Kentucky Sale of Goods Act: A Detailed Description The Kentucky Sale of Goods Act is a set of statutory provisions that regulate the sale of goods within the state of Kentucky, United States. Enacted as part of the broader Uniform Commercial Code (UCC), this legislation governs various aspects related to the sale, purchase, and exchange of goods between buyers and sellers. Keywords: Kentucky Sale of Goods Act, statutory provisions, sale of goods, Uniform Commercial Code, buyer, seller. Under the Kentucky Sale of Goods Act, general provisions and guidelines are provided to ensure fair and equitable transactions, protecting the rights of both buyers and sellers involved in commercial exchanges. Let's explore some critical aspects covered by this legislation: 1. Formation of Contracts: The Act outlines rules and principles governing the formation of sale contracts, including offer and acceptance, consideration, capacity of parties, and the requirement of a written agreement for certain transactions. 2. Title and Risk of Loss: It establishes rules regarding the transfer of ownership (title) and the risk of loss or damage to goods during transportation or while in possession of the buyer or seller. 3. Warranties: The Kentucky Sale of Goods Act outlines warranties that implicitly apply to all sale transactions unless explicitly disclaimed. These warranties include the warranty of title, warranty against infringement, and warranty of merchantability (goods are fit for their ordinary purpose). 4. Remedies: In case of breach of contract, the Act provides various remedies to the aggrieved party, such as the right to seek damages, specific performance, or even revocation of the contract. Kentucky Sale of Goods Act does not have specific variations or types. However, it is a broader adoption of the Uniform Commercial Code (UCC) which has been enacted with slight variations in all 50 states of the U.S., including Kentucky. Therefore, similar provisions and principles can be found in other state-specific enactment of the UCC. In Conclusion, the Kentucky Sale of Goods Act ensures fairness, transparency, and consistency in commercial transactions involving the sale of goods within the state. It provides a clear legal framework, outlining the rights and responsibilities of both buyers and sellers and serves as a valuable reference in resolving disputes related to the sale of goods in Kentucky. Keywords: Kentucky Sale of Goods Act, fair transactions, rights of buyers and sellers, commercial exchanges, sale contracts, formation, title transfer, risk of loss, warranties, remedies, breach of contract, Uniform Commercial Code (UCC).

Kentucky Sale of Goods, General

Description

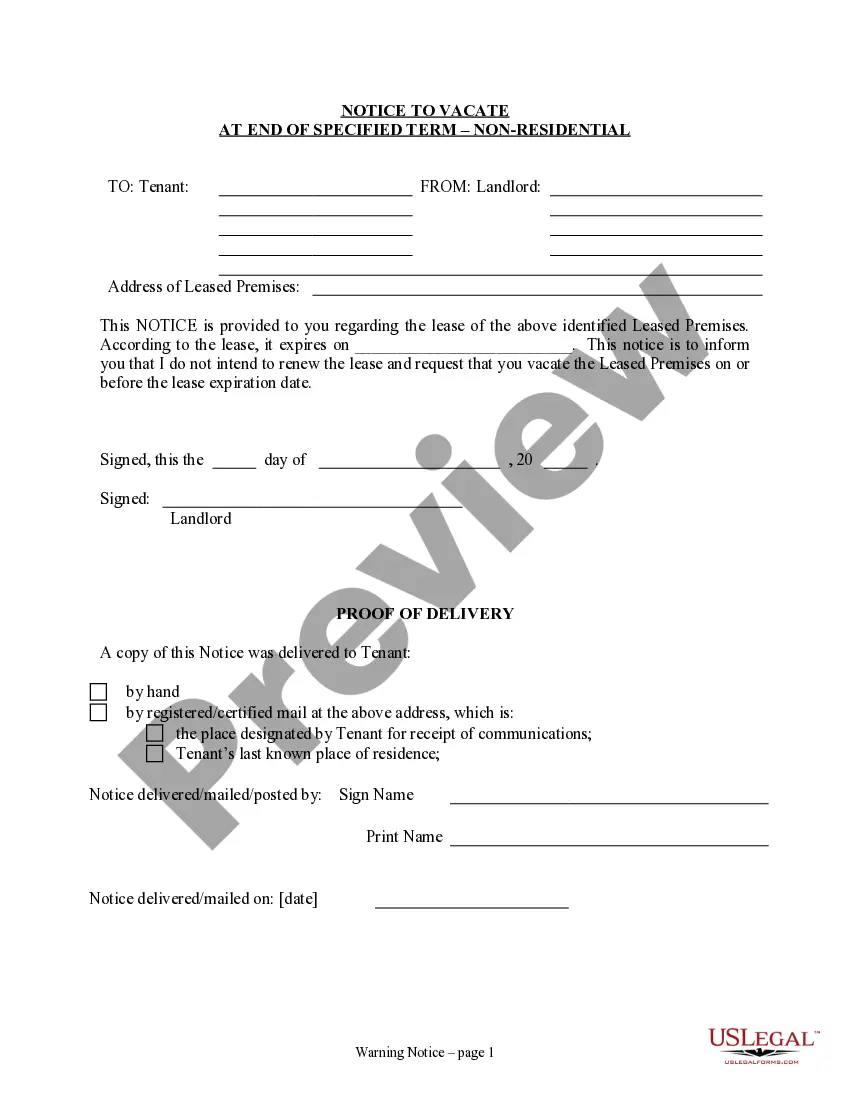

How to fill out Kentucky Sale Of Goods, General?

Locating the appropriate legal document template can be a challenge. Certainly, there are numerous templates available online, but how will you find the legal form you need.

Utilize the US Legal Forms website. The platform offers a vast selection of templates, such as the Kentucky Sale of Goods, General, suitable for commercial and personal use. All forms are verified by professionals and comply with federal and state regulations.

If you are currently registered, Log In to your account and click the Acquire button to locate the Kentucky Sale of Goods, General. Use your account to browse through the legal forms you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you need.

Finally, complete, modify, print, and sign the acquired Kentucky Sale of Goods, General. US Legal Forms is the largest repository of legal forms that allows you to find various document templates. Utilize the service to download professionally crafted paperwork that adheres to state requirements.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure that you have selected the correct form for your city/region. You can review the form using the Review button and read the form description to confirm this is the appropriate one for you.

- If the form doesn’t meet your requirements, use the Search field to find the right form.

- Once you are sure the form is suitable, click the Buy now button to obtain the form.

- Select the pricing plan you prefer and enter the necessary information. Create your account and pay for the order with your PayPal account or a credit card.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

Kentucky has recently introduced new sales tax rules that impact various sectors, including the expansion of taxable services. It’s essential to be aware of these updates to avoid compliance issues. For the most accurate and up-to-date information, refer to the Kentucky Department of Revenue's announcements. Adapting to these changes is crucial for your business engaged in the Kentucky Sale of Goods, General market.

Certain items are exempt from sales tax in Kentucky, including most food and food ingredients, certain medical supplies, and a selection of educational materials. However, regulations can change, so it is advisable to check for the latest information from the Kentucky Department of Revenue. Staying informed will help you make accurate decisions regarding the Kentucky Sale of Goods, General. Understanding exemptions can enhance your strategy.

Yes, if you are purchasing goods for resale in Kentucky, you will need a resale certificate. This document allows you to buy items without paying sales tax, as you intend to resell them. Ensure that you provide the seller with a valid resale certificate to comply with state regulations. This is especially relevant for anyone involved in the Kentucky Sale of Goods, General.

You typically do not need a resale certificate for every state, but you do need one for each state where you make taxable purchases for resale. This is crucial for ensuring compliance with sales tax laws in various states. It's best to familiarize yourself with the resale certificate requirements in states where your business operates. If you’re engaged in the Kentucky Sale of Goods, General, make sure to acquire certificates as dictated by state laws.

Some states have restrictions on accepting out-of-state resale certificates. These states may require buyers to obtain a valid resale certificate issued by their own state. Therefore, it is crucial to research specific state regulations before making purchases. Understanding these requirements is essential for your compliance in the Kentucky Sale of Goods, General context.

You can mail Kentucky tax forms to the Kentucky Department of Revenue. Ensure that you send them to the appropriate address based on the type of form you are submitting. You can find these addresses on the Kentucky Department of Revenue's official website. Using the correct address helps ensure timely processing of your Kentucky Sale of Goods, General forms.

To obtain a resale certificate in Kentucky, you first need to have a seller's permit. After securing your seller's permit from the Kentucky Department of Revenue, you can fill out a Kentucky resale certificate form. This certificate facilitates the process of buying goods intended for resale under Kentucky Sale of Goods, General without incurring sales tax.

To obtain a Kentucky LLC number, you must first establish your Limited Liability Company by filing Articles of Organization with the Kentucky Secretary of State. Once your LLC is recognized, you will receive a unique identification number that allows you to operate legally within the state. This number is essential for any business engaged in Kentucky Sale of Goods, General.

Yes, you need a business license to sell goods in Kentucky. Licenses can vary by locality, so it is important to check with your city or county clerk for specific requirements and fees. Having a business license not only legitimizes your operations but also complies with Kentucky Sale of Goods, General regulations.

The Kentucky Procurement Assistance Program provides resources and guidance for businesses looking to compete for government contracts. This program helps small businesses navigate the complexities of the bidding process and enhances their chances of success. By participating, businesses can better position themselves in the market, especially when dealing with Kentucky Sale of Goods, General.

Interesting Questions

More info

House Standing Committees Legislative & Executive Committees Congressional Committees Legislative & Executive Committee Special & Executive Committees Select Committees Rules Committee Rules Subcommittee Legislative Rules Committee Joint Committee on Governmental Organization House Joint Committee on Governmental Organization Senate Joint Committee on Governmental Organization Rules Committee Joint Rules Committee House Senate Joint Rules Committee Appropriations Chairman of the Committee on Rules Chairman of the Select Committee on Rules Representative Committees House Representative Committees Senate Select Committees Committee Chairs and Vice Chairs Senate Select Committee on Rules House Select Committee on Rules Senate Select Committee on Rules Select Committees Subcommittee House Select Subcommittee Senate Select Subcommittee Appropriations Select Subcommittees Legislative & Executive Page Created: Wednesday, May 01, 2016 12:16:07 AM Last Modified: Monday, March 15, 2018 10:21:57