If you need to total, obtain, or printing authorized file templates, use US Legal Forms, the greatest collection of authorized types, that can be found on the Internet. Take advantage of the site`s basic and convenient lookup to discover the papers you will need. Different templates for business and personal uses are sorted by classes and claims, or keywords. Use US Legal Forms to discover the Kentucky Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company in a couple of mouse clicks.

If you are presently a US Legal Forms consumer, log in for your bank account and click the Acquire switch to find the Kentucky Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company. You may also entry types you formerly delivered electronically inside the My Forms tab of your bank account.

If you use US Legal Forms initially, refer to the instructions beneath:

- Step 1. Ensure you have chosen the shape to the appropriate metropolis/region.

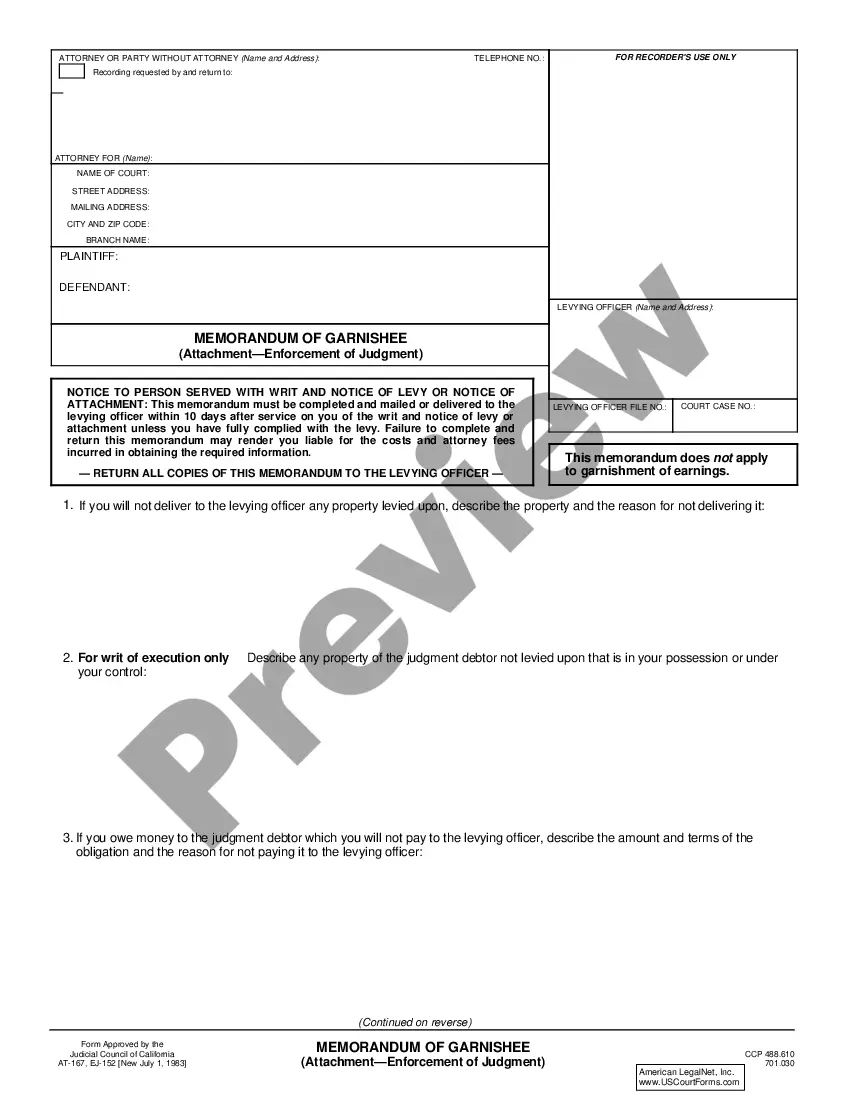

- Step 2. Take advantage of the Review choice to look over the form`s articles. Don`t forget about to read the explanation.

- Step 3. If you are not satisfied using the form, use the Search discipline near the top of the display to find other variations from the authorized form web template.

- Step 4. Upon having identified the shape you will need, select the Buy now switch. Choose the rates prepare you choose and include your credentials to sign up to have an bank account.

- Step 5. Procedure the deal. You can utilize your credit card or PayPal bank account to accomplish the deal.

- Step 6. Choose the format from the authorized form and obtain it on your gadget.

- Step 7. Complete, edit and printing or indicator the Kentucky Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company.

Every single authorized file web template you buy is the one you have for a long time. You might have acces to each form you delivered electronically within your acccount. Click the My Forms section and choose a form to printing or obtain once more.

Compete and obtain, and printing the Kentucky Sale and Assignment of a Percentage Ownership Interest in a Limited Liability Company with US Legal Forms. There are millions of professional and status-distinct types you can utilize for your business or personal needs.