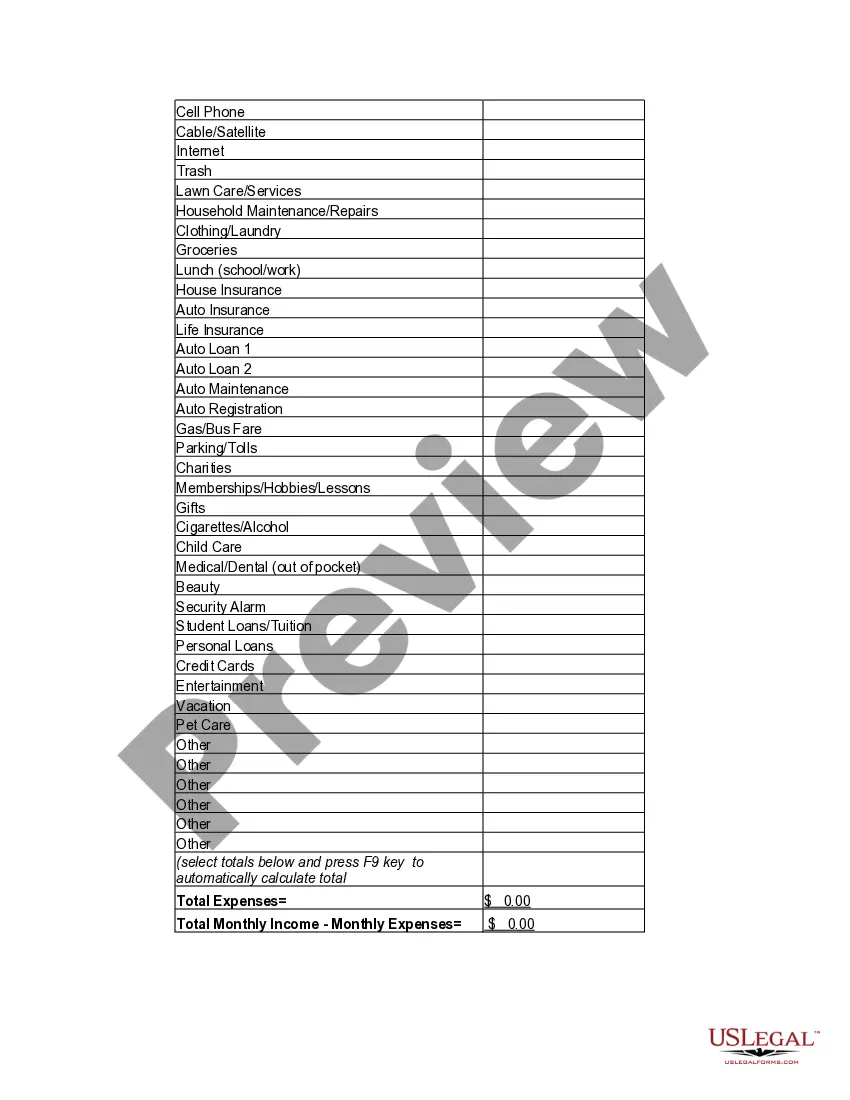

Kentucky Personal Monthly Budget Worksheet

Description

How to fill out Personal Monthly Budget Worksheet?

Selecting the appropriate legal document template can be a challenge. Naturally, there are many templates accessible online, but how do you find the legal form you require.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Kentucky Personal Monthly Budget Worksheet, suitable for both business and personal needs.

All of the forms are reviewed by professionals and comply with state and federal regulations.

Once you are confident that the form is suitable, click the Get now button to obtain the form. Choose your pricing plan and enter the required details. Create your account and complete the purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, and print, then sign the downloaded Kentucky Personal Monthly Budget Worksheet. US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Take advantage of this service to download professionally crafted documents that meet state requirements.

- If you are already registered, Log In to your account and click the Download button to acquire the Kentucky Personal Monthly Budget Worksheet.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents tab in your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your city/region. You can preview the form using the Preview button and read the form description to confirm it is the right one for you.

- If the form does not fulfill your requirements, use the Search area to find the correct form.

Form popularity

FAQ

Certain types of retirement income, including Social Security benefits and specified pensions, can be exempt from taxation in Kentucky. It is essential to review the specific criteria provided by the Kentucky Department of Revenue to understand what qualifies for exemptions. Utilizing a Kentucky Personal Monthly Budget Worksheet can help you plan your finances effectively, considering both taxable and non-taxable retirement income.

In Kentucky, eligibility for the family size tax credit generally depends on your household size and adjusted gross income. Taxpayers should check the latest guidelines from the Kentucky Department of Revenue to confirm their eligibility. A Kentucky Personal Monthly Budget Worksheet can help you determine your household income and better navigate credits available to you.

Tax code 740 pertains to Kentucky's individual income tax returns, specifically focusing on how residents should report their income and claim tax credits. This tax code outlines the rules governing tax liabilities for individuals living in Kentucky. Having a Kentucky Personal Monthly Budget Worksheet may help you clarify your income sources, ensuring compliance with tax code 740.

To file the Kentucky K 5 form, which reports income for non-resident individuals, you should gather necessary documentation about your earnings and any Kentucky tax withheld. You can file this form electronically or by mail through the Kentucky Department of Revenue. The Kentucky Personal Monthly Budget Worksheet can be a useful tool to ensure you understand your non-resident income and tax obligations.

The KY 740 form is Kentucky's individual income tax return that residents use to report their taxable income. This form includes various deductions and credits available to taxpayers. Using a Kentucky Personal Monthly Budget Worksheet can provide clarity on your income and expenses, making it easier to complete your tax return accurately.

In Kentucky, the income threshold before you must file taxes can vary based on your filing status and age. Generally, you should file if your income exceeds the federal standard deduction amounts. Utilizing a Kentucky Personal Monthly Budget Worksheet can help you track your income and decide whether you need to file taxes.

To establish a payment plan for your Kentucky state taxes, you can contact the Kentucky Department of Revenue directly or visit their website. Typically, you will need to provide income information and details about your tax obligations. Integrating a Kentucky Personal Monthly Budget Worksheet can assist you in reaching a manageable payment plan by analyzing your monthly expenses.

The W7 tax form allows individuals who are not eligible to obtain a Social Security Number to apply for an Individual Taxpayer Identification Number (ITIN). This form is essential for foreign nationals and non-residents filing a tax return in the United States. Understanding how to manage your finances with tools like the Kentucky Personal Monthly Budget Worksheet can help you effectively prepare your tax documents.

A good monthly personal budget should reflect your income, essential expenses, savings goals, and personal lifestyle preferences. Many recommend allocating around 50% for needs, 30% for wants, and 20% for savings. The Kentucky Personal Monthly Budget Worksheet can help you customize and track your monthly budget, ensuring it aligns with your financial objectives.

The 50 20 30 budget rule is a framework for managing your finances by dedicating 50% of income to needs, 20% to savings, and 30% to wants. This rule promotes financial stability and can simplify budgeting. Using a Kentucky Personal Monthly Budget Worksheet allows you to have a structured approach to implementing this guideline.