Kentucky Open a Bank Account - Corporate Resolutions Forms

Description

How to fill out Open A Bank Account - Corporate Resolutions Forms?

If you need to compile, obtain, or create sanctioned document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Make use of the website's convenient and user-friendly search feature to find the documents you require.

Numerous templates for commercial and personal use are organized by categories and jurisdictions, or keywords.

Every legal document template you purchase is yours permanently. You have access to all forms you downloaded in your account. Click the My documents section and choose a form to print or download again.

Complete and obtain, and print the Kentucky Open a Bank Account - Corporate Resolutions Forms with US Legal Forms. There are numerous professional and state-specific forms you can utilize for your personal or business needs.

- Use US Legal Forms to acquire the Kentucky Open a Bank Account - Corporate Resolutions Forms in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and click the Download button to retrieve the Kentucky Open a Bank Account - Corporate Resolutions Forms.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your appropriate region/state.

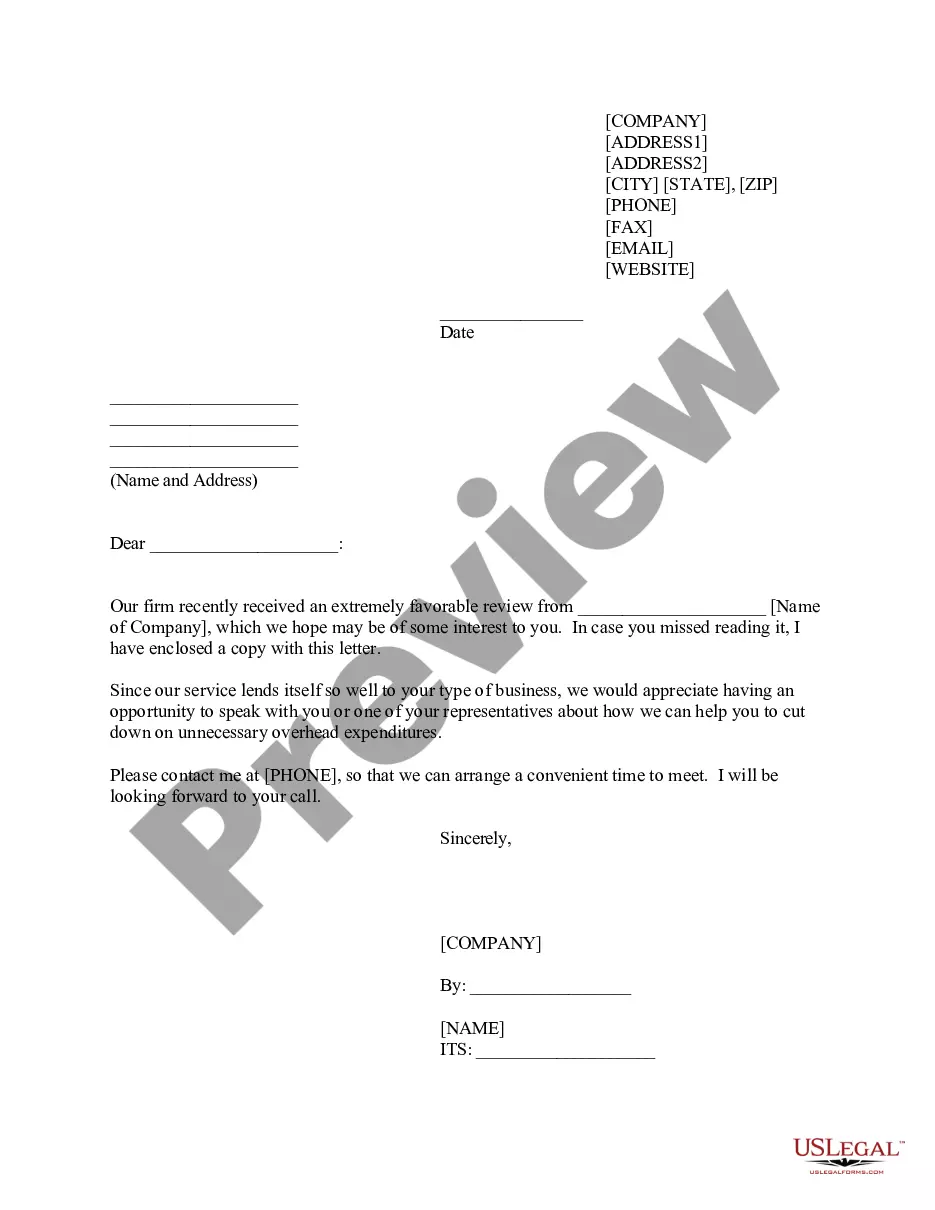

- Step 2. Use the Preview option to review the contents of the form. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the page to find alternative versions of the legal form template.

- Step 4. Once you find the form you need, click the Purchase now button. Choose the payment plan that suits you and provide your details to register for an account.

- Step 5. Process the payment. You can use your Visa, Mastercard, or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Kentucky Open a Bank Account - Corporate Resolutions Forms.

Form popularity

FAQ

A corporate resolution to open an investment account is a formal document that authorizes specific individuals to manage investment activities on behalf of the corporation. It outlines the details of the account and assigns responsibilities to designated representatives. This resolution is essential when navigating the process of Kentucky Open a Bank Account - Corporate Resolutions Forms and securing financial assets.

To write a corporate resolution, begin with the name of the corporation at the top of the document. Then, clearly outline the actions being authorized in a logical format, using resolute language. Include space for signatures of the authorized individuals or board members. This process is vital for ensuring proper documentation when you decide to Kentucky Open a Bank Account - Corporate Resolutions Forms.

The format for writing a resolution generally includes a title, a statement of the purpose, and the resolution itself. Start with a heading that indicates it’s a resolution, followed by the specific action being resolved. Maintain clear and concise language to ensure that it addresses the Kentucky Open a Bank Account - Corporate Resolutions Forms effectively.

An example of a company resolution could be a decision to appoint a new officer within the business. It would typically state the name of the new officer and their specific role, along with any responsibilities entrusted to them. Such resolutions are crucial for maintaining order and documenting decisions, especially when seeking to Kentucky Open a Bank Account - Corporate Resolutions Forms.

To write a corporate resolution example, begin by stating the name of the corporation, followed by a narrative that provides context. Specify the action being taken, such as 'Resolved, that the company will open a bank account.' Finally, include signatures from the officers or stakeholders involved. This simple structure will ensure clarity when utilizing Kentucky Open a Bank Account - Corporate Resolutions Forms.

A resolution is a formal document that expresses a specific decision made by the board of directors or shareholders of a company. For instance, a resolution to authorize a bank account opening could state the intent and details necessary to Kentucky Open a Bank Account - Corporate Resolutions Forms. This document ensures that all parties are in agreement and legally recognizes the decision.

To find your KY withholding account number, you can check paperwork from your initial registration with the Kentucky Department of Revenue. If you cannot locate it, consider contacting their office directly for assistance. Remember that this number is crucial if you Kentucky Open a Bank Account - Corporate Resolutions Forms, as it's needed for tax-related transactions.

A banking resolution template is a pre-formatted document that allows a corporation to provide authority for specific individuals to act on its behalf regarding banking transactions. This template simplifies the process, ensuring all necessary details are included for clarity. When you Kentucky Open a Bank Account - Corporate Resolutions Forms, utilizing a banking resolution template can streamline your efforts.

To get a KY state tax ID number, you need to apply through the Kentucky Department of Revenue. This process usually involves filling out an application online or submitting a paper form. Having your tax ID number is essential when you Kentucky Open a Bank Account - Corporate Resolutions Forms, as it represents your business's tax identity.

The Kentucky llet account number consists of a unique combination of numbers. Generally, this number contains a total of 8 digits. Knowing this is beneficial when you prepare to Kentucky Open a Bank Account - Corporate Resolutions Forms and need to provide your business identification.