Kentucky Debt Agreement, also known as a debt settlement agreement, is a legally binding arrangement between a debtor (individual or business) and their creditors to settle outstanding debts for less than the full amount owed. This agreement is typically reached when the debtor is facing financial hardship and is unable to make full payments. A Kentucky Debt Agreement aims to negotiate a reduced settlement amount with creditors, often achieved by offering a lump sum payment or a revised payment plan that is more manageable for the debtor. By accepting a debt settlement agreement, creditors agree to consider the debt paid in full after receiving the negotiated amount. There are several types of Kentucky Debt Agreements that debtors can explore: 1. Unsecured Debt Settlement: This type of agreement deals with unsecured debts, such as credit card debts, medical bills, personal loans, or utility bills. These debts are not backed by collateral and can often be negotiated for a lower settlement amount. 2. Secured Debt Settlement: Secured debts involve collateral, such as a mortgage or a car loan. While it is still possible to negotiate a debt settlement for secured debts, creditors may be more reluctant to accept reduced amounts as they have the option to repossess the collateral in case of default. 3. Business Debt Settlement: Small business owners facing financial difficulties can consider a business debt settlement agreement to negotiate with creditors and reduce outstanding debts. This can help alleviate the financial burden on the business and allow for a fresh start. It is important to note that pursuing a Kentucky Debt Agreement may have certain consequences. Debtors often experience a negative impact on their credit score, as the settlement will be reported to credit bureaus. Additionally, there may be tax implications for the forgiven debt, as it is considered taxable income. In summary, a Kentucky Debt Agreement is an option for individuals and businesses struggling with debt to negotiate with creditors for a reduced settlement amount. This agreement can help alleviate financial burden and provide an opportunity for a fresh start. However, it is crucial for debtors to weigh the potential consequences and consider seeking professional advice before entering into such an arrangement.

Kentucky Debt Agreement

Description

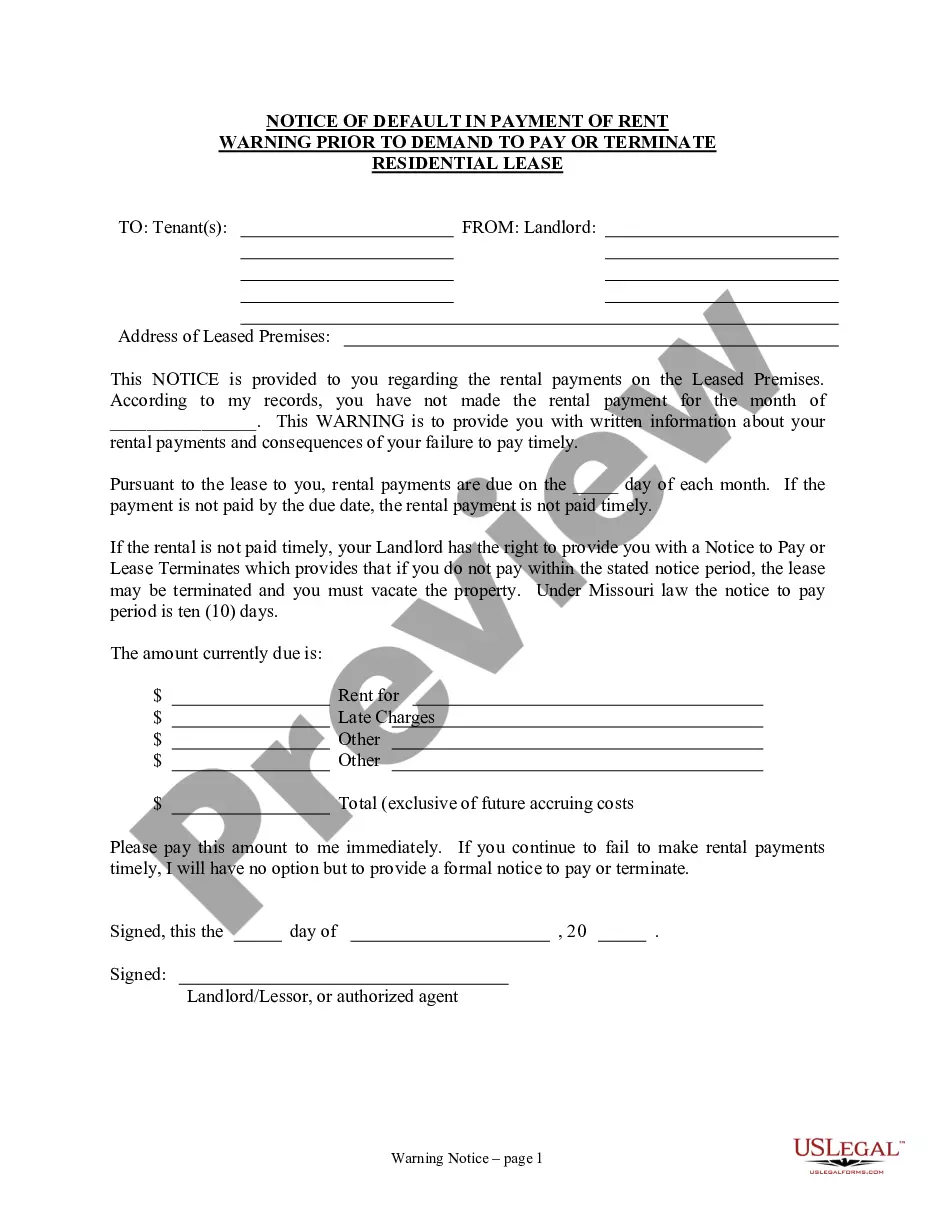

How to fill out Kentucky Debt Agreement?

If you need to total, download, or print lawful file web templates, use US Legal Forms, the most important assortment of lawful kinds, which can be found on the Internet. Make use of the site`s easy and convenient lookup to get the paperwork you require. Different web templates for company and specific reasons are categorized by types and states, or search phrases. Use US Legal Forms to get the Kentucky Debt Agreement in just a couple of clicks.

In case you are presently a US Legal Forms buyer, log in to the account and click the Download option to get the Kentucky Debt Agreement . You may also access kinds you earlier delivered electronically in the My Forms tab of your respective account.

If you use US Legal Forms the very first time, follow the instructions listed below:

- Step 1. Be sure you have selected the shape to the correct area/nation.

- Step 2. Take advantage of the Review option to look over the form`s articles. Don`t forget to read through the description.

- Step 3. In case you are unsatisfied together with the form, make use of the Search discipline towards the top of the display to find other versions from the lawful form format.

- Step 4. Once you have found the shape you require, go through the Purchase now option. Select the rates prepare you like and add your credentials to register on an account.

- Step 5. Process the financial transaction. You may use your Мisa or Ьastercard or PayPal account to accomplish the financial transaction.

- Step 6. Select the formatting from the lawful form and download it on your system.

- Step 7. Comprehensive, edit and print or signal the Kentucky Debt Agreement .

Each lawful file format you get is the one you have forever. You possess acces to each form you delivered electronically within your acccount. Click the My Forms portion and select a form to print or download once again.

Remain competitive and download, and print the Kentucky Debt Agreement with US Legal Forms. There are millions of specialist and express-certain kinds you can utilize for your personal company or specific demands.

Form popularity

FAQ

In many cases, a 10-year-old debt may be too old to collect in Kentucky, depending on its type and when the last payment was made. By law, certain debts can become uncollectible after the statute of limitations expires. If you're unsure about the status of an old debt, a Kentucky Debt Agreement can help clarify your options and guide you through potential resolutions.

In Kentucky, the statute of limitations for most debts is typically around five to fifteen years, depending on the type of debt. Once this period expires, creditors can no longer legally pursue collection. Understanding your timeline is vital, particularly if you are considering a Kentucky Debt Agreement as a potential solution for your financial challenges.

In Kentucky, creditors typically have one year from the date of death to file a claim against an estate. The estate must settle valid claims before distributing assets to heirs. Establishing a Kentucky Debt Agreement may help manage outstanding debts and ensure a smoother process during estate settlements. It's essential to address these matters promptly.

Kentucky law outlines specific practices for debt collection to protect consumers. Collectors must adhere to guidelines that prevent harassment and ensure transparency. If you face challenges with debt collection, exploring a Kentucky Debt Agreement could provide a structured way to manage your obligations. Knowing your rights can empower you during this process.

As of recent reports, Kentucky's total debt stands at approximately $42 billion. This figure encompasses various forms of debt, including general obligation bonds and other liabilities. Understanding the state's financial position is crucial, especially when navigating a Kentucky Debt Agreement. Being informed helps residents make better choices regarding their financial obligations.

In Kentucky, debts typically become uncollectible after a statute of limitations period of five years for most types of consumer debt. This period begins from the date of the last payment or the last activity on the account. Understanding this timeline is vital if you are exploring options such as a Kentucky Debt Agreement, as it can provide insight into your rights and potential strategies for managing your debts. Always consider legal advice to navigate this process successfully.

As of now, California holds the title for the highest state debt in the United States. This debt largely arises from its extensive budget deficits and high spending needs. It is noteworthy, however, that understanding debt levels of different states, including Kentucky, can be crucial when considering options like a Kentucky Debt Agreement. This knowledge empowers consumers to make informed decisions about their financial futures.

The state of Kentucky has accumulated a significant level of debt, primarily related to pension obligations and infrastructure spending. As of recent reports, Kentucky's public debt includes bonds and other forms of borrowing that fund essential services. Understanding this debt is important for state residents, especially when engaging in discussions about financial agreements like the Kentucky Debt Agreement. Awareness of the state's financial health can influence local economic decisions and personal finances.

In Kentucky, debt collection laws protect consumers from unfair collection practices. Under these laws, debt collectors must follow specific procedures, including notifying consumers of their rights. It is essential to understand these laws, especially if you find yourself navigating a Kentucky Debt Agreement. Familiarizing yourself with your rights can help you handle potential debt collection more effectively.

If you owe KY state taxes, the state may take measures to recover the funds, such as wage garnishment or property liens. It's essential to address the situation promptly to avoid escalation. By creating a Kentucky Debt Agreement, you can potentially negotiate terms that allow you to repay your state taxes over time while minimizing penalties.

More info

Stakeholders Interest Rate Agreements IRS Contact Us Social Security Number.