Whenever credit for personal, family, or household purposes involving a consumer is denied or the charge for the credit is increased either wholly or partly because of information obtained from a person other than a credit reporting agency bearing on the consumer's creditworthiness, credit standing, credit capacity, character, general reputation, personal characteristics, or mode of living, certain requirements must be met. The user of such information, when the adverse action is communicated to the consumer, must clearly and accurately disclose the consumer's right to make a written request for disclosure of the information. If such a request is made and is received within 60 days after the consumer learned of the adverse action, the user, within a reasonable period of time, must disclose to the consumer the nature of the information.

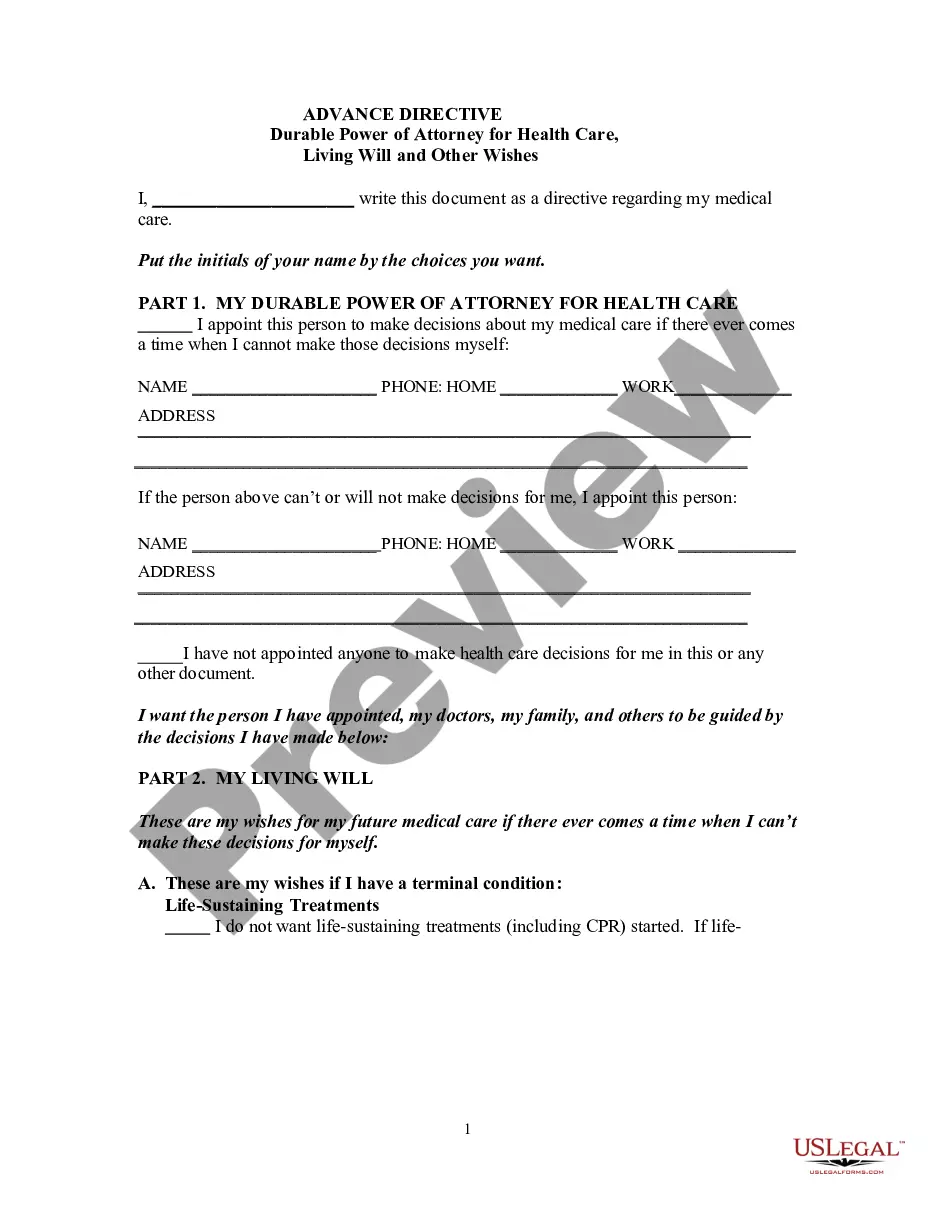

Kentucky Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency

Description

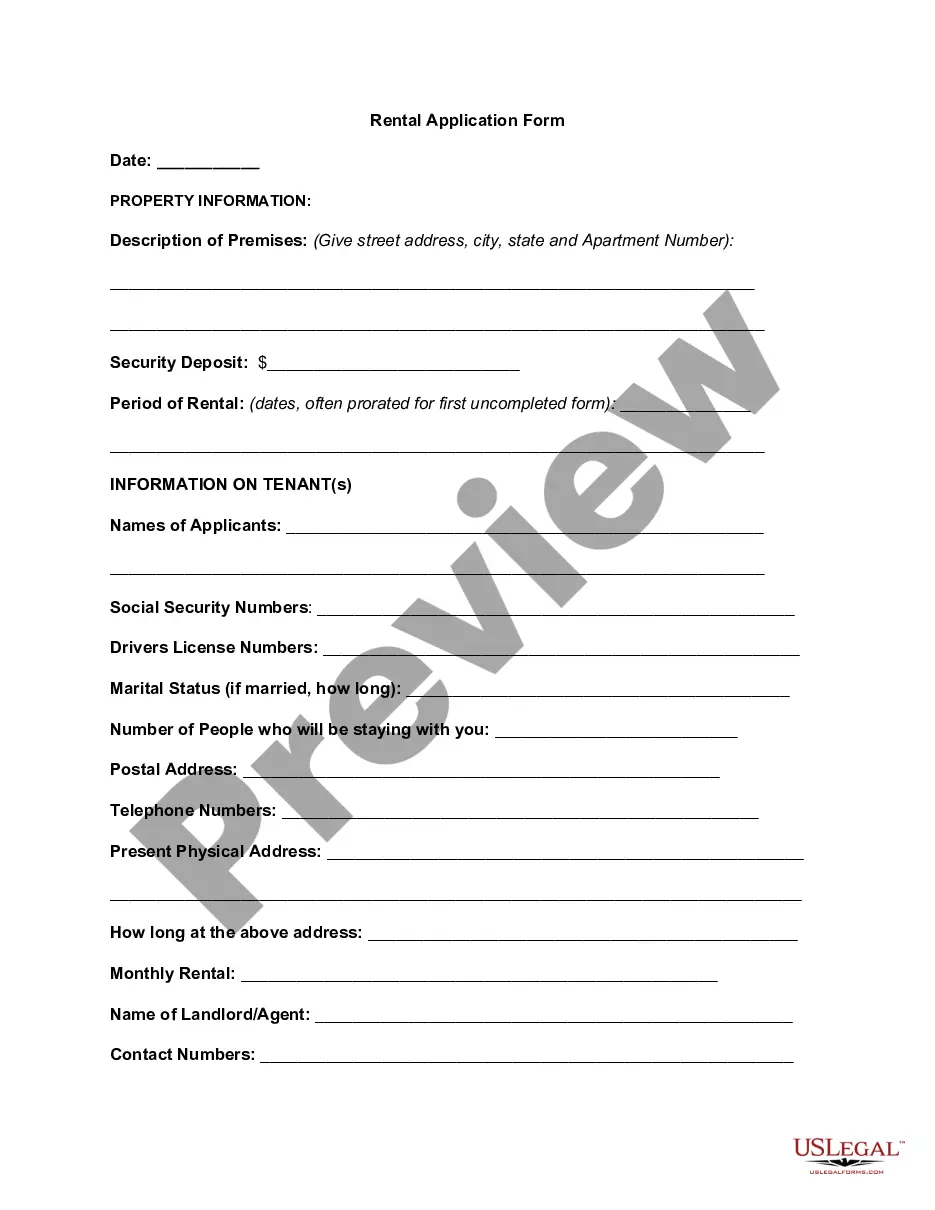

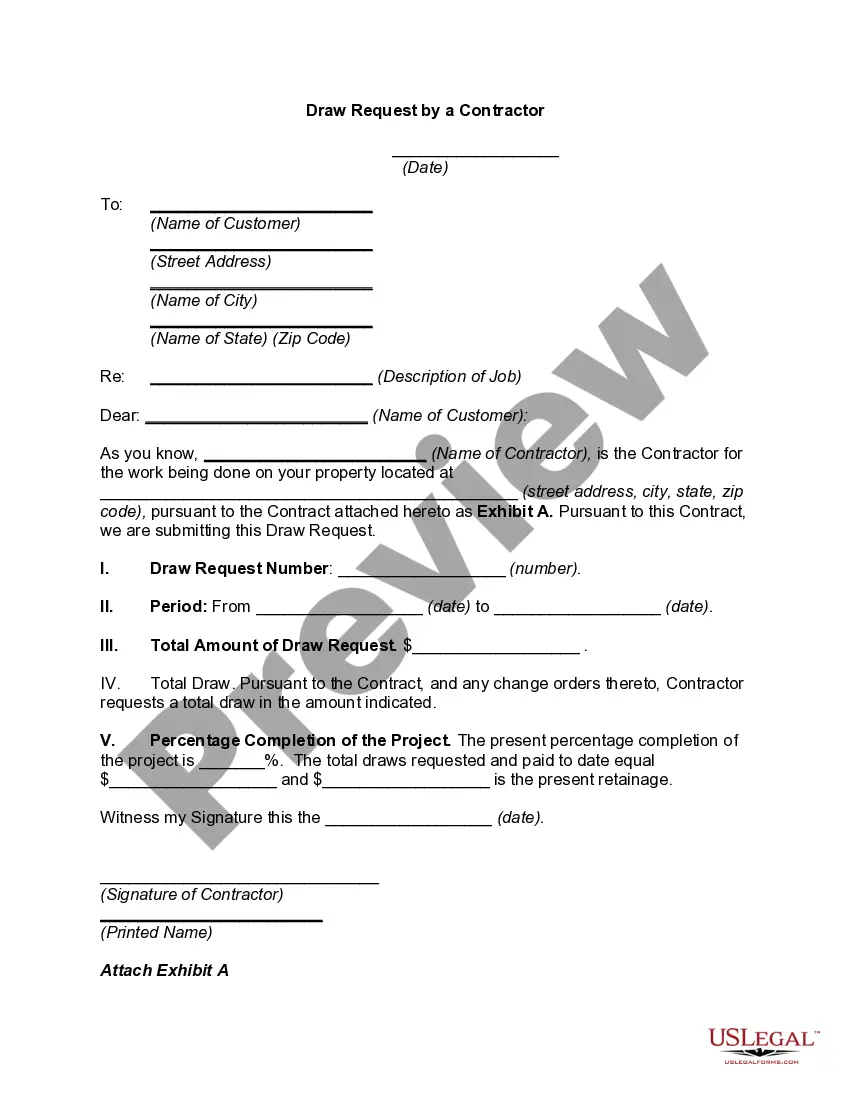

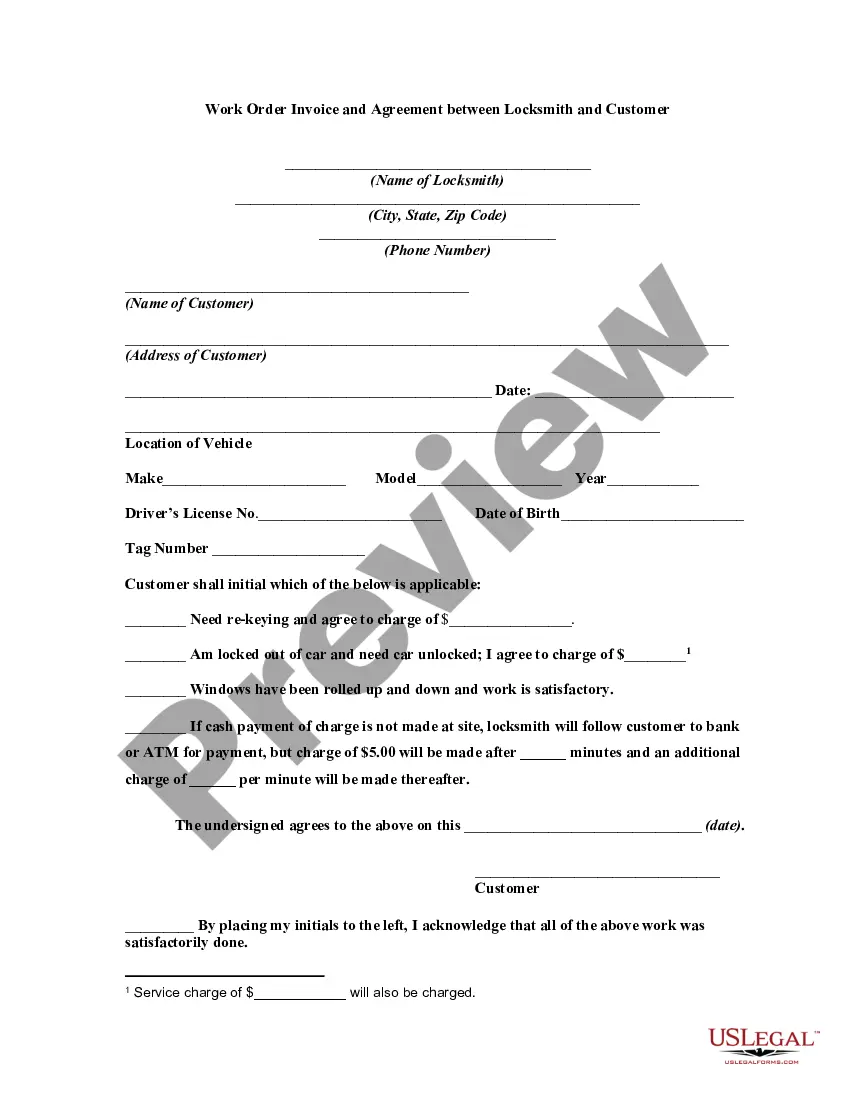

How to fill out Notice Of Increase In Charge For Credit Based On Information Received From Person Other Than Consumer Reporting Agency?

You are able to spend hours on the web attempting to find the lawful file web template that fits the federal and state specifications you want. US Legal Forms offers thousands of lawful varieties which are evaluated by professionals. It is possible to obtain or print out the Kentucky Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency from the services.

If you currently have a US Legal Forms bank account, it is possible to log in and click on the Acquire key. Afterward, it is possible to total, change, print out, or indicator the Kentucky Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency. Each and every lawful file web template you purchase is the one you have forever. To acquire an additional duplicate associated with a obtained form, visit the My Forms tab and click on the corresponding key.

Should you use the US Legal Forms website initially, stick to the straightforward instructions below:

- First, make sure that you have chosen the best file web template for the county/metropolis of your choosing. Read the form information to ensure you have chosen the correct form. If readily available, use the Review key to search throughout the file web template at the same time.

- If you would like get an additional edition from the form, use the Research field to get the web template that meets your needs and specifications.

- Upon having located the web template you need, simply click Purchase now to carry on.

- Select the costs prepare you need, type in your qualifications, and sign up for an account on US Legal Forms.

- Full the transaction. You should use your Visa or Mastercard or PayPal bank account to fund the lawful form.

- Select the formatting from the file and obtain it to the gadget.

- Make modifications to the file if necessary. You are able to total, change and indicator and print out Kentucky Notice of Increase in Charge for Credit Based on Information Received From Person Other Than Consumer Reporting Agency.

Acquire and print out thousands of file themes utilizing the US Legal Forms Internet site, which offers the most important collection of lawful varieties. Use skilled and express-particular themes to take on your organization or specific demands.

Form popularity

FAQ

Section 623(a)(1)(B). If a consumer notifies a furnisher that the consumer disputes the completeness or accuracy of any information reported by the furnisher, the furnisher may not subsequently report that information to a CRA without providing notice of the dispute.

The FCRA gives you the right to be told if information in your credit file is used against you to deny your application for credit, employment or insurance. The FCRA also gives you the right to request and access all the information a consumer reporting agency has about you (this is called "file disclosure").

A dispute notice from a consumer must include: 1) Sufficient information to identify the account or other relationship that is in dispute, such as an account number and the name, address, and telephone number of the consumer; 2) The specific information that the consumer is disputing and an explanation of the basis for ...

Upon receiving a consumer's proper notice of dispute, the furnisher must conduct a reasonable investigation of the dispute. The furnisher also must review all relevant information provided by the consumer with the dispute notice.

The FCRA specifies those with a valid need for access. You must give your consent for reports to be provided to employers. A consumer reporting agency may not give out information about you to your employer, or a potential employer, without your written consent given to the employer.

Thus, under the FCRA, certain consumer information will be subject to two opt-out notices, a sharing opt-out notice (Section 603(d)) and a marketing use opt-out notice (Section 624). These two opt-out notices may be consolidated. Federal Register to implement this section (72 FR 62910).

The Fair Credit Reporting Act (FCRA), 15 U.S.C. 1681-1681y, requires that this notice be provided to inform users of consumer reports of their legal obligations. State law may impose additional requirements.

It may also include employment information, present and previous addresses, whether they have ever filed for bankruptcy or owe child support, and any arrest record. In some, but not all, instances, consumers must have initiated a transaction or agreed in writing before the credit bureau can release their report.