Kentucky Assignment of Property in Attached Schedule

Description

How to fill out Assignment Of Property In Attached Schedule?

Have you ever found yourself in a scenario where you need documentation for both corporate and personal activities nearly every day.

There are numerous legal document templates accessible online, but finding trustworthy ones can be challenging.

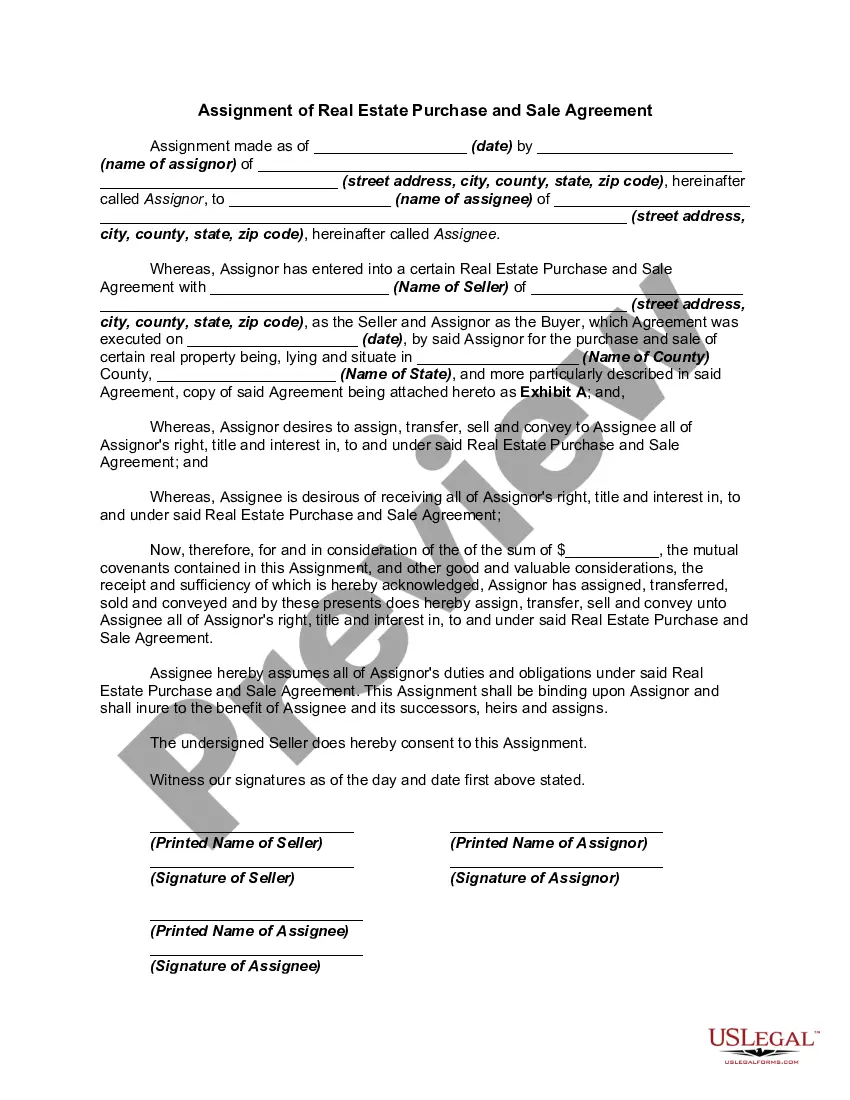

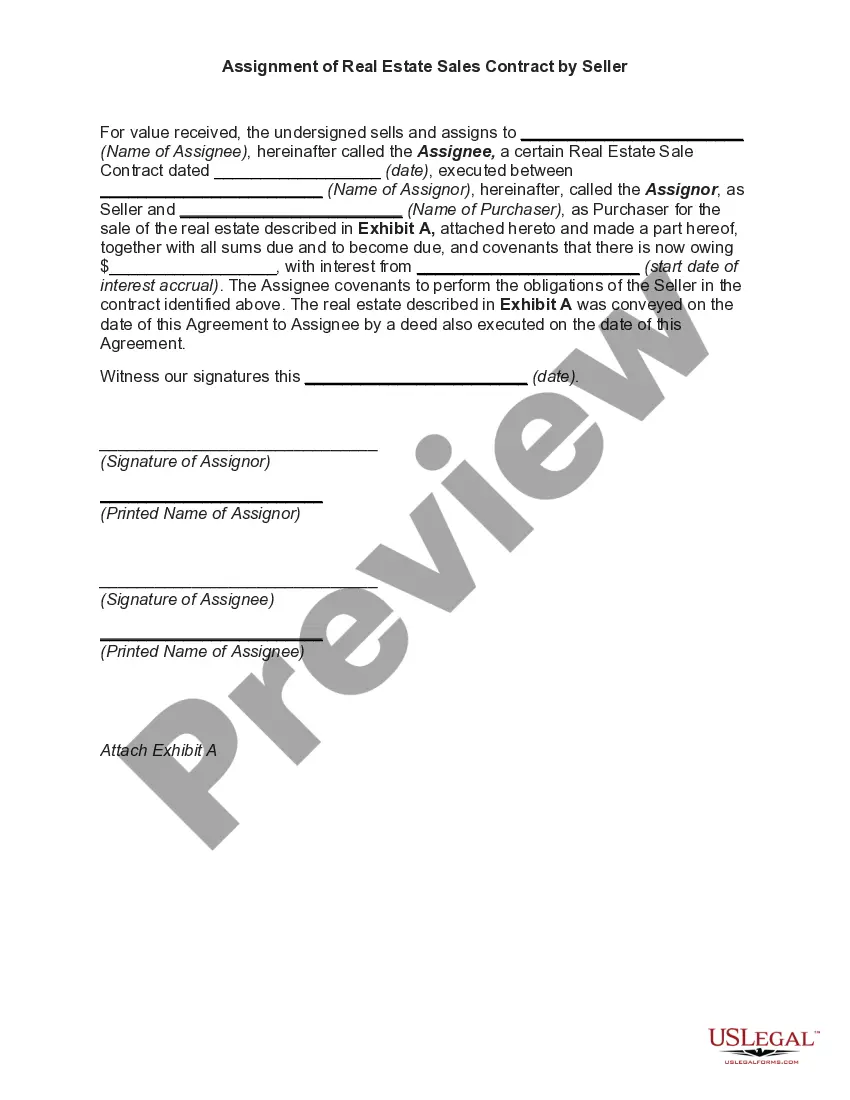

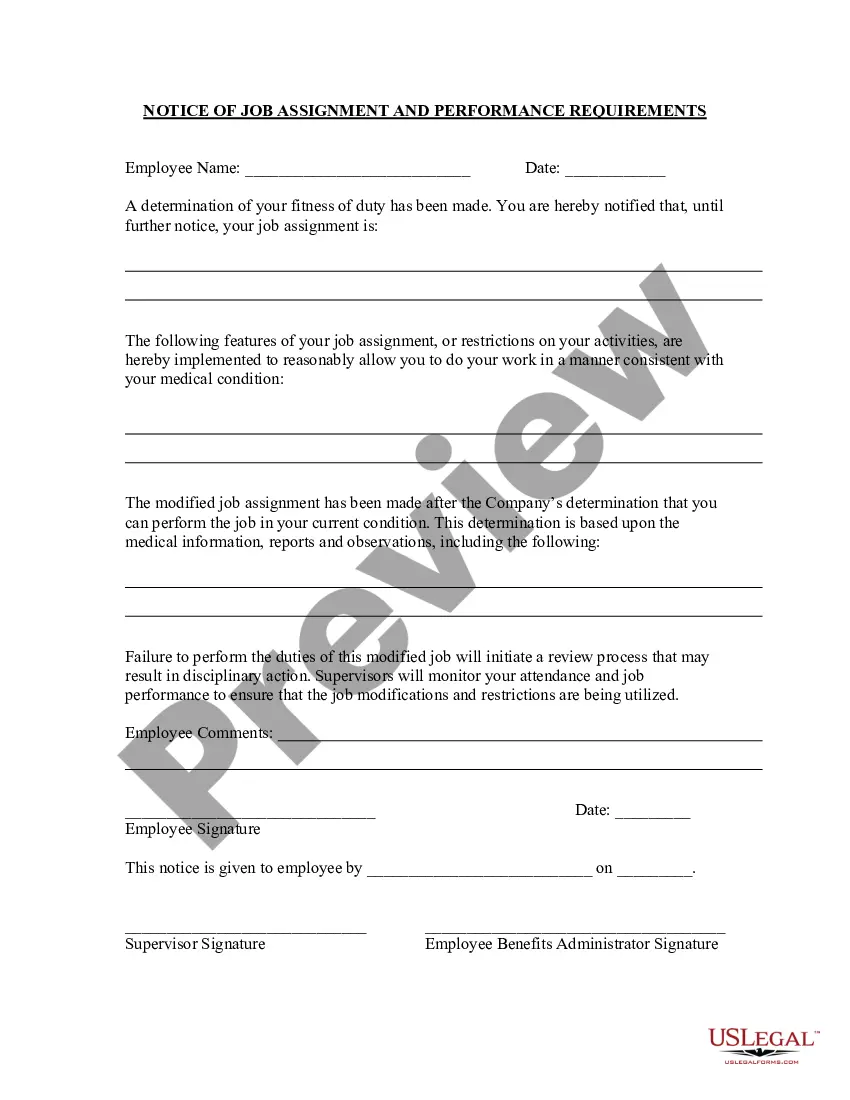

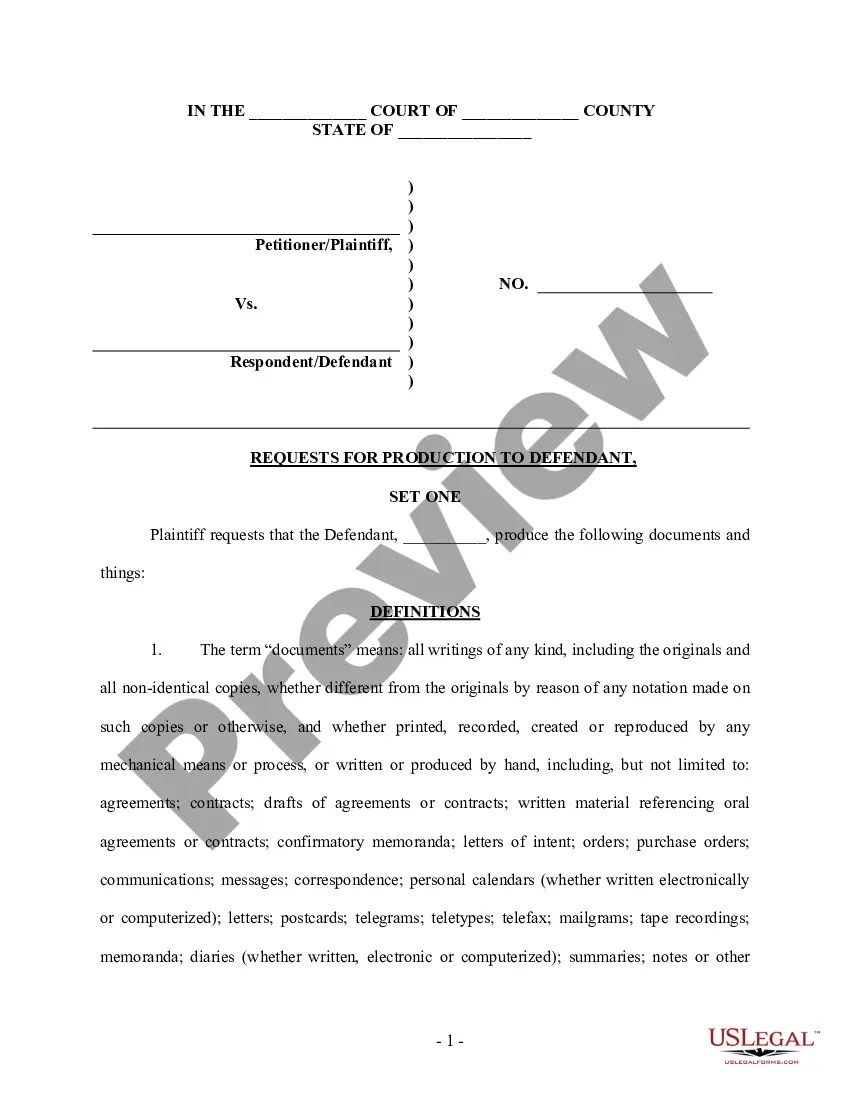

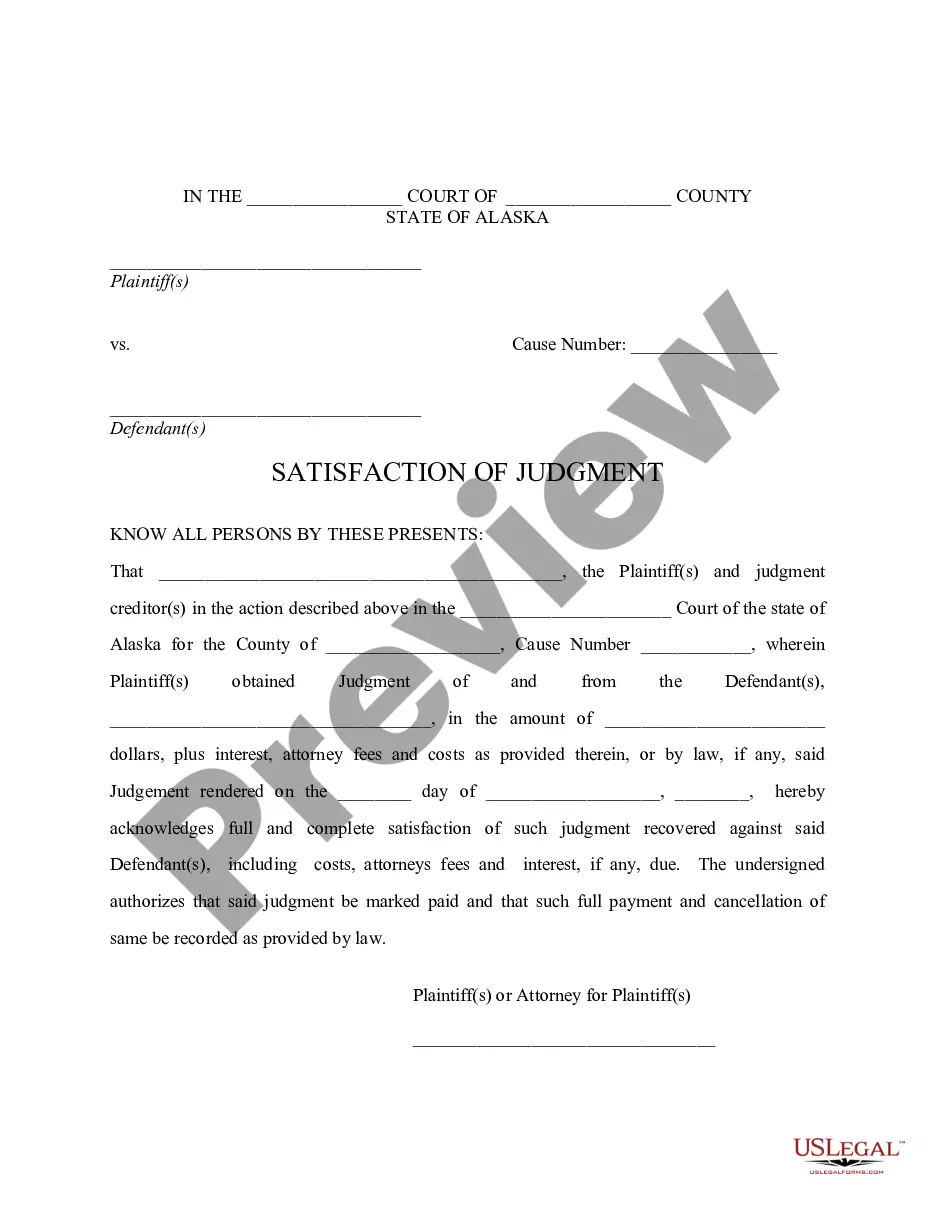

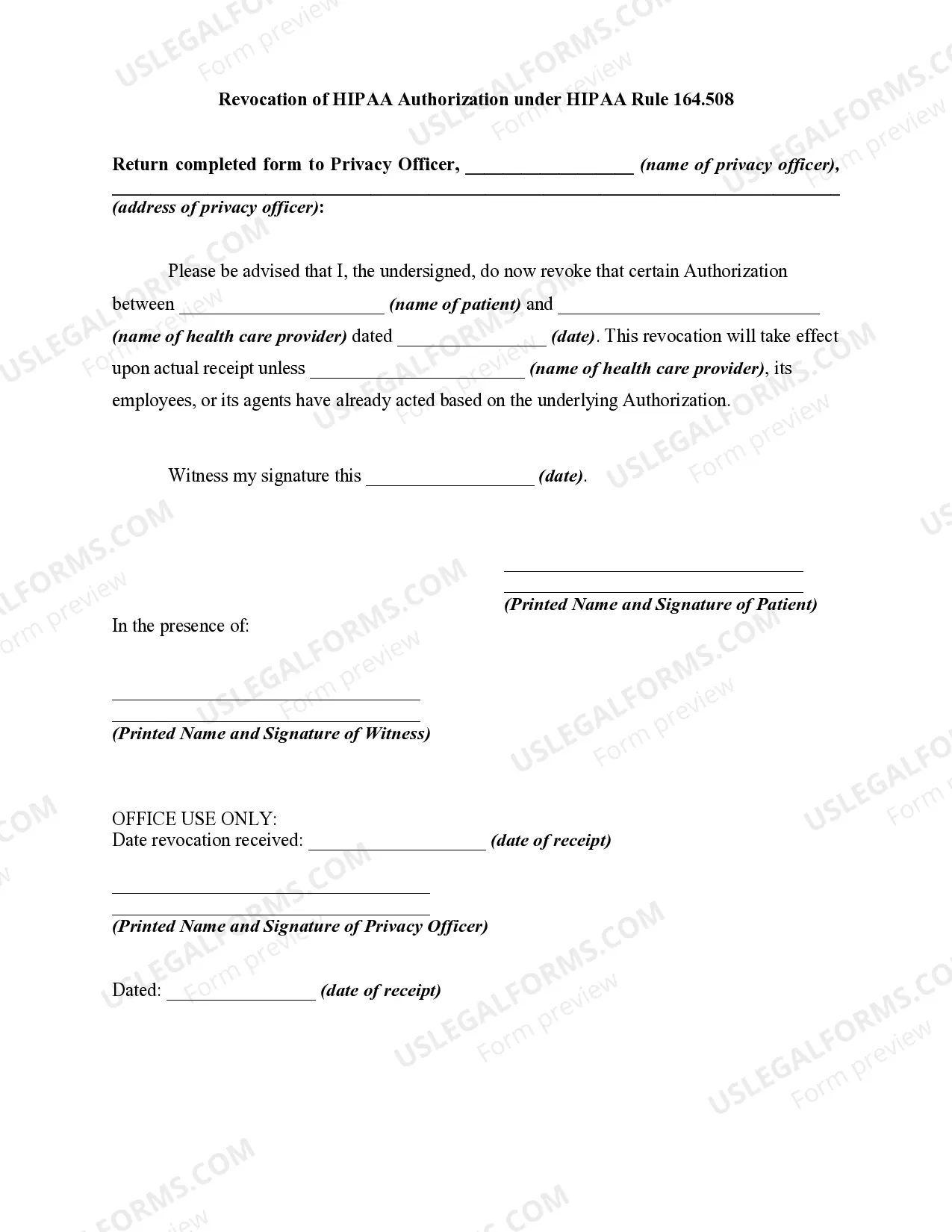

US Legal Forms offers thousands of form templates, including the Kentucky Assignment of Property in Attached Schedule, that are designed to comply with federal and state regulations.

Once you find the correct document, click Acquire now.

Choose the pricing plan you prefer, enter the required information to create your account, and pay for your order using PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Kentucky Assignment of Property in Attached Schedule template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Find the document you need and ensure it is for the correct municipality/county.

- Utilize the Review button to examine the form.

- Read the description to confirm that you have selected the right document.

- If the document is not what you are looking for, use the Search field to locate the form that suits your needs and requirements.

Form popularity

FAQ

Property tax rates in Kentucky generally range from 0.8% to 1.2% of the property's assessed value. Factors such as local government needs and school funding influence these rates. Understanding the Kentucky Assignment of Property in Attached Schedule can aid property owners in estimating their tax liabilities effectively. For personalized assistance, consider exploring UsLegalForms to find the right resources.

In Kentucky, property tax is levied annually on real estate, and the rates vary by county. It is crucial for property owners to be aware of the Kentucky Assignment of Property in Attached Schedule, as it outlines the specific duties and rights related to property ownership. If you have any questions about how property tax is structured, UsLegalForms offers valuable insights to navigate your obligations.

Kentucky property tax is assessed based on the value of your property. The county property assessor determines this value, which then influences your tax bill. Homeowners should understand how the Kentucky Assignment of Property in Attached Schedule can impact their property valuation and tax responsibilities. Utilizing resources like UsLegalForms can help clarify these processes.

A Kentucky Schedule E is a crucial component of the Kentucky Assignment of Property in Attached Schedule. This document lists specific properties that may be assigned to creditors or beneficiaries in relevant legal scenarios. Understanding Schedule E helps individuals manage their assets appropriately and ensures they meet legal requirements. You can utilize US Legal Forms to access the necessary documents and templates to simplify the process.

Married couples may choose to file separately in situations where it benefits their overall tax scenario. This choice can be advantageous if one spouse has significant medical expenses or miscellaneous deductions. Additionally, if either spouse has concerns regarding liability, such as issues related to a Kentucky Assignment of Property in Attached Schedule, filing separately may offer a solution. Always consider your unique circumstances and consult with a tax professional to make the best choice.

Filing separately while married is not illegal, but it is important to understand the potential downsides. This status can limit your access to certain tax benefits and increase your overall tax liability. If your situation involves a Kentucky Assignment of Property in Attached Schedule, assess how the filing status affects your tax position. It may be wise to seek guidance to ensure compliance and optimize your outcome.

If you earned income in Kentucky but do not reside there, you may be required to file a Kentucky nonresident tax return. This ensures that you report the income sourced from the state correctly. Keep in mind that if you engage in transactions involving a Kentucky Assignment of Property in Attached Schedule, filing may be necessary to claim deductions properly. Check the specific requirements to determine your filing obligations.

Yes, you can file married filing separately in Kentucky. This option allows each spouse to be responsible for their own tax return. However, this filing status can have varied tax implications, including how it relates to a Kentucky Assignment of Property in Attached Schedule. Review your finances and discuss your options with a tax consultant before making a decision.

Filing married filing separately does not automatically guarantee a larger refund. In many cases, it can actually reduce the refund amount due to restrictions on credits and deductions. When considering the Kentucky Assignment of Property in Attached Schedule, evaluate how your filing status affects your overall tax strategy. It's beneficial to analyze both scenarios with a tax expert.

The Kentucky 740 form is a state income tax return used by residents and part-year residents of Kentucky. This form allows you to report your income, deductions, and any tax credits applicable to you. Additionally, if your tax situation involves a Kentucky Assignment of Property in Attached Schedule, this form will be important for accurate reporting. Ensure you follow the instructions carefully to avoid complications.