Unless the continuation of a trust is necessary to carry out a material purpose of the trust (such as tax benefits), the trust may be terminated by agreement of all the beneficiaries if none of them is mentally incompetent or underage (e.g., under 21 in some states). However, termination generally cannot take place when it is contrary to the clearly expressed intention of the trustor. In the absence of a provision in a trust instrument giving the trustee power to terminate the trust, a trustee generally has no control over the continuance of the trust.

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

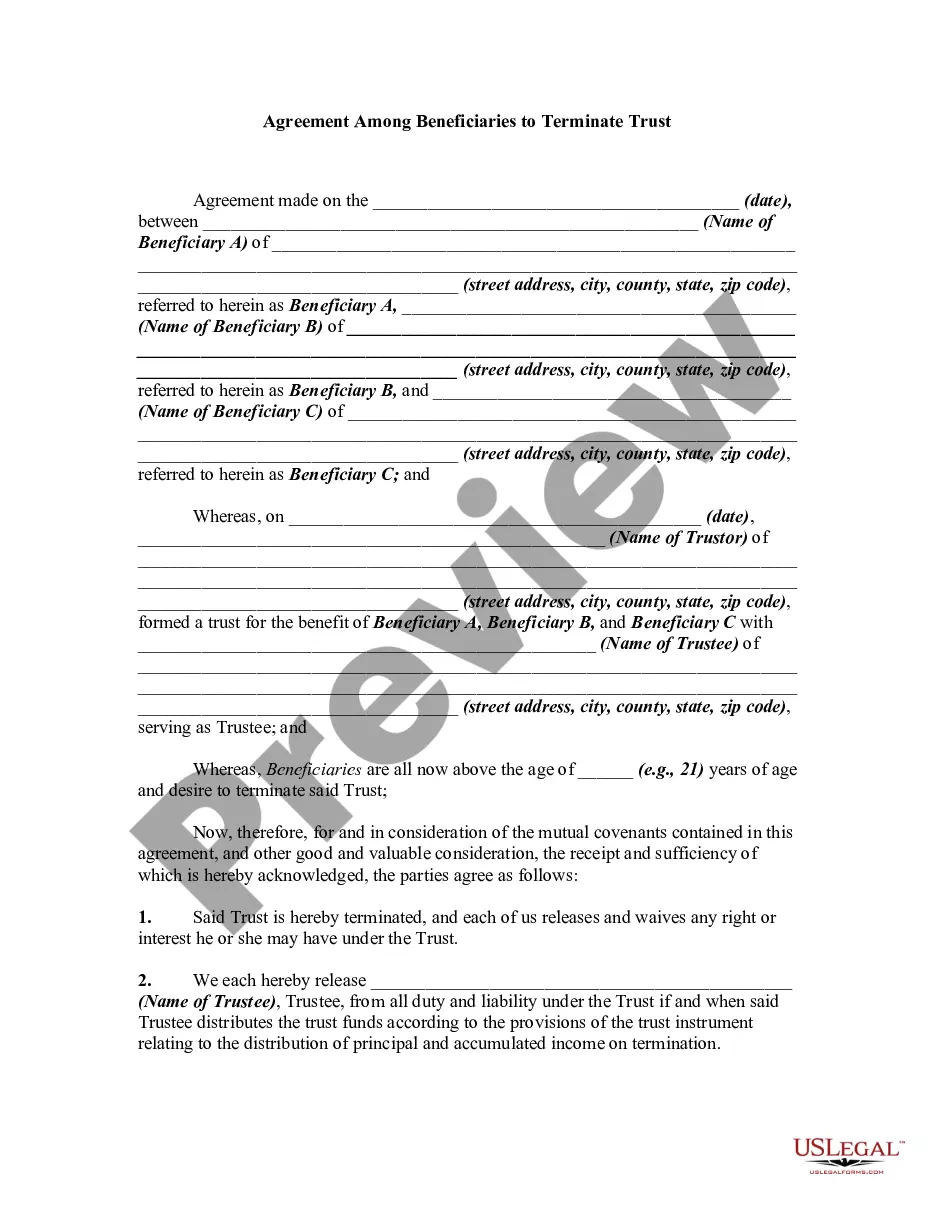

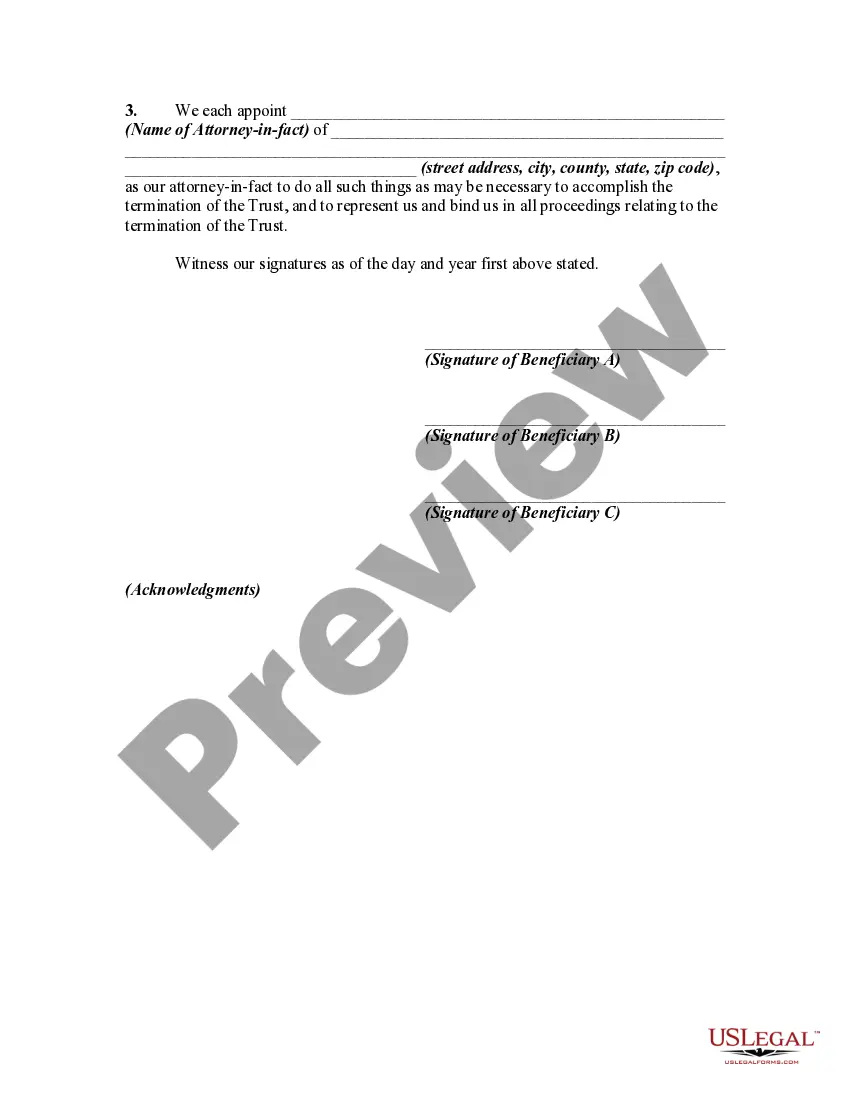

Kentucky Agreement Among Beneficiaries to Terminate Trust is a legal document that outlines the terms and conditions under which multiple beneficiaries of a trust collectively agree to terminate the trust and distribute its assets. This agreement is commonly used when all beneficiaries are in agreement that the trust no longer serves its intended purpose or becomes unnecessary due to changing circumstances. In Kentucky, there are different types of Agreement Among Beneficiaries to Terminate Trust, including: 1. Irrevocable Trust Termination Agreement: This type of agreement is used when the trust was initially set up as irrevocable, meaning it cannot be changed or terminated without the consent of all beneficiaries. In this case, the beneficiaries collectively agree to terminate the trust and distribute its assets according to the provisions outlined in the agreement. 2. Revocable Trust Termination Agreement: This agreement is utilized when the trust was initially established as revocable, allowing the trust or (or settler) to make changes or terminate it at will. In this scenario, the beneficiaries come together and decide to terminate the trust, usually due to fulfilling its objectives or other reasons agreed upon by all parties involved. The Kentucky Agreement Among Beneficiaries to Terminate Trust typically includes the following key components: 1. Identification of the trust: The agreement starts by clearly identifying the trust to be terminated. This includes the trust's name, date of creation, and any relevant identification numbers. 2. Beneficiary agreement: All beneficiaries involved in the trust must agree to terminate it. Their names, addresses, and contact information are listed in the agreement. Each beneficiary signs the document, indicating their consent. 3. Reason for termination: The agreement specifies the reason or reasons for terminating the trust. Whether it is due to achieve the trust's purpose, changes in circumstances, fulfillment of all obligations, or other justifiable reasons, the rationale is detailed in this section. 4. Distribution of trust assets: The agreement outlines how the assets held within the trust will be distributed among the beneficiaries upon termination. It typically includes the specific assets to be distributed, their estimated values, and the method of distribution agreed upon by the beneficiaries. 5. Discharge and release of trustees: To complete the trust termination process, the agreement includes provisions for the discharge and release of the trustees. This ensures that all parties involved are legally released from their duties and obligations pertaining to the trust upon termination. It is important to consult with a qualified attorney when drafting or executing a Kentucky Agreement Among Beneficiaries to Terminate Trust, as the specific legal requirements and procedures may vary based on individual circumstances and the type of trust being terminated.