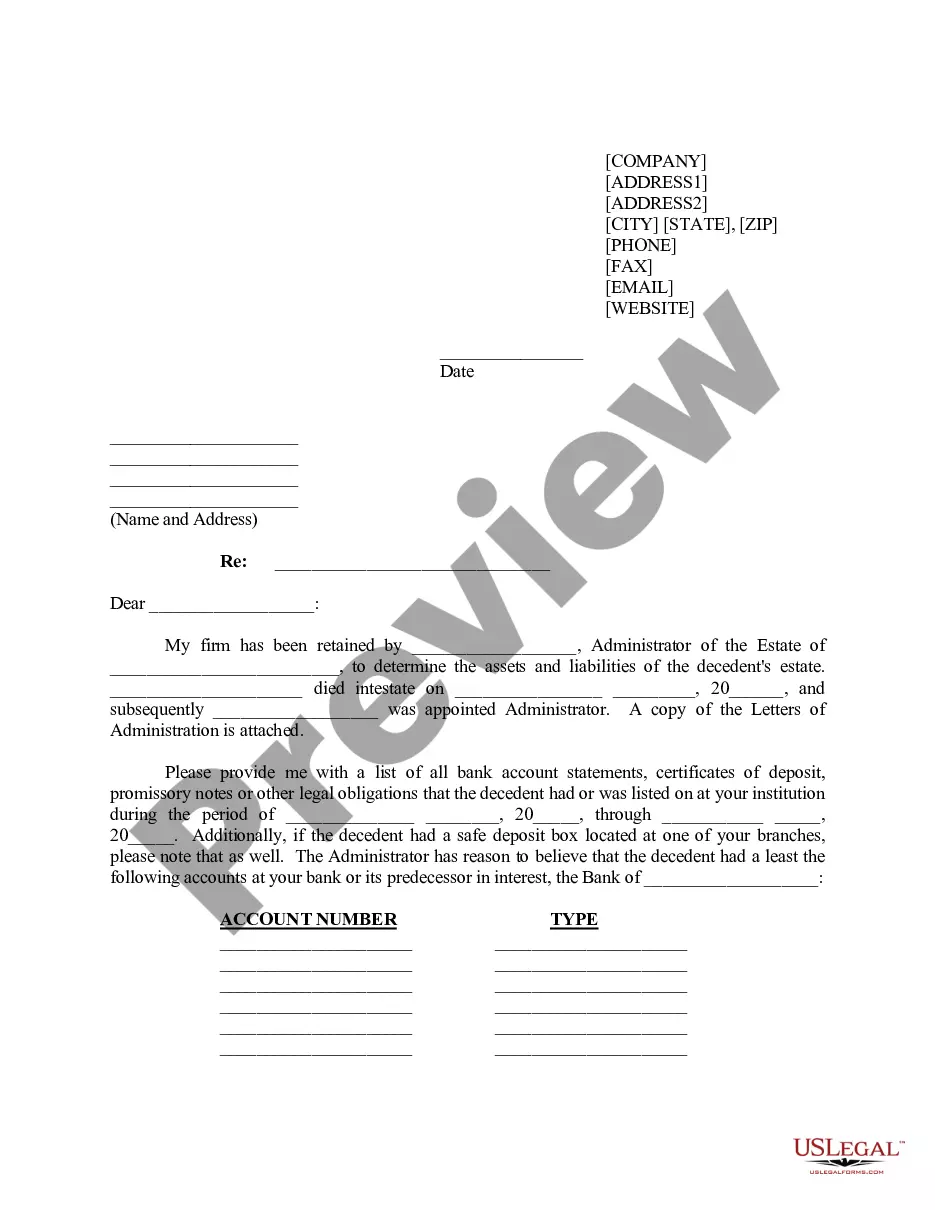

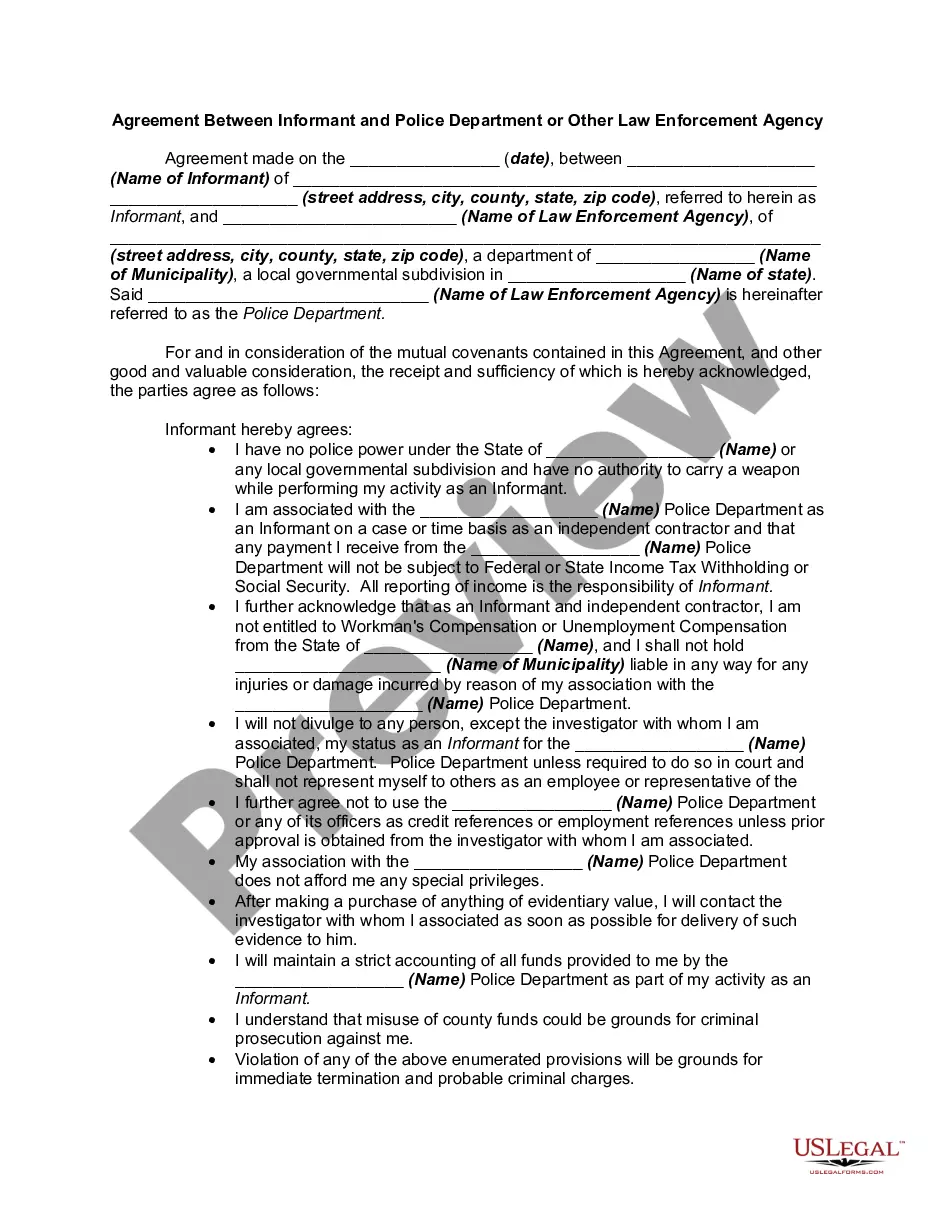

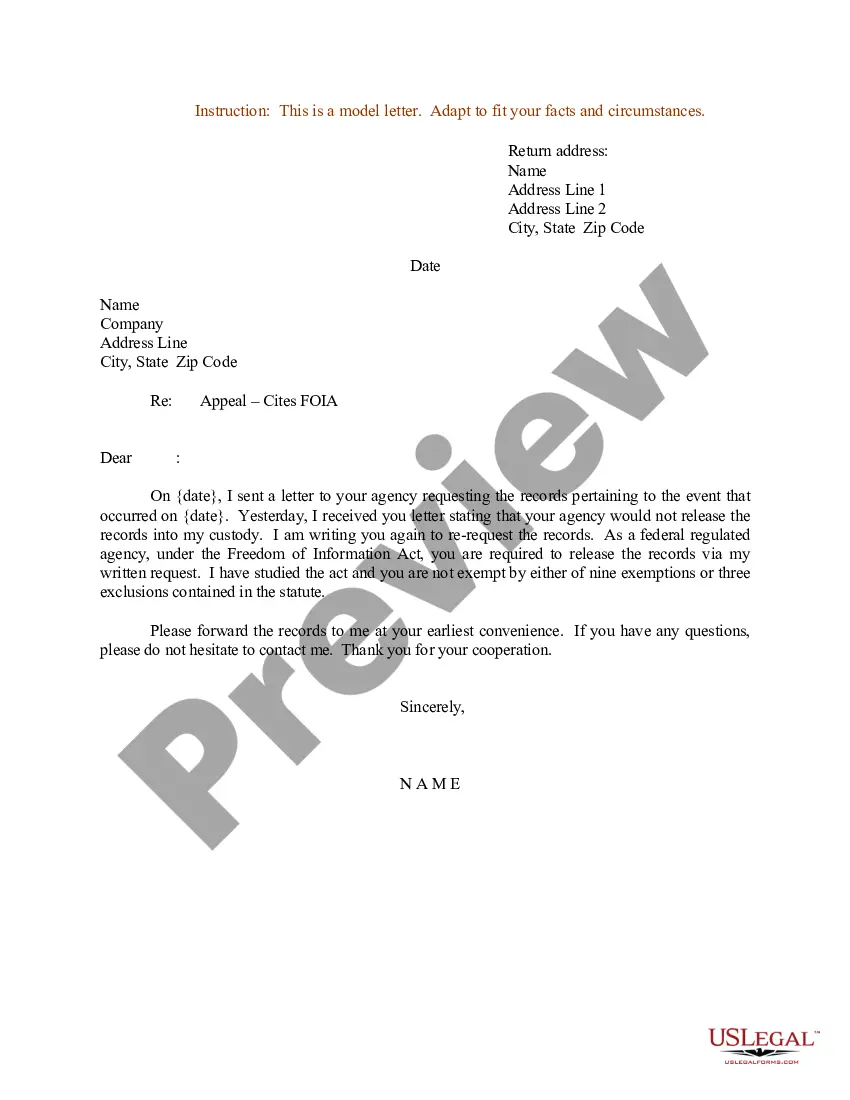

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Kentucky Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent

Description

How to fill out Letter Of Instruction To Investment Firm Regarding Account Of Decedent From Executor / Trustee For Transfer Of Assets In Account To Trustee Of Trust For The Benefit Of Decedent?

You can dedicate numerous hours online searching for the legal document format that fulfills both state and federal stipulations you require. US Legal Forms offers a vast collection of legal templates that are vetted by professionals.

It is easy to download or print the Kentucky Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent using our service.

If you already possess a US Legal Forms account, you can Log In and click on the Acquire option. After that, you can complete, modify, print, or sign the Kentucky Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent. Each legal document template you purchase is yours forever.

Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document. Choose the format of the document and download it to your device. Make modifications to the document if necessary. You can complete, edit, sign, and print the Kentucky Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent. Obtain and print numerous document templates using the US Legal Forms site, which provides the most extensive collection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the relevant option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- Firstly, ensure you have selected the correct document format for the state/city of your choice.

- Read the form description to confirm that you have chosen the appropriate template.

- If available, utilize the Preview option to review the document format as well.

- If you want to discover another version of the form, utilize the Search field to find the format that fits your requirements and specifications.

- Once you have located the format you need, click on Purchase now to proceed.

- Select the pricing option you want, input your details, and register for an account on US Legal Forms.

Form popularity

FAQ

The duties of an executor in Kentucky include managing the estate's assets, paying debts, and distributing property to beneficiaries according to the will. Executors must file necessary legal documents, maintain accurate records, and communicate with beneficiaries throughout the process. It is essential for executors to act in the best interests of the estate while abiding by legal regulations. Using a Kentucky Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can facilitate these responsibilities.

In Kentucky, an executor does not typically need the approval of all beneficiaries to sell property, unless explicitly required by the will. The executor has the authority to manage estate assets, including selling property, to fulfill the will's terms and settle debts. However, maintaining open communication with beneficiaries can prevent disputes and foster trust. A Kentucky Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can help clarify the executor's authority and intentions.

In Kentucky, an executor typically has one year to settle an estate, although complexities may extend this timeline. The court may grant additional time depending on specific circumstances, such as disputes among beneficiaries or complications regarding asset valuation. It’s essential for an executor to manage tasks promptly and keep beneficiaries informed throughout the process. A Kentucky Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can help manage timelines effectively.

Yes, in Kentucky, an executor is generally required to provide an accounting to beneficiaries. This obligation helps keep beneficiaries informed about the estate's financial status and the executor’s actions. The accounting should include all relevant financial information regarding income and expenses. Creating a Kentucky Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can further ensure that all involved parties understand the financial decisions made.

In Kentucky, several types of assets may be exempt from the probate process. Common examples include property held in joint tenancy, assets with designated beneficiaries, and certain insurance policies. These exemptions simplify the transfer process and can help beneficiaries access funds more quickly. Utilizing a Kentucky Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can clarify these distinctions.

The final accounting to beneficiaries is a detailed report that an executor provides to show how the estate's assets were managed and distributed. In Kentucky, this accounting must fulfill legal standards, outlining all income, expenses, and distributions made to beneficiaries. It ensures transparency and helps maintain trust among beneficiaries. Including a Kentucky Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can streamline this process.

Yes, Kentucky law allows you a maximum of one year from the decedent's death to initiate the probate process. Starting earlier can prevent complications, especially regarding the management and distribution of assets. Utilizing a Kentucky Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can help clarify and accelerate the process of asset transfer.

Avoiding probate in Kentucky can be achieved through several strategies, such as creating trusts or establishing joint ownership of assets. These methods can help ensure that your assets pass directly to your beneficiaries. It is important to document these arrangements clearly, possibly through a Kentucky Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, which can guide the distribution of assets without probate.

You have up to one year after the date of death to file for probate in Kentucky. However, delays may complicate matters, particularly when dealing with asset transfers. By crafting a Kentucky Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, you can expedite asset transfers and reduce administrative delays.

Kentucky does not impose a minimum asset threshold that triggers the need for probate. Instead, probate applies if the decedent owned property solely in their name. If you encounter this situation, consider preparing a Kentucky Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent to streamline the process.