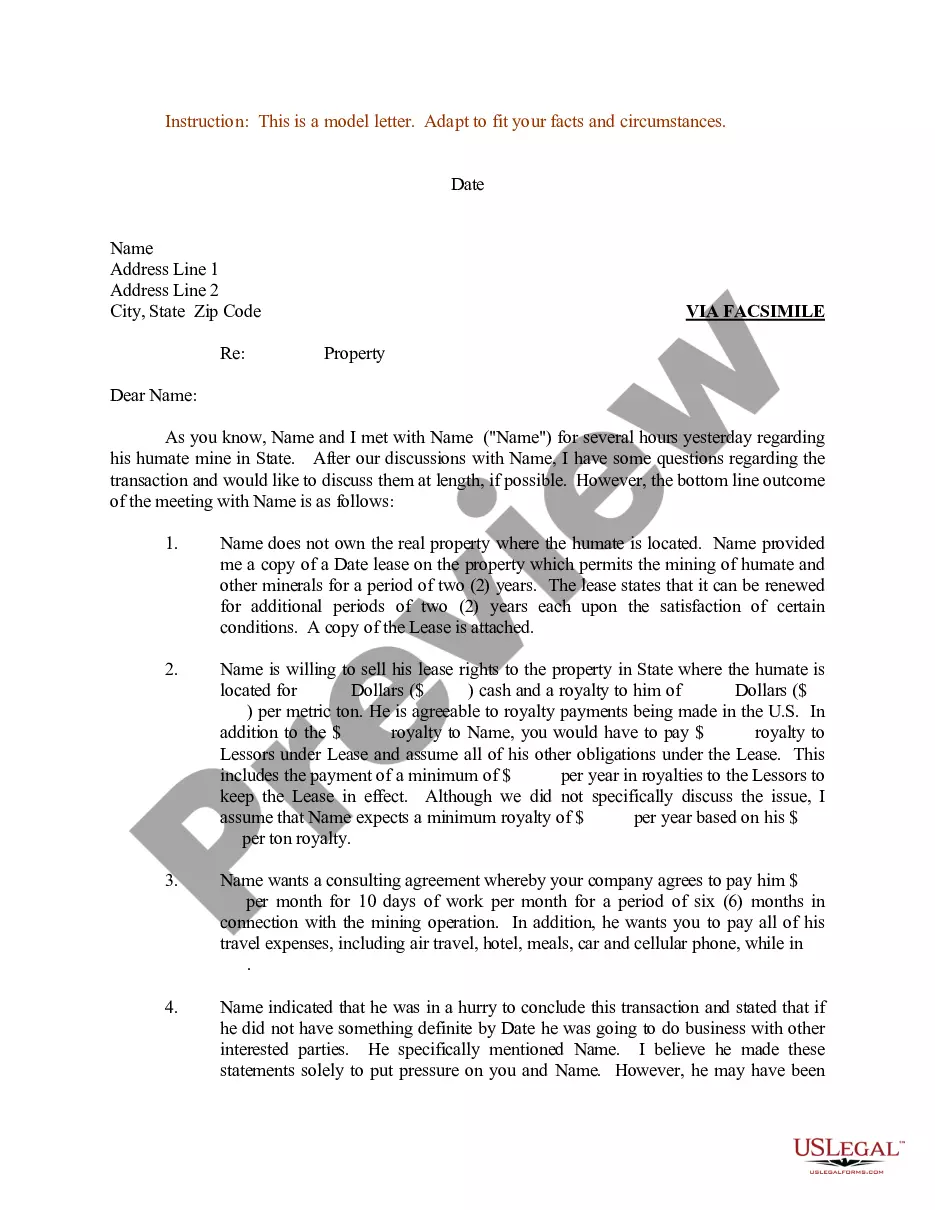

The Kentucky Receipt Template for Cash Payment is a document used to provide proof of cash transaction between a buyer and a seller in the state of Kentucky, USA. It enables both parties to maintain a clear record of the transaction for future reference or financial documentation purposes. The receipt template includes key details of the transaction, such as the date, amount paid in cash, a description of the goods or services purchased, and the names and signatures of the buyer and seller. This standardized template ensures that all essential information is recorded accurately, minimizing the chances of disputes or misunderstandings. It serves as an official acknowledgment that the buyer has paid the required amount in cash and confirms the seller's receipt of payment. The Kentucky Receipt Template for Cash Payment can be used by individuals, businesses, or organizations that engage in cash transactions, including retail stores, restaurants, service providers, and freelancers. Although there may not be specific types of Kentucky Receipt Template for Cash Payment, some variations could include specific templates tailored toward different industries or sectors. For instance, there might be separate templates or formats designed for retail businesses, professional services, or cash donations. These templates could include additional fields or sections specific to the type of transaction, such as itemized lists for products purchased or services rendered, tax calculations, or donation-specific information. By using the Kentucky Receipt Template for Cash Payment, both buyers and sellers can maintain organized records of their financial transactions, ensuring transparency and accountability. Furthermore, these receipts can serve as valuable evidence for tax purposes, expense tracking, or warranty claims. It is crucial for both parties to retain copies of the receipts for a reasonable period, typically for several years, to address potential future inquiries or disputes.

Kentucky Receipt Template for Cash Payment

Description

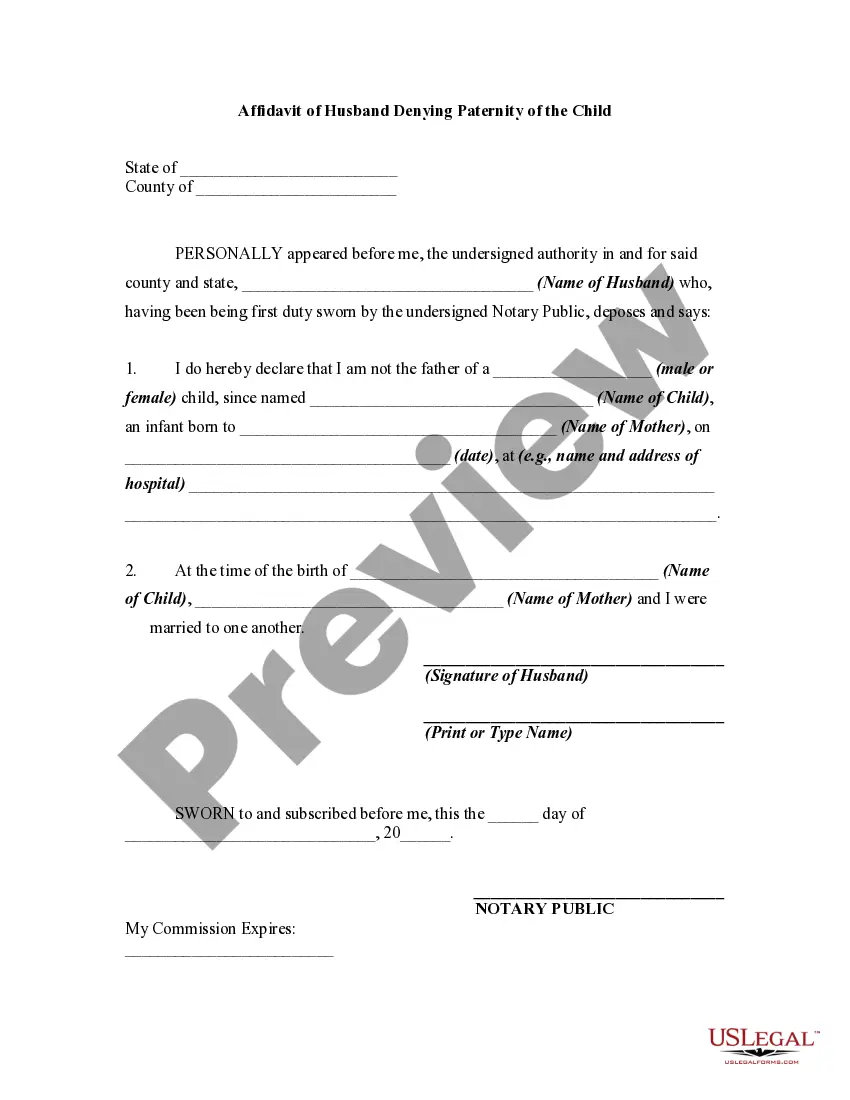

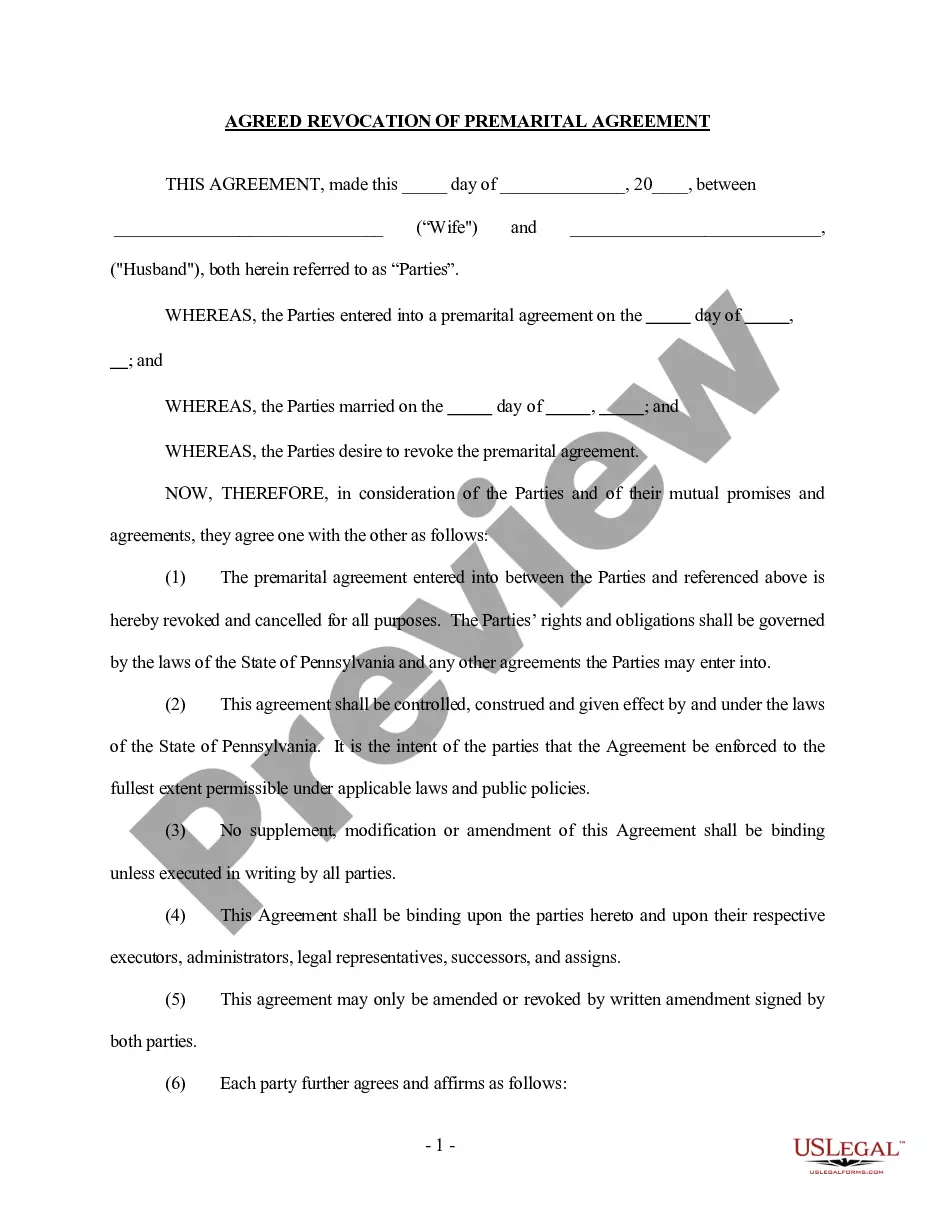

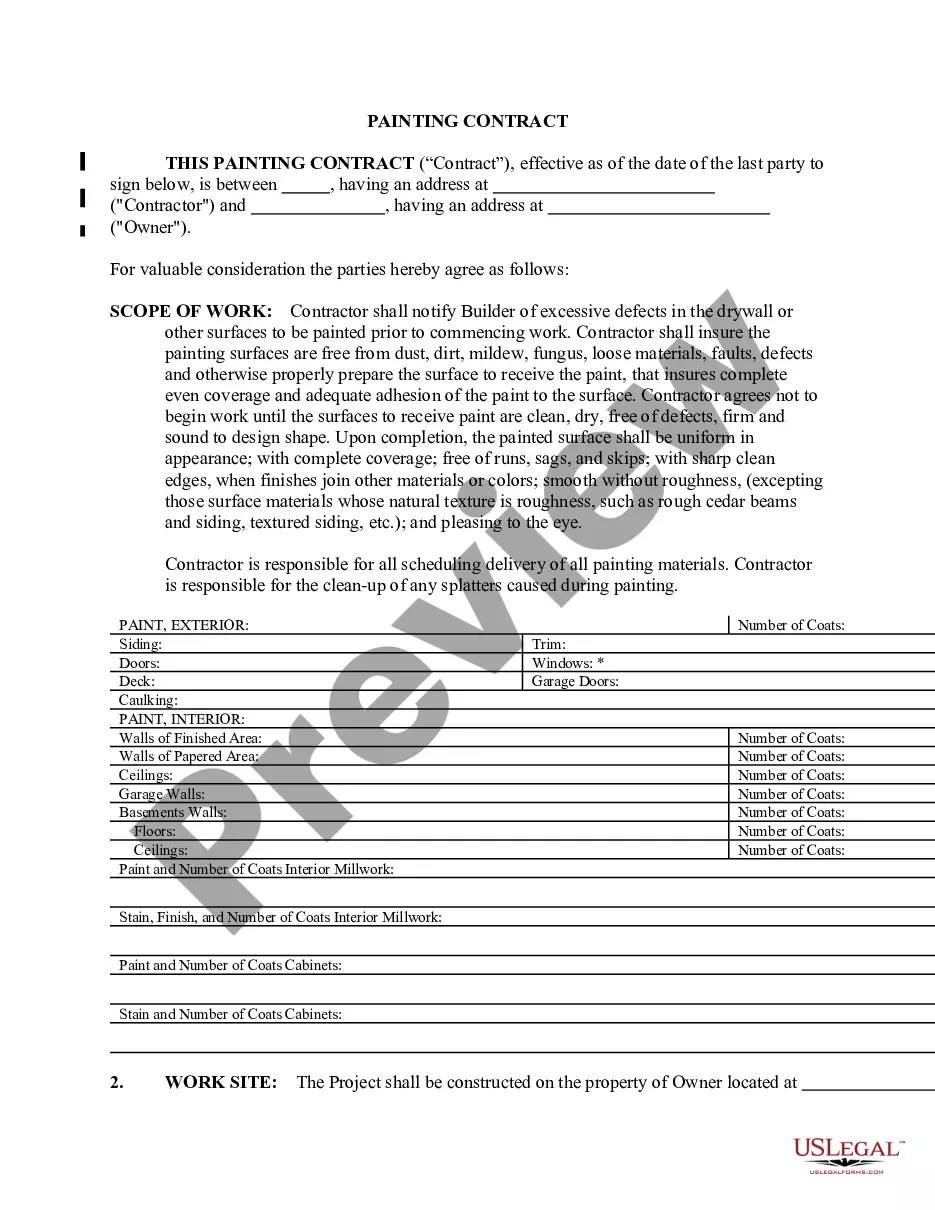

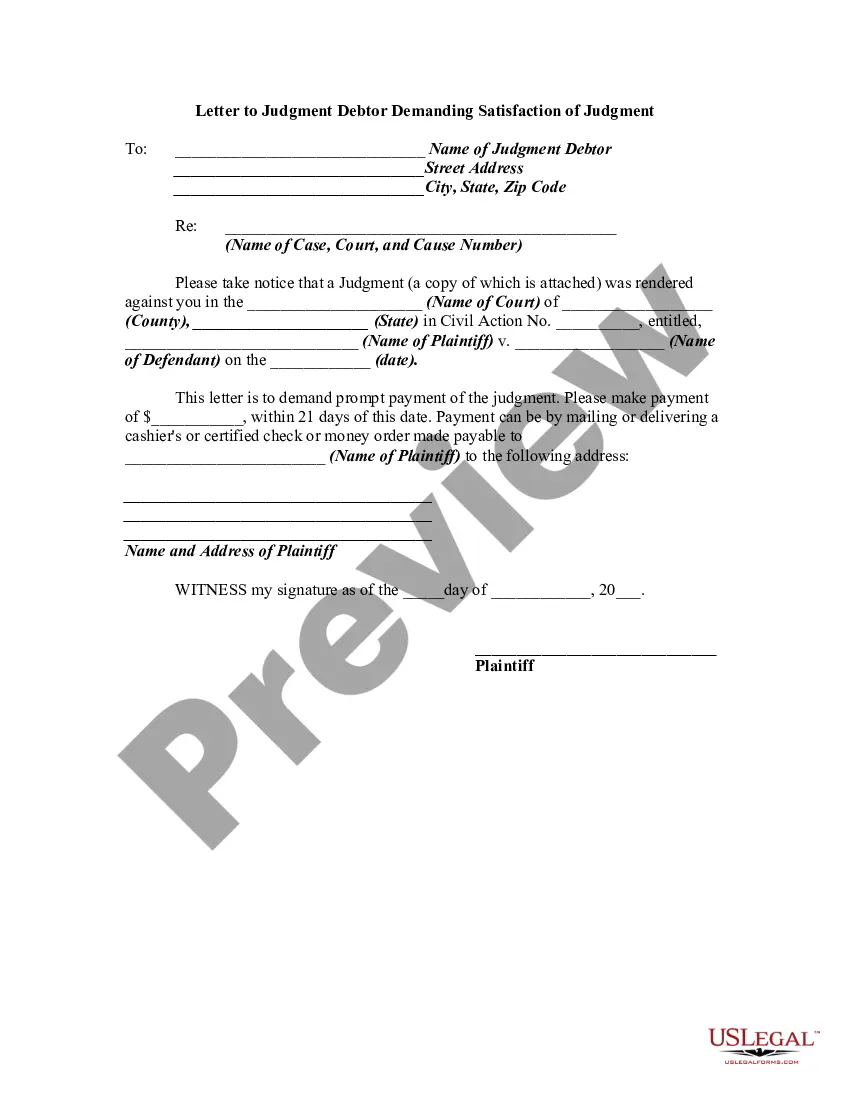

How to fill out Kentucky Receipt Template For Cash Payment?

Have you been within a position in which you need to have papers for both company or specific purposes almost every working day? There are a variety of legitimate record web templates available on the net, but locating versions you can trust isn`t easy. US Legal Forms offers 1000s of form web templates, like the Kentucky Receipt Template for Cash Payment, that happen to be composed to fulfill state and federal needs.

Should you be presently informed about US Legal Forms site and possess a free account, merely log in. Following that, you are able to acquire the Kentucky Receipt Template for Cash Payment format.

Should you not have an accounts and want to start using US Legal Forms, adopt these measures:

- Find the form you will need and ensure it is for the appropriate city/county.

- Use the Review key to review the form.

- Read the explanation to actually have selected the appropriate form.

- In case the form isn`t what you are searching for, make use of the Research field to find the form that fits your needs and needs.

- When you obtain the appropriate form, click Get now.

- Pick the rates program you want, fill in the desired details to create your bank account, and buy the transaction utilizing your PayPal or bank card.

- Choose a handy document structure and acquire your backup.

Locate each of the record web templates you might have bought in the My Forms food list. You can get a further backup of Kentucky Receipt Template for Cash Payment any time, if necessary. Just select the needed form to acquire or produce the record format.

Use US Legal Forms, one of the most substantial assortment of legitimate kinds, to save some time and prevent errors. The services offers skillfully produced legitimate record web templates that can be used for an array of purposes. Produce a free account on US Legal Forms and begin producing your life a little easier.

Form popularity

FAQ

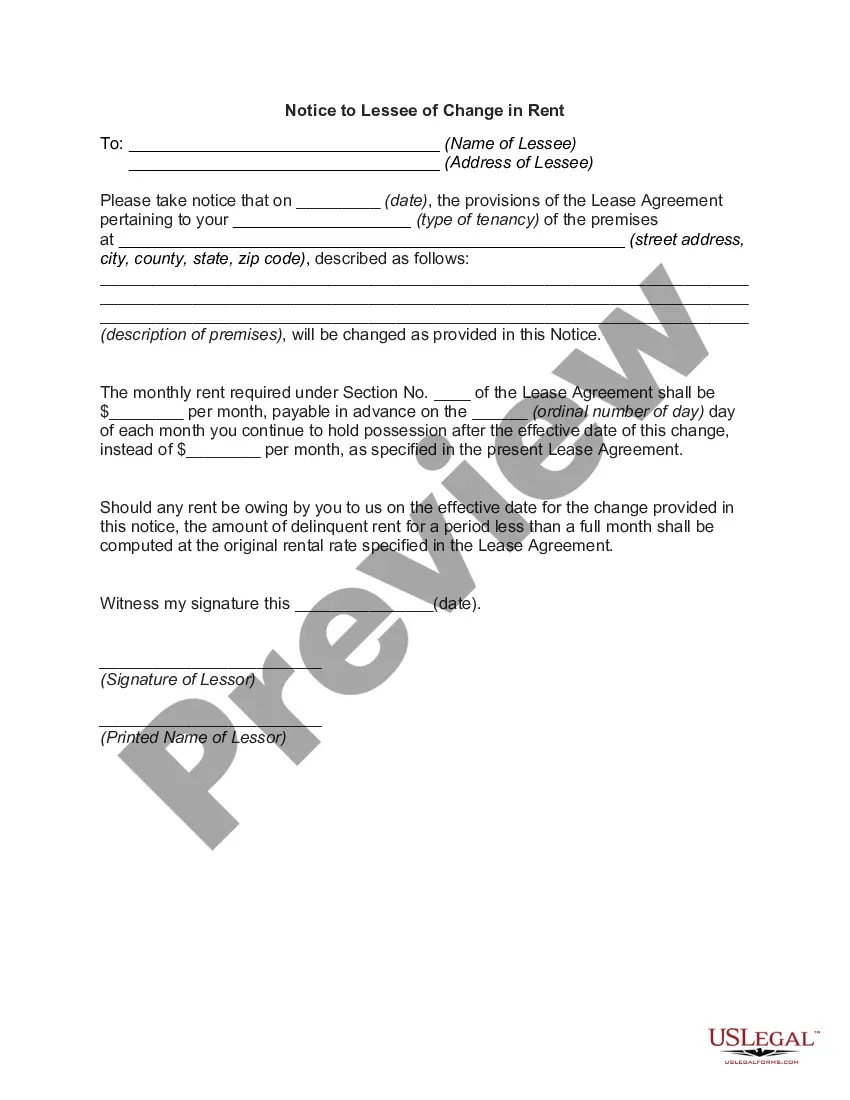

How do you write a receipt for a cash payment? If you are writing out a receipt for a cash payment, include the date, items purchased, quantity of each item, price of each item, total price, type of payment and payment amount, and your business name and contact information.

How to Write a ReceiptDate;Receipt Number;Amount Received ($);Transaction Details (what was purchased?);Received by (seller);Received from (buyer);Payment Method (cash, check, credit card, etc.);Check Number (if applicable); and.More items...?

To prove that cash is income, use:Invoices.Tax statements.Letters from those who pay you, or from agencies that contract you out or contract your services.Duplicate receipt ledger (give one copy to every customer and keep one for your records)

Format of Cash ReceiptThe date on which the transaction happened.The unique number assigned to the document for identification.The name of the customer.The amount of cash received.The method of payment, i.e., by cash, cheque, etc.;The signature of the vendor.

Just make sure they include:The date of payment,A description of the services or goods purchased,The amount paid in cash, and.The name of the company or person paid.

Receipts should be provided for every product or service purchased from your business, even if the customer is paying with cash. You can print the receipt as you sell the product or service and give it to the customer immediately after their purchase.

This is the information that should be included on a receipt: Your company's details including name, address, telephone number, and/or e-mail address. The date the transaction took place. List of products/services with a brief description of each along with the quantity delivered.

How do you write a receipt for a cash payment? If you are writing out a receipt for a cash payment, include the date, items purchased, quantity of each item, price of each item, total price, type of payment and payment amount, and your business name and contact information.

Just make sure they include:The date of payment,A description of the services or goods purchased,The amount paid in cash, and.The name of the company or person paid.