Kentucky Receipt Template for Child Care

Description

How to fill out Receipt Template For Child Care?

You can allocate time online looking for the official document template that meets the national and state stipulations you require.

US Legal Forms provides a vast array of legal forms that are reviewed by experts.

You can easily download or print the Kentucky Receipt Template for Child Care from the service.

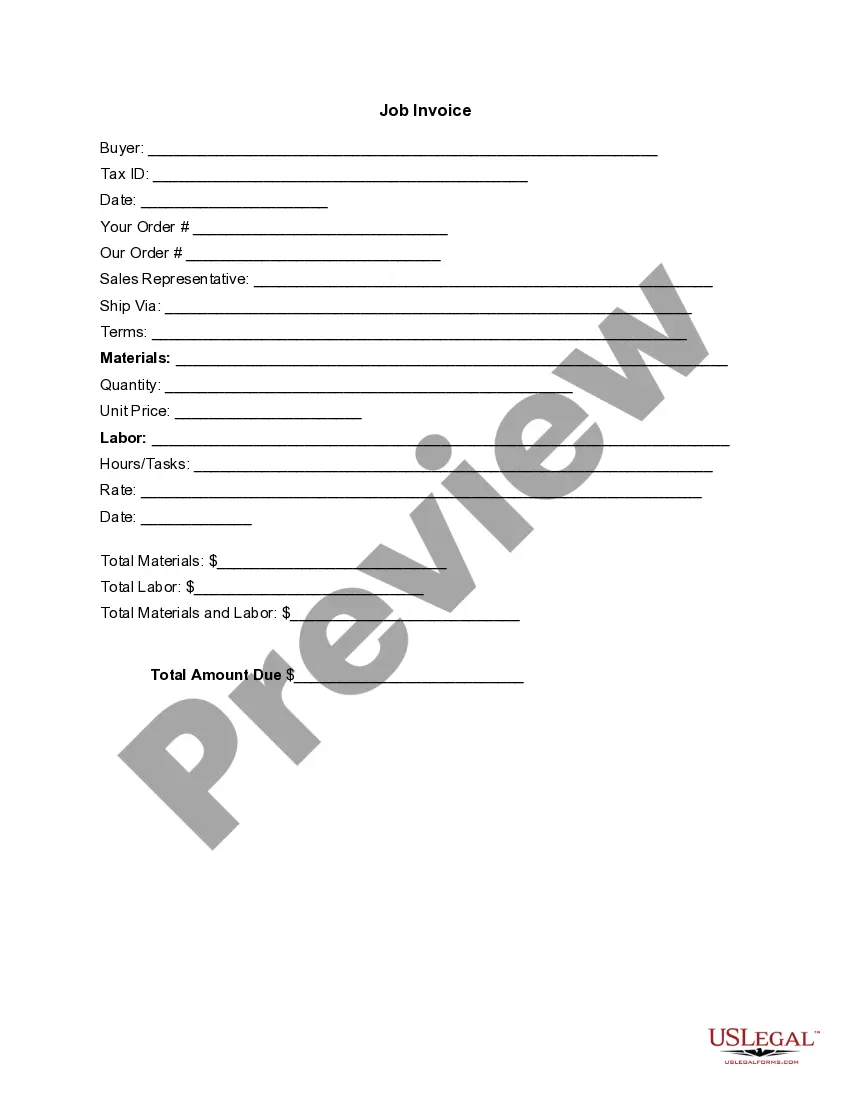

If available, utilize the Preview option to view the document template at the same time.

- If you possess a US Legal Forms account, you can sign in and click the Download button.

- After that, you can fill out, modify, print, or sign the Kentucky Receipt Template for Child Care.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of the purchased document, visit the My documents tab and click the corresponding option.

- If this is your first time using the US Legal Forms website, follow the simple steps below.

- First, make sure you have selected the correct document template for the state/city of your choice.

- Review the document description to ensure you have chosen the correct form.

Form popularity

FAQ

Writing an invoice for childcare should detail the services provided, including the child's name and the total amount due. You can create a professional-looking invoice using a Kentucky Receipt Template for Child Care, which can also serve as a receipt if payment has been made. By including all relevant information, your invoice will be clear and precise.

To prove child care, gather all relevant documentation that includes receipts, letters, and payment confirmations. A Kentucky Receipt Template for Child Care can help organize your documents in a way that's easily understandable. This organized approach enhances your ability to substantiate your claims during tax time.

Writing a letter for proof of child care should include pertinent details such as the child's name, the dates of care, and the provider's contact information. Using a Kentucky Receipt Template for Child Care can guide you in structuring this letter effectively. Ensure that you clearly state the need for the letter to increase its validity.

Claiming child care expenses without receipts can be challenging, as the IRS usually requires documentation. However, you may use bank statements or other proof of payment alongside a Kentucky Receipt Template for Child Care. Providing a clear explanation of your situation with these documents may help support your claims.

Creating a receipt for child care involves detailing the services rendered, the payment amount, and the child's name. You can effectively use a Kentucky Receipt Template for Child Care to structure your receipt clearly. Make sure the template includes the provider's details and the service dates to satisfy IRS requirements.

To prove your child care payment, you should keep detailed records, including receipts and payment confirmations. A Kentucky Receipt Template for Child Care can simplify this process by providing a professional format for your receipts. Always ensure that your documents include the provider's information and the service dates for credibility.

Yes, you must prove child care expenses to claim them on your tax return. The IRS expects valid documentation, such as receipts, to substantiate these costs. Utilizing a Kentucky Receipt Template for Child Care allows you to structure your proof efficiently. This can help you avoid potential issues during tax reviews.

The IRS verifies child care expenses through documentation provided by taxpayers. This includes receipts and a completed child care expense form. Using a Kentucky Receipt Template for Child Care helps you maintain clear records that can support your claims. Accurate documentation ensures you comply with IRS regulations.

Yes, you will receive a tax document related to your dependent care FSA, usually in the form of a Form 2441. This document outlines your contributions and helps you report your childcare expenses on your tax return. To ensure proper documentation, consider using a Kentucky Receipt Template for Child Care to keep track of your expenses, making tax time easier.

Yes, the IRS does require receipts for FSA expenses to verify that the charges are legitimate and qualify under FSA guidelines. Using a Kentucky Receipt Template for Child Care can help you create clear and compliant receipts. This documentation will be essential if you ever need to validate your expenses during tax time or for reimbursement purposes.