Kentucky Computer Software Lease with License Agreement

Description

How to fill out Computer Software Lease With License Agreement?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a diverse assortment of legal document templates that you can obtain or print.

By using the platform, you will access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find updated versions of documents such as the Kentucky Software Lease with License Agreement in just moments.

If you already hold a subscription, Log In to retrieve the Kentucky Software Lease with License Agreement from your collection on US Legal Forms. The Download button will appear on every template you review. You can view all previously downloaded forms in the My documents section of your account.

Make modifications. Fill out, change, print, and sign the downloaded Kentucky Software Lease with License Agreement.

Each template you add to your account has no expiration date and belongs to you indefinitely. Thus, if you need to obtain or print another copy, simply navigate to the My documents section and click on the form you require. Access the Kentucky Software Lease with License Agreement through US Legal Forms, the most extensive collection of legal document templates available. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

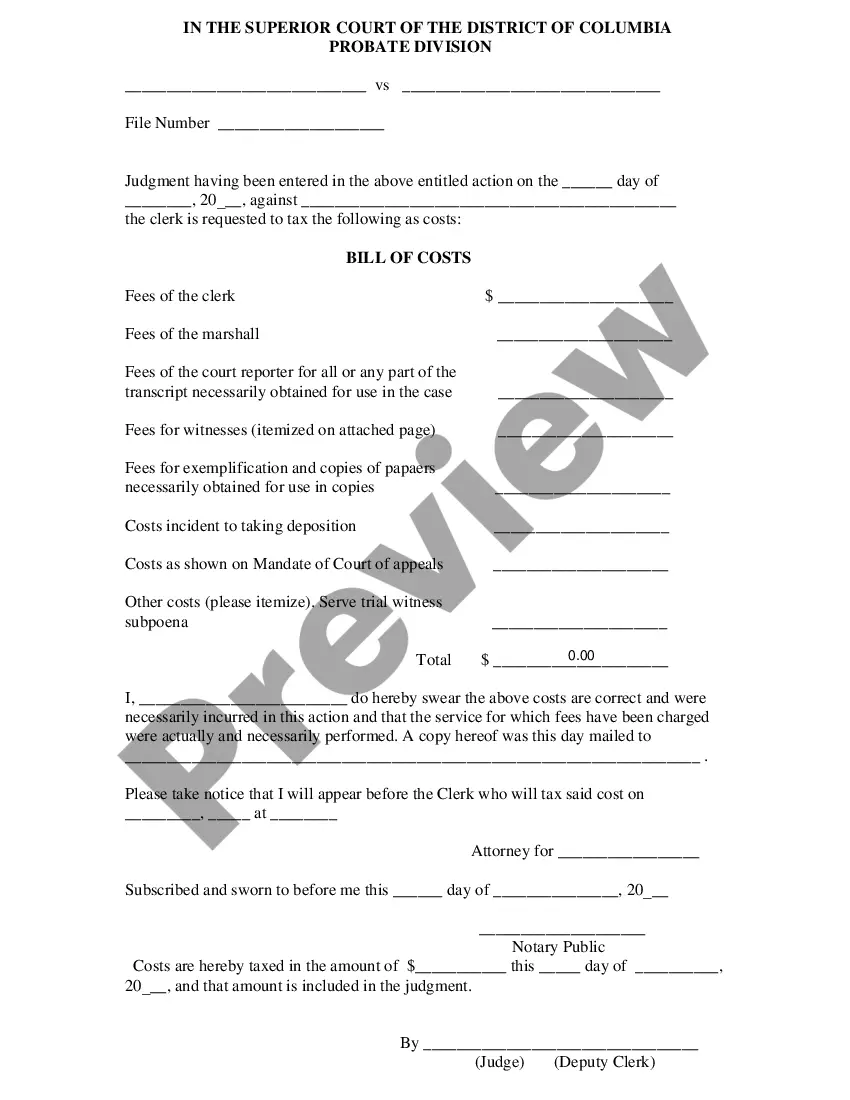

- Confirm you have chosen the correct form for your locality. Press the Preview button to review the form's content. Read the form description to ensure you've selected the right document.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, validate your choice by clicking the Buy now button. Then choose the pricing plan that suits you and provide your details to register for the account.

- Complete the transaction. Use a Visa or MasterCard or a PayPal account to finalize the transaction.

- Select the file format and download the document to your device.

Form popularity

FAQ

Nexus rules in Kentucky dictate when businesses are required to collect state taxes. Generally, a business establishes nexus if it has a physical presence in Kentucky or makes significant sales within the state. Understanding these rules can help you navigate the complexities of the Kentucky Computer Software Lease with License Agreement and ensure that your business fulfills tax obligations.

Yes, software licenses are typically taxable in Kentucky, especially if they fall under the definition of a Kentucky Computer Software Lease with License Agreement. This taxation applies whether the license is for a perpetual or a subscription basis. Therefore, businesses must factor this into their accounting practices to remain compliant with state regulations.

In Kentucky, the taxability of Software as a Service (SaaS) is subject to local regulations. Generally, SaaS may be taxed if it involves the transfer of tangible personal property or if it includes a Kentucky Computer Software Lease with License Agreement. It’s essential to review Kentucky’s tax guidelines to ensure compliance and determine your specific obligations.

Only two states Tennessee and Vermont have specific statutes in place to address SaaS transactions and sales tax. Several states have ping-ponged on their decisions, the most recent being Michigan, who ultimately decided to exempt it.

Can I get a Kentucky account number for a client? 200bThe best way to access company account numbers is via Kentucky One Stop Business Portal. Another way would be if the interested party is listed on form 20A100 (Power of Attorney/Declaration of Representative) on file with the Department of Revenue.

Register online with the KY Dept of Revenue to receive a Withholding Account Number. Registration may also be completed via the Kentucky Registration Application (10A100). Please visit the Kentucky DOR Tax Registration Information page or additional resources or call the KY DOR at (502) 564-4581.

Traditional Goods or Services Goods that are subject to sales tax in Kentucky include physical property, like furniture, home appliances, and motor vehicles. Groceries, prescription medicine, and gasoline are all tax-exempt. Some services in Kentucky are subject to sales tax.

Kentucky SaaS is non-taxable because it isn't tangible personal property.

Sales of custom software - delivered on tangible media are exempt from the sales tax in Kentucky. Sales of custom software - downloaded are exempt from the sales tax in Kentucky.

10A100(P) (06-21) Employer's Withholding Tax Account. Sales and Use Tax Account/Permit. Transient Room Tax Account. Motor Vehicle Tire Fee Account.