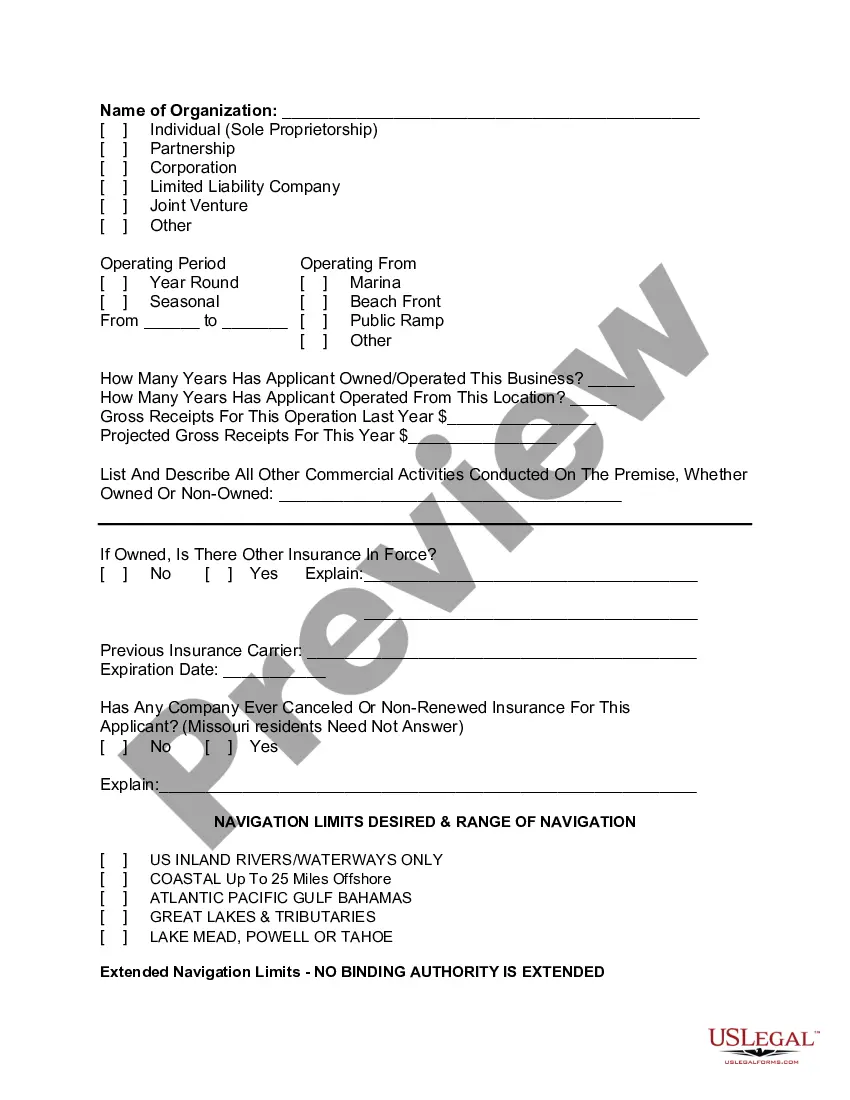

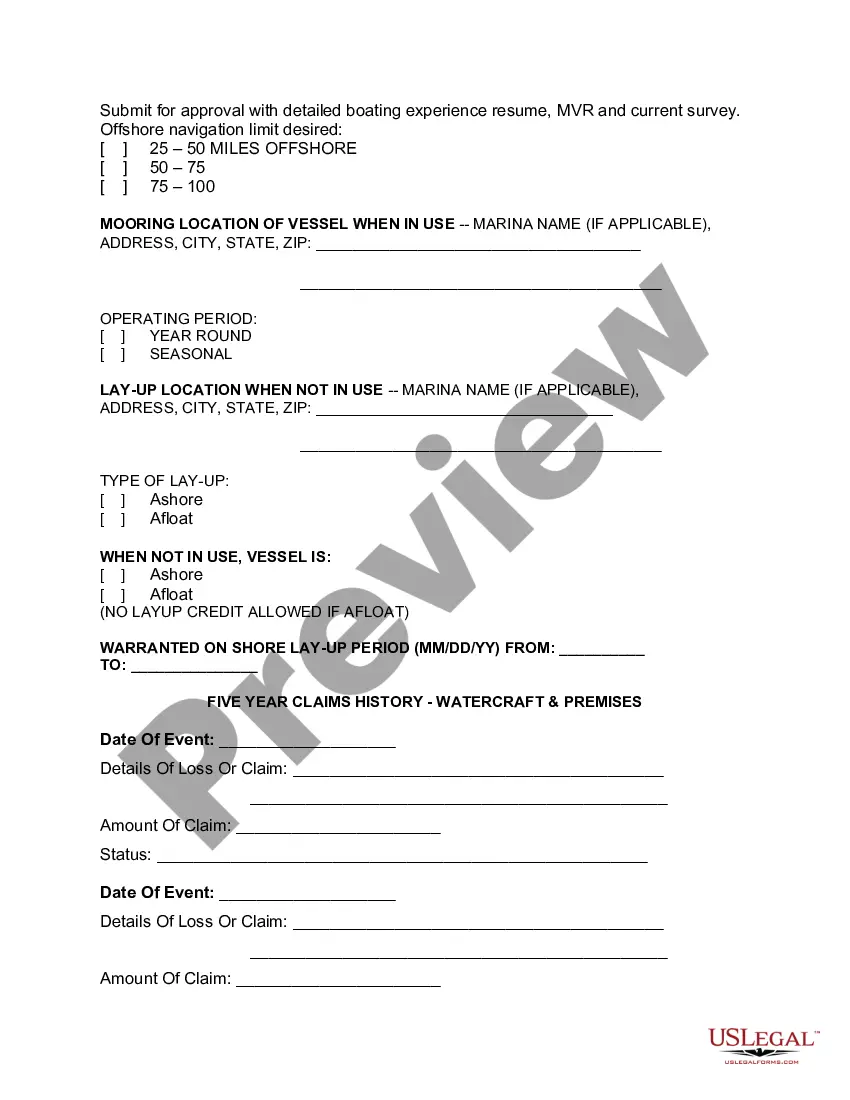

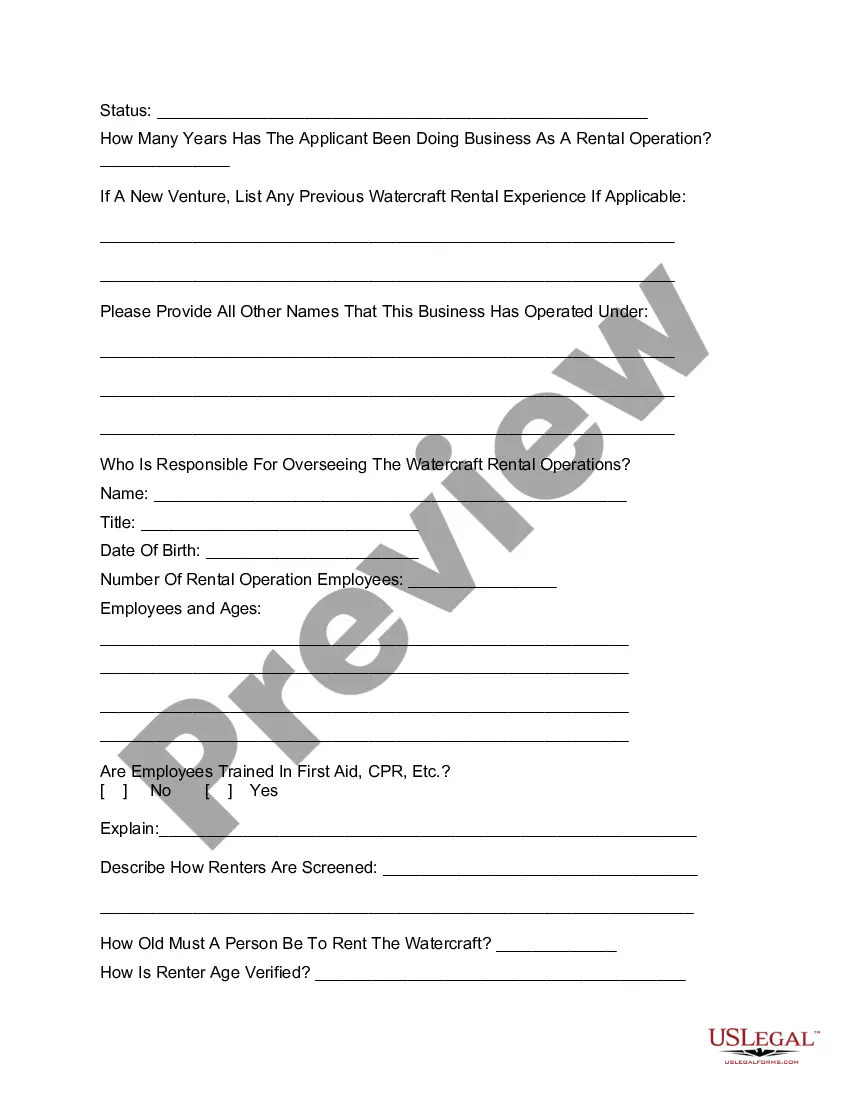

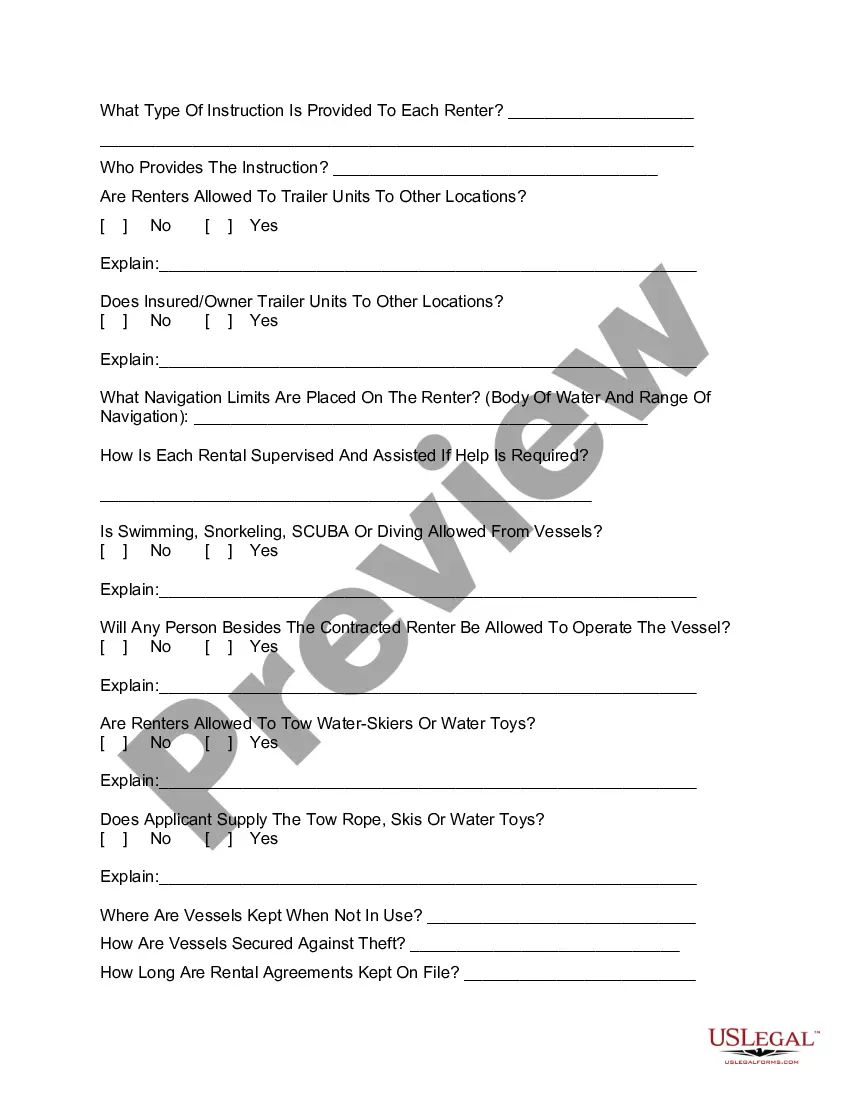

Kentucky Commercial Watercraft Rental Insurance Application

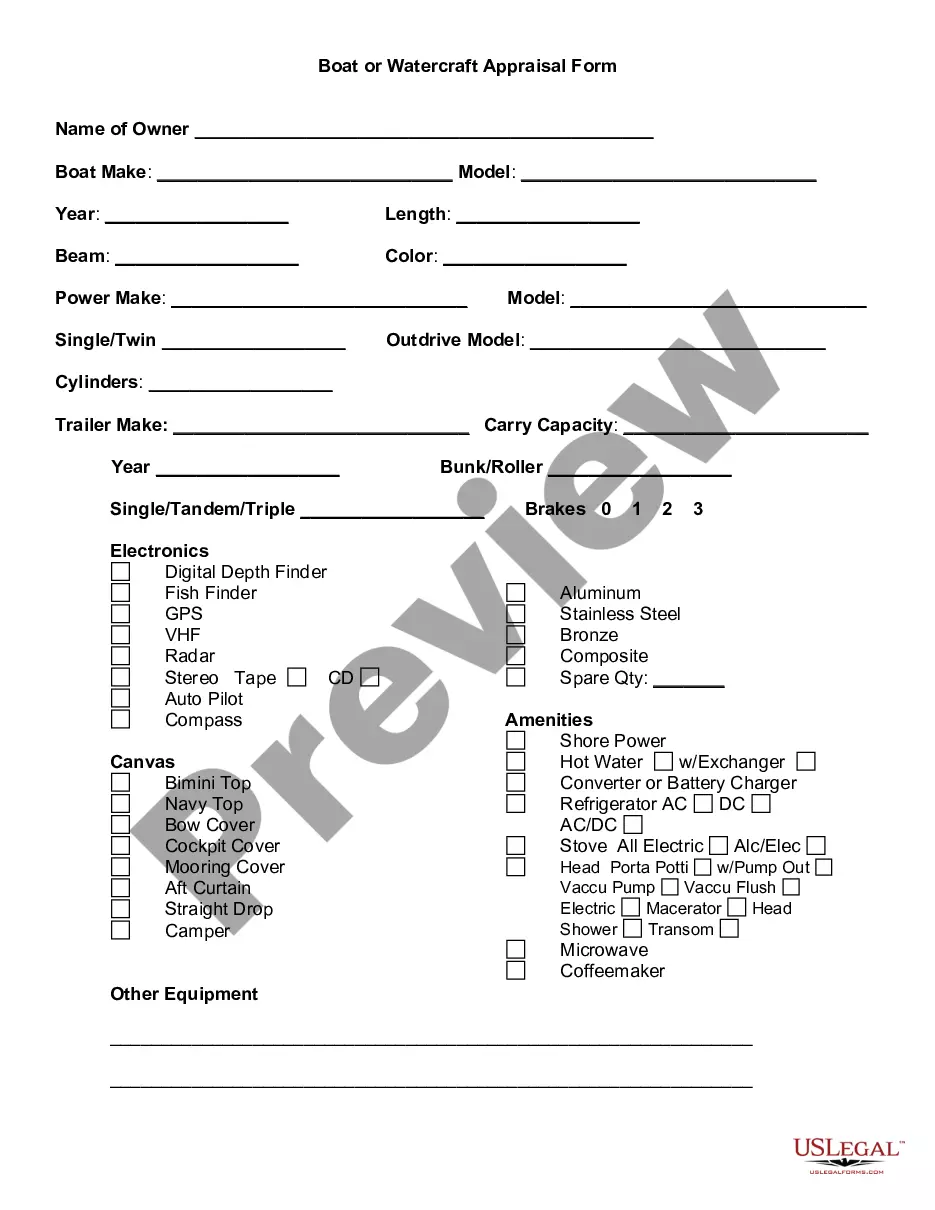

Description

How to fill out Commercial Watercraft Rental Insurance Application?

US Legal Forms - one of several greatest libraries of lawful forms in the States - delivers a wide array of lawful papers web templates you may acquire or print. Making use of the website, you can get a huge number of forms for company and individual functions, sorted by classes, states, or search phrases.You will find the latest variations of forms much like the Kentucky Commercial Watercraft Rental Insurance Application within minutes.

If you have a subscription, log in and acquire Kentucky Commercial Watercraft Rental Insurance Application from your US Legal Forms library. The Obtain key can look on each and every develop you look at. You get access to all earlier saved forms inside the My Forms tab of your respective accounts.

If you would like use US Legal Forms the first time, listed below are simple recommendations to help you get started:

- Be sure you have chosen the proper develop for your metropolis/county. Select the Review key to review the form`s articles. Browse the develop information to actually have selected the proper develop.

- In case the develop does not fit your specifications, utilize the Look for industry towards the top of the screen to find the the one that does.

- If you are content with the form, confirm your option by clicking the Acquire now key. Then, choose the costs strategy you like and supply your references to register on an accounts.

- Process the purchase. Make use of bank card or PayPal accounts to complete the purchase.

- Find the structure and acquire the form on your own gadget.

- Make modifications. Load, modify and print and indication the saved Kentucky Commercial Watercraft Rental Insurance Application.

Each web template you put into your account does not have an expiry time and is also your own property eternally. So, if you would like acquire or print yet another duplicate, just check out the My Forms portion and then click around the develop you need.

Get access to the Kentucky Commercial Watercraft Rental Insurance Application with US Legal Forms, probably the most considerable library of lawful papers web templates. Use a huge number of professional and condition-particular web templates that meet your company or individual requirements and specifications.

Form popularity

FAQ

Comprehensive and collision Comprehensive coverage protects your watercraft against damages from events outside of your control, including theft and vandalism, explosions, and fire, falling trees and objects, hurricanes, lightning, and other weather-related issues.

Examples of the types of costs covered by watercraft insurance policies include physical loss or damage to the boat, theft of the boat, and towing.

Boats in Kentucky are not required to be insured, however it is recommended. Boats in Kentucky are required to correctly display their registration number and validations stickers.

General Liability Exclusions Most general liability policies contain an exclusion under Bodily Injury and Property Damage Liability. The exclusion eliminates coverage for bodily injury or property damage arising out of the ownership, maintenance or use of any watercraft that any of the insureds own or operate.

With the Watercraft Endorsement, an insured can purchase coverages for: Watercraft up to 26 feet long powered by outboard engines or motors exceeding 25 horsepower. Watercraft powered by inboard or inboard-outdrive engines or motors. Sailboats 26 feet or longer; with or without auxiliary power.

All boat insurance policies have exclusions. The boat owner has the responsibility to maintain their boat, and so normal wear and tear is often excluded under a boat or yacht policy. Other exclusions can include gradual deterioration, weathering, insects, mold, animals, and other marine life.

Termites and insect damage, bird or rodent damage, rust, rot, mold, and general wear and tear are not covered. Damage caused by smog or smoke from industrial or agricultural operations is also not covered. If something is poorly made or has a hidden defect, this is generally excluded and won't be covered.

Jet ski insurance is not a requirement, but it is still a good idea to have your jet ski insured. Depending on your boat insurance provider, you can get jet ski insurance with several levels of coverage. When you have your jet ski insured, you can include it as part of a claim in the event of theft, loss or damage.