Kentucky Nonresidential Simple Lease

Description

How to fill out Nonresidential Simple Lease?

Are you currently in a circumstance where you require documents for business or particular purposes almost every workday.

There are numerous legal document templates accessible online, yet discovering ones you can rely on is challenging.

US Legal Forms offers thousands of form templates, such as the Kentucky Nonresidential Simple Lease, which are designed to meet state and federal standards.

Once you find the right form, click Purchase now.

Select the pricing plan you prefer, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Kentucky Nonresidential Simple Lease template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and verify it is for the right region/state.

- Utilize the Preview button to review the form.

- Read the description to ensure you have selected the correct template.

- If the form is not what you are looking for, use the Search field to find the document that meets your needs.

Form popularity

FAQ

In Kentucky, a rental agreement does not need to be notarized to be valid. However, having a Kentucky Nonresidential Simple Lease that is signed and dated by both parties provides a clear record of the terms and obligations. While notarization can add an extra layer of security, it is not a legal requirement. For your peace of mind, drafting a well-structured lease is essential.

Yes, you can live in a rental property without being on the lease, but this situation often leads to complications. When you are not listed on the lease, the leaseholder has no legal obligation to you. If disputes arise, your rights may be limited. For those considering a Kentucky Nonresidential Simple Lease, understanding the implications of occupancy is crucial.

Filling out a residential lease inventory and condition form involves carefully documenting the state of the property before the tenant moves in. Start by listing each room and its features, noting any existing damages or necessary repairs. This detailed record will help protect both landlords and tenants under a Kentucky Nonresidential Simple Lease. You can find comprehensive resources on uslegalforms to guide you through this essential step.

To write a non-renewal lease, you should clearly state your intention not to extend the agreement beyond its current term. Include specific dates for the start and end of the lease, and mention any necessary notices required by law. In the context of a Kentucky Nonresidential Simple Lease, ensure you reference relevant state laws to avoid any misunderstandings. For additional assistance, you can explore the templates available on uslegalforms that simplify this process.

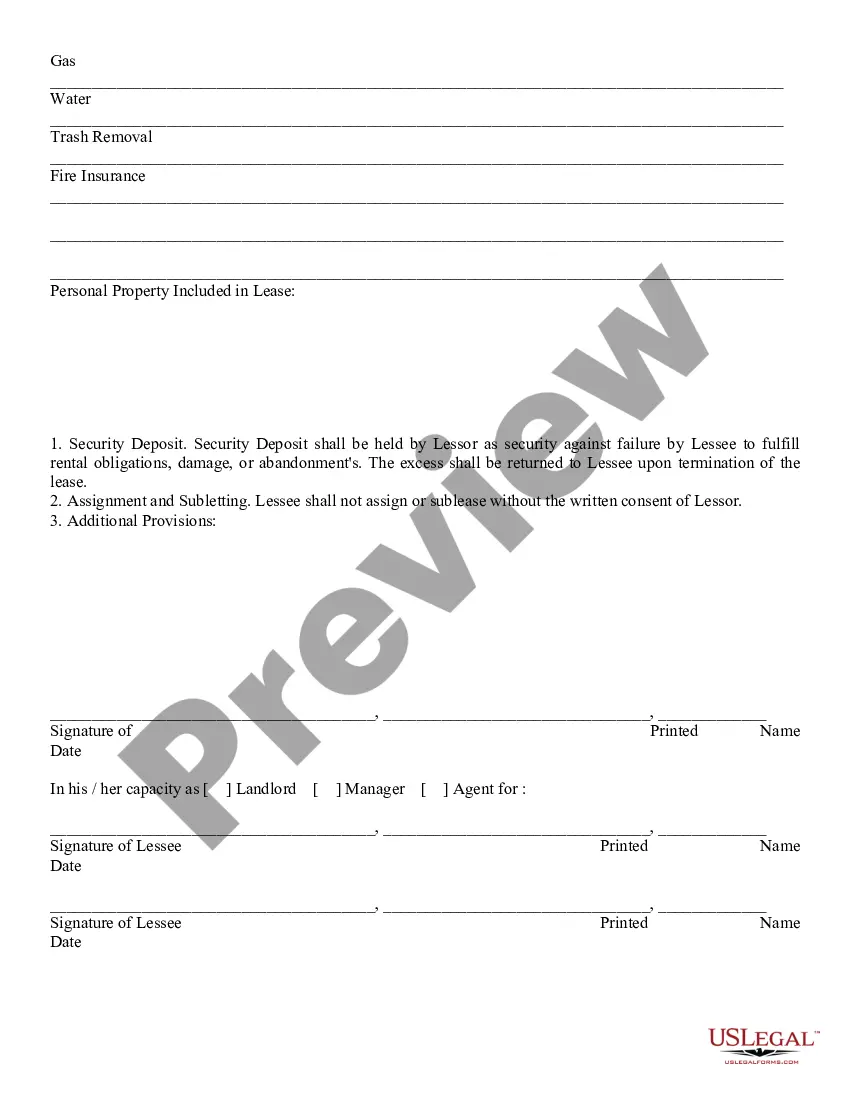

A nonresidential lease is an agreement for renting property that is not used for residential purposes, such as offices, retail spaces, or warehouses. These leases often have different regulations compared to residential leases and require clearer definitions of use and maintenance duties. If you're considering renting a nonresidential property in Kentucky, a Kentucky Nonresidential Simple Lease can simplify the process and clarify obligations for both tenants and landlords.

The basic lease agreement in Kentucky usually includes key details such as the rent amount, duration of the lease, and maintenance responsibilities. Both the tenant and landlord should sign the document to ensure it is legally binding. This agreement serves to protect the interests of both parties involved. For those seeking simplicity, a Kentucky Nonresidential Simple Lease can provide a solid foundation for a rental relationship.

A simple lease is a straightforward rental agreement that outlines the terms of renting a property without excessive complexity. In Kentucky, this type of lease efficiently covers essential elements like rent amount, duration, and responsibilities of both landlord and tenant. It typically streamlines the rental process, making it easier for both parties to understand their commitments. When you use a Kentucky Nonresidential Simple Lease, you're opting for clarity and ease.

In Kentucky, living in a rental property without being on the lease can lead to complications. Landlords typically expect all residents to be listed on the lease agreement. If you're considering a Kentucky Nonresidential Simple Lease, it is important to ensure that everyone living in the space is compliant with the lease terms. Not being listed could result in eviction or loss of rights to the property.

Nonresidents must use Form 740-NP when filing tax returns in Kentucky. This form is specifically for individuals who earn income from Kentucky but live elsewhere. If you’re entering the state to manage a Kentucky Nonresidential Simple Lease, ensure your paperwork is accurate to avoid potential penalties. Review the instructions carefully, and consider using services like uslegalforms for assistance.

The 183 day rule in Kentucky determines if you are considered a resident for tax purposes. If you spend 183 days or more in Kentucky during a tax year, you may be liable for resident taxes. This rule is important when managing rentals under a Kentucky Nonresidential Simple Lease. Understanding your residency status can help you make informed financial decisions.