Barter is the trading of goods or services directly for other goods or services, without using money or any other similar unit of account or medium of exchange. Bartering is sometimes used among business as the method for the exchange of goods and services. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Kentucky Bartering Contract or Exchange Agreement

Description

How to fill out Bartering Contract Or Exchange Agreement?

You can allocate numerous hours online looking for the authentic document template that meets the federal and state requirements you require.

US Legal Forms provides a multitude of authentic forms that are reviewed by professionals.

It is easy to obtain or print the Kentucky Bartering Contract or Exchange Agreement from my services.

To find another version of the form, utilize the Lookup field to locate the template that fulfills your needs and specifications.

- If you already have a US Legal Forms account, you can Log In and click on the Obtain option.

- Afterward, you can fill out, modify, print, or sign the Kentucky Bartering Contract or Exchange Agreement.

- Every legal document template you acquire is yours permanently.

- To get another copy of a previously purchased form, go to the My documents tab and click on the related option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/region of your choice.

- Review the form description to confirm you have selected the correct form.

- If available, use the Review option to examine the document template as well.

Form popularity

FAQ

A barter contract, also known as an Exchange Agreement, is a legal document that outlines the specific terms and conditions of a barter transaction. This contract ensures that both parties understand their rights, the value of the goods or services exchanged, and the agreed-upon timelines. Utilizing a Kentucky Bartering Contract can provide clarity and protection, reducing the chances of misunderstandings. By formalizing your exchange, you can engage in effective and beneficial bartering.

Yes, the IRS does allow bartering; however, they require that you report the fair market value of the goods and services exchanged. Under a Kentucky Bartering Contract or Exchange Agreement, both parties must recognize and acknowledge the value of their exchanges for tax documentation purposes. This means that while you can barter, you need to be responsible and transparent about the transactions. Ensuring compliance with IRS regulations can help avoid potential legal issues down the line.

When you engage in bartering, you must report any bartered goods or services on your taxes. The IRS considers bartering as taxable income, so it's crucial to keep track of the fair market value of the exchanged items. Using a Kentucky Bartering Contract or Exchange Agreement can help document these transactions for tax purposes. For advice specific to your situation, it's a good idea to consult a tax professional.

While bartering is legal, there are limits to what can be exchanged under a Kentucky Bartering Contract or Exchange Agreement. For instance, certain goods or services may be restricted by law, and therefore, cannot be included in a barter deal. Additionally, any barter agreements must not violate any contractual obligations or regulations. To stay within legal bounds, always review relevant laws or seek legal advice when necessary.

A contract of barter or exchange is a formal document that details the terms under which goods or services are exchanged between two parties. It delineates each party's obligations and ensures that everyone involved understands their rights and responsibilities. Using a Kentucky Bartering Contract or Exchange Agreement can provide a structured approach to engaging in this type of transaction, helping to mitigate risks.

When you barter, the value of the goods or services exchanged must be reported as income on your tax return. This means both parties need to determine the fair market value of what they exchanged. Utilizing a Kentucky Bartering Contract or Exchange Agreement can assist in documenting the transaction accurately, making tax reporting easier and more organized.

Bartering is legal in the United States, provided that the exchanged goods or services are not prohibited by law. However, it is essential to adhere to tax regulations concerning barter transactions, as these can have implications for income reporting. A comprehensive Kentucky Bartering Contract or Exchange Agreement can help clarify the terms and ensure compliance with applicable legal standards.

A contract of barter is a legal document that formalizes the terms of an exchange between parties. It specifies the goods or services exchanged, along with the responsibilities of each party. A well-drafted Kentucky Bartering Contract or Exchange Agreement minimizes misunderstandings and enhances the likelihood of a successful transaction.

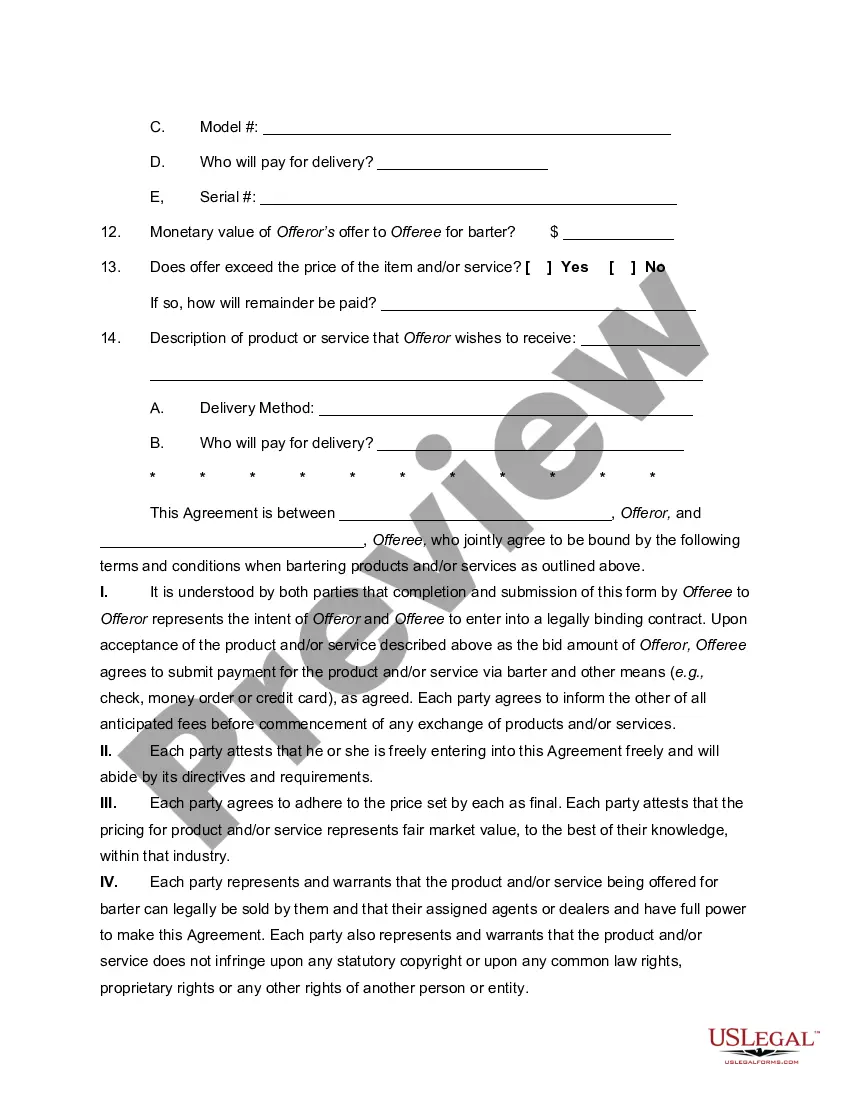

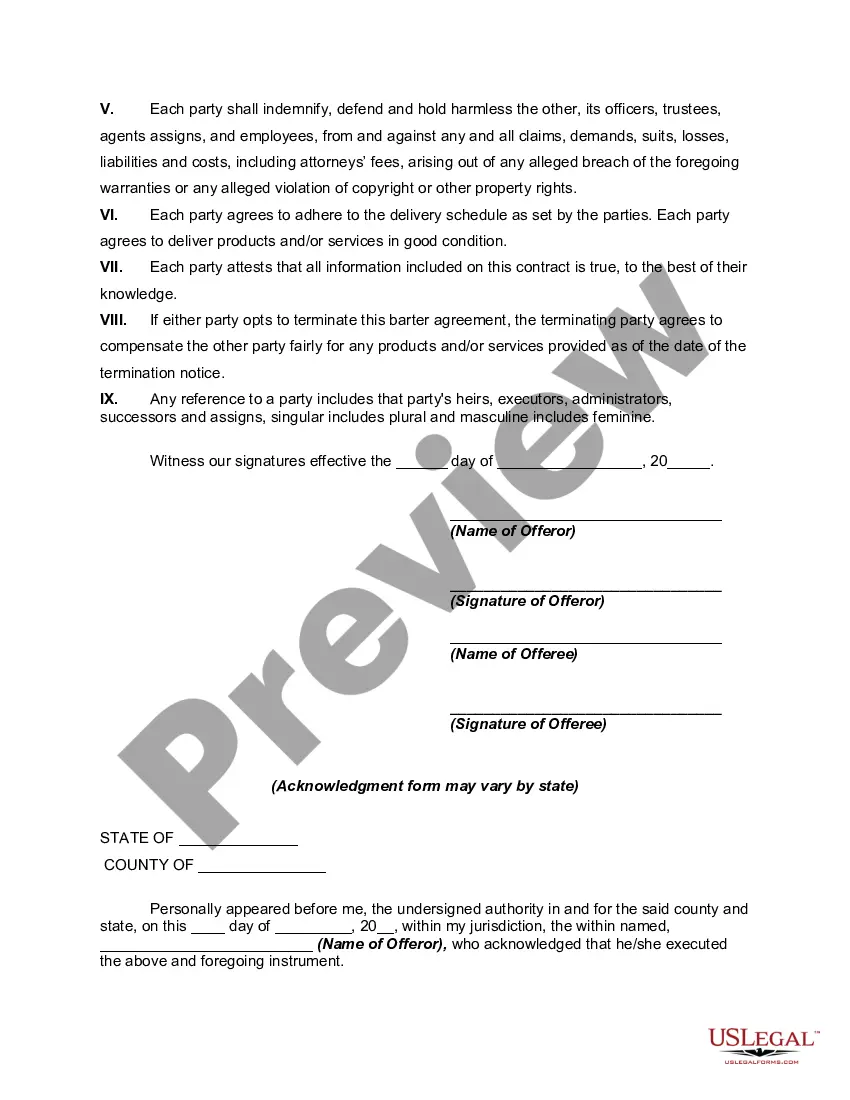

To write a barter agreement, begin by clearly defining the items or services being exchanged. Include specific details such as delivery dates, responsibilities, and any potential liabilities. Utilizing a Kentucky Bartering Contract or Exchange Agreement template from a trusted provider can simplify this process and ensure all essential elements are covered.

A barter agreement can be as straightforward as exchanging services between two parties. For instance, a graphic designer may provide branding services in return for website development from a programmer. This type of Kentucky Bartering Contract or Exchange Agreement clearly outlines the specific services each party will deliver, ensuring both sides understand their obligations.