Title: Simplify Tax and Reporting Obligations: Kentucky Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees Introduction: In this article, we will provide a detailed description of the Kentucky Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees. This comprehensive letter serves as a guideline for businesses operating in Kentucky to fulfill their tax obligations and file annual reports accurately and in a timely manner. We will explore the key components of this letter, along with its purpose and benefits. Additionally, we will highlight any variations or specific types of these sample letters for different scenarios. Keywords: Kentucky, sample letter, payment, corporate income tax, franchise tax, annual report filing fees 1. Understanding the Kentucky Sample Letter: The Kentucky Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees is a valuable resource provided by the state to assist businesses in fulfilling their tax-related obligations. It outlines the specific instructions and guidelines for making payments and filing annual reports in accordance with state laws. 2. Components of the Kentucky Sample Letter: 2.1 Payment of Corporate Income and Franchise Taxes: This section of the letter provides detailed instructions on the proper method for calculating and submitting corporate income and franchise taxes. It highlights the due dates, the acceptable payment methods, and any necessary forms or documentation that must accompany the submission. 2.2 Annual Report Filing Fees: In this segment, the letter explains the procedures for paying the required fees associated with filing annual reports. It encompasses the relevant due dates, acceptable payment methods, and any supporting documentation or forms that businesses need to include. 3. Purpose and Benefits of the Kentucky Sample Letter: 3.1 Ensuring Compliance: The sample letter helps businesses to adhere to Kentucky's tax laws and regulations effectively. By providing clear instructions and guidelines, it reduces the chances of errors or omissions during the payment process and annual report filing. 3.2 Time and Cost Efficiency: The letter streamlines the tax payment and annual report filing procedures, enabling businesses to complete these obligations accurately and efficiently. By following the given instructions, businesses can save time and avoid potential penalties or delays. 4. Types of Kentucky Sample Letters for Different Scenarios: While the general Kentucky Sample Letter is applicable to most businesses, specific variations may exist for different scenarios, such as: 4.1 Nonprofit Organizations: Nonprofit organizations may require a modified version of the sample letter to adhere to their specific tax-exempt status and reporting requirements. 4.2 Small Businesses: A simplified version of the sample letter might be available for small businesses with lesser tax burdens and streamlined annual reporting procedures. Conclusion: The Kentucky Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees is a crucial resource maintaining compliance with tax obligations in Kentucky. By following the guidelines provided in this comprehensive letter, businesses can successfully complete their tax payments and annual report filings accurately and within the specified deadlines.

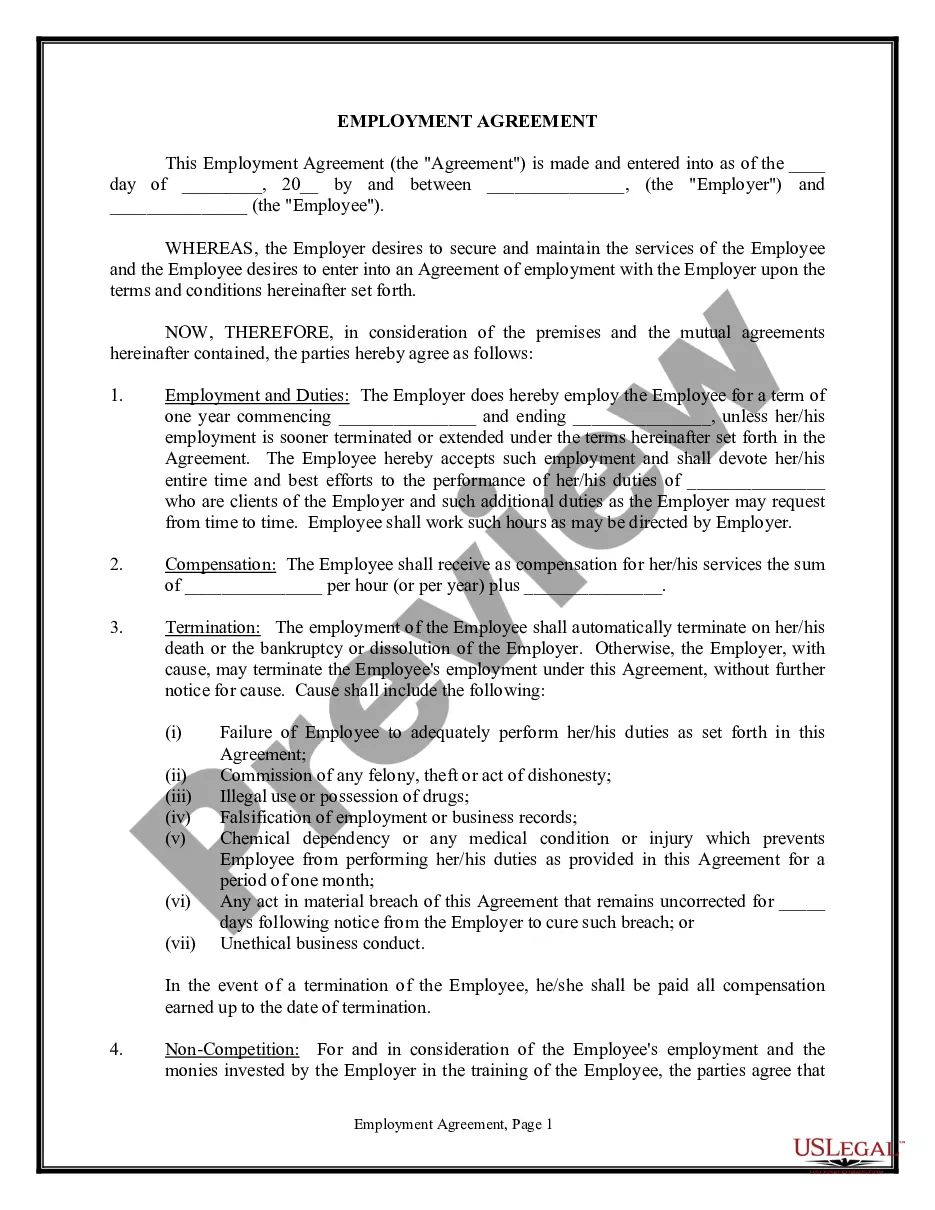

Kentucky Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees

Description

How to fill out Kentucky Sample Letter For Payment Of Corporate Income And Franchise Taxes And Annual Report Filing Fees?

You are able to devote time on the web looking for the lawful file format that suits the federal and state demands you need. US Legal Forms offers 1000s of lawful varieties which can be reviewed by professionals. You can easily acquire or printing the Kentucky Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees from our support.

If you already possess a US Legal Forms accounts, you can log in and click on the Down load button. Afterward, you can full, change, printing, or indication the Kentucky Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees. Every single lawful file format you acquire is your own property eternally. To acquire another duplicate associated with a bought develop, proceed to the My Forms tab and click on the corresponding button.

If you work with the US Legal Forms web site initially, follow the straightforward instructions below:

- Very first, ensure that you have selected the best file format for that area/metropolis that you pick. See the develop outline to make sure you have chosen the appropriate develop. If available, make use of the Review button to check through the file format too.

- If you would like locate another edition of the develop, make use of the Look for industry to discover the format that suits you and demands.

- When you have found the format you would like, click Acquire now to move forward.

- Find the rates plan you would like, type in your qualifications, and sign up for an account on US Legal Forms.

- Full the deal. You should use your bank card or PayPal accounts to cover the lawful develop.

- Find the structure of the file and acquire it for your gadget.

- Make changes for your file if necessary. You are able to full, change and indication and printing Kentucky Sample Letter for Payment of Corporate Income and Franchise Taxes and Annual Report Filing Fees.

Down load and printing 1000s of file layouts while using US Legal Forms web site, that provides the most important selection of lawful varieties. Use professional and express-particular layouts to deal with your business or personal needs.