Kentucky Stock Dividend Resolution Form is a crucial document used in corporate resolutions. This form outlines the specific details and procedures associated with distributing stock dividends within a Kentucky corporation. By describing the various aspects and keywords related to this topic, here is a comprehensive description: The Kentucky Stock Dividend Resolution Form is a legally binding document that outlines the process and authorization of distributing stock dividends within a Kentucky corporation. This resolution form is used by the company's board of directors or shareholders during meetings to approve the distribution of stock dividends. A stock dividend, also known as a stock split, is a corporate decision to increase the number of outstanding shares by issuing additional shares to existing shareholders in proportion to their current ownership. This method is employed by companies to reward shareholders, increase liquidity, and enhance market demand for their stock. The resolution form starts by stating the purpose of the resolution, which is to authorize the distribution of stock dividends in accordance with the laws and regulations governing corporations in the state of Kentucky. It highlights the need for careful consideration and adherence to the corporation's bylaws and relevant legal statutes. Key elements within the Kentucky Stock Dividend Resolution Form include: 1. Resolution Identification: This section includes the company name, date, and identification number associated with the resolution. It ensures accurate record-keeping and facilitates easy retrieval of information. 2. Stock Dividend Details: This segment outlines specific details related to the stock dividend, including the number of additional shares to be distributed, the record date (date determining which shareholders are entitled to the stock dividend), and the payment date (when the stock dividend will be issued). 3. Authorization: This section outlines the approval process for the distribution of stock dividends, requiring the consent of the board of directors or shareholders. The resolution form must clearly state the number of votes required and the decision-making process, adhering to the corporation's bylaws and legal requirements. Different types of Kentucky Stock Dividend Resolutions may include: 1. Ordinary Stock Dividend Resolution: This type of resolution is the most common and is used when the corporation decides to distribute additional shares to shareholders without significantly impacting the company's capital structure. 2. Special Stock Dividend Resolution: In some cases, a company may decide to distribute a special stock dividend that goes beyond a typical dividend distribution. This resolution might involve complex financial processes, including capitalization of retained earnings or surplus. 3. Stock Split Resolution: While not strictly a dividend, a stock split can be authorized through a resolution and involves dividing existing shares into multiple new shares. This aims to lower the stock's market price per share, making it more affordable and increasing liquidity. In conclusion, the Kentucky Stock Dividend Resolution Form is pivotal in authorizing the distribution of stock dividends within a Kentucky corporation. This document reflects the careful consideration and compliance with legal requirements when making crucial decisions regarding shareholder rewards and capital structure adjustments.

Kentucky Stock Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Kentucky Stock Dividend - Resolution Form - Corporate Resolutions?

If you desire to be thorough, acquire, or reproducing legal document formats, utilize US Legal Forms, the most extensive assortment of legal documents available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you require.

Various templates for business and personal applications are sorted by categories and states, or keywords. Utilize US Legal Forms to locate the Kentucky Stock Dividend - Resolution Form - Corporate Resolutions in just a few clicks.

Step 5. Complete the payment process. You can utilize your credit card or PayPal account to finalize the transaction.

Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Kentucky Stock Dividend - Resolution Form - Corporate Resolutions. Every legal document template you obtain is your permanent property. You have access to every document you saved in your account. Visit the My documents section and choose a document to print or download again.

- If you are currently a US Legal Forms member, Log In to your account and then click the Acquire button to access the Kentucky Stock Dividend - Resolution Form - Corporate Resolutions.

- You can also retrieve documents you have previously saved within the My documents tab of your account.

- If you are using US Legal Forms for the first time, consult the steps below.

- Step 1. Ensure you have selected the template for the correct city/state.

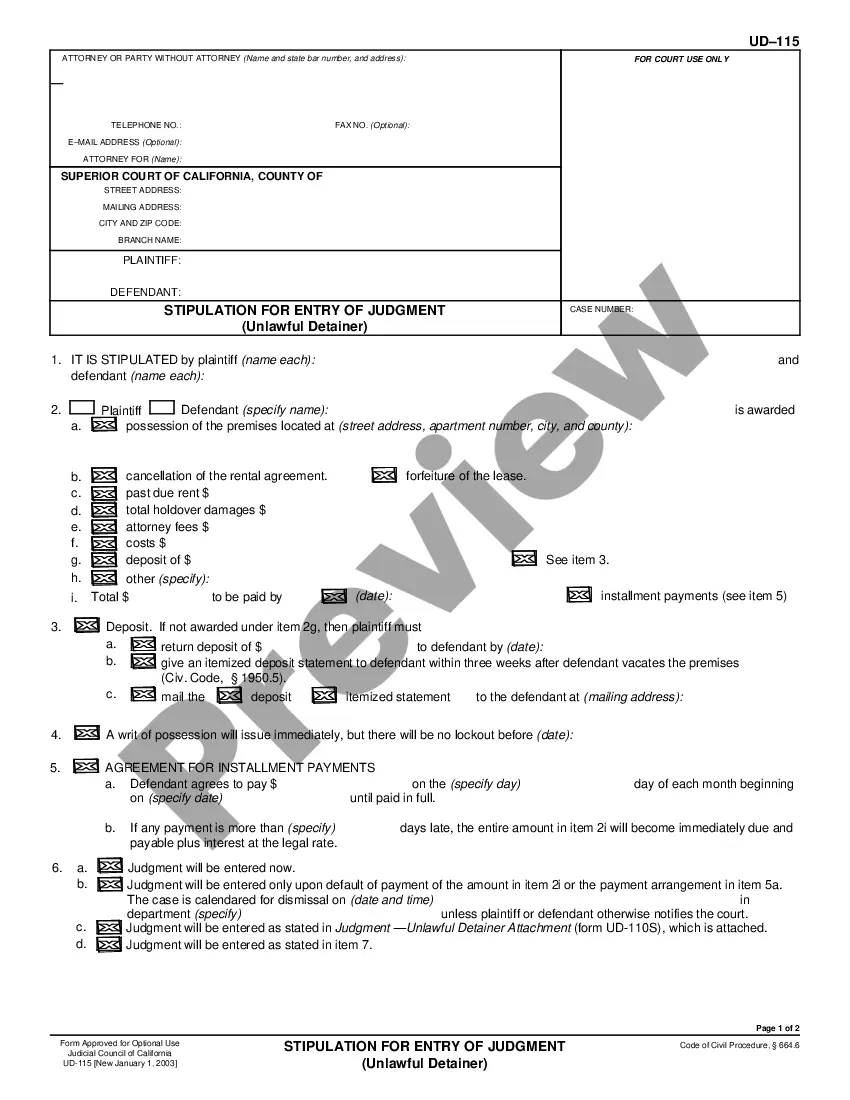

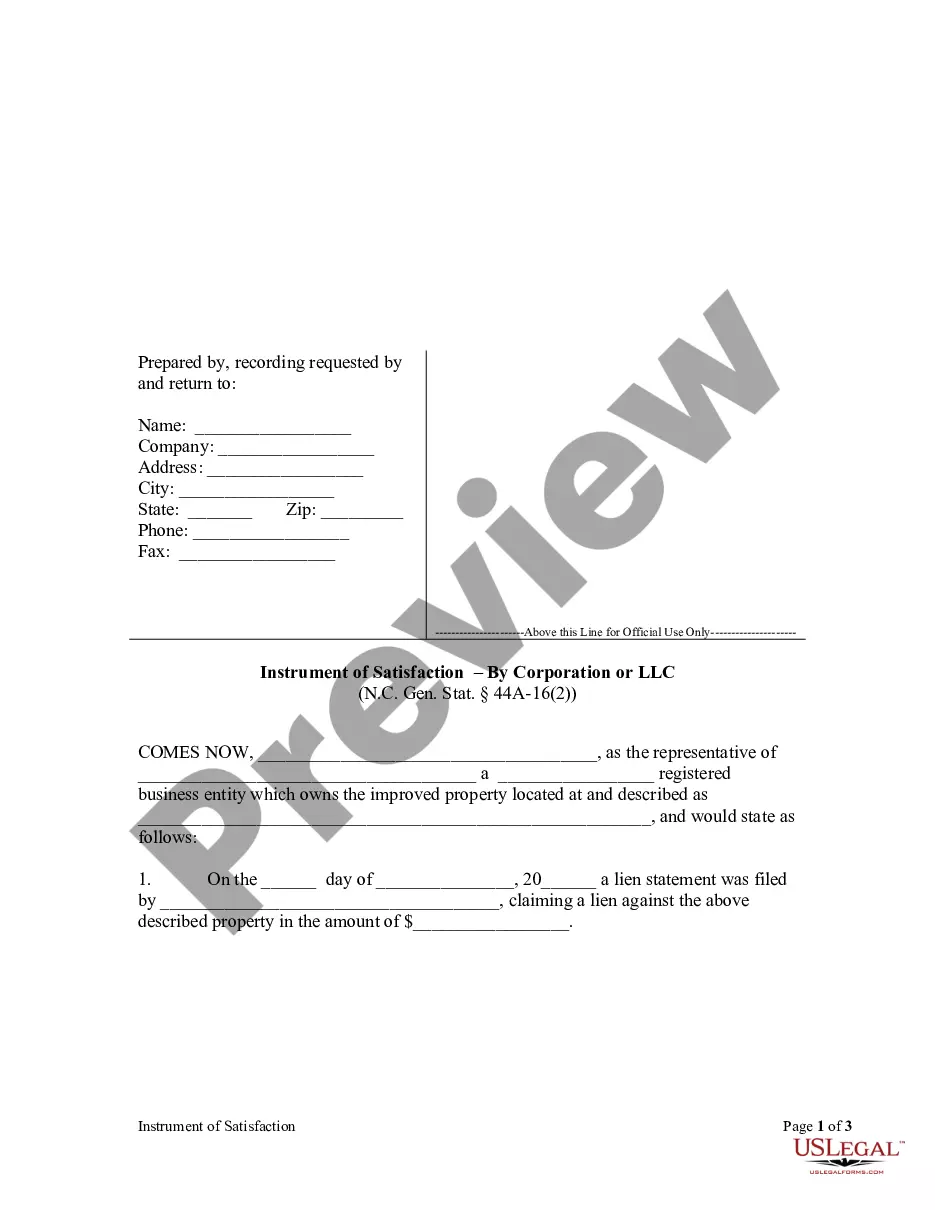

- Step 2. Use the Review option to peruse the document’s content. Don’t forget to review the details.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. After locating the document you desire, click the Get now button. Choose the payment plan you prefer and enter your credentials to register for the account.

Form popularity

FAQ

A general shareholder resolution is a formal proposal submitted by shareholders for consideration at a company's annual meeting. These resolutions can cover a wide range of issues, from corporate governance to environmental practices. Utilizing the Kentucky Stock Dividend - Resolution Form - Corporate Resolutions can help you articulate your proposal clearly, making it easier for other shareholders to understand and support your initiative.

The requirements for a shareholder resolution typically include a clear statement of the proposal and backing from a certain percentage of shareholders. Make sure to follow your corporation’s bylaws for specific procedures. The Kentucky Stock Dividend - Resolution Form - Corporate Resolutions simplifies adherence to these requirements and ensures proper processing.

A board resolution on dividend distribution is an official statement from the board authorizing the payment of dividends to shareholders. This resolution outlines the amount and timing of the distribution, reflecting the financial health of the corporation. With the Kentucky Stock Dividend - Resolution Form - Corporate Resolutions, you can formalize this important decision efficiently.

An example of a shareholder resolution might involve proposing a change in executive compensation or suggesting increased transparency in financial reporting. These resolutions aim to improve corporate responsibility and governance. Using the Kentucky Stock Dividend - Resolution Form - Corporate Resolutions enhances clarity and effectiveness in presenting your ideas.

To initiate a shareholder resolution, draft your proposal clearly stating the desired action. Share the resolution with other shareholders to secure support. Submitting the resolution using the Kentucky Stock Dividend - Resolution Form - Corporate Resolutions will help streamline the process and maintain proper documentation.

Writing a corporate resolution requires a clear format and specific content. Start by stating the name of the corporation, the date, and the purpose of the resolution. Utilize the Kentucky Stock Dividend - Resolution Form - Corporate Resolutions for a structured approach, ensuring all board members review and approve the resolution before signing.

The Kentucky Limited Liability Entity Tax (LLET) is calculated based on gross receipts or the entity's net income. The tax applies to various entities, including corporations and LLCs. To determine your tax amount, consider using resources from U.S. Legal Forms, which can provide comprehensive guidance on compliance and necessary forms.

In Kentucky, any shareholder of a corporation can file a shareholder resolution. This process allows shareholders to make proposals regarding corporate governance or other corporate matters. If you hold shares, you can utilize the Kentucky Stock Dividend - Resolution Form - Corporate Resolutions to submit your proposal effectively.

To obtain a Kentucky LLC number, you need to register your business with the Kentucky Secretary of State. This registration can typically be completed online or by submitting paper forms through the mail. Once registered, you will receive an official LLC number, which is crucial for compliance. For assistance with corporate resolutions, explore the Kentucky Stock Dividend - Resolution Form - Corporate Resolutions on the US Legal platform.

You can find shareholder resolutions in publicly available filings, such as those submitted to the SEC, and through company investor relations websites. Additionally, many comprehensive legal platforms offer resources where you may access or draft these resolutions. The US Legal site features the Kentucky Stock Dividend - Resolution Form - Corporate Resolutions for your convenience.