The "look through" trust can affords long term IRA deferrals and special protection or tax benefits for the family. But, as with all specialized tools, you must use it only in the right situation. If the IRA participant names a trust as beneficiary, and the trust meets certain requirements, for purposes of calculating minimum distributions after death, one can "look through" the trust and treat the trust beneficiary as the designated beneficiary of the IRA. You can then use the beneficiary's life expectancy to calculate minimum distributions. Were it not for this "look through" rule, the IRA or plan assets would have to be paid out over a much shorter period after the owner's death, thereby losing long term deferral.

Kentucky Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account

Description

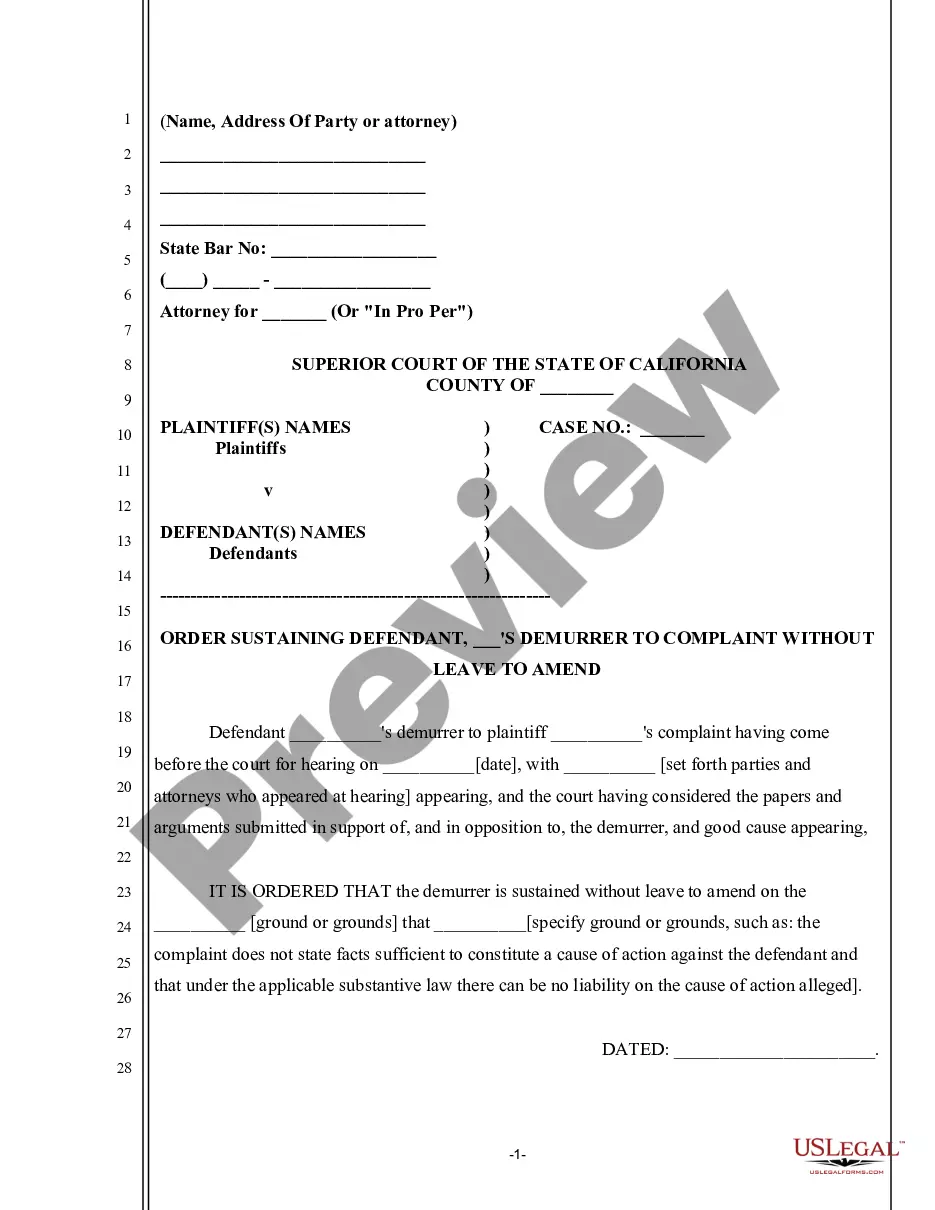

How to fill out Irrevocable Trust As Designated Beneficiary Of An Individual Retirement Account?

Are you currently in a situation where you require documents for either business or personal use almost every time.

There are numerous legal document templates available online, but finding trustworthy forms isn't straightforward.

US Legal Forms provides thousands of template options, such as the Kentucky Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, which can be completed to meet state and federal regulations.

Select a convenient document format and download your version.

Access all the document templates you have purchased in the My documents section. You can obtain another copy of the Kentucky Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account at any time, if needed. Simply select the desired form to download or print the document template.

- If you are already acquainted with the US Legal Forms site and have an account, simply Log In.

- Then, you can download the Kentucky Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need, ensuring it is for your correct city/state.

- Utilize the Preview button to review the form.

- Check the description to confirm you have selected the right form.

- If the form isn’t what you are looking for, use the Search field to locate the form that fits your needs and requirements.

- Once you obtain the correct form, click Purchase now.

- Choose the pricing plan you prefer, fill in the required information to create your account, and complete the purchase with your PayPal or Visa or Mastercard.

Form popularity

FAQ

A trust can be a retirement account beneficiary, and many individuals opt for this approach. A Kentucky Irrevocable Trust as the designated beneficiary of an Individual Retirement Account can provide long-term benefits for your heirs. This structure allows for careful management of the IRA's assets, protecting them from creditors and ensuring they align with your estate planning goals. It's essential to consult with a legal expert to navigate the process correctly.

You can indeed name a trust as an IRA beneficiary. By selecting a Kentucky Irrevocable Trust, you ensure that your intentions regarding asset distribution are clearly expressed and legally binding. This choice not only secures the benefits of the trust structure but also helps maintain control over how your beneficiaries access their inheritance. Properly setting up and designating the trust is crucial to maximize its advantages.

Filling out a beneficiary designation requires you to provide specific information about the individuals or entities you want to name. When considering a Kentucky Irrevocable Trust as Desgined Beneficiary of your IRA, you should include the trust's legal name, the date it was created, and the names of the current trustees. Ensure you follow the instructions provided by your financial institution, as inaccuracies can lead to delays in asset distribution.

Yes, you can designate a trust as a beneficiary of your IRA. In fact, a Kentucky Irrevocable Trust often serves as a strategic choice for ensuring your retirement assets are preserved and distributed according to your intentions. It can help mitigate taxes and protect assets from creditors. Thus, choosing a trust provides a layer of control over how and when your beneficiaries receive their inheritances.

The beneficiary of an individual retirement account (IRA) can be a person, entity, or trust. If you designate a Kentucky Irrevocable Trust as the beneficiary of your IRA, the trust will receive the account's assets upon your passing. This arrangement helps ensure that your assets are distributed according to your wishes. Additionally, a trust can offer protection and management of these assets for your beneficiaries.

Absolutely, a trust can be named as the beneficiary of a retirement account. Specifically, a Kentucky Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account allows you to control the distribution of the assets after death. This designation helps protect the funds and ensures they are used according to your wishes. For tailored guidance, it’s important to work with experts in estate planning and trust management.

Directly placing a retirement account into an irrevocable trust is typically not allowed. However, designating a Kentucky Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account is a beneficial approach. This method allows the trust to receive the IRA funds after the account holder’s death. Engaging a legal professional can help clarify the best path for your situation.

Certain assets may not be ideal for inclusion in an irrevocable trust. For instance, personal residences and certain retirement accounts might not provide the best benefits when placed in a Kentucky Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account. Additionally, assets that require hands-on management might be difficult to administer through a trust. It is crucial to evaluate your assets carefully before making decisions.

Yes, an irrevocable trust can be designated as the beneficiary of an IRA. When you opt for a Kentucky Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account, it ensures that the account's assets will be managed under the trust's terms. This strategy can help with asset protection and controlling the distribution of funds. Consulting with a professional is wise to ensure proper setup and compliance.

Generally, retirement accounts cannot be directly placed into an irrevocable trust. However, a Kentucky Irrevocable Trust as Designated Beneficiary of an Individual Retirement Account allows the trust to inherit the IRA upon the account owner's passing. This arrangement can effectively manage the funds while offering tax benefits. Always consult with a legal expert to understand your specific situation.