This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

Kentucky Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children

Description

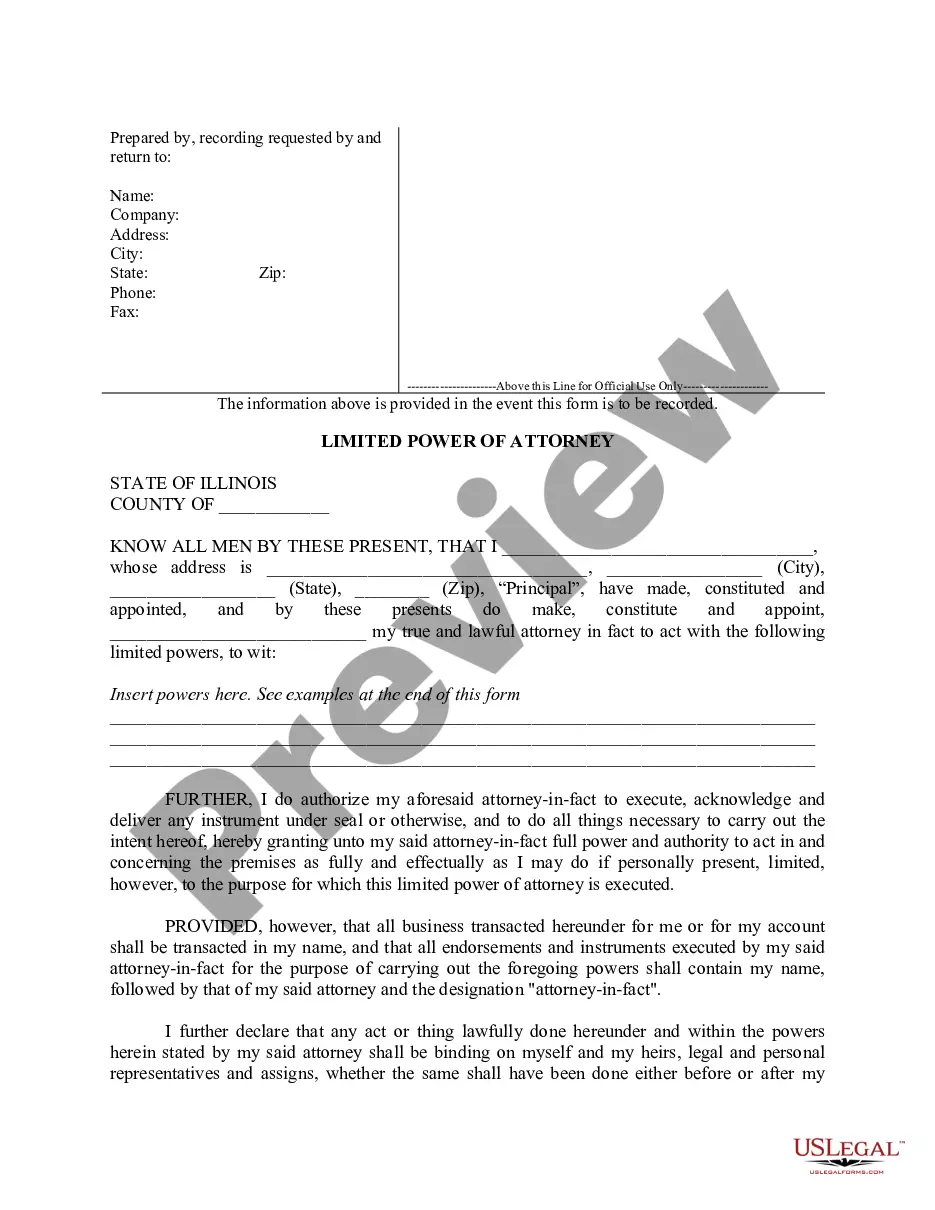

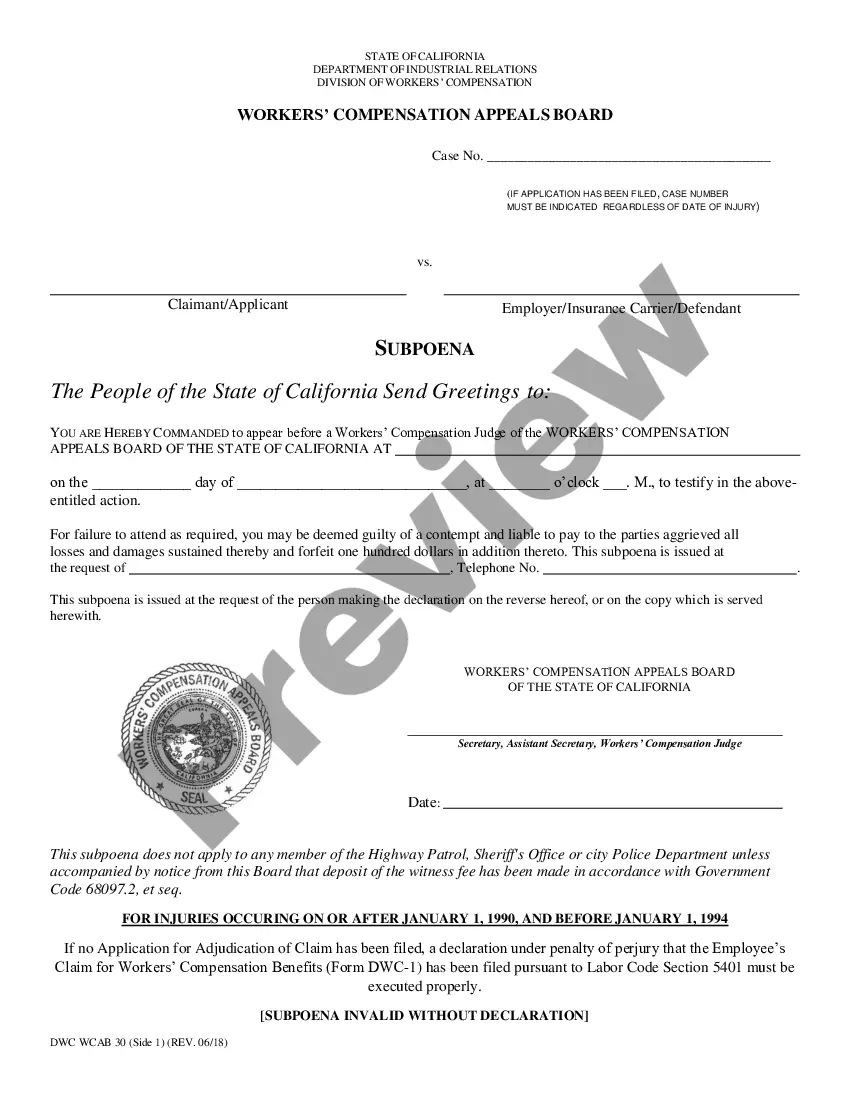

How to fill out Trust Agreement For Minors Qualifying For Annual Gift Tax Exclusion - Multiple Trusts For Children?

Finding the appropriate legal document format can be challenging.

Of course, there is a plethora of templates accessible online, but how can you locate the correct one you need.

Utilize the US Legal Forms website. This service offers thousands of templates, such as the Kentucky Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, which you can use for both business and personal needs.

You can review the form using the Preview button and read the form description to ensure it is the correct one for you.

- All of the documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to access the Kentucky Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children.

- Use your account to search for the legal forms you have previously purchased.

- Go to the My documents tab in your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps you can follow.

- First, ensure that you have chosen the correct form for your city/county.

Form popularity

FAQ

Yes, there are software solutions available for completing Form 709, which is essential for establishing a Kentucky Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. These platforms simplify the process, ensuring accurate data entry and compliance with tax regulations. You can find user-friendly systems that guide you through the preparation and submission of your forms, saving you time and reducing errors. Consider using US Legal Forms for a comprehensive solution tailored specifically for your needs.

TurboTax does indeed support Form 709, making it a solid choice for reporting gifts to minors. As you explore a Kentucky Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, you will find that TurboTax offers an intuitive interface for efficient filing. With its comprehensive features, you can tackle your tax needs confidently and accurately.

TaxAct provides Form 709, allowing users to report gifts made to minors effectively. This tool is useful for anyone creating a Kentucky Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. Utilizing TaxAct can help streamline your filing process, ensuring you properly address all necessary tax obligations.

Yes, H&R Block software does include Form 709, which is essential for reporting gifts to minors. This feature is particularly valuable for those exploring a Kentucky Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. With H&R Block, you can easily ensure compliance with gift tax regulations while maximizing your financial benefits.

When filing your income tax returns, a variety of software options can assist you. Popular choices include TurboTax, H&R Block, and TaxAct. Each software offers user-friendly features that simplify the process, especially when navigating Kentucky Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. You can confidently select any of these tools for an efficient filing experience.

As of 2024, Kentucky's estate tax exemption is set at a specific threshold, which allows individuals to pass on a certain amount of their estate without incurring tax. Understanding how this exemption interacts with the Kentucky Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children is crucial for effective estate planning. Always consult with a knowledgeable professional to navigate these laws and ensure your estate is structured optimally.

Kentucky imposes a state income tax on individuals and corporations, which varies based on income levels. Additionally, the state has an inheritance tax that can affect assets transferred to heirs. When considering a Kentucky Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, keep these taxes in mind for effective financial planning.

Gifts to certain types of trusts can qualify for the annual exclusion if they meet specific criteria. For example, a Kentucky Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children might qualify if it allows the minor beneficiary to withdraw the gift within a specified time frame. It’s advisable to consult with a tax professional to ensure compliance and maximize benefits.

In Kentucky, certain relationships are exempt from inheritance tax, including surviving spouses, children, and parents. Under the Kentucky Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, assets placed in a minor's trust might also benefit from these exemptions. Understanding your specific situation can help in planning inheritance without tax burdens.

A gift qualifies for the annual exclusion if it is made directly to the beneficiary without any conditions. In the context of a Kentucky Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, gifts made directly into these trusts can also qualify. It’s important to ensure that the gift does not exceed the annual exclusion limit set by the IRS.