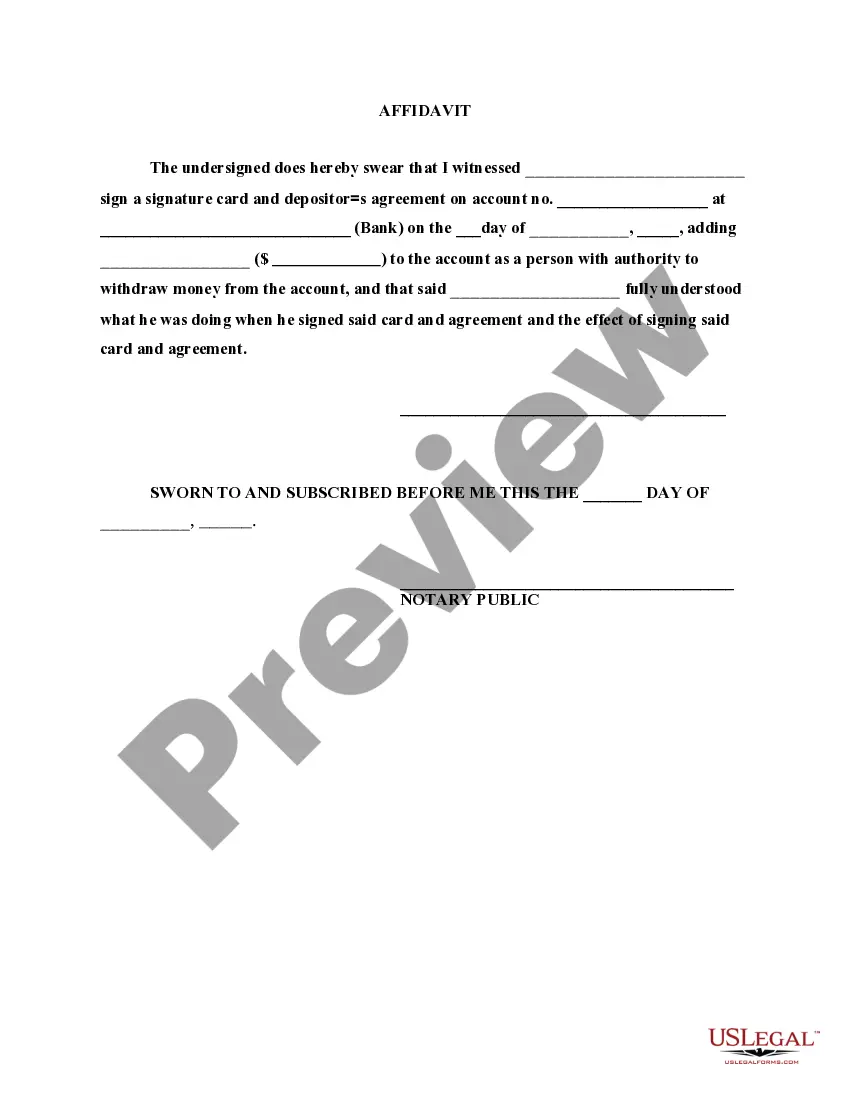

Kentucky Bank Account Monthly Withdrawal Authorization

Description

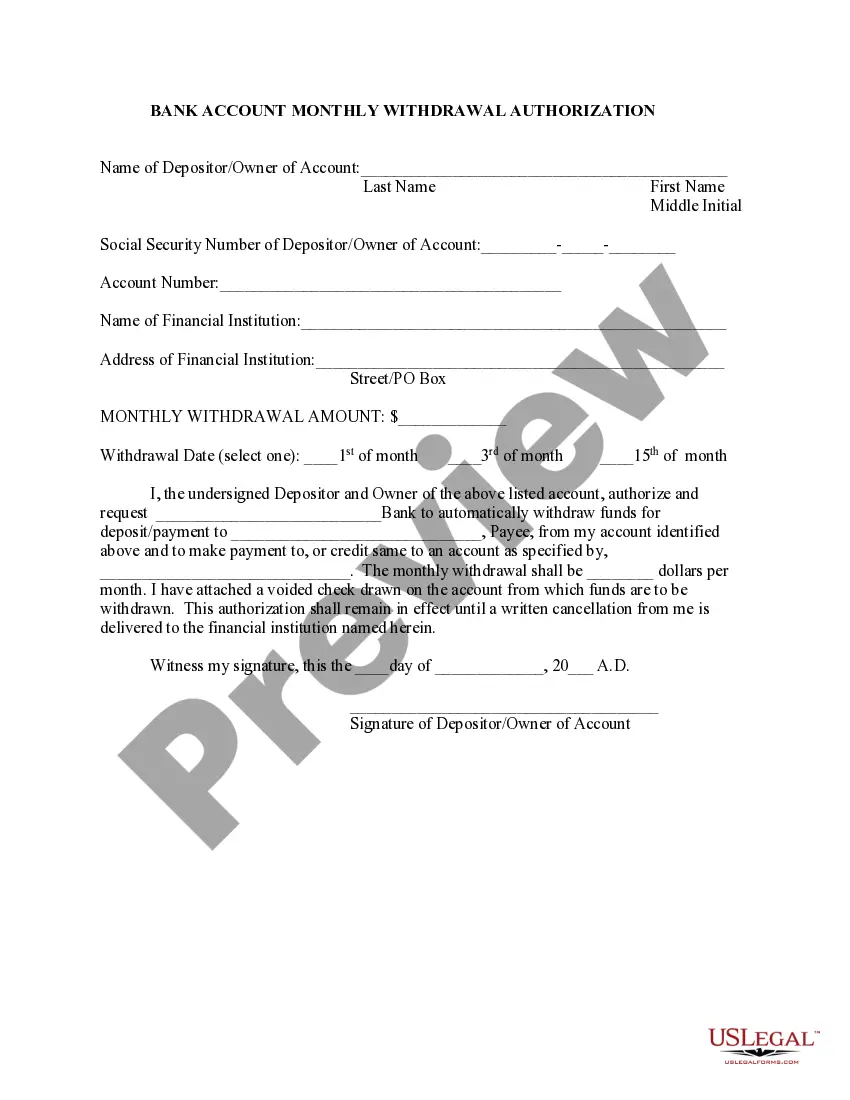

How to fill out Bank Account Monthly Withdrawal Authorization?

Finding the right lawful file template can be a battle. Naturally, there are plenty of layouts available online, but how can you obtain the lawful develop you will need? Utilize the US Legal Forms site. The services delivers 1000s of layouts, such as the Kentucky Bank Account Monthly Withdrawal Authorization, that can be used for enterprise and private needs. All the types are examined by specialists and satisfy state and federal specifications.

Should you be previously registered, log in for your bank account and then click the Down load option to obtain the Kentucky Bank Account Monthly Withdrawal Authorization. Make use of your bank account to look through the lawful types you have purchased formerly. Go to the My Forms tab of your bank account and get one more backup of the file you will need.

Should you be a new customer of US Legal Forms, listed below are basic recommendations so that you can adhere to:

- First, make sure you have selected the appropriate develop for your city/county. It is possible to examine the form utilizing the Review option and browse the form information to make sure it will be the best for you.

- In case the develop fails to satisfy your requirements, take advantage of the Seach discipline to discover the right develop.

- Once you are certain the form is acceptable, click on the Acquire now option to obtain the develop.

- Pick the pricing strategy you would like and enter the essential info. Make your bank account and buy the order utilizing your PayPal bank account or bank card.

- Select the document structure and down load the lawful file template for your gadget.

- Full, edit and produce and sign the received Kentucky Bank Account Monthly Withdrawal Authorization.

US Legal Forms will be the most significant catalogue of lawful types where you can see various file layouts. Utilize the company to down load appropriately-produced documents that adhere to status specifications.

Form popularity

FAQ

$5,000 Death Benefit A retiree may name one person, his or her estate, a trust, or a funeral home as beneficiary for this benefit.

Kentucky allows all pension and retirement income to be excluded up to $31,110.

The Special Death Benefit is a monthly allowance to an eligible surviving spouse, eligible registered domestic partner, or unmarried child under age 22 equal to half of the member's average monthly salary for the last 12 or 36 months, regardless of the member's age or years of service credit.

Nonhazardous retirement benefits are based on the last (not highest) five full fiscal years of salary. If the member does not have five full fiscal years, partial years will be added to reach the 60-month minimum. Hazardous retirement benefits are based on a member's highest three full fiscal years of salary (3-High).

Pension protection lump sum This lump sum is usually the value of the pension payments which are due to be paid between your death and the end of the guarantee period. This is paid tax-free if you die before the age of 75. Otherwise, it's taxed as earnings on the person(s) receiving it.

In order to process a refund of their accumulated account balance, members must complete a Form 4525, Application for Refund of Member Contributions and Direct Rollover/Direct Payment Selection?. The member's employer is also required to report the termination date on the monthly report to KPPA.

If a retiree dies, a lump-sum benefit equal to the annuity due the deceased but not paid before death may be payable. If no survivor annuity is payable based on the retiree's death, the balance of any retirement deductions remaining to the deceased retiree's credit in the Fund, plus any applicable interest, is payable.

When a participant in a retirement plan dies, benefits the participant would have been entitled to are usually paid to the participant's designated beneficiary in a form provided by the terms of the plan (lump-sum distribution or an annuity).