Kentucky Disputed Accounted Settlement, also known as a settlement for disputed accounts in Kentucky, refers to a legal process aimed at resolving disputes related to financial accounts in the state of Kentucky, United States. This settlement serves as a means for individuals or entities to reach a resolution and find closure regarding disputed accounts. In a Kentucky Disputed Accounted Settlement, disputing parties can come together to negotiate, mediate, or arbitrate the terms and conditions of settling the disagreement. The objective is to achieve a mutually agreed-upon resolution and avoid the need for litigation. Different types of Kentucky Disputed Accounted Settlement may include: 1. Consumer Credit Dispute Settlement: This type of settlement typically arises from disagreements regarding credit card accounts, loans, mortgages, or other types of consumer credit. The settlement process involves discussions between consumers and financial institutions or creditors to find an acceptable resolution. 2. Business Account Dispute Settlement: In this scenario, businesses engage in a disputed account settlement to resolve conflicts concerning financial accounts, such as unpaid invoices, billing errors, or contract disputes. It allows the involved parties to find a fair resolution, minimizing potential financial losses and preserving business relationships. 3. Insurance Claim Dispute Settlement: This type of settlement occurs when there are discrepancies or disagreements between policyholders and insurance companies regarding the payment or denial of claims. The settlement process seeks to address these disputes and negotiate a resolution that satisfies both parties. 4. Legal or Court-Ordered Account Settlement: These settlements are initiated following legal proceedings or court orders that require disputing parties to reach an agreement regarding financial accounts. The settlement may involve the presence of lawyers, judges, or mediators to ensure a fair and impartial resolution. 5. Government Account Dispute Settlement: This involves resolving disputes related to financial accounts between individuals or businesses and government entities, such as tax owed disputes, benefit claim discrepancies, or contract conflicts. In all types of Kentucky Disputed Accounted Settlements, it is crucial to ensure that all relevant documents, evidence, and financial records are presented accurately and fairly. The settlement process provides an opportunity for parties to find a middle ground and potentially avoid costly and time-consuming courtroom litigation. Ultimately, the goal is to achieve a satisfactory outcome for all involved parties.

Kentucky Disputed Accounted Settlement

Description

How to fill out Kentucky Disputed Accounted Settlement?

US Legal Forms - among the biggest libraries of legitimate kinds in the USA - offers an array of legitimate papers themes you are able to obtain or print. Utilizing the internet site, you may get thousands of kinds for business and personal uses, sorted by types, claims, or key phrases.You can find the newest versions of kinds much like the Kentucky Disputed Accounted Settlement in seconds.

If you already have a subscription, log in and obtain Kentucky Disputed Accounted Settlement from your US Legal Forms library. The Obtain option will show up on every type you perspective. You gain access to all formerly delivered electronically kinds within the My Forms tab of your own account.

If you would like use US Legal Forms the first time, listed here are easy recommendations to obtain started off:

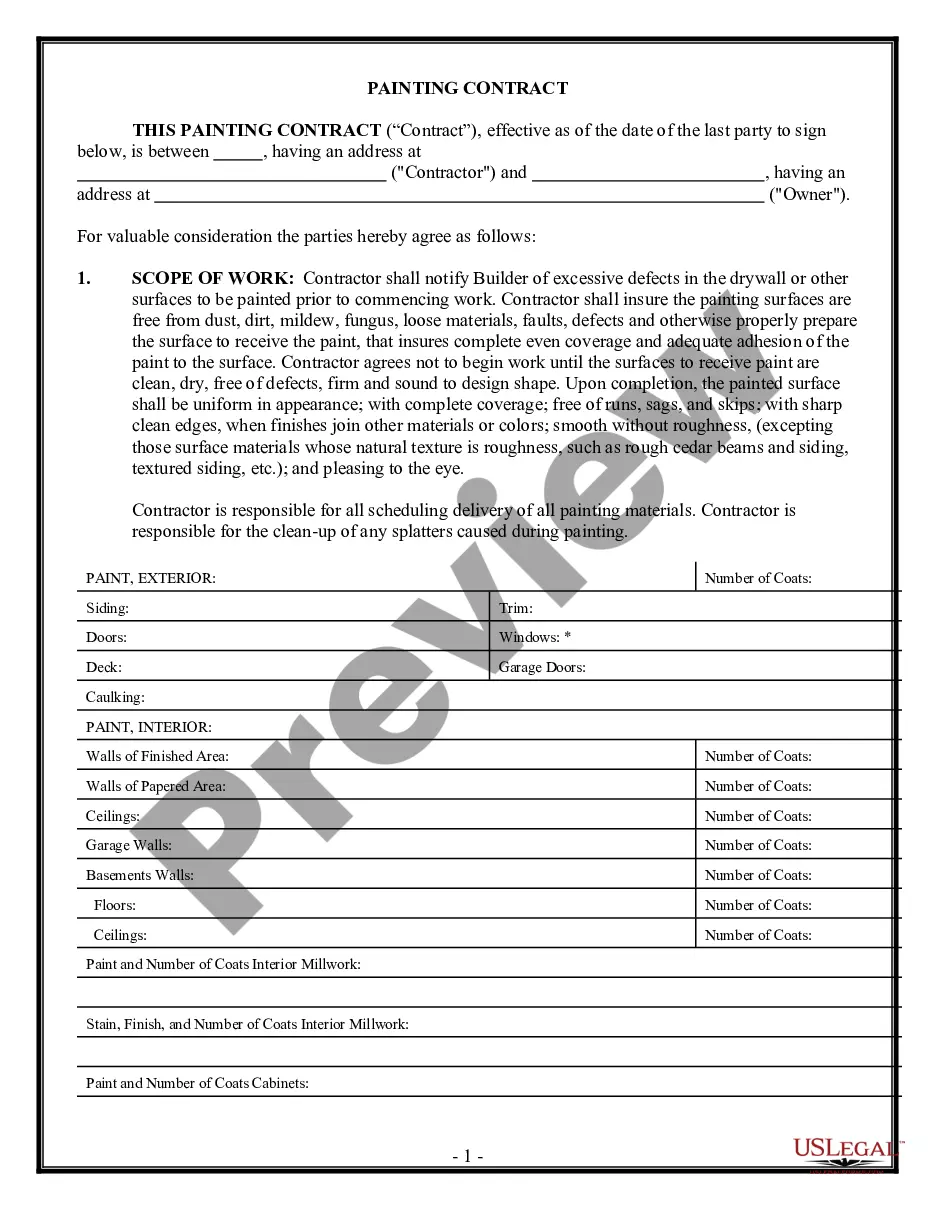

- Be sure to have selected the correct type for your city/area. Click on the Preview option to examine the form`s information. See the type outline to actually have selected the proper type.

- In the event the type doesn`t satisfy your specifications, utilize the Look for discipline near the top of the screen to get the one which does.

- If you are pleased with the form, validate your option by simply clicking the Acquire now option. Then, select the costs program you want and supply your credentials to sign up for the account.

- Approach the purchase. Make use of charge card or PayPal account to perform the purchase.

- Pick the formatting and obtain the form on your device.

- Make alterations. Fill out, modify and print and signal the delivered electronically Kentucky Disputed Accounted Settlement.

Every web template you added to your bank account lacks an expiry date which is the one you have eternally. So, if you would like obtain or print one more copy, just go to the My Forms portion and then click around the type you need.

Obtain access to the Kentucky Disputed Accounted Settlement with US Legal Forms, by far the most substantial library of legitimate papers themes. Use thousands of expert and express-certain themes that meet your organization or personal requires and specifications.