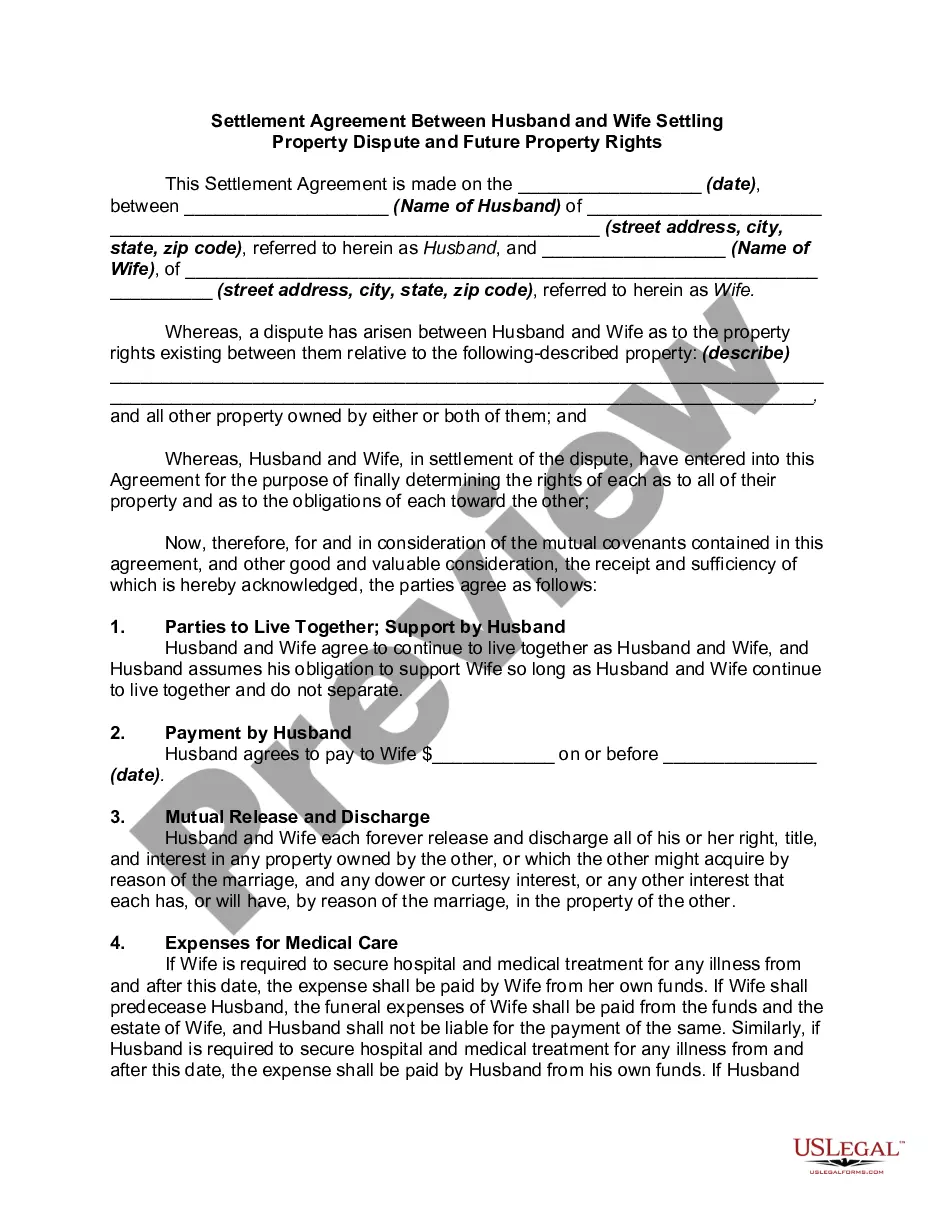

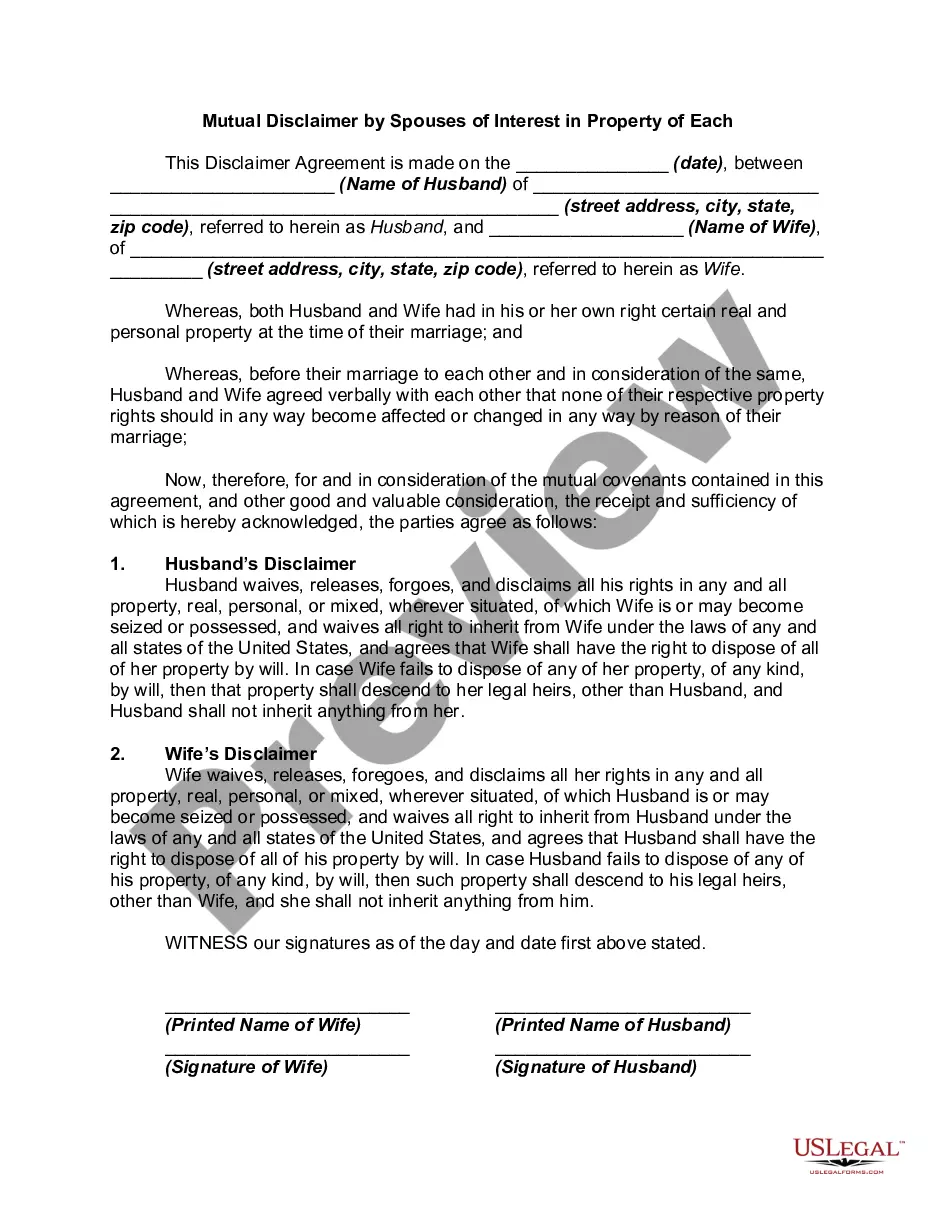

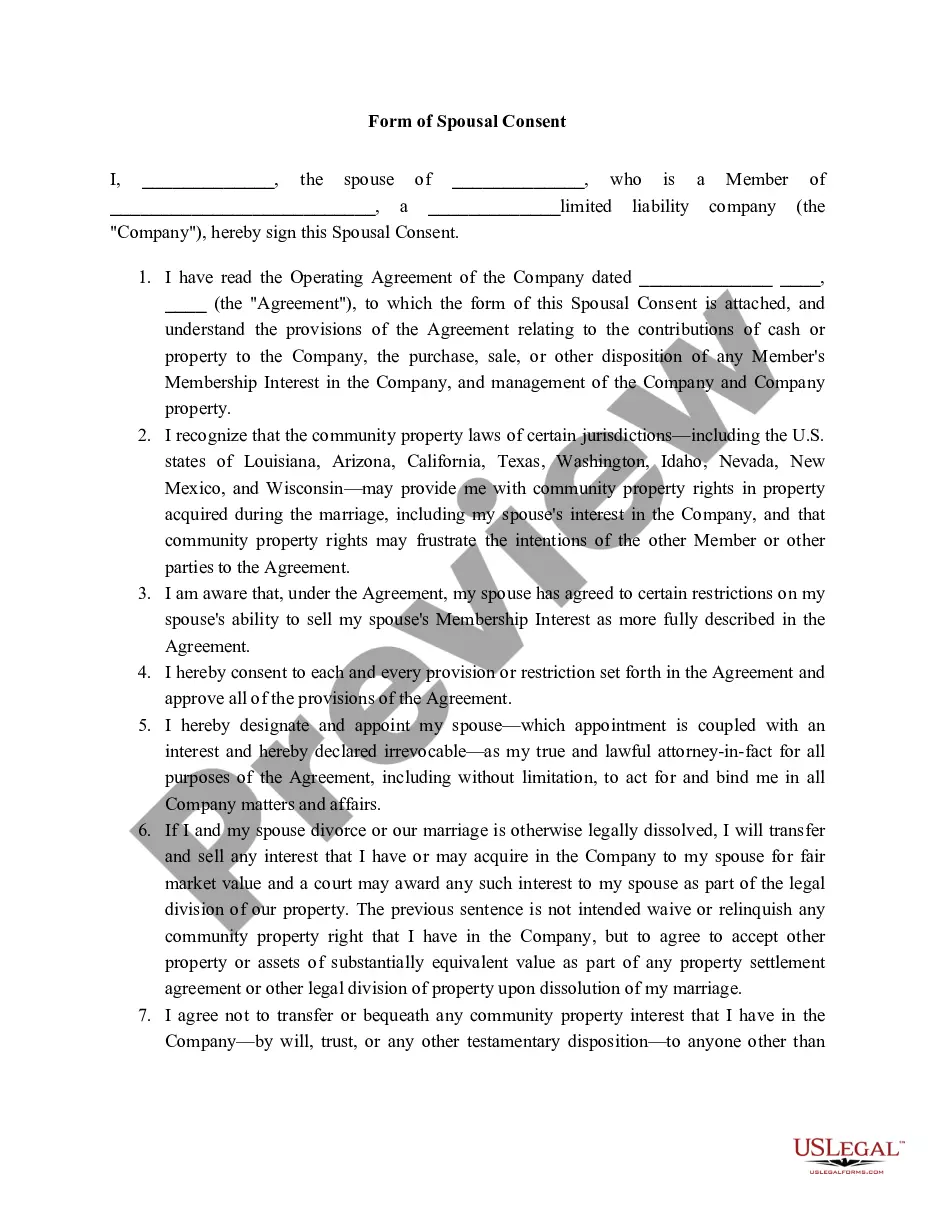

This form is a post-nuptial agreement between husband and wife. A post-nuptial agreement is a written contract executed after a couple gets married, to settle the couple's affairs and assets in the event of a separation or divorce. Like the contents of a prenuptial agreement, it can vary widely, but commonly includes provisions for division of property and spousal support in the event of divorce, death of one of the spouses, or breakup of marriage.

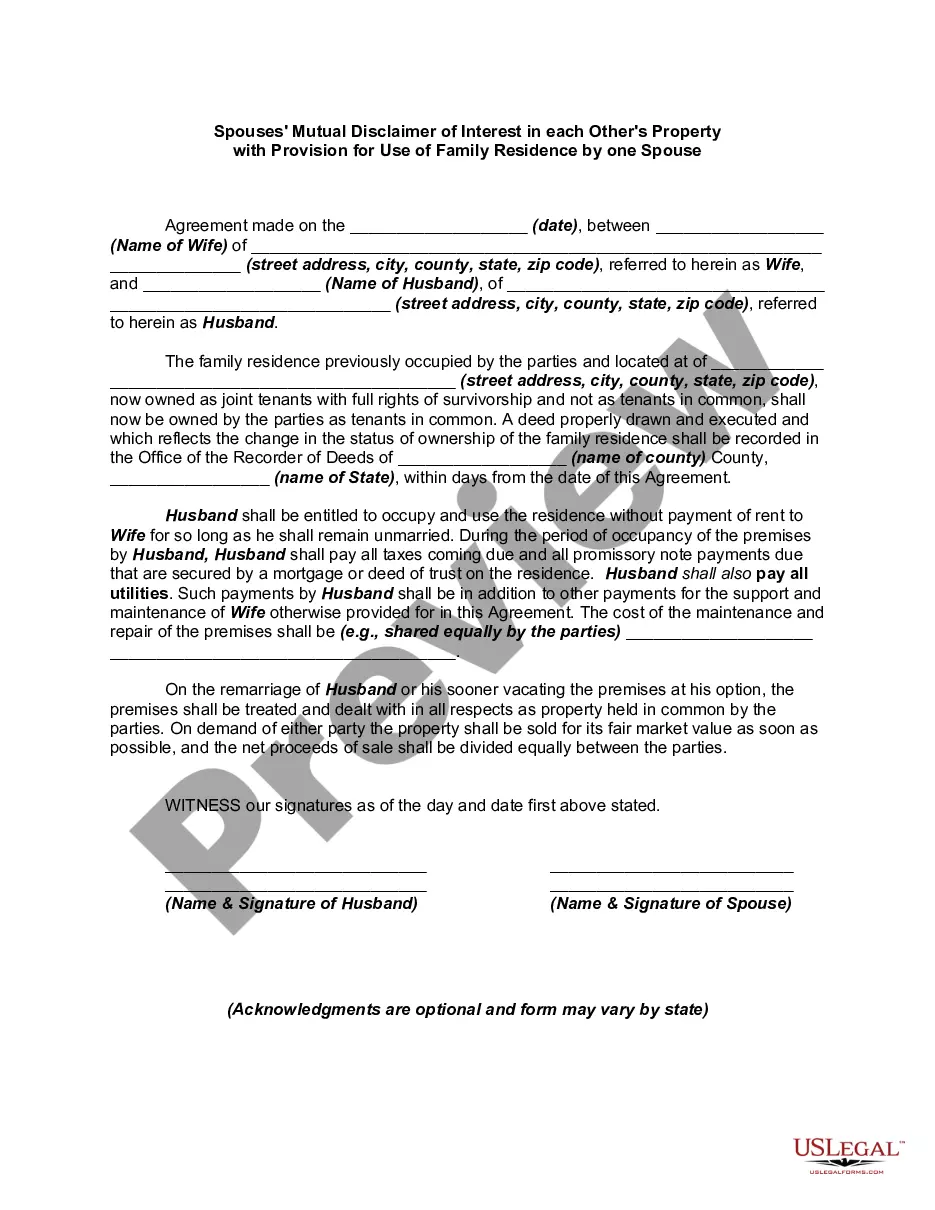

Kentucky Spouses' Mutual Disclaimer of Interest in each Other's Property with Provision for Use of Family Residence by one Spouse

Description

How to fill out Spouses' Mutual Disclaimer Of Interest In Each Other's Property With Provision For Use Of Family Residence By One Spouse?

If you need to download, print, or obtain valid document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Make use of the site's user-friendly and convenient search feature to find the documents you require.

Numerous templates for business and personal applications are categorized by types and jurisdictions, or keywords.

Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find alternative versions of your legal form format.

Step 4. Once you have located the form you need, click the Buy now button. Select your preferred pricing plan and enter your details to register for an account.

- Employ US Legal Forms to retrieve the Kentucky Spouses' Mutual Disclaimer of Interest in each Other's Property with Provision for Use of Family Residence by one Spouse in just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and then click the Download button to acquire the Kentucky Spouses' Mutual Disclaimer of Interest in each Other's Property with Provision for Use of Family Residence by one Spouse.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Preview option to examine the form's details. Remember to read through the summary.

Form popularity

FAQ

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

In Kentucky, the spouse of a deceased person will get everything if there are no children or other descendants, but if there are descendants, spouses generally receive half of the estate.

Life estate consThe life tenant cannot change the remainder beneficiary without their consent.If the life tenant applies for any loans, they cannot use the life estate property as collateral.There's no creditor protection for the remainderman.You can't minimize estate tax.More items...

A person with life interest generally (as we have not perused the Will) does not have the right to sell, transfer or alienate the property to the detriment of the absolute owner, which in your case is the son, i.e., you. It is a limited right to enjoy the property up to the death of the life holder.

Simply put, if you have a legally binding will when you pass away then the dictates of that document will determine what happens to your assets- so if you have listed your spouse as sole beneficiary, they will receive everything, or exactly how much you have given to them in the will.

What is a life interest trust of property? Put simply, the beneficiary has the use of the property during their life time but on their death it passes to a third party; e.g. A house is left to a spouse to live in during their lifetime but on their death the houses passes to children.

More specifically, each person becomes the owner of half of their community property, but also half of their collective debt, according to California inheritance laws. The only property that doesn't become community property automatically are gifts and inheritances that one spouse receives.

The Spouse's Share in Kentucky The rest of your property passes to your descendants, parents, or siblings. If you don't have descendants, parents, or siblings, then your spouse inherits everything.

Find the client's age in the Age column and then go to the column called Life Estate. Take the percentage listed here and multiply it by the TOTAL value of the real property. This will give you the value of the client's life estate interest.

Dower and curtesy rights exist by statute in Kentucky. They are inchoate (undeveloped) rights, and every spouse has them to their spouse's property. As soon as you say "I do" you have the right, if your spouse dies, to roughly one half of their property.