A Kentucky General Letter of Credit with Account of Shipment is a financial instrument that ensures payment to a seller when specific conditions are met. This type of letter of credit is widely used in international trade, particularly for shipments involving goods from Kentucky. It establishes a contractual obligation between the buyer, known as the applicant, and a bank, known as the issuing bank, to pay the beneficiary, who is usually the exporter or seller. The Kentucky General Letter of Credit with Account of Shipment offers security to both parties involved in the transaction. It protects the seller by guaranteeing payment for the shipped goods, provided they comply with the terms specified in the credit. Simultaneously, it assures the buyer that the payment will only be made when the necessary documents are presented, ensuring that the goods arrive as agreed. Different types of Kentucky General Letter of Credit with Account of Shipment include: 1. Revocable Letter of Credit: This type of letter of credit can be modified or cancelled by the issuing bank without prior notice. It provides less security for the beneficiary as the terms can be changed at any time. 2. Irrevocable Letter of Credit: Unlike the revocable letter of credit, this type cannot be modified or cancelled without the beneficiary's consent. It offers more security to the seller, ensuring that payment will be made as long as the terms are met. 3. Confirmed Letter of Credit: In this type, a confirming bank adds its guarantee to the letter of credit. The confirming bank ensures payment to the seller even if the issuing bank fails to fulfill its payment obligations. This type offers additional security and is commonly used when the issuing bank is unknown or located in a risky jurisdiction. 4. Standby Letter of Credit: While not specific to Kentucky, this type is often used in conjunction with account of shipment. A standby letter of credit acts as a backup payment method in case the buyer defaults or fails to make the payment as agreed. It acts as a guarantee for the seller, giving them confidence in accepting the buyer's offer. Overall, a Kentucky General Letter of Credit with Account of Shipment streamlines trade transactions and enables smooth international commerce by mitigating the risks associated with cross-border trading. It ensures transparency, reduces payment delays, and builds trust between the buyer and seller. With its various types depending on the needs and requirements of the parties involved, this powerful financial tool facilitates secure and efficient global commercial transactions.

Kentucky General Letter of Credit with Account of Shipment

Description

How to fill out Kentucky General Letter Of Credit With Account Of Shipment?

If you have to total, acquire, or print lawful record web templates, use US Legal Forms, the most important variety of lawful kinds, which can be found on the web. Utilize the site`s easy and hassle-free research to discover the files you will need. Numerous web templates for business and specific functions are categorized by categories and says, or keywords and phrases. Use US Legal Forms to discover the Kentucky General Letter of Credit with Account of Shipment in just a few click throughs.

When you are currently a US Legal Forms client, log in to your accounts and then click the Download option to find the Kentucky General Letter of Credit with Account of Shipment. Also you can accessibility kinds you formerly saved in the My Forms tab of the accounts.

If you work with US Legal Forms for the first time, follow the instructions listed below:

- Step 1. Ensure you have chosen the shape to the right town/country.

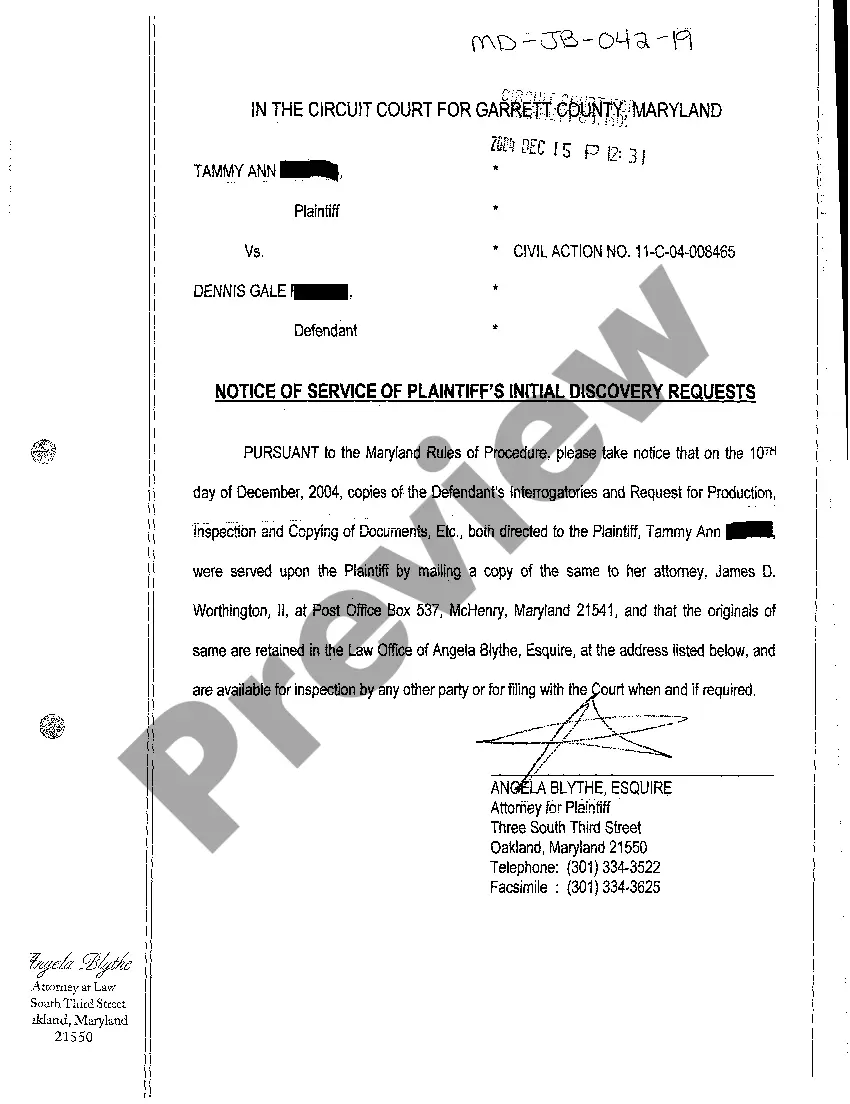

- Step 2. Utilize the Review choice to examine the form`s content material. Do not forget about to read through the explanation.

- Step 3. When you are not happy using the form, take advantage of the Lookup discipline near the top of the display screen to locate other models of your lawful form design.

- Step 4. Once you have discovered the shape you will need, go through the Get now option. Choose the rates plan you like and put your accreditations to sign up for the accounts.

- Step 5. Method the financial transaction. You may use your bank card or PayPal accounts to finish the financial transaction.

- Step 6. Choose the formatting of your lawful form and acquire it on your own product.

- Step 7. Comprehensive, revise and print or sign the Kentucky General Letter of Credit with Account of Shipment.

Every lawful record design you purchase is yours permanently. You might have acces to every single form you saved with your acccount. Go through the My Forms segment and choose a form to print or acquire once more.

Remain competitive and acquire, and print the Kentucky General Letter of Credit with Account of Shipment with US Legal Forms. There are millions of expert and status-certain kinds you can use to your business or specific demands.