The Kentucky General Form of Receipt is a legally recognized document that serves as proof of a transaction between two parties in the state of Kentucky. This receipt includes essential information about the transaction, such as the date, the parties involved, and the nature of the exchange. It is often used to document payments made for goods, services, or rent. The Kentucky General Form of Receipt typically contains key elements to ensure clarity and accuracy. The document commonly includes the name, address, and contact details of both the payer and the recipient. It further provides a detailed description of the items or services exchanged, including quantities, unit prices, and any applicable taxes or fees. Aside from these fundamental details, the Kentucky General Form of Receipt may vary depending on the specific transaction or industry. For instance, there are different types of receipts tailored to various purposes. These include: 1. Sales Receipt: This type of receipt is generated when a sale occurs, typically in retail or e-commerce settings. It reflects the purchase price, any discounts or promotions applied, and the payment method used. Sales receipts are often utilized by businesses to maintain accurate sales records and allow customers to make returns or exchanges. 2. Rental Receipt: When a tenant pays rent to a landlord or property manager, a rental receipt is issued. This receipt outlines the rental period, the amount paid, and any additional charges such as utilities or late fees. Rental receipts are essential for both parties to track payments and serve as documentation for any future disputes or legal purposes. 3. Service Receipt: Service providers frequently issue service receipts to their clients. These receipts detail the type of service provided, the duration or quantity of the service, and the total amount due. Service receipts can be used for a wide range of services, such as professional consultation, home repairs, or freelance work. 4. Donation Receipt: Nonprofit organizations often issue donation receipts to acknowledge contributions made by individuals or businesses. These receipts confirm the amount of the donation and include the organization's tax-exempt status, enabling donors to claim tax deductions. Donations receipts are important for establishing transparency, accountability, and compliance with tax regulations. In summary, the Kentucky General Form of Receipt is a versatile document used to validate transactions in different industries and contexts. Whether it's a sales receipt, rental receipt, service receipt, or donation receipt, the core purpose remains the same — to provide a clear record of the transaction and protect the rights and interests of both parties involved.

Kentucky General Form of Receipt

Description

How to fill out Kentucky General Form Of Receipt?

If you have to total, down load, or print authorized record templates, use US Legal Forms, the largest collection of authorized varieties, which can be found online. Make use of the site`s easy and convenient research to obtain the files you want. Numerous templates for enterprise and specific reasons are categorized by groups and states, or keywords and phrases. Use US Legal Forms to obtain the Kentucky General Form of Receipt with a handful of click throughs.

When you are previously a US Legal Forms consumer, log in to the account and then click the Acquire key to obtain the Kentucky General Form of Receipt. You can even entry varieties you formerly downloaded inside the My Forms tab of the account.

If you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Ensure you have chosen the shape for that correct city/region.

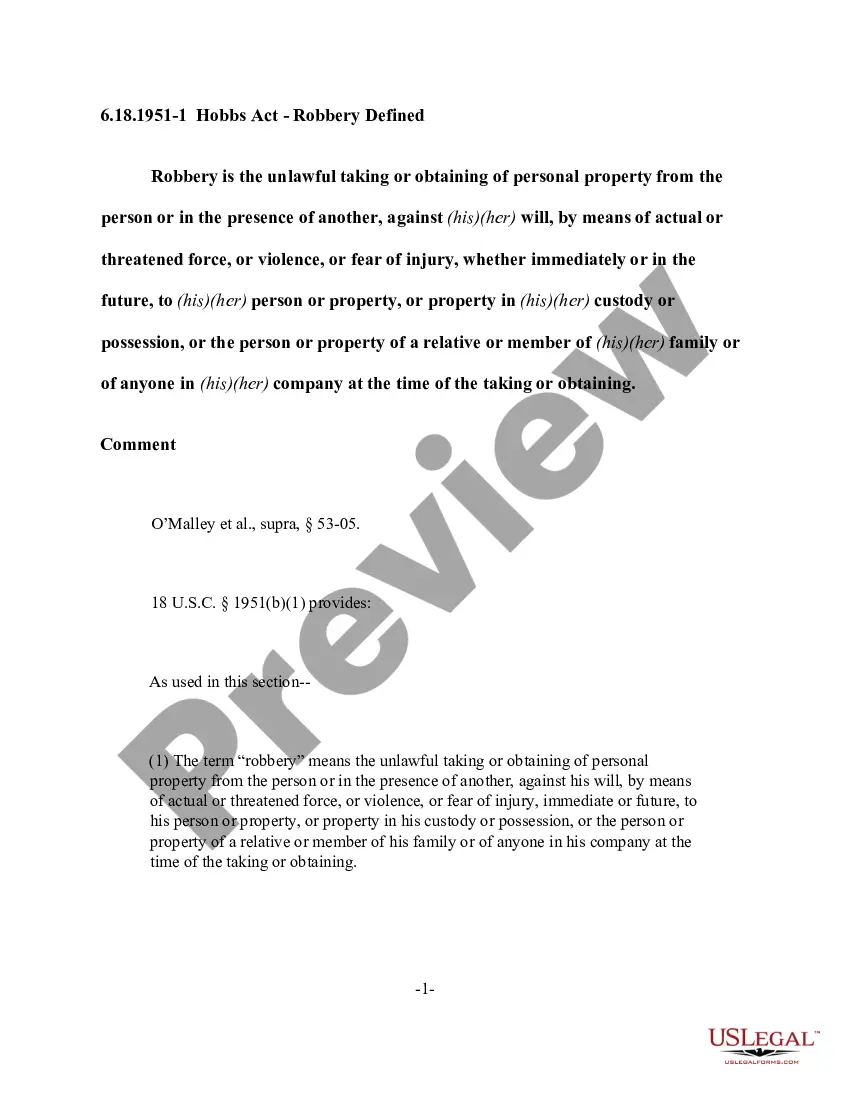

- Step 2. Make use of the Review choice to check out the form`s content. Don`t overlook to see the outline.

- Step 3. When you are not happy together with the develop, make use of the Research discipline towards the top of the screen to get other models in the authorized develop web template.

- Step 4. Upon having discovered the shape you want, click the Buy now key. Pick the pricing plan you like and add your qualifications to sign up for an account.

- Step 5. Procedure the purchase. You may use your charge card or PayPal account to accomplish the purchase.

- Step 6. Find the file format in the authorized develop and down load it on your own product.

- Step 7. Full, modify and print or indication the Kentucky General Form of Receipt.

Each authorized record web template you get is yours eternally. You may have acces to each develop you downloaded within your acccount. Click the My Forms area and decide on a develop to print or down load yet again.

Compete and down load, and print the Kentucky General Form of Receipt with US Legal Forms. There are millions of expert and status-specific varieties you may use to your enterprise or specific needs.