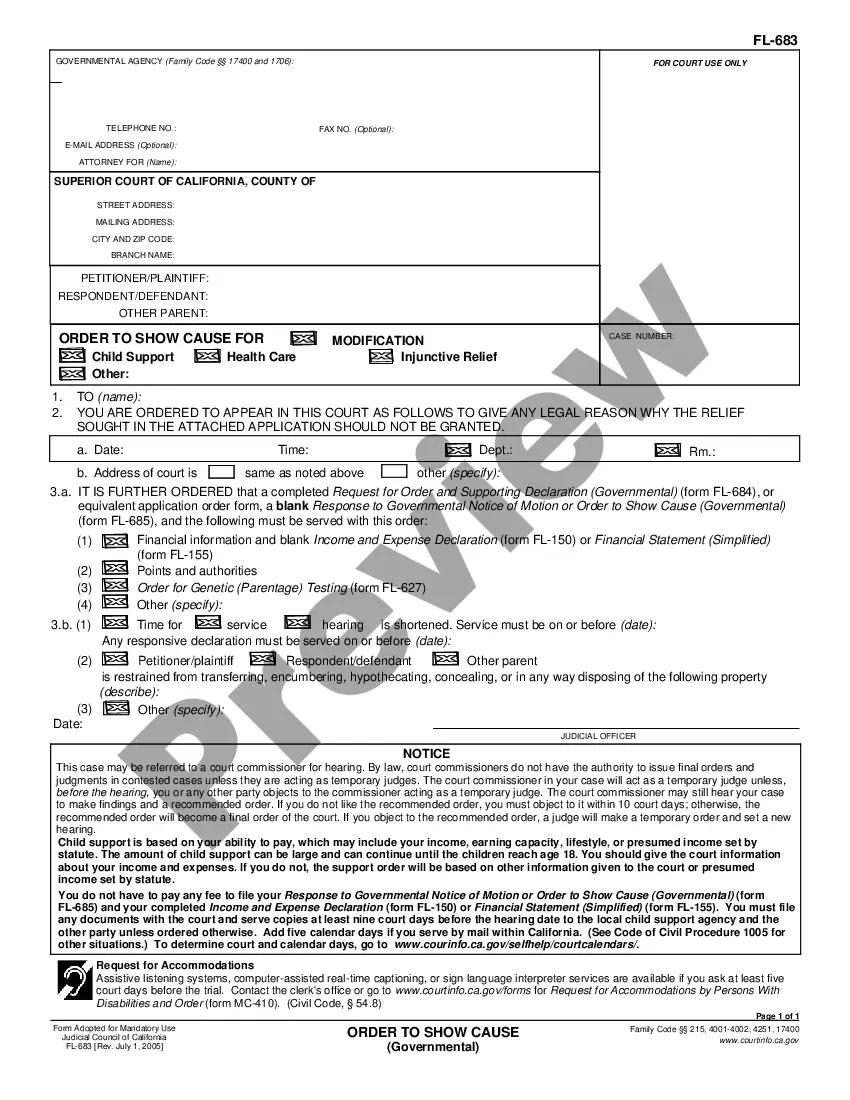

Kentucky Financing Statement

Description

How to fill out Financing Statement?

You can spend multiple hours online searching for the legal document template that meets the federal and state regulations you desire.

US Legal Forms offers thousands of legal templates that are verified by experts.

You can obtain or print the Kentucky Financing Statement from our service.

Check the template details to confirm that you have chosen the right form. If available, utilize the Preview button to view the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Kentucky Financing Statement.

- Every legal document template you acquire is yours forever.

- To obtain an additional copy of any purchased template, go to the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/town of your choice.

Form popularity

FAQ

Yes, a Kentucky Financing Statement is a public document. This means that anyone can access it, allowing transparency in financing transactions. This public nature helps inform potential lenders and buyers regarding existing liens on a debtor’s assets. It's vital to understand this aspect when engaging in any secured transaction.

You can file a Kentucky Financing Statement with the Kentucky Secretary of State's office. The filing process can also extend to specific county clerks, depending on the type of collateral involved. To streamline this process, consider using an online platform like uslegalforms, which offers guidance and necessary forms for filing securely and accurately.

Typically, the secured party files the Kentucky Financing Statement. This is the entity or individual who has a security interest in the debtor's assets. They ensure that the document is accurately recorded to protect their rights. Utilizing a reliable service can simplify this filing process.

A financing statement on a title acts as a public notice of a secured party's interest in a debtor's collateral. In Kentucky, it helps protect the secured creditor's rights regarding the assets listed in the statement. If a debtor defaults, the secured party can claim their interest in the specified property. Understanding this concept is crucial for both lenders and borrowers.

Yes, a Kentucky Financing Statement must be signed to be valid. The signature indicates that the debtor agrees to the security interest being recorded. Without a signature, the statement may not hold legal weight in a dispute. Therefore, it is essential to ensure the proper signing process is followed.

The primary difference between a UCC-1 and a UCC-3 lies in their functions. A UCC-1 is used to initially secure a lien or claim against a debtor’s assets, while a UCC-3 is utilized to amend, continue, or terminate an existing UCC-1 filing. Understanding this distinction is essential for effectively managing your Kentucky Financing Statement.

UCC financing statements should be filed with the Secretary of State in the place where the debtor is located. In Kentucky, this means you would file your Kentucky Financing Statement with the state's Secretary of State. Proper filing not only secures your financial interests but also informs creditors of any existing claims.

For a foreign entity, a UCC-1 should be filed in the state where the entity is conducting business or where its chief executive office is located. If the foreign entity is operating in Kentucky, you will file your Kentucky Financing Statement with the Kentucky Secretary of State. This compliance is vital for establishing the priority of your security interest.

Filing a UCC-3 financing statement serves several essential purposes, including amending, continuing, or terminating a previously filed UCC-1 financing statement. It ensures that modifications to the security interest are legally documented and effectively communicated. By accurately managing your Kentucky Financing Statement, you protect your interests and keep the records current.

A UCC fixture filing should be filed in the same location as a UCC-1 financing statement, specifically with the Secretary of State in Kentucky if that is where the debtor is located. Since fixtures are considered part of a property, it's crucial that this Kentucky Financing Statement accurately reflects the correct details. This enables potential lenders to see the collateral secured by real property.