Kentucky Liability Waiver for Employee

Description

How to fill out Liability Waiver For Employee?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a variety of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for both business and personal use, categorized by type, state, or keywords. You can obtain the latest versions of forms like the Kentucky Liability Waiver for Employee within moments.

If you already have a subscription, Log In to access the Kentucky Liability Waiver for Employee from your US Legal Forms library. The Download button will be visible on every form you view. You can find all previously downloaded forms in the My documents section of your account.

Proceed with the purchase. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device.

- First, ensure you have selected the correct form for your city/county.

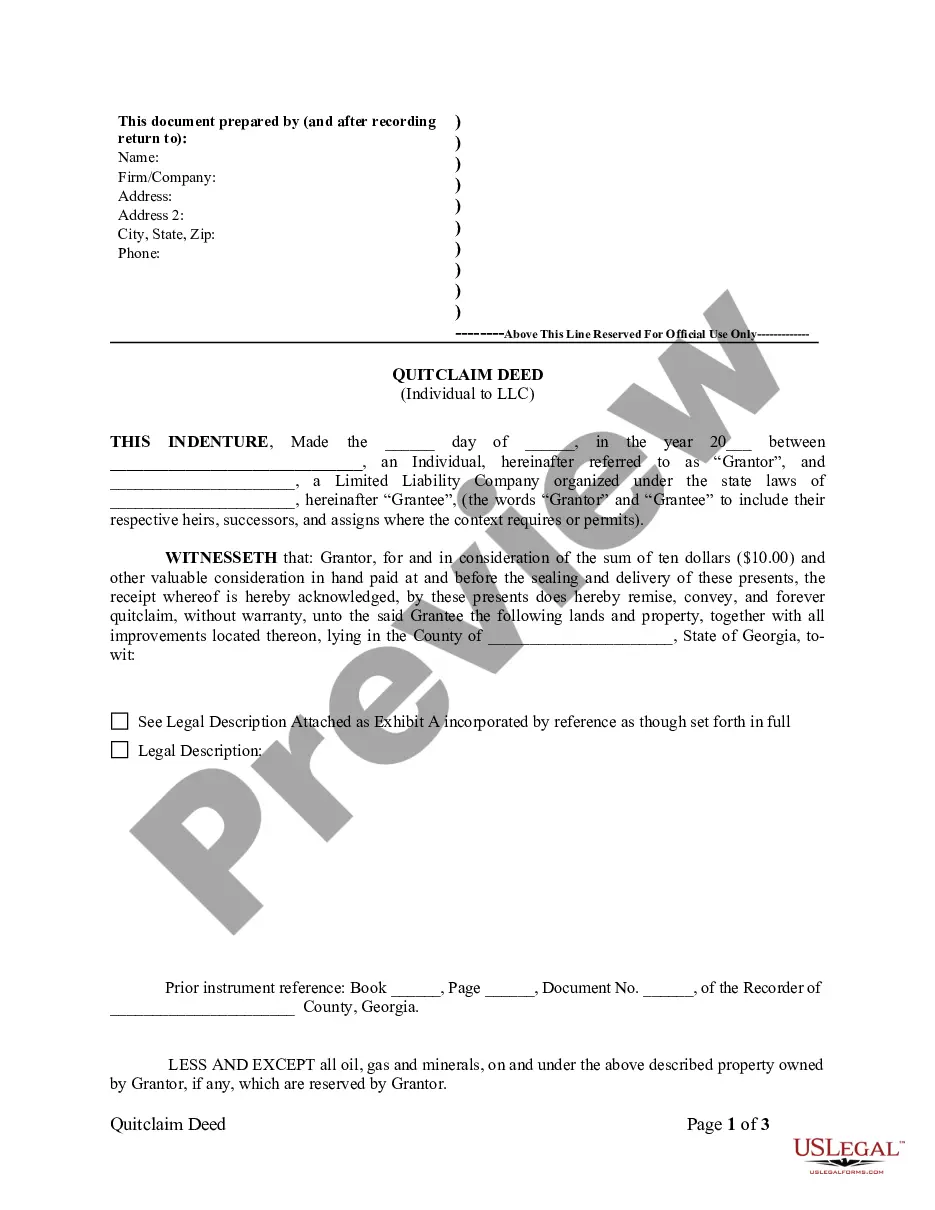

- Click the Preview button to review the form's content.

- Check the form details to confirm you have chosen the right one.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- When you are satisfied with the form, confirm your selection by clicking the Buy now button.

- Then, choose the pricing plan that suits you and enter your information to register for an account.

Form popularity

FAQ

Signing a waiver does not absolutely prevent you from suing; it generally limits your ability to claim damages for certain injuries. A Kentucky Liability Waiver for Employee serves to inform employees of risks and protects employers from liability in specific situations. However, if an employer acts recklessly or violates laws, individuals still have the right to pursue legal action. Consulting with legal experts can provide clarity on specific cases.

Liability waivers, including a Kentucky Liability Waiver for Employee, can be upheld in court if they meet proper legal standards. Courts generally enforce waivers that are clear, reasonable, and voluntarily signed, as long as they do not violate public policy. However, some circumstances, like gross negligence or intentional harm, may render them ineffective. Therefore, having a well-drafted waiver is crucial for its enforceability.

Kentucky is not considered a strict liability state; it typically follows a fault-based system. This means that to hold someone accountable for negligence, the plaintiff must demonstrate that the other party acted carelessly. However, signing a Kentucky Liability Waiver for Employee may limit liability for certain activities. Therefore, understanding liability laws in Kentucky helps employees and employers navigate risks.

A liability waiver becomes enforceable when it meets specific legal criteria. In Kentucky, it must clearly outline the risks involved and be signed voluntarily by the employee. Furthermore, the language in the waiver must be straightforward and not misleading. Ensuring the waiver is comprehensive helps protect both employees and employers.

Once you've completed your Kentucky tax return, you should mail it to the address specified on the form instructions. Ensure you send it to the correct location to avoid delays. Additionally, when handling your paperwork, a Kentucky Liability Waiver for Employee can offer peace of mind against any potential legal claims.

Filing Kentucky Form K-5 involves reporting the appropriate income information as required. You can download the form from the Kentucky Department of Revenue's website and complete it carefully. If you're concerned about any legal ramifications, considering a Kentucky Liability Waiver for Employee may provide you with added security.

If you earn income in Kentucky as a non-resident, you are required to file Kentucky state taxes. Utilizing the correct forms is essential to ensure compliance. A Kentucky Liability Waiver for Employee can also be beneficial in showing that you have taken measures to limit potential liabilities associated with your employment in the state.

Yes, Kentucky offers online e-filing options for residents. Completing your tax forms electronically can save you time and ensure accuracy. As you utilize these services, consider incorporating a Kentucky Liability Waiver for Employee to ensure you’re protected while meeting your tax obligations.

Employees in Kentucky typically use the Kentucky Form IT-40 for state tax filing. This form allows you to report your income accurately and determine your tax due. As you complete your forms, remember that a Kentucky Liability Waiver for Employee could protect you from unexpected legal issues related to your employment.

Filing your Kentucky state taxes is straightforward. Begin by gathering your income documents and any necessary deductions. Visit the Kentucky Department of Revenue's website to access the appropriate forms. Consider using the Kentucky Liability Waiver for Employee to safeguard yourself against potential liabilities while completing your tax forms.