Kentucky Indemnification of Buyer and Seller of Business is a legal provision that aims to protect both parties involved in a business transaction by allocating responsibilities and liabilities in the event of certain specified risks or damages. The indemnification process involves one party (the indemnity) agreeing to compensate or reimburse the other party (the indemnity) for any losses, damages, or expenses resulting from certain specified events or conditions. The indemnification clause is commonly included in the purchase agreement or contract when buying or selling a business in Kentucky. It serves as a form of insurance for the buyer, ensuring that they will be protected against any unforeseen liabilities or undisclosed risks that may surface after the transaction is complete. Similarly, it provides the seller with assurance that they will not be held responsible for losses incurred by the buyer post-sale. There can be different types of indemnification provisions in Kentucky, tailored to fit the specific circumstances of the business transaction. Some commonly encountered types include: 1. General Indemnification: This type of indemnity clause covers a broad range of potential risks and liabilities that may arise from the business. It encompasses both known and unknown risks, ensuring that the buyer is protected against any claims made against the business prior to the sale. 2. Specific Indemnification: In this type, the indemnification is limited to specified risks or liabilities that are expressly identified and defined in the contract. This allows the parties to allocate risks based on their knowledge of the business and its potential vulnerabilities. 3. Third-Party Indemnification: This provision entails indemnifying one party against claims brought by third parties, such as customers, suppliers, or other stakeholders. It transfers the responsibility and legal costs associated with defending against such claims to the indemnity. 4. Survival Period Indemnification: The indemnification obligations often have a designated time period during which the indemnity can make claims for compensation. This period typically extends beyond the closing date of the business sale, allowing the buyer sufficient time to identify and address any potential liabilities that may have been undisclosed during the negotiation process. It is crucial for both buyers and sellers to consult with experienced legal professionals while drafting or reviewing the indemnification provisions in their purchase agreements. Each transaction is unique, and having a tailored indemnification clause that considers the specific risks and liabilities of the business is essential in protecting the interests of both parties involved in the Kentucky Indemnification of Buyer and Seller of Business.

Kentucky Indemnification of Buyer and Seller of Business

Description

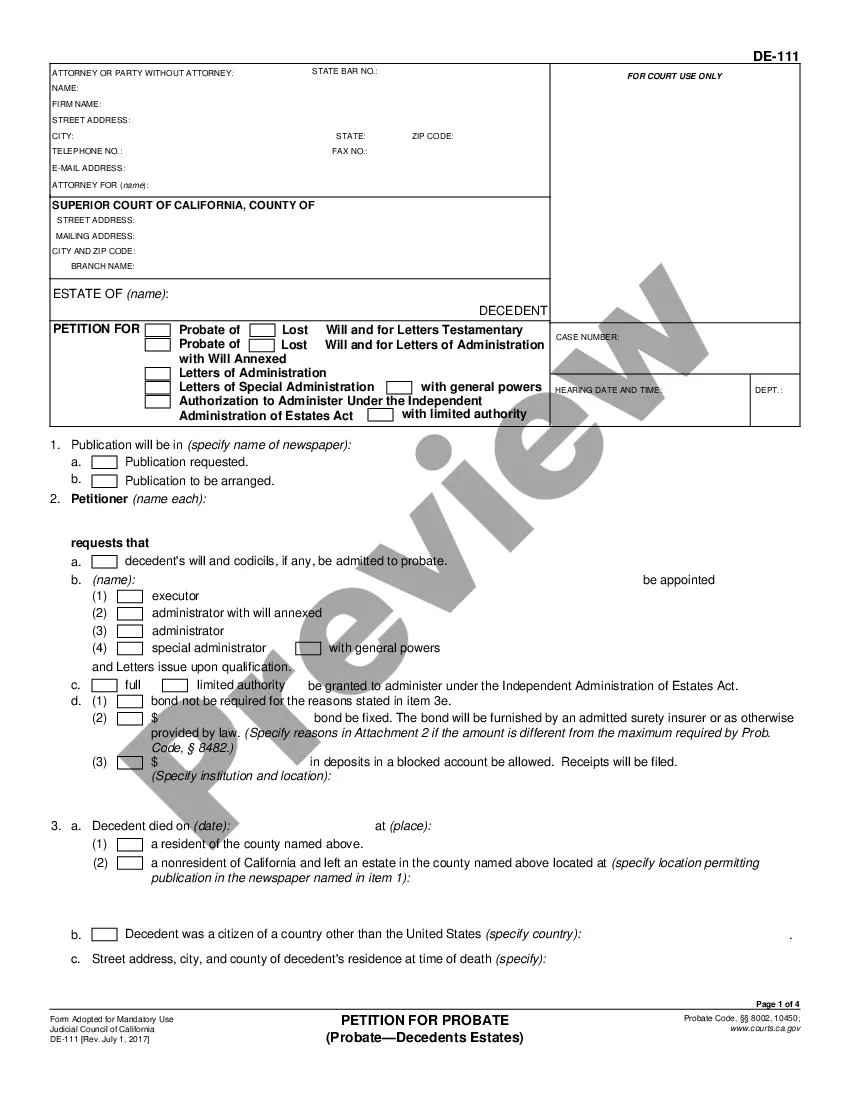

How to fill out Kentucky Indemnification Of Buyer And Seller Of Business?

US Legal Forms - one of the largest repositories of legal documents in the United States - provides a diverse range of legal document templates that you can download or generate.

By utilizing the website, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent versions of documents such as the Kentucky Indemnification of Buyer and Seller of Business in just minutes.

When the document does not meet your requirements, use the Search field at the top of the page to find one that does.

Once you're satisfied with the document, confirm your choice by clicking the Purchase now button. Then, select your preferred payment plan and provide your details to register for an account.

- If you already have a monthly subscription, Log In and download the Kentucky Indemnification of Buyer and Seller of Business from the US Legal Forms collection.

- The Download button will be visible on every document you view.

- You have access to all previously downloaded documents in the My documents section of your account.

- If you're using US Legal Forms for the first time, here are simple steps to get started.

- Make sure you have selected the correct document for your city/region.

- Click the Preview button to review the content of the document.

Form popularity

FAQ

Filling out an indemnity agreement requires you to define the scope of indemnification between the buyer and seller. Make sure to include all relevant details, such as the duration of the agreement and any specific conditions that apply. This ensures compliance with the Kentucky Indemnification of Buyer and Seller of Business framework. Consider utilizing uslegalforms, where you can find user-friendly templates and expert guidance to simplify the completion of your agreement.

To fill an indemnity form, begin by clearly identifying the parties involved in the transaction. Provide detailed information about the business being sold or purchased, ensuring that you accurately state the terms of indemnification. In this context, the Kentucky Indemnification of Buyer and Seller of Business provides essential protection for both parties. Use a reliable platform like uslegalforms to access templates that can guide you through this process.

To draft an indemnity clause, start by identifying potential risks associated with the business transaction and outline who will be responsible for those risks. In the Kentucky indemnification of buyer and seller of business context, clarity and precision are paramount. It may be beneficial to consult legal experts or utilize platforms like uslegalforms to ensure the clause meets all necessary legal criteria.

Yes, indemnification clauses can hold up in court if they are clearly written and agreed upon by both parties. In Kentucky, the courts often uphold these clauses provided they comply with legal standards and are not deemed unconscionable. Properly constructed indemnification terms will significantly increase the likelihood of enforceability in a legal setting.

The indemnification clause for the sale of a business outlines the obligations of each party regarding potential losses post-transaction. It should specify the circumstances under which indemnification applies in Kentucky indemnification of buyer and seller of business. Having a comprehensive clause helps mitigate risks and provides clarity, enhancing the overall transaction experience.

A reasonable indemnity clause clearly defines the scope of indemnification, including the types of claims covered and the limitations on liability. In the context of Kentucky indemnification of buyer and seller of business, it should balance protection with fairness to both parties. A well-crafted clause prevents ambiguity and ensures that both the buyer and seller understand their responsibilities.

A buyer may indemnify a seller to assure the seller against any claims that may arise post-sale. This is particularly important in Kentucky, where the indemnification of buyer and seller of business provides shared risk management. By providing indemnity, the buyer creates trust and encourages a smoother transaction, as the seller feels secure from any potential fallout.

To enforce indemnification, the affected party must provide proof of the loss or damage incurred, along with evidence that aligns with the indemnity agreement. In Kentucky indemnification of buyer and seller of business, legal documentation plays a crucial role in establishing enforceability. If disputes arise, mediation or legal proceedings may be necessary to compel compliance.

Indemnification in the sale of a business refers to the process where one party agrees to compensate another for losses or damages that occur due to specific events. In the context of Kentucky indemnification of buyer and seller of business, it protects both parties from potential liabilities that may arise after the transaction. This ensures that the buyer and seller can proceed with confidence, knowing they are safeguarded against unforeseen issues.

To draft an indemnity agreement, start by clearly outlining the parties involved, the scope of the indemnity, and specific conditions under which indemnification will occur. In the context of Kentucky Indemnification of Buyer and Seller of Business, you should guarantee that the terms address potential risks that both the buyer and seller may face. It’s recommended to use straightforward language and include provisions for legal implications. Using platforms like UsLegalForms can help streamline the process and ensure you cover all necessary components.

More info

, What Pays This Contact (WPA) is the legal definition and legal definition of what constitutes what a “reasonable charge” or “reasonable charge.” What is a reasonable charge? An explanation of what is an acceptable charge is provided on the What Pays This Contact page. What are the “reasonable charge” definitions? The three criteria for determining what constitutes a reasonable charge are explained on the WPA FAQ page; here, they are defined as: The type of charges that can be used (this may vary from state to state, so it may be good to get advice about the local laws and rules that you must follow. Some states have different definitions of the terms “reasonable” and “reasonable” charge for different business types). The level of service or amount of time a company charges for a transaction.