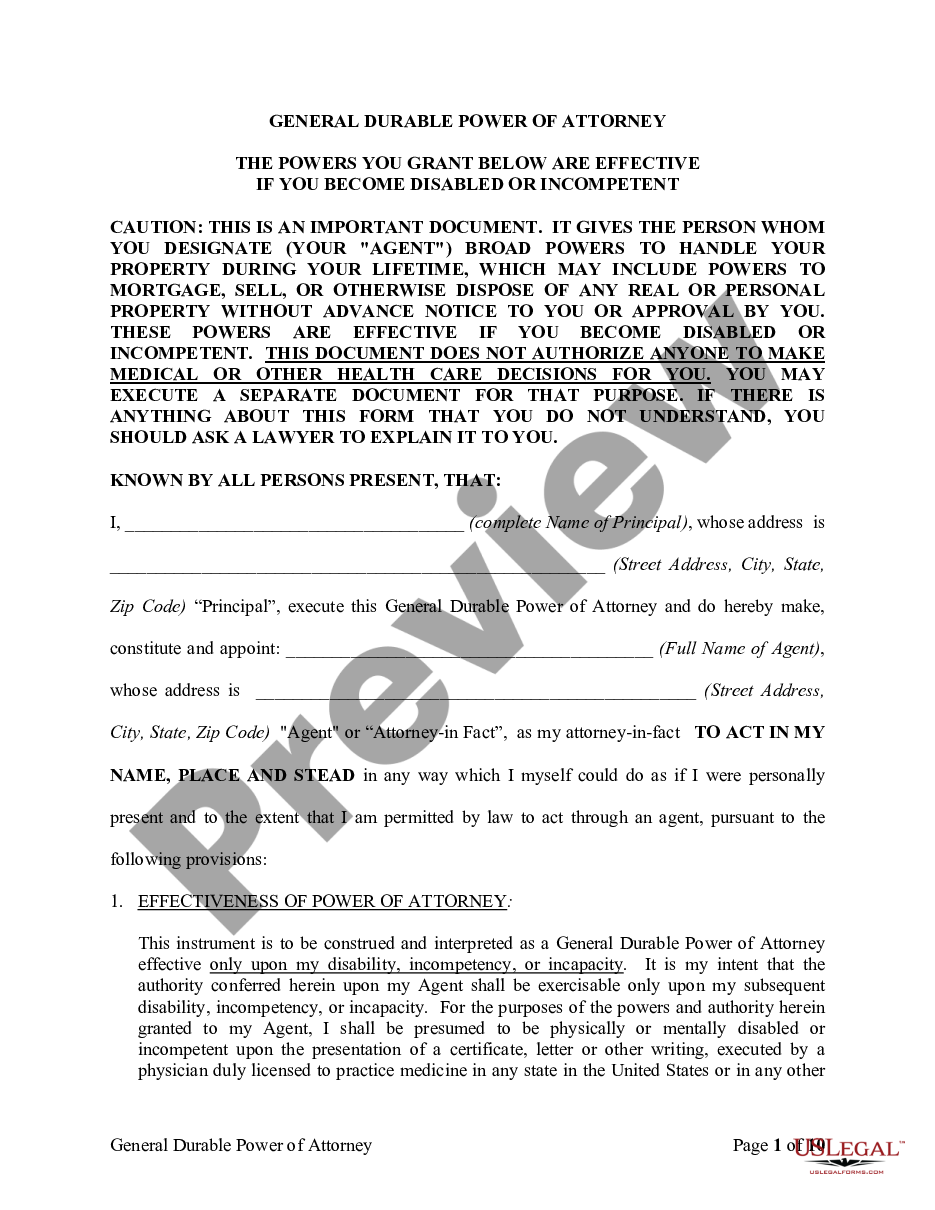

How to fill out Kentucky Secured Promissory Note?

You may spend hours online looking for the legal document template that aligns with the state and federal requirements you possess.

US Legal Forms provides a vast array of legal documents that have been reviewed by professionals.

You can easily download or print the Kentucky Secured Promissory Note from your services.

If available, use the Review button to look through the document template as well.

- If you already possess a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can complete, edit, print, or sign the Kentucky Secured Promissory Note.

- Every legal document template you purchase is yours eternally.

- To retrieve another copy of a purchased form, visit the My documents tab and click on the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, verify that you have selected the correct document template for the area/city of your choice.

- Review the form details to ensure you have chosen the appropriate form.

Form popularity

FAQ

Recording a promissory note is not a legal requirement in Kentucky, but it is prudent to keep a copy for your records. If the note is secured, consider filing a financing statement to establish a public record of your claim. Using a platform like uslegalforms can help ensure that your Kentucky Secured Promissory Note is drafted and stored correctly, providing you with peace of mind.

Generally, a promissory note itself does not appear on your credit report. However, if payments are missed and the lender reports this default, it could affect your credit score. Thus, maintaining timely payments on a Kentucky Secured Promissory Note is essential to protect your financial reputation.

While a promissory note does not need to be filed with a government agency, it is crucial to keep it on file with your personal or business records. If the note is secured by collateral, you may want to consider filing a financing statement with the Secretary of State in Kentucky. This step provides public notice of your security interest in the collateral specified in the Kentucky Secured Promissory Note.

For tax purposes, you should report any interest earned from a Kentucky Secured Promissory Note as income. This income typically goes on your tax return under interest income. It is wise to keep detailed records of payments received throughout the year to simplify the reporting process.

Recording a promissory note payable involves maintaining accurate financial records for both parties. The borrower should document the agreement in their accounting system, noting the principal amount, interest rate, and due dates. This process ensures that all obligations and payments related to the Kentucky Secured Promissory Note are properly tracked for future reference.

In Kentucky, a promissory note must clearly specify the amount owed, the interest rate, and the repayment schedule. Additionally, the terms must be agreed upon by both parties, which should include signatures and dates. To ensure enforceability, it is recommended to have it in writing, and both parties should keep a copy of the Kentucky Secured Promissory Note.

The format of a promissory note generally includes the date, names of the parties, the amount borrowed, interest rate, repayment terms, and any collateral details if it is a secured note. A clear and concise structure is essential to prevent misunderstandings. Utilizing services like US Legal Forms can simplify the creation process, ensuring you have a professionally formatted note.

The primary difference is that secured notes have collateral, while unsecured notes do not. This means that secured notes offer more security to the lender, as they can claim the collateral if the borrower defaults. When considering options in Kentucky, it's vital to weigh the benefits of each type carefully.

To fill out a promissory demand note, begin with the names of both parties, followed by the amount due. Clearly state that the note is a demand note, which means the lender can request repayment at any time. It’s beneficial to use templates available from US Legal Forms for precise wording.

Filling out a promissory note involves providing essential details such as the borrower and lender's names, the amount borrowed, and the interest rate. Additionally, you need to specify repayment terms and any collateral if the note is secured. Using a platform like US Legal Forms can streamline this process, ensuring you complete it correctly.