Kentucky Owner Financing Contract for Car

Description

How to fill out Owner Financing Contract For Car?

Are you currently in a situation where you need documentation for business or personal activities nearly every day.

There is a multitude of legal document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Kentucky Owner Financing Agreement for Vehicle, that are designed to comply with federal and state requirements.

Select the pricing plan you want, fill out the required information to set up your account, and pay for the order using your PayPal or credit card.

Choose a preferred file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you will be able to download the Kentucky Owner Financing Agreement for Vehicle template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

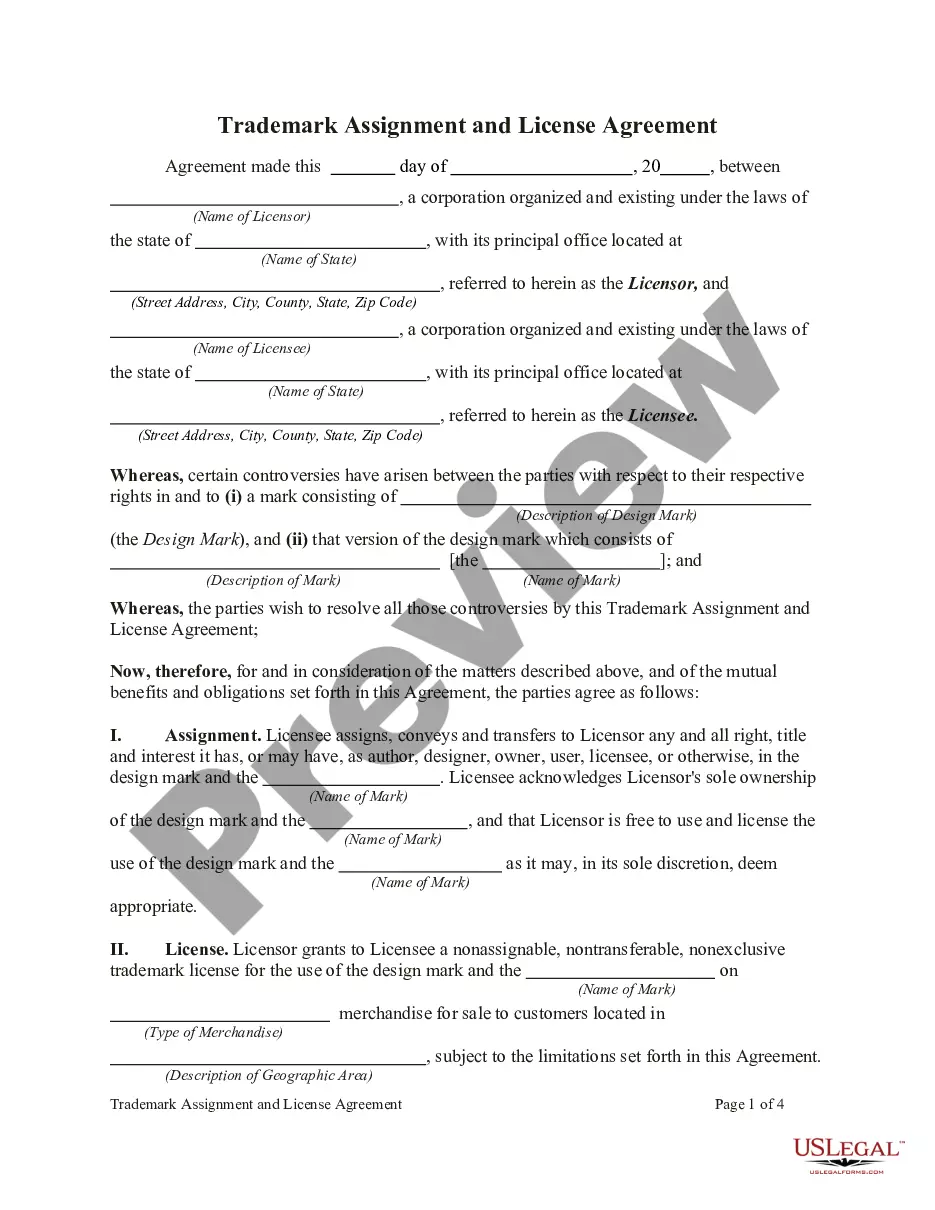

- Use the Preview button to review the document.

- Review the details to ensure that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

- Once you find the correct form, click on Purchase now.

Form popularity

FAQ

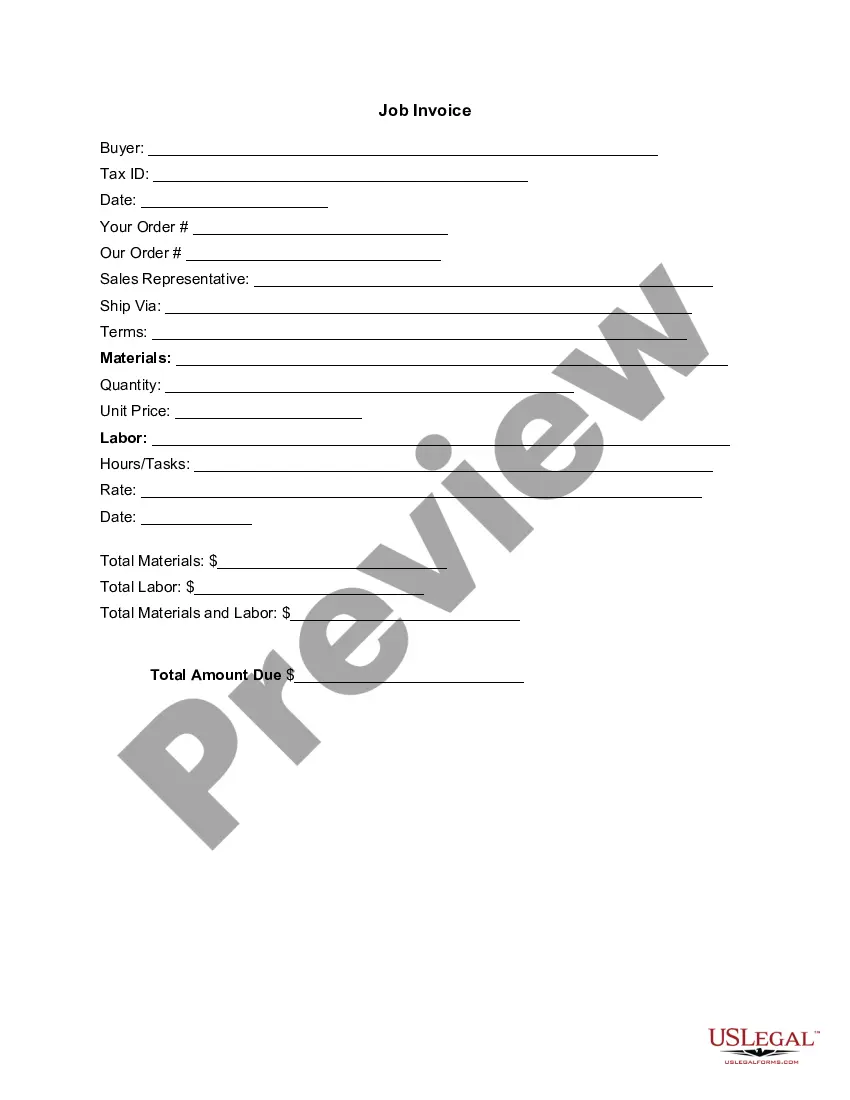

An example of owner financing could involve an individual purchasing a vehicle directly from another individual or dealer. The buyer pays a deposit and agrees to monthly payments, often with interest, directly to the seller. By using a Kentucky Owner Financing Contract for Car, both parties can formalize their agreement, protecting their rights and ensuring a smooth transaction.

To write an owner finance contract, begin by detailing the buyer and seller's information and the property or item being financed. Clearly outline payment terms, interest rates, and the duration of the contract. Furthermore, incorporating legal protections and using a Kentucky Owner Financing Contract for Car template can streamline the process and ensure you cover all necessary elements.

No, owner finance is not the same as rent to own. While owner financing involves a buyer making payments to the seller to eventually own the car, rent to own typically allows a person to use the car while making payments without transferring ownership. Understanding the distinctions between these options can help you make better financial choices. A Kentucky Owner Financing Contract for Car clearly defines ownership terms, making it an excellent option if you desire full ownership without delay.

The owner finance document serves as a written record detailing the buyer's obligation to make payments directly to the seller. This contract is particularly beneficial in Kentucky, where the Owner Financing Contract for Car can simplify the purchasing process for both individuals and businesses. By using this document, you can streamline negotiations and ensure all terms are clearly defined and legally binding.

Good terms in a Kentucky Owner Financing Contract for Car typically include a reasonable down payment, a competitive interest rate, and a manageable repayment schedule. Commonly, a down payment of 10% to 20% works well, alongside an interest rate that aligns with prevailing market rates. Flexible payment terms—duration of three to five years—often appeal to buyers and make the deal more attractive. Ultimately, both parties should arrive at terms that meet their needs and protect their interests.

Closing costs for owner financing can vary significantly depending on the specifics of the agreement and the parties involved. Generally, these costs may include filing fees, legal fees, and any other administrative expenses needed to complete the Kentucky Owner Financing Contract for Car. It is advisable to discuss potential closing costs upfront to avoid surprises later in the process.

To set up an owner financing contract, start by drafting a Kentucky Owner Financing Contract for Car that clearly outlines payment details and other terms. Both parties should review the agreement thoroughly to ensure it meets their needs. Once finalized, both the buyer and seller should sign the contract to make it legally binding.

The seller generally establishes the criteria for owner financing, including the down payment, interest rate, and payment schedule. However, the terms should be agreeable to both parties. Utilizing a Kentucky Owner Financing Contract for Car can help outline these criteria clearly, ensuring that everyone is on the same page.

In an owner financing scenario, the seller typically retains the title or deed until the buyer fulfills the payment terms outlined in the Kentucky Owner Financing Contract for Car. This arrangement protects the seller's interests while giving the buyer the benefit of using the vehicle. Once the buyer completes all payments, the deed transfers to them.

To secure your own financing for a car, start by assessing your credit score and financial situation. While traditional loans are available, owner financing offers an alternative. In this scenario, a Kentucky Owner Financing Contract for Car can make the process more straightforward, as it allows direct negotiation with the seller.