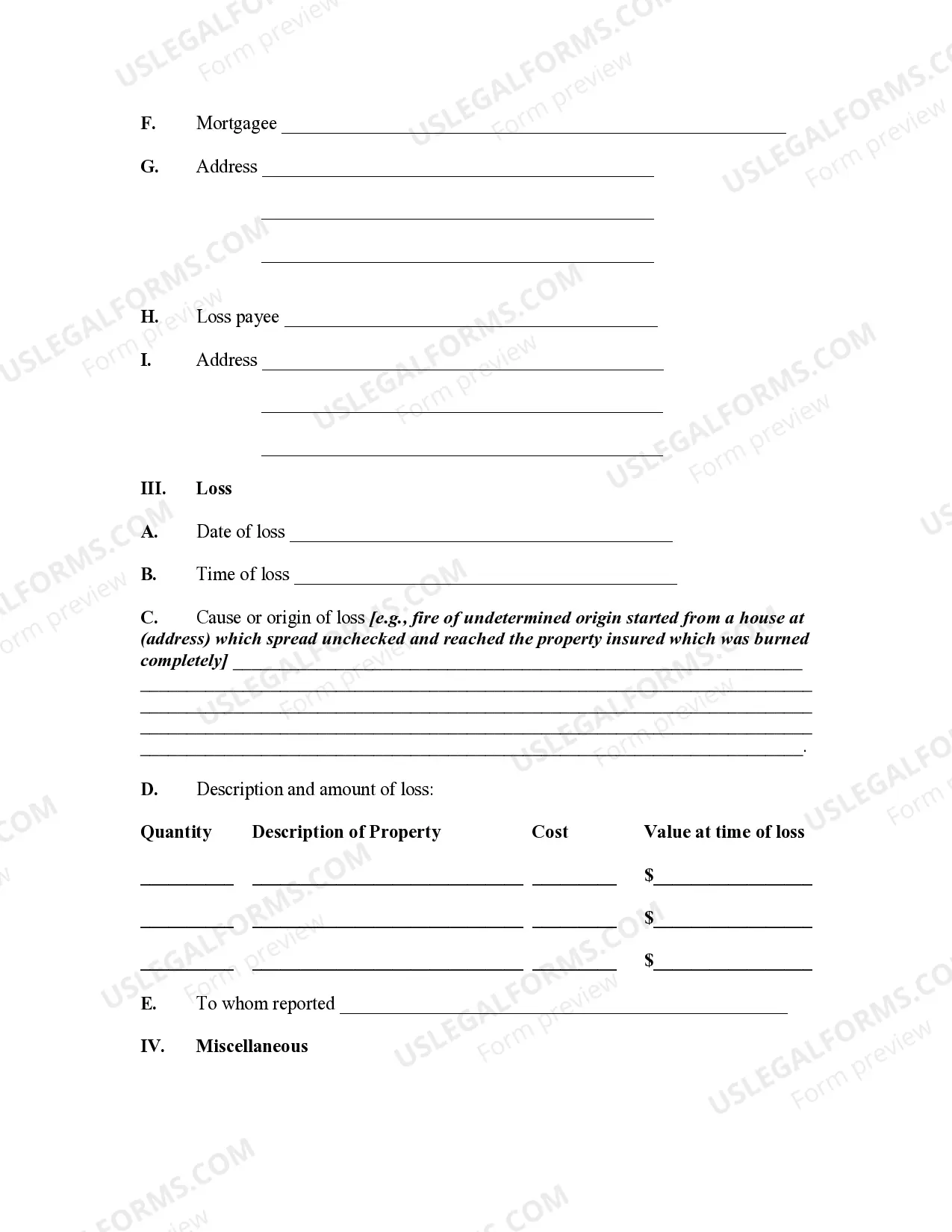

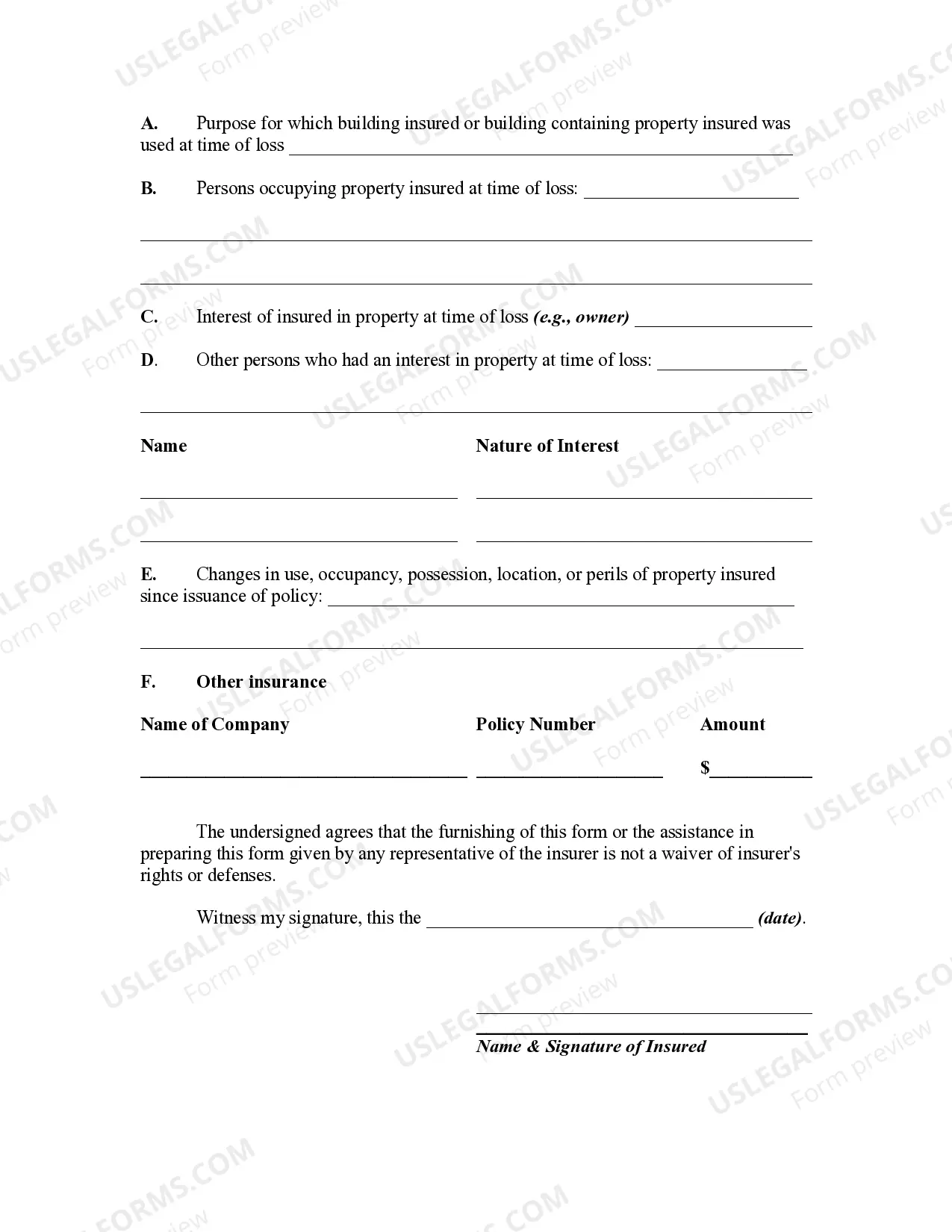

A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

Kentucky Proof of Loss for Fire Insurance Claim is a crucial document required for individuals or businesses who have suffered fire damage and are seeking reimbursement from their insurance company. This document serves as a formal statement, verifying the extent of the loss incurred, and acts as evidence during the claims process. The Kentucky Proof of Loss is designed to capture comprehensive details about the fire incident, including the date and time of the occurrence, the cause of the fire, the items or property damaged, and the estimated value of the loss. It is essential to provide accurate and detailed information, as this document will determine the amount of compensation the policyholder will receive. To create an effective Kentucky Proof of Loss for Fire Insurance Claim, certain essential keywords or sections should be included. These may include: 1. Policyholder Information: Start by including the policyholder's name, contact details, and policy number. This information ensures that the insurer can easily identify and process the claim. 2. Incident Description: Provide a detailed account of the fire incident, including the date, time, and location of the occurrence. Mention any contributing factors, such as electrical faults or natural disasters. 3. Property Description: List all the affected items or property that experienced fire damage. Include a detailed description of each item, including brand, model, age, and any unique features. Attach supporting documents like receipts, photographs, or purchase invoices whenever possible. 4. Estimation of Loss: This section requires an estimate of the cost to repair or replace the damaged items. Provide detailed itemized lists, specifying the quantity, value, and replacement/repair cost for each item. It is advisable to obtain professional assessments or estimates to validate the accuracy of the presented figures. 5. Loss Verification: Include any supporting evidence to validate the claim, such as photographs of the damaged property, fire incident reports from the local fire department, witness testimonies, or any relevant documentation related to the insurance policy. In Kentucky, there isn't a specific distinction for different types of Proof of Loss forms concerning fire insurance claims. However, it is essential to review and use the specific form provided by the insurance company or consult with a legal professional to ensure compliance with state regulations. In conclusion, when filing a fire insurance claim in Kentucky, a detailed and accurately completed Proof of Loss form is critical to the success of the claim. Providing thorough information, documentation, and estimated costs will facilitate the claim's processing and increase the likelihood of fair compensation for the loss suffered.Kentucky Proof of Loss for Fire Insurance Claim is a crucial document required for individuals or businesses who have suffered fire damage and are seeking reimbursement from their insurance company. This document serves as a formal statement, verifying the extent of the loss incurred, and acts as evidence during the claims process. The Kentucky Proof of Loss is designed to capture comprehensive details about the fire incident, including the date and time of the occurrence, the cause of the fire, the items or property damaged, and the estimated value of the loss. It is essential to provide accurate and detailed information, as this document will determine the amount of compensation the policyholder will receive. To create an effective Kentucky Proof of Loss for Fire Insurance Claim, certain essential keywords or sections should be included. These may include: 1. Policyholder Information: Start by including the policyholder's name, contact details, and policy number. This information ensures that the insurer can easily identify and process the claim. 2. Incident Description: Provide a detailed account of the fire incident, including the date, time, and location of the occurrence. Mention any contributing factors, such as electrical faults or natural disasters. 3. Property Description: List all the affected items or property that experienced fire damage. Include a detailed description of each item, including brand, model, age, and any unique features. Attach supporting documents like receipts, photographs, or purchase invoices whenever possible. 4. Estimation of Loss: This section requires an estimate of the cost to repair or replace the damaged items. Provide detailed itemized lists, specifying the quantity, value, and replacement/repair cost for each item. It is advisable to obtain professional assessments or estimates to validate the accuracy of the presented figures. 5. Loss Verification: Include any supporting evidence to validate the claim, such as photographs of the damaged property, fire incident reports from the local fire department, witness testimonies, or any relevant documentation related to the insurance policy. In Kentucky, there isn't a specific distinction for different types of Proof of Loss forms concerning fire insurance claims. However, it is essential to review and use the specific form provided by the insurance company or consult with a legal professional to ensure compliance with state regulations. In conclusion, when filing a fire insurance claim in Kentucky, a detailed and accurately completed Proof of Loss form is critical to the success of the claim. Providing thorough information, documentation, and estimated costs will facilitate the claim's processing and increase the likelihood of fair compensation for the loss suffered.