Kentucky Sample Letter for Checks for Settlement

Description

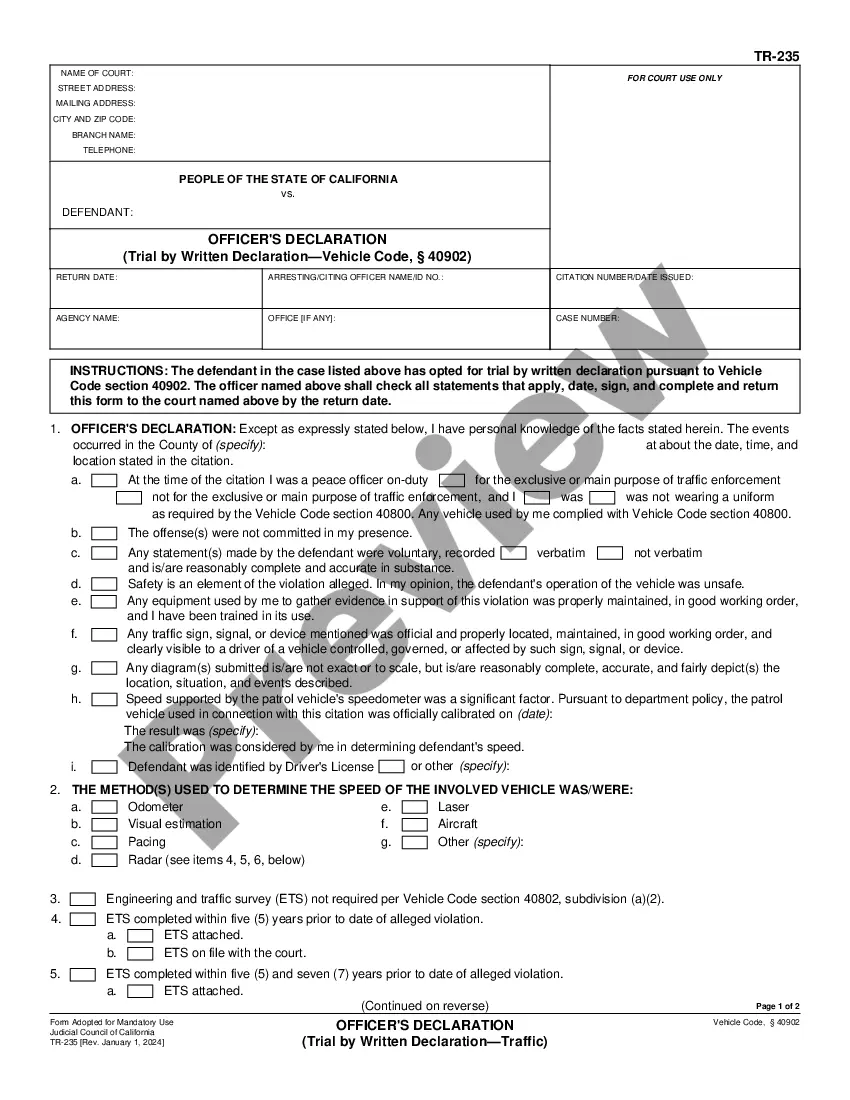

How to fill out Sample Letter For Checks For Settlement?

If you need to total, down load, or printing lawful file templates, use US Legal Forms, the most important variety of lawful forms, that can be found on the web. Make use of the site`s easy and practical search to find the papers you will need. Numerous templates for organization and personal purposes are categorized by classes and claims, or search phrases. Use US Legal Forms to find the Kentucky Sample Letter for Checks for Settlement in a couple of clicks.

In case you are already a US Legal Forms consumer, log in to your bank account and click the Acquire key to obtain the Kentucky Sample Letter for Checks for Settlement. You can even entry forms you earlier delivered electronically within the My Forms tab of your own bank account.

If you work with US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape for the right area/country.

- Step 2. Take advantage of the Preview option to check out the form`s content. Never forget about to read through the description.

- Step 3. In case you are unsatisfied with the form, use the Search industry near the top of the screen to find other types of your lawful form design.

- Step 4. Once you have identified the shape you will need, go through the Buy now key. Pick the costs program you like and add your references to register on an bank account.

- Step 5. Approach the deal. You should use your charge card or PayPal bank account to complete the deal.

- Step 6. Choose the formatting of your lawful form and down load it on your own product.

- Step 7. Complete, change and printing or signal the Kentucky Sample Letter for Checks for Settlement.

Every single lawful file design you acquire is your own eternally. You might have acces to every single form you delivered electronically within your acccount. Select the My Forms area and select a form to printing or down load again.

Compete and down load, and printing the Kentucky Sample Letter for Checks for Settlement with US Legal Forms. There are many specialist and status-distinct forms you may use for your personal organization or personal demands.

Form popularity

FAQ

Kentucky Department of Revenue (@RevenueKY) / X. KY Revenue is to administer tax laws, collect revenue, and provide services in a fair, courteous, and efficient manner for the benefit of the Commonwealth.

What is a Kentucky Tax Status Compliance Certificate? In Kentucky a Tax Status Compliance Certificate is called a Certificate of Good Standing and is issued by the Kentucky Department of Revenue for a Company (Corporation or LLC) or Sole Proprietor which has met all of its Kentucky tax obligations.

If you received a letter from us, your return has been selected for identity confirmation and verification is required in order to complete the processing of your tax return.

The quiz consists of multiple choice questions with answers that help us verify your identity. The quiz can be taken online or by telephone with an authorized representative to help with the process. At the completion of the quiz you will be advised whether you passed or failed.

The Franchise Tax Board will send a notice or letter to personal taxpayers and business entities for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

If your debt is currently being handled by the Division of Collections you can set up your own payment plan by going to the following website . You will need your case number from any Division of Collections' letter. Follow the on-line instructions.

Paying A Tax Bill If no protest is submitted within the appropriate time, any unpaid debt will be referred to the Division of Collections. In addition, a 25% cost of collection fee will be added to each notice. Interest will continue to accrue. More penalties may be added if applicable.