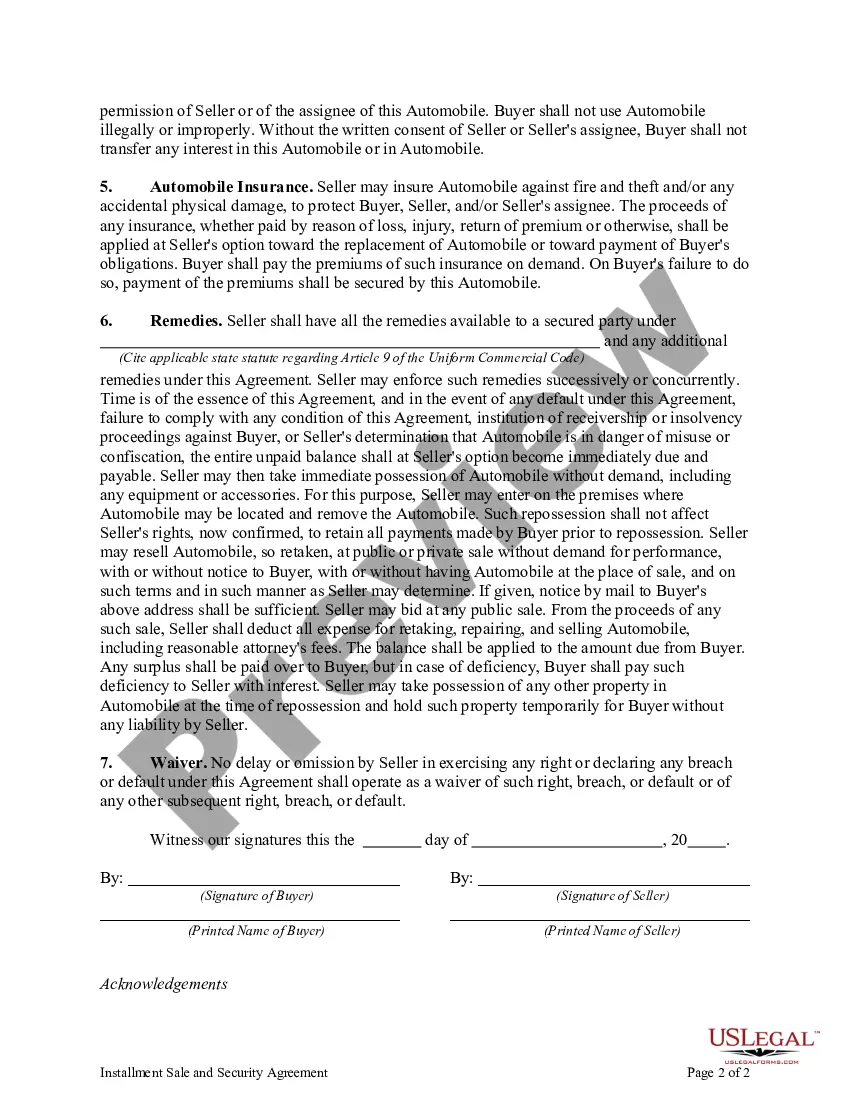

Kentucky Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another is a legally binding document that outlines the terms and conditions of the sale of a vehicle between two individuals in the state of Kentucky. This agreement is designed to protect the rights and interests of both the buyer and the seller, ensuring a fair and transparent transaction. The Kentucky Installment Sale and Security Agreement involves a deferred payment plan, where the buyer agrees to pay the purchase price of the vehicle in installments, rather than in a lump sum. This agreement is commonly used when individuals wish to finance the purchase of a vehicle directly from the seller, without involving a traditional lending institution. The main components of the Kentucky Installment Sale and Security Agreement include: 1. Identification of Parties: The agreement clearly identifies the buyer and seller, including their full legal names, addresses, and contact information. 2. Description of the Vehicle: Detailed information about the automobile being sold, including the make, model, year, Vehicle Identification Number (VIN), mileage, and any relevant features or modifications. 3. Purchase Price and Installment Terms: This section outlines the total purchase price of the vehicle, the amount of the down payment (if any), the number of installments, the frequency of payments, the due dates, and the agreed interest rate (if applicable). 4. Payment Schedule: The agreement provides a clear payment schedule, indicating the amount to be paid and the due date for each installment. It may also include late payment penalties or fees. 5. Security Interest: The seller retains a security interest in the vehicle until the buyer pays the full purchase price. This provision allows the seller to repossess the vehicle in case of default. 6. Title Transfer and Ownership: The agreement specifies that the seller will transfer the title of the vehicle to the buyer upon full payment. Until then, the seller holds the title as collateral. 7. Condition and Warranty: The agreement may include a section addressing the condition of the vehicle and any warranties or guarantees provided by the seller. It is recommended that buyers obtain a vehicle inspection and purchase additional warranty coverage if desired. 8. Default and Remedies: This section outlines the actions to be taken in case of buyer's default, including repossession, legal proceedings, and the seller's rights to recover damages. Different variations or types of Kentucky Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another may include additional clauses or provisions, depending on the specific circumstances of the transaction. It is essential for both parties to carefully review and understand the agreement before signing, and consult with legal professionals if needed to ensure compliance with Kentucky laws.

Kentucky Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another

Description

How to fill out Kentucky Installment Sale And Security Agreement Regarding Sale Of Automobile From One Individual To Another?

US Legal Forms - among the biggest libraries of authorized varieties in the USA - delivers an array of authorized papers web templates you are able to obtain or printing. Making use of the site, you can get a large number of varieties for company and personal purposes, sorted by classes, suggests, or search phrases.You can get the most up-to-date models of varieties just like the Kentucky Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another in seconds.

If you already possess a monthly subscription, log in and obtain Kentucky Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another from your US Legal Forms collection. The Down load button can look on each and every form you view. You have accessibility to all previously saved varieties within the My Forms tab of your respective bank account.

In order to use US Legal Forms the first time, allow me to share easy recommendations to obtain began:

- Ensure you have picked the proper form for your personal city/county. Select the Preview button to analyze the form`s content material. Look at the form information to ensure that you have selected the appropriate form.

- If the form does not match your needs, use the Search industry on top of the screen to discover the the one that does.

- In case you are satisfied with the form, validate your choice by visiting the Buy now button. Then, choose the pricing prepare you like and supply your references to sign up on an bank account.

- Approach the financial transaction. Make use of your charge card or PayPal bank account to complete the financial transaction.

- Select the structure and obtain the form on the product.

- Make modifications. Fill up, edit and printing and indication the saved Kentucky Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another.

Each and every design you added to your bank account lacks an expiry date and it is your own property eternally. So, if you would like obtain or printing one more backup, just go to the My Forms portion and click around the form you need.

Get access to the Kentucky Installment Sale and Security Agreement Regarding Sale of Automobile from One Individual to Another with US Legal Forms, one of the most extensive collection of authorized papers web templates. Use a large number of specialist and state-distinct web templates that satisfy your business or personal needs and needs.

Form popularity

FAQ

A Kentucky bill of sale records the private sale and transfer of personal property from a seller to a buyer. A bill of sale can be used to record the sale of any item, such as furniture, collectibles, cars, boats, clothing, antiques, and firearms.

Under an installment contract, the buyer gets possession of the property and makes installment payments of the purchase price over an extended period of time to the seller, who conveys legal title to property once the purchase price is fully paid.

What you will need:Original Kentucky Title.Original Kentucky Registration.Proof of current Kentucky liability insurance in the buyer's name for the purchased vehicle.Picture identification for buyer and seller.Social Security Number for each new owner(s) appearing on the title or Federal Tax ID Number for companies.More items...

The following information should appear on the Kentucky Bill of Sale Form: Name and complete address of the seller. Name and complete address of the buyer. Complete vehicle description, including Vehicle Identification Number (VIN), make, model, year, series number and body type.

What is an instalment agreement? If you buy goods under an instalment agreement, the seller will give you the goods immediately and you will have to pay the price in instal- ments (smaller amounts of the full price) over a period of time.

An installment purchase agreement is a contract used to finance the acquisition of assets. Under the terms of such an agreement, the buyer pays the seller the full purchase price by making a series of partial payments over time. The payments include stated or imputed interest.

In hire purchase, both ownership and purchase are delayed till the complete payment, whereas, in installment purchase, purchase and ownership take place before the complete payment.

A retail installment contract is a contract for the sale of goods under which the buyer makes payments periodically and the seller retains title to or a security interest in the goods. A retail installment contract is also termed as a retail installment contract and security agreement; conditional sales contract.

When you sell or buy a vehicle in the Commonwealth of Kentucky a specific Bill of Sale VTR Form # TC96-182 is necessary. This serves as a contract from the seller to the buyer documenting the transaction. This form must be submitted for Title/Registration and must be signed and notarized.

What you need to sell a car in KentuckyKentucky Certificate of Title (or, if you don't have one, a duplicate title form)Proof of insurance.Valid Kentucky ID.Signature of the buyer.Bill of sale.Lien release.Payment for fees and taxes.