Kentucky Advertising Sales Representative Agreement for Website

Description

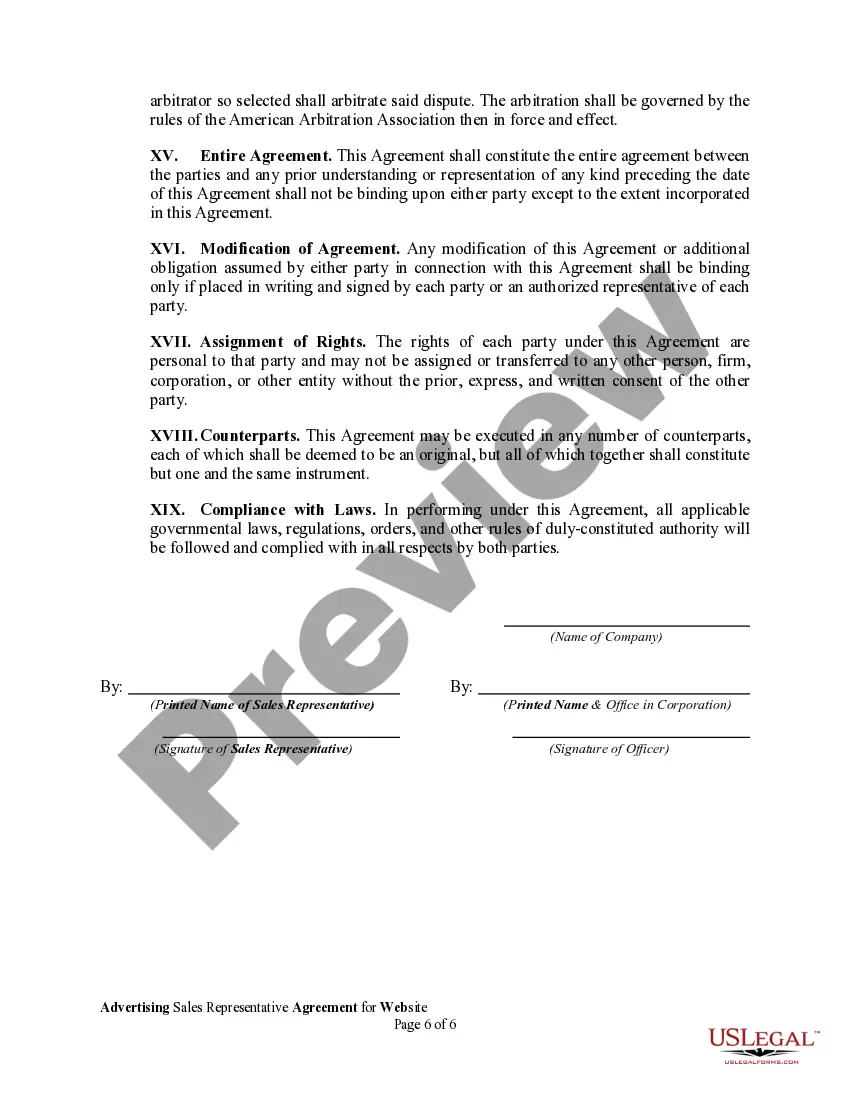

How to fill out Advertising Sales Representative Agreement For Website?

Are you currently in a circumstance where you require documents for either business or personal purposes nearly every day? There are numerous legal document templates accessible online, but locating ones you can trust isn't straightforward.

US Legal Forms offers thousands of template designs, including the Kentucky Advertising Sales Representative Agreement for Website, that are crafted to adhere to federal and state regulations.

If you are already acquainted with the US Legal Forms website and have an account, simply Log In. After that, you can download the Kentucky Advertising Sales Representative Agreement for Website template.

- Obtain the document you require and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Check the outline to confirm that you have selected the right document.

- If the document isn't what you're looking for, utilize the Research field to find the document that meets your needs and criteria.

- When you locate the appropriate document, click on Acquire now.

- Choose the payment plan you prefer, complete the necessary information to create your account, and purchase the transaction using your PayPal or Visa or MasterCard.

- Select a suitable file format and download your version.

Form popularity

FAQ

To apply for a sales tax permit in Kentucky, you need to complete the registration process through the Kentucky Department of Revenue. You can typically do this online, and you will need to provide information about your business operations. Following this process is crucial when establishing a Kentucky Advertising Sales Representative Agreement for Website, as it ensures you remain compliant with tax laws.

Yes, having an employee working in Kentucky typically establishes Nexus for your business. This means that your business may be required to register for sales tax purposes and comply with Kentucky tax regulations. If you are considering a Kentucky Advertising Sales Representative Agreement for Website, be aware of the implications of employing individuals in the state.

In Kentucky, certain items are exempt from sales tax, such as groceries and some medical services. Understanding what is not taxed can affect your agreements, including a Kentucky Advertising Sales Representative Agreement for Website. This knowledge helps in budgeting and planning, ensuring you avoid unexpected costs.

In Kentucky, Nexus can be created by having physical locations, employees, or even substantial sales activity within the state. For businesses entering a Kentucky Advertising Sales Representative Agreement for Website, any of these factors could establish a tax obligation. It's essential to monitor your business activities in Kentucky to ensure compliance.

Nexus refers to a connection between a business and a state that triggers tax obligations. In the context of a Kentucky Advertising Sales Representative Agreement for Website, establishing Nexus may mean that your business has sufficient physical presence or economic activity in Kentucky. Understanding this requirement helps you comply with tax laws and avoid potential penalties.

An advertising sales representative is a professional who sells advertising space or time on behalf of different media outlets. They act as intermediaries between clients and media providers, strategizing on how to meet clients' promotional goals. If you are seeking to engage an advertising sales representative, consider using a Kentucky Advertising Sales Representative Agreement for Website to formalize your working relationship.

To obtain an advertising contract, begin by outlining your advertising needs and objectives. Once you understand your requirements, you can approach an advertising agency or individual representative. Utilizing a Kentucky Advertising Sales Representative Agreement for Website template can simplify the process, helping you create a comprehensive and legally sound contract.

The advertising sales representative agreement is a specialized contract designed for individuals acting as sales representatives in advertising. It defines the terms of sale, commission structures, and the nature of the advertising services provided. By using a precise Kentucky Advertising Sales Representative Agreement for Website, both parties can ensure they are on the same page regarding expectations and obligations.

A rep agreement, short for representative agreement, is a legal contract where one party authorizes another to act on their behalf, usually in sales or marketing. It specifies the rights and responsibilities of each party, ensuring mutual understanding in the representative's activities. Crafting a detailed Kentucky Advertising Sales Representative Agreement for Website can safeguard your interests and facilitate smoother operations.

Yes, advertising services can be taxable in Kentucky. Generally, property or services consumed in advertising, such as media purchases, can incur sales tax. Understanding this aspect is important for businesses entering into a Kentucky Advertising Sales Representative Agreement for Website, as it influences budgeting and financial planning.