Kentucky Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

How to fill out Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

Choosing the best authorized document design might be a have a problem. Naturally, there are tons of templates available on the net, but how will you get the authorized develop you require? Make use of the US Legal Forms internet site. The support offers 1000s of templates, like the Kentucky Letter to Creditors Notifying Them of Identity Theft for New Accounts, which can be used for company and personal demands. Every one of the kinds are checked by experts and meet federal and state requirements.

If you are presently authorized, log in to your accounts and then click the Download option to get the Kentucky Letter to Creditors Notifying Them of Identity Theft for New Accounts. Utilize your accounts to appear through the authorized kinds you may have purchased earlier. Visit the My Forms tab of your respective accounts and obtain another copy from the document you require.

If you are a fresh end user of US Legal Forms, allow me to share simple recommendations that you can follow:

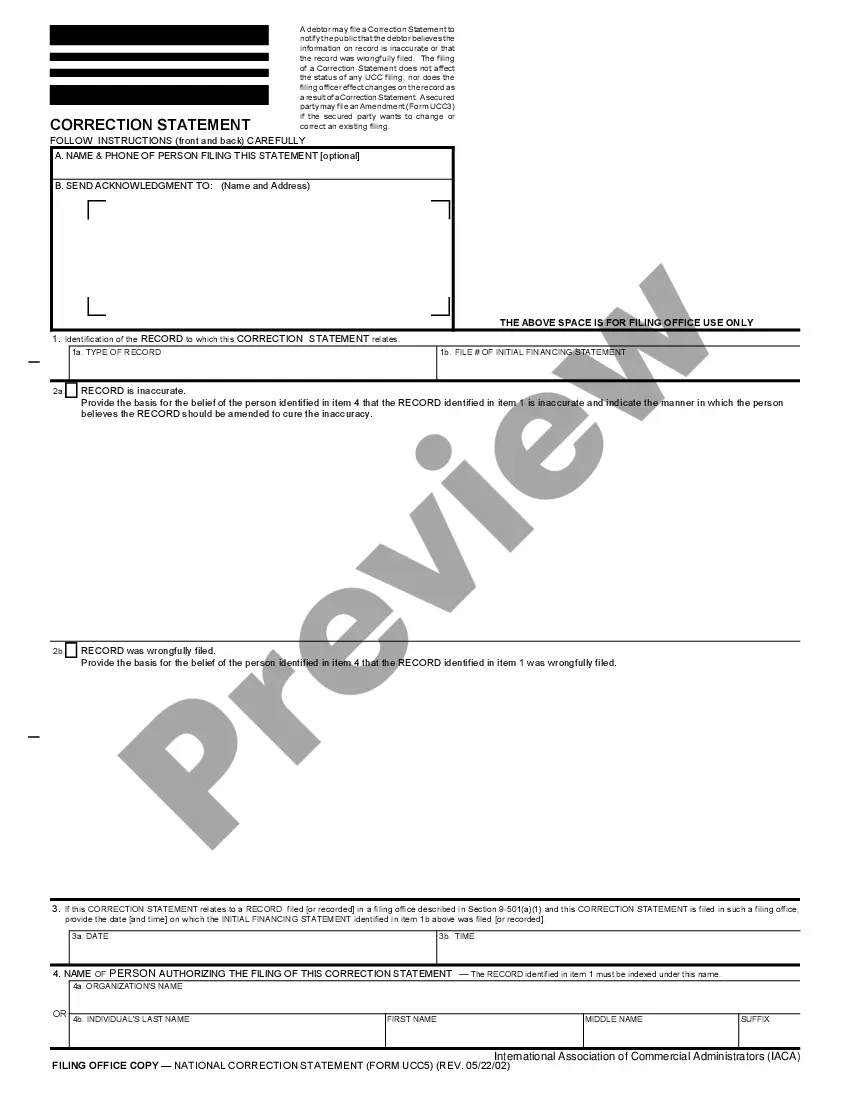

- First, make certain you have chosen the proper develop for the area/state. You are able to examine the form making use of the Preview option and study the form information to guarantee it is the right one for you.

- If the develop is not going to meet your expectations, take advantage of the Seach area to discover the proper develop.

- Once you are certain that the form would work, click on the Purchase now option to get the develop.

- Pick the rates strategy you would like and enter in the required info. Build your accounts and purchase the transaction using your PayPal accounts or credit card.

- Opt for the submit format and acquire the authorized document design to your device.

- Total, change and print and signal the attained Kentucky Letter to Creditors Notifying Them of Identity Theft for New Accounts.

US Legal Forms is the largest local library of authorized kinds for which you can find a variety of document templates. Make use of the service to acquire professionally-made documents that follow condition requirements.

Form popularity

FAQ

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

Change the passwords, pin numbers, and log in information for all of your potentially affected accounts, including your email accounts, and any accounts that use the same password, pin, or log in information. Contact your police department, report the crime and obtain a police report.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

(1)A person is guilty of the theft of the identity of another when he or she knowingly possesses or uses any current or former identifying information of the other person or family member or ancestor of the other person, such as that person's or family member's or ancestor's name, address, telephone number, electronic ...

Steps for Victims of Identity Theft or Fraud Place a fraud alert on your credit report. Close out accounts that have been tampered with or opened fraudulently. Report the identity theft to the Federal Trade Commission. File a report with your local police department.

Let's get to work! Contact the companies and banks where the fraud occurred. ... Place fraud alerts with the three credit bureaus. ... Ask for copies of your credit reports. ... Place a security freeze on your credit report. ... Reach out to debt collectors and block the reporting of fraudulent information. ... Report identity theft to the FTC.

If you report your identity theft to the FTC within two business days of discovering it, you will only be liable to pay $50 of any unauthorized use of your bank and credit accounts (under federal law). The longer you leave it, the more that financial liability falls on your shoulders.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.