A home equity line of credit is a form of revolving credit in which your home serves as collateral. Because the home is likely to be a consumer's largest asset, many homeowners use their credit lines only for major items such as education, home improvements, or medical bills and not for day-to-day expenses. A home equity line of credit differs from a conventional home equity loan in that the borrower is not advanced the entire sum up front, but uses a line of credit to borrow sums that total no more than the amount, similar to a credit card.

Another important difference from a conventional loan is that the interest rate on a home equity line of credit is variable based on an index such as prime rate. This means that the interest rate can - and almost certainly will - change over time. The margin is the difference between the prime rate and the interest rate the borrower will actually pay.

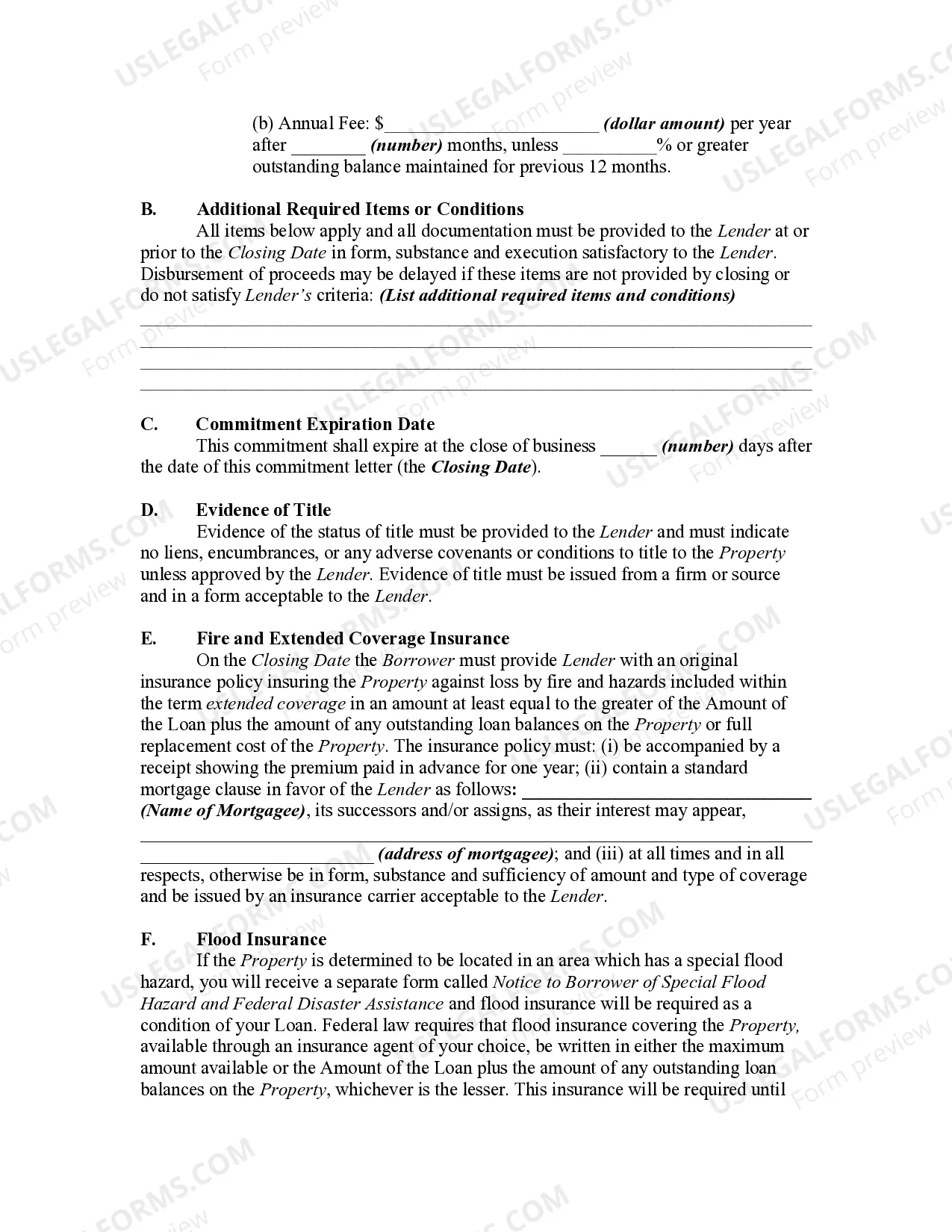

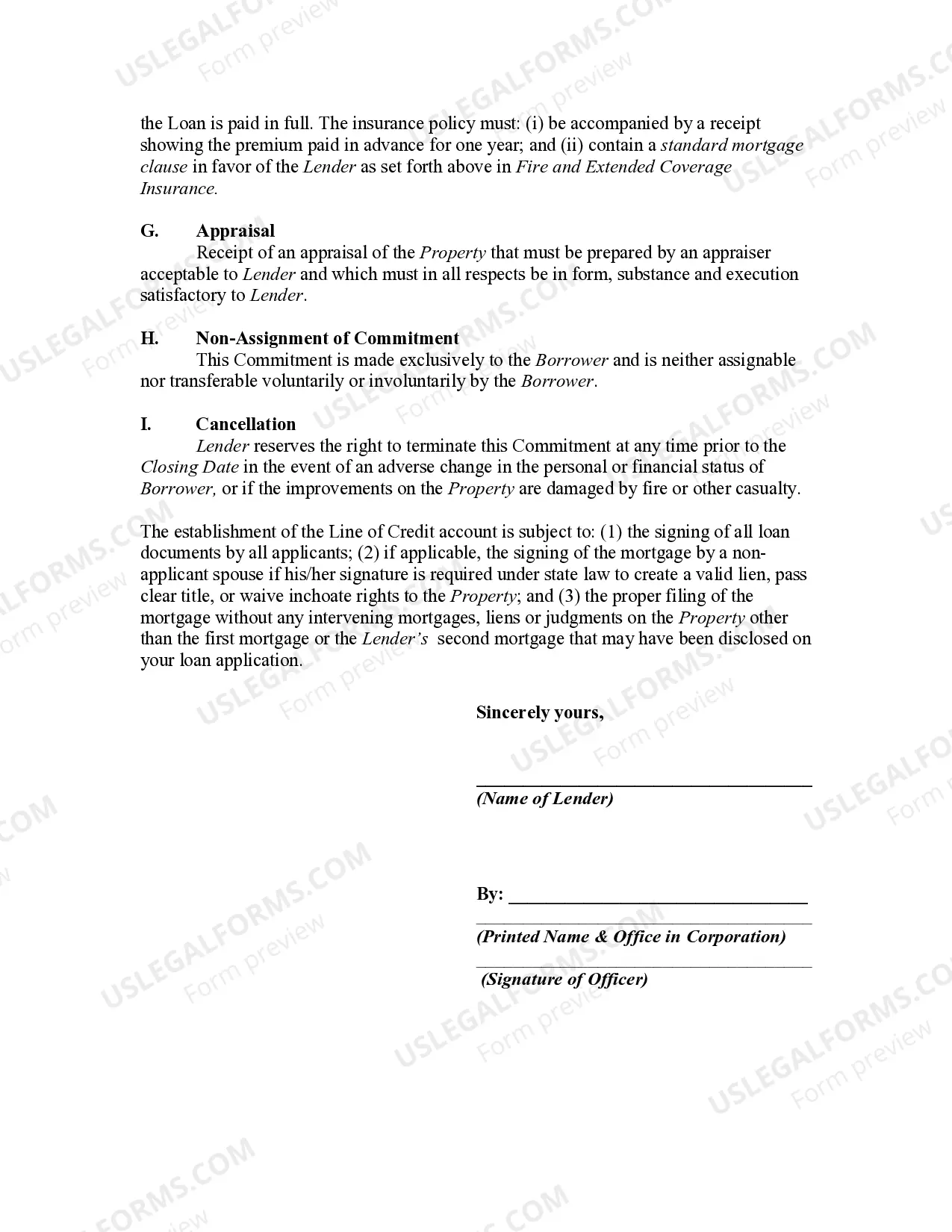

A Kentucky Mortgage Loan Commitment for Home Equity Line of Credit (HELOT) is a legal document provided by a lender to a borrower in the state of Kentucky that outlines the terms and conditions of a loan agreement specifically for home equity lines of credit. This commitment serves as a guarantee that the lender will provide the specified loan amount for the borrower to access funds based on their home's equity. The Kentucky Mortgage Loan Commitment for HELOT typically includes essential details such as the loan amount approved, the interest rate, repayment terms, draw period, and any additional fees or charges associated with the loan. It outlines the borrower's obligations and responsibilities, including timely repayment of any amounts borrowed. There are various types of Kentucky Mortgage Loan Commitment for HELOT, which may include: 1. Fixed-rate HELOT Commitment: In this type of commitment, the interest rate remains fixed throughout the loan term, offering predictability and stability in monthly payments. This is beneficial for borrowers who prefer consistent payments and want to avoid fluctuating interest rates. 2. Adjustable-rate HELOT Commitment: With an adjustable-rate commitment, the interest rate can change over time based on prevailing market rates. This type of commitment might be attractive to borrowers who anticipate interest rates to be lower in the future or those planning to pay off the loan quickly, as initial rates are often lower than fixed-rate commitments. 3. Hybrid HELOT Commitment: A hybrid commitment combines elements of both fixed and adjustable-rate commitments. It typically starts with a fixed-rate period during the initial stages of the loan, transition to an adjustable-rate commitment after a pre-determined period. Hybrid HELOT commitments can offer borrowers flexibility and potential savings if they plan to utilize the loan for a specific period. 4. Interest-only HELOT Commitment: In this type of commitment, borrowers are required to make payments only on the interest portion of the loan during the draw period. This can be appealing for those seeking lower initial monthly payments; however, it's important to note that principal repayment will begin once the draw period ends. It is crucial for borrowers in Kentucky to carefully review the terms and conditions of the specific Mortgage Loan Commitment for HELOT they are considering and consult with a financial advisor or mortgage specialist to understand the implications and choose the most suitable commitment for their needs.A Kentucky Mortgage Loan Commitment for Home Equity Line of Credit (HELOT) is a legal document provided by a lender to a borrower in the state of Kentucky that outlines the terms and conditions of a loan agreement specifically for home equity lines of credit. This commitment serves as a guarantee that the lender will provide the specified loan amount for the borrower to access funds based on their home's equity. The Kentucky Mortgage Loan Commitment for HELOT typically includes essential details such as the loan amount approved, the interest rate, repayment terms, draw period, and any additional fees or charges associated with the loan. It outlines the borrower's obligations and responsibilities, including timely repayment of any amounts borrowed. There are various types of Kentucky Mortgage Loan Commitment for HELOT, which may include: 1. Fixed-rate HELOT Commitment: In this type of commitment, the interest rate remains fixed throughout the loan term, offering predictability and stability in monthly payments. This is beneficial for borrowers who prefer consistent payments and want to avoid fluctuating interest rates. 2. Adjustable-rate HELOT Commitment: With an adjustable-rate commitment, the interest rate can change over time based on prevailing market rates. This type of commitment might be attractive to borrowers who anticipate interest rates to be lower in the future or those planning to pay off the loan quickly, as initial rates are often lower than fixed-rate commitments. 3. Hybrid HELOT Commitment: A hybrid commitment combines elements of both fixed and adjustable-rate commitments. It typically starts with a fixed-rate period during the initial stages of the loan, transition to an adjustable-rate commitment after a pre-determined period. Hybrid HELOT commitments can offer borrowers flexibility and potential savings if they plan to utilize the loan for a specific period. 4. Interest-only HELOT Commitment: In this type of commitment, borrowers are required to make payments only on the interest portion of the loan during the draw period. This can be appealing for those seeking lower initial monthly payments; however, it's important to note that principal repayment will begin once the draw period ends. It is crucial for borrowers in Kentucky to carefully review the terms and conditions of the specific Mortgage Loan Commitment for HELOT they are considering and consult with a financial advisor or mortgage specialist to understand the implications and choose the most suitable commitment for their needs.