A Kentucky Simple Promissory Note for Personal Loan is a legally binding document that establishes the terms and conditions of a loan transaction between two individuals. It serves as a written agreement, outlining the borrower's promise to repay the lender a specified amount of money within a designated timeframe. This type of promissory note is commonly used for personal loans in the state of Kentucky, providing clarity and protection for both parties involved. The Kentucky Simple Promissory Note for Personal Loan typically includes essential information such as the names and contact details of the borrower and lender, the loan amount, the interest rate (if applicable), the repayment schedule, and any additional terms agreed upon. This comprehensive document ensures that all parties understand their obligations and rights regarding the loan, minimizing potential disputes or misunderstandings. When it comes to different types of Kentucky Simple Promissory Notes for Personal Loan, they can be categorized based on the loan's specific characteristics or purpose. For instance, there are fixed-term promissory notes that establish a set period within which the borrower must repay the loan. On the other hand, open-ended promissory notes lack a specified repayment period, allowing the borrower to make payments at their convenience, but still ensuring the loan is repaid eventually. Another type of Kentucky Simple Promissory Note for Personal Loan is a secured promissory note. This type of note includes additional provisions that grant the lender the right to claim certain collateral or assets in case of default. By securing the loan, the lender is provided with added protection and reassurance that they can recover their investment if the borrower fails to repay the loan as agreed. In contrast, an unsecured promissory note does not require any collateral, making it solely based on the borrower's credibility and trustworthiness. This type of note may have a higher interest rate to compensate for the increased risk faced by the lender. Overall, a Kentucky Simple Promissory Note for Personal Loan is a vital document that establishes a clear agreement between a borrower and a lender. Whether it is a fixed-term, open-ended, secured, or unsecured promissory note, it is essential for all parties involved in a loan transaction to understand the terms and conditions outlined within the document.

Kentucky Simple Promissory Note for Personal Loan

Description

How to fill out Kentucky Simple Promissory Note For Personal Loan?

If you wish to full, download, or print out authorized file layouts, use US Legal Forms, the most important assortment of authorized forms, that can be found on-line. Use the site`s simple and easy handy research to find the paperwork you require. Different layouts for business and individual reasons are categorized by types and claims, or search phrases. Use US Legal Forms to find the Kentucky Simple Promissory Note for Personal Loan with a handful of click throughs.

Should you be already a US Legal Forms customer, log in for your account and click on the Down load option to get the Kentucky Simple Promissory Note for Personal Loan. You can even entry forms you previously downloaded within the My Forms tab of your respective account.

If you are using US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have selected the form for that appropriate metropolis/country.

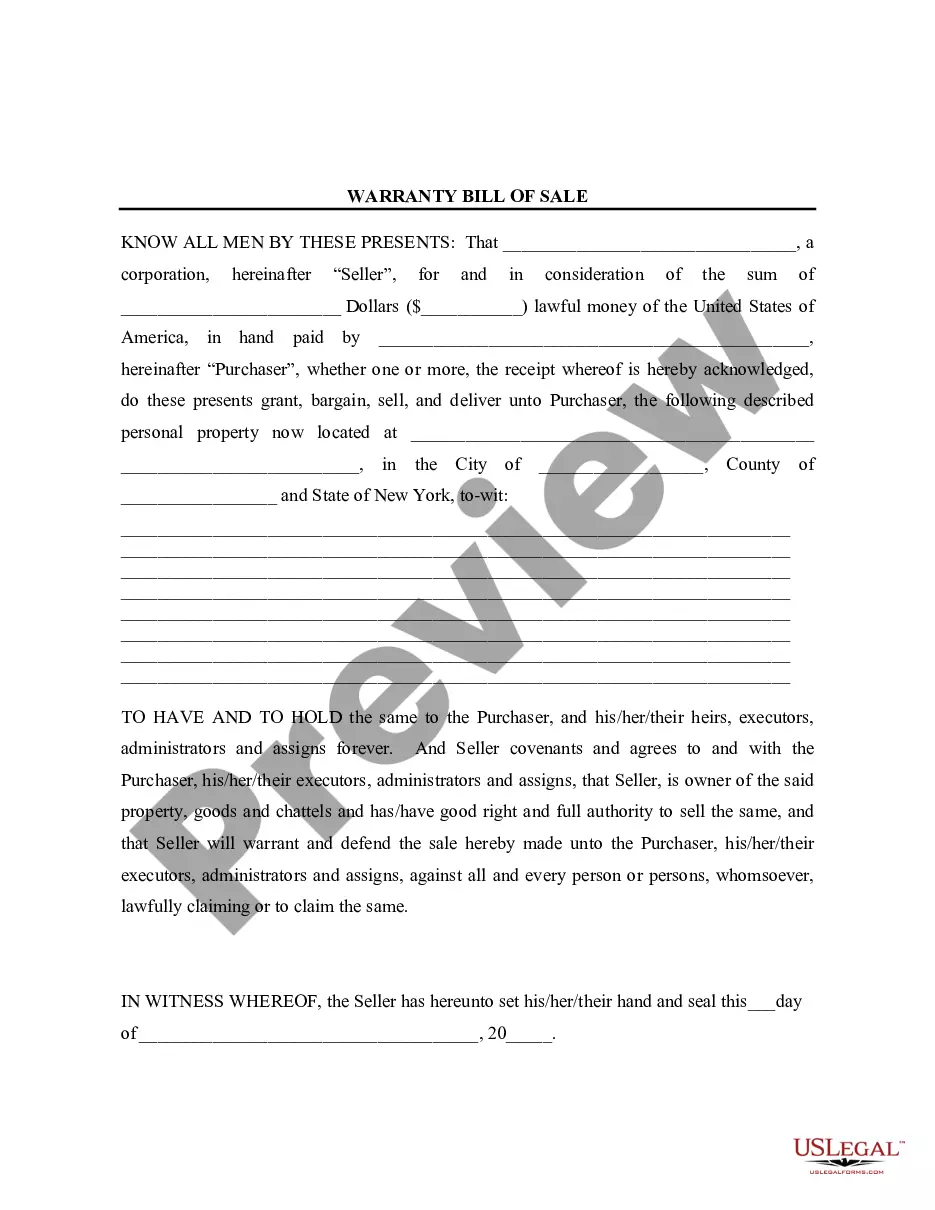

- Step 2. Make use of the Preview method to examine the form`s content. Never neglect to read through the description.

- Step 3. Should you be not happy using the type, make use of the Lookup industry near the top of the display to locate other types of the authorized type format.

- Step 4. Once you have identified the form you require, click the Get now option. Select the pricing strategy you favor and add your credentials to register to have an account.

- Step 5. Method the deal. You can use your Мisa or Ьastercard or PayPal account to accomplish the deal.

- Step 6. Find the structure of the authorized type and download it on your product.

- Step 7. Total, modify and print out or indication the Kentucky Simple Promissory Note for Personal Loan.

Every authorized file format you acquire is yours for a long time. You may have acces to each type you downloaded with your acccount. Go through the My Forms area and pick a type to print out or download once again.

Compete and download, and print out the Kentucky Simple Promissory Note for Personal Loan with US Legal Forms. There are thousands of skilled and status-particular forms you can use for your business or individual requires.

Form popularity

FAQ

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

Any two parties who wish to enter into a loan agreement can draft a promissory note, which states the intention of the lender to loan the borrower a specific amount of money, as well as the terms and conditions for repayment of that loan, to which both parties have agreed.

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

A promissory note is used for mortgages, student loans, car loans, business loans, and personal loans between family and friends.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

A promissory note must include the date of the loan, the dollar amount, the names of both parties, the rate of interest, any collateral involved, and the timeline for repayment. When this document is signed by the borrower, it becomes a legally binding contract.

At its most basic, a promissory note should include the following things:Date.Name of the lender and borrower.Loan amount.Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral?Payment amount and frequency.Payment due date.Whether the loan has a cosigner, and if so, who.

Promissory notes do not bind the lender. As alluded to above, although both documents bind the borrower, only loan agreements also "bind" the lender. That's because the lender also signs a loan agreement, but does not sign a promissory note.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.