Kentucky Letter to Credit Card Companies and Financial Institutions Notifying Them of Death

Description

How to fill out Letter To Credit Card Companies And Financial Institutions Notifying Them Of Death?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating reliable ones isn't straightforward.

US Legal Forms provides thousands of template options, such as the Kentucky Letter to Credit Card Companies and Financial Institutions Notifying Them of Death, designed to comply with state and federal regulations.

You can find all the document templates you have purchased in the My documents section.

You can obtain an additional copy of the Kentucky Letter to Credit Card Companies and Financial Institutions Notifying Them of Death at any time, if necessary. Just select the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal documents, to save time and minimize mistakes. The service offers professionally crafted legal document templates for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Kentucky Letter to Credit Card Companies and Financial Institutions Notifying Them of Death template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct state/region.

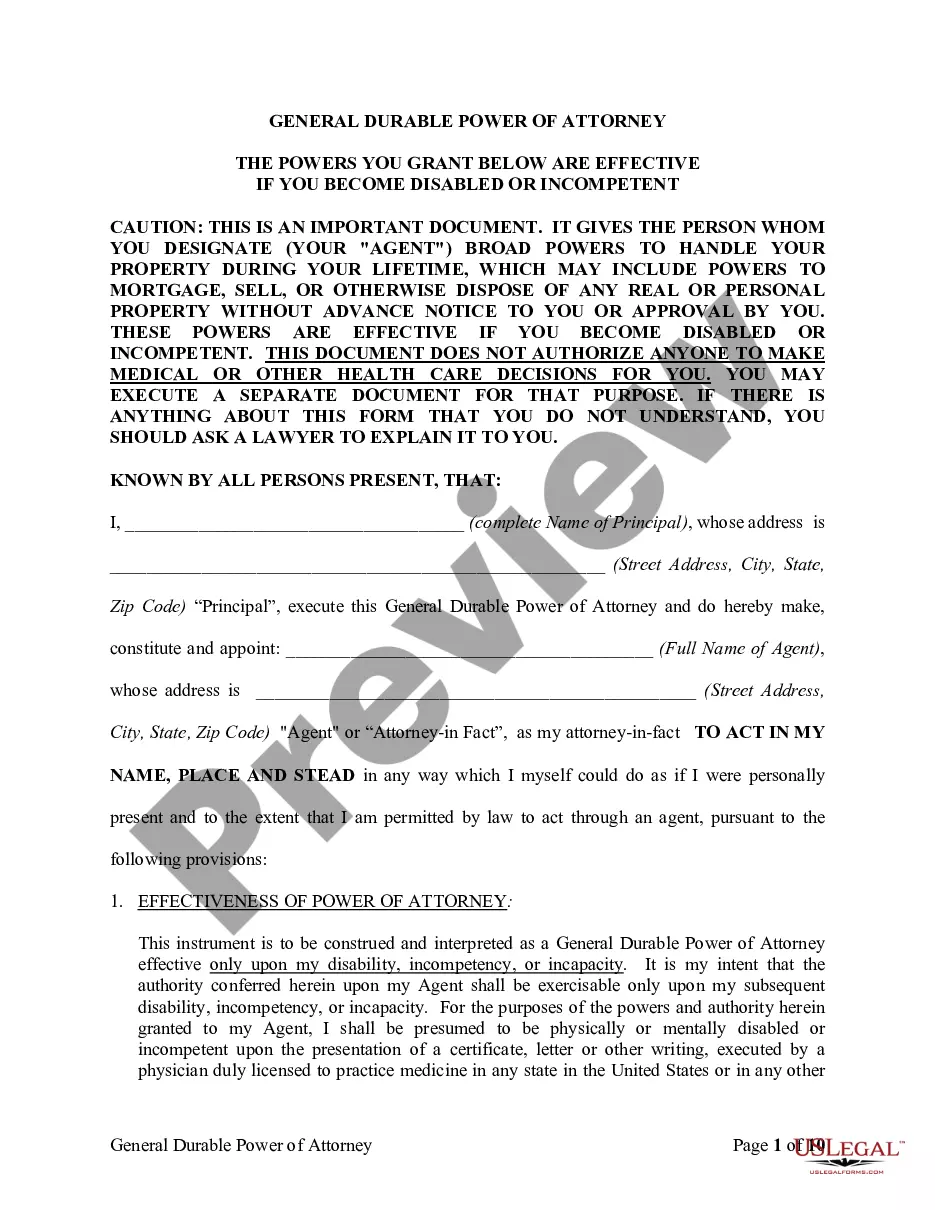

- Utilize the Preview button to review the form.

- Read the description to confirm that you have selected the appropriate form.

- If the form isn't what you're looking for, use the Search section to find the form that fits your requirements.

- Once you find the correct form, click Buy now.

- Select the pricing plan you prefer, fill in the required information to create your account, and make the payment using your PayPal or credit card.

- Choose a suitable file format and download your copy.

Form popularity

FAQ

When you notify the issuer, be prepared to present an original copy of the death certificate and any important court documents pertaining to the estate. Not all issuers request this information, but many do, so it's helpful to have access if necessary.

In the unfortunate event of the user's demise, the credit card issuer cannot issue notices in the deceased's name to ensure repayment. Hence, they hold the next of kin or legal heirs responsible for repaying the outstanding amount.

Credit card debt doesn't follow you to the grave. It lives on and is either paid off through estate assets or becomes the joint account holder's or co-signer's responsibility.

When a loved one passes away, you'll have a lot to take care of, including their finances. It's important to remember that credit card debt does not automatically go away when someone dies. It must be paid by the estate or the co-signers on the account.

If there's no money in their estate, the debts will usually go unpaid. For survivors of deceased loved ones, including spouses, you're not responsible for their debts unless you shared legal responsibility for repaying as a co-signer, a joint account holder, or if you fall within another exception.

Credit reporting companies regularly receive notifications from the Social Security Administration about individuals who have passed away, but it's better to also notify them on your own to ensure no one applies for credit in the deceased's name in the meantime.

The credit card company may request a copy of the death certificate or any paperwork relating to the estate. This is a great opportunity for you to reiterate your request to close the account in writing. If the account is a joint account, the issuer will simply remove your loved one's name from the account.