The Kentucky Notice of Shareholders Meeting is a legal document that informs shareholders about an upcoming meeting of a company's shareholders. It provides crucial information regarding the date, time, location, and agenda of the meeting. The notice serves as an official communication channel between the company and its shareholders, enabling them to participate in decision-making and exercise their voting rights. The Kentucky Notice of Shareholders Meeting typically includes keywords such as: 1. Shareholders: This term refers to the owners of shares in a company or corporation. The notice is specifically directed towards them to ensure their participation and engagement in the meeting. 2. Meeting: The notice announces a gathering or assembly of shareholders, during which important matters related to the company's operations or management will be discussed. 3. Agenda: The agenda outlines the topics to be discussed and the decisions to be made during the meeting. This may include items such as electing directors, approving financial statements, discussing mergers or acquisitions, or considering amendments to the company's bylaws. 4. Date and Time: The notice specifies the exact date and time of the meeting, ensuring shareholders can adequately plan their attendance or arrange for proxy voting if unable to attend in person. 5. Location: The notice provides the physical address or virtual platform where the meeting will take place, specifying the venue for shareholders to participate. 6. Proxy Voting: When shareholders are unable to attend the meeting, the notice may include information on how to appoint a proxy to act on their behalf and cast votes accordingly. 7. Quorum: The notice may specify the minimum number of shareholders required to be present (either physically or through proxy) to constitute a valid meeting, ensuring that important decisions are made with an appropriate level of shareholder participation. Different types of Kentucky Notice of Shareholders Meeting may include: 1. Annual General Meeting (AGM): This is a mandatory meeting held once a year, typically within a certain timeframe and usually covers a broad range of topics, including financial reports, director elections, and executive compensation. 2. Special Shareholders Meeting: This type of meeting is called for specific purposes that require shareholder approval but are not covered under regular annual meetings. For example, major corporate decisions like mergers, acquisitions, or changes in the company's bylaws may require a special meeting. In conclusion, the Kentucky Notice of Shareholders Meeting is a crucial document that ensures effective communication between a company and its shareholders. It provides important details about meetings and enables shareholders to participate in decision-making processes, ensuring transparency and accountability.

Kentucky Notice of Shareholders Meeting

Description

How to fill out Kentucky Notice Of Shareholders Meeting?

Are you currently in the place that you will need documents for either enterprise or individual uses almost every day? There are plenty of legitimate papers themes available online, but finding versions you can depend on isn`t straightforward. US Legal Forms delivers a large number of kind themes, just like the Kentucky Notice of Shareholders Meeting, that are created to meet federal and state demands.

In case you are presently knowledgeable about US Legal Forms website and get a merchant account, simply log in. Following that, it is possible to obtain the Kentucky Notice of Shareholders Meeting design.

If you do not come with an profile and need to begin using US Legal Forms, follow these steps:

- Get the kind you require and make sure it is for that proper town/state.

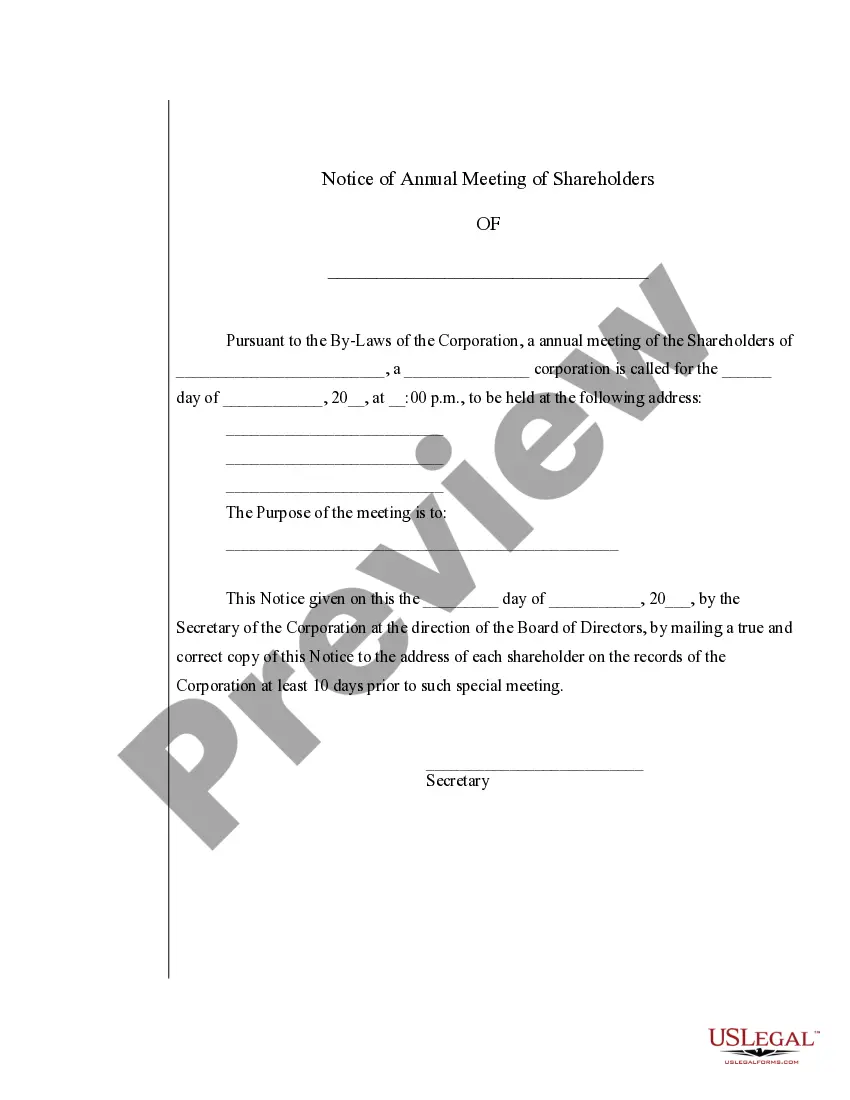

- Make use of the Review button to analyze the form.

- Look at the outline to actually have selected the correct kind.

- When the kind isn`t what you`re looking for, take advantage of the Lookup area to find the kind that suits you and demands.

- Whenever you find the proper kind, click on Buy now.

- Choose the prices strategy you want, submit the desired details to produce your bank account, and purchase your order using your PayPal or credit card.

- Decide on a convenient file formatting and obtain your copy.

Get every one of the papers themes you possess purchased in the My Forms food selection. You can get a extra copy of Kentucky Notice of Shareholders Meeting at any time, if needed. Just click on the needed kind to obtain or print the papers design.

Use US Legal Forms, probably the most extensive collection of legitimate forms, in order to save efforts and stay away from errors. The services delivers skillfully made legitimate papers themes that can be used for a variety of uses. Make a merchant account on US Legal Forms and commence producing your daily life a little easier.