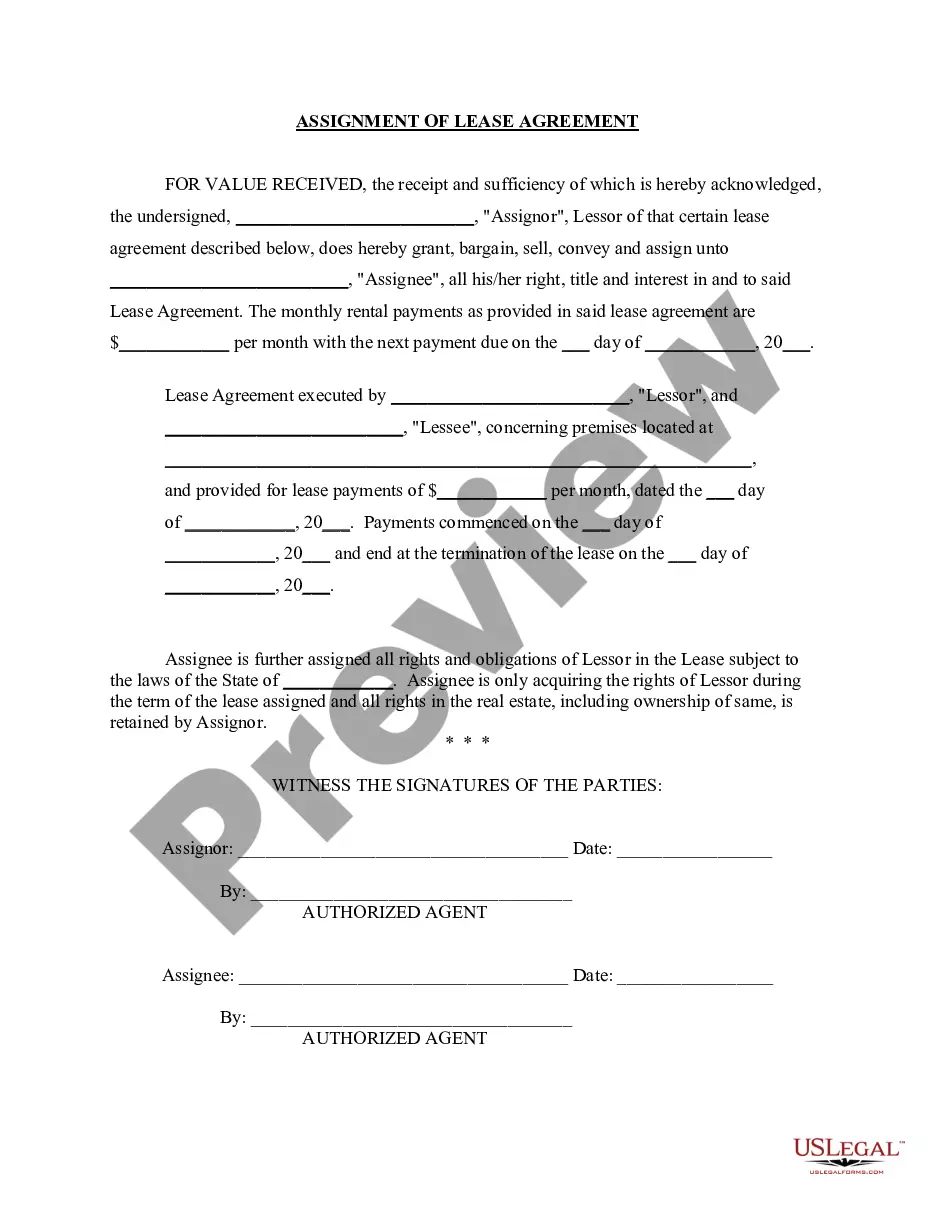

Keywords: Kentucky, Venture Capital, Finder's Fee Agreement Description: The Kentucky Venture Capital Finder's Fee Agreement is a legally binding contract used in the state of Kentucky to formalize the relationship between a venture capital firm and a finder who assists the firm in identifying potential investment opportunities. This agreement outlines the details and terms governing the payment of a finder's fee or commission to the individual or entity who successfully introduces a viable investment opportunity to the venture capital firm. The finder's fee acts as compensation for the finder's efforts, expertise, and network, thus incentivizing them to source valuable investment prospects. The Kentucky Venture Capital Finder's Fee Agreement typically includes sections covering essential aspects such as: 1. Parties Involved: Clearly identifies the venture capital firm and the finder, providing their legal names and contact information. 2. Purpose: Specifies that the agreement is being entered into for the purpose of seeking and identifying potential investment opportunities. 3. Finder's Obligations: Outlines the specific responsibilities of the finder, which may include conducting due diligence, market research, and presenting potential investment opportunities to the venture capital firm. 4. Compensation: Describes the finder's fee structure, including the percentage or flat fee agreed upon as compensation for successful introductions. This section may also address how multiple finders would split the fee if applicable. 5. Term and Termination: States the duration of the agreement and the circumstances under which it can be terminated. 6. Confidentiality and Non-Disclosure: Includes provisions to protect sensitive information shared between the parties during the course of their collaboration. 7. Governing Law: Specifies that the agreement is subject to Kentucky state laws. Note that while the general structure of the Kentucky Venture Capital Finder's Fee Agreement remains consistent, there may be variations or additional terms based on the preferences or specific requirements of the involved parties. It is advisable to consult legal professionals specializing in venture capital agreements to ensure compliance with all relevant laws and regulations. Although there may not be officially recognized different types of Kentucky Venture Capital Finder's Fee Agreements, variations may exist based on customized terms and conditions agreed upon by the parties involved.

Kentucky Venture Capital Finder's Fee Agreement

Description

How to fill out Kentucky Venture Capital Finder's Fee Agreement?

If you want to total, download, or produce authorized file layouts, use US Legal Forms, the largest selection of authorized forms, that can be found on-line. Make use of the site`s simple and easy hassle-free look for to discover the papers you require. Numerous layouts for company and specific uses are sorted by categories and says, or keywords. Use US Legal Forms to discover the Kentucky Venture Capital Finder's Fee Agreement with a few clicks.

When you are already a US Legal Forms consumer, log in in your profile and click on the Acquire option to find the Kentucky Venture Capital Finder's Fee Agreement. You can even gain access to forms you previously delivered electronically within the My Forms tab of your respective profile.

If you use US Legal Forms for the first time, refer to the instructions below:

- Step 1. Be sure you have chosen the form for your right metropolis/nation.

- Step 2. Utilize the Preview method to check out the form`s articles. Never forget about to see the outline.

- Step 3. When you are not happy with all the form, utilize the Lookup discipline on top of the display screen to discover other types from the authorized form design.

- Step 4. Once you have discovered the form you require, select the Buy now option. Pick the costs program you like and add your references to sign up for the profile.

- Step 5. Procedure the purchase. You can utilize your charge card or PayPal profile to perform the purchase.

- Step 6. Select the structure from the authorized form and download it on your product.

- Step 7. Comprehensive, edit and produce or indicator the Kentucky Venture Capital Finder's Fee Agreement.

Each authorized file design you purchase is the one you have permanently. You have acces to every single form you delivered electronically inside your acccount. Click on the My Forms segment and choose a form to produce or download once more.

Compete and download, and produce the Kentucky Venture Capital Finder's Fee Agreement with US Legal Forms. There are many professional and condition-particular forms you may use to your company or specific requires.