Kentucky Bill of Sale by Corporation of all or Substantially all of its Assets

Description

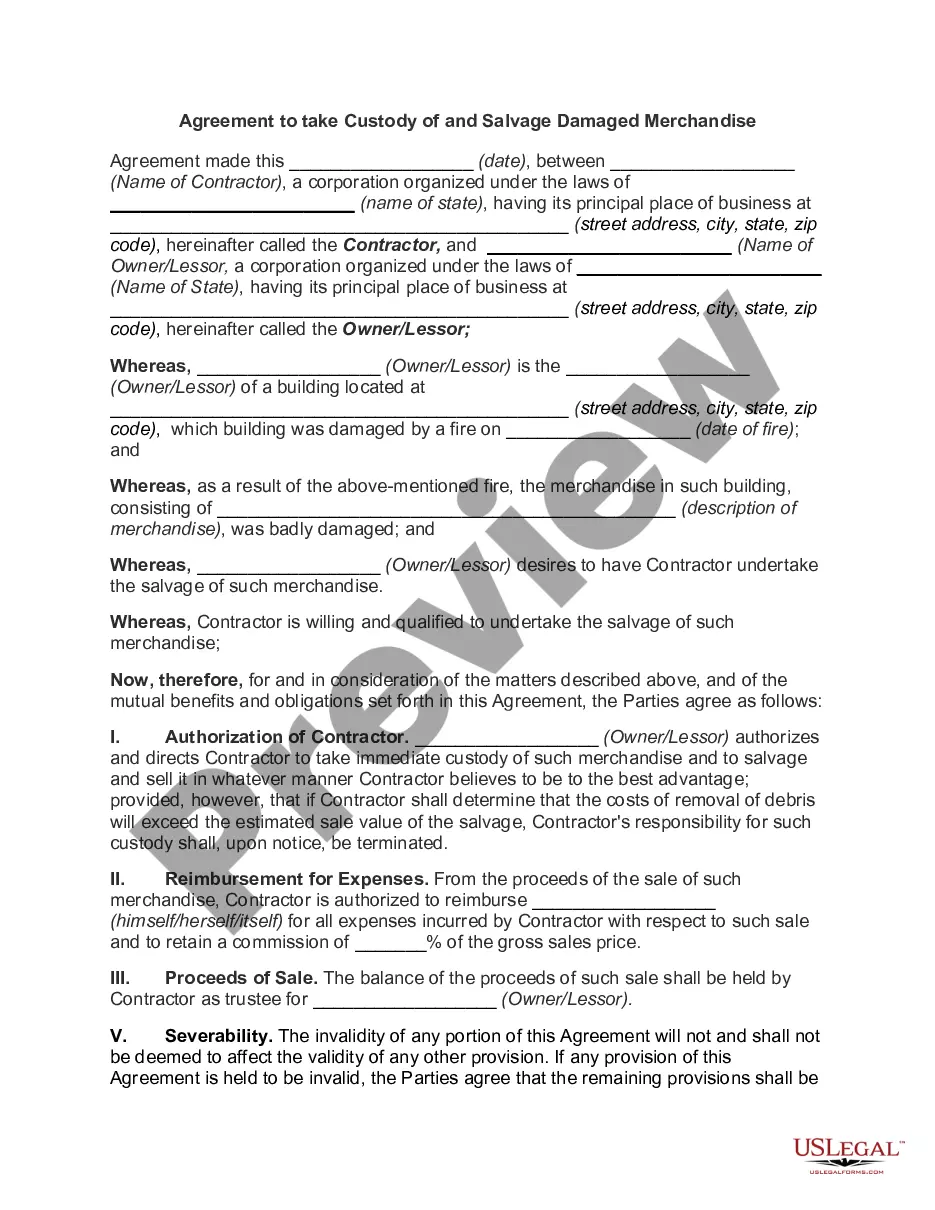

How to fill out Bill Of Sale By Corporation Of All Or Substantially All Of Its Assets?

Selecting the appropriate legal document template can be challenging.

Of course, there are numerous templates accessible online, but how do you acquire the legal form you require.

Utilize the US Legal Forms website.

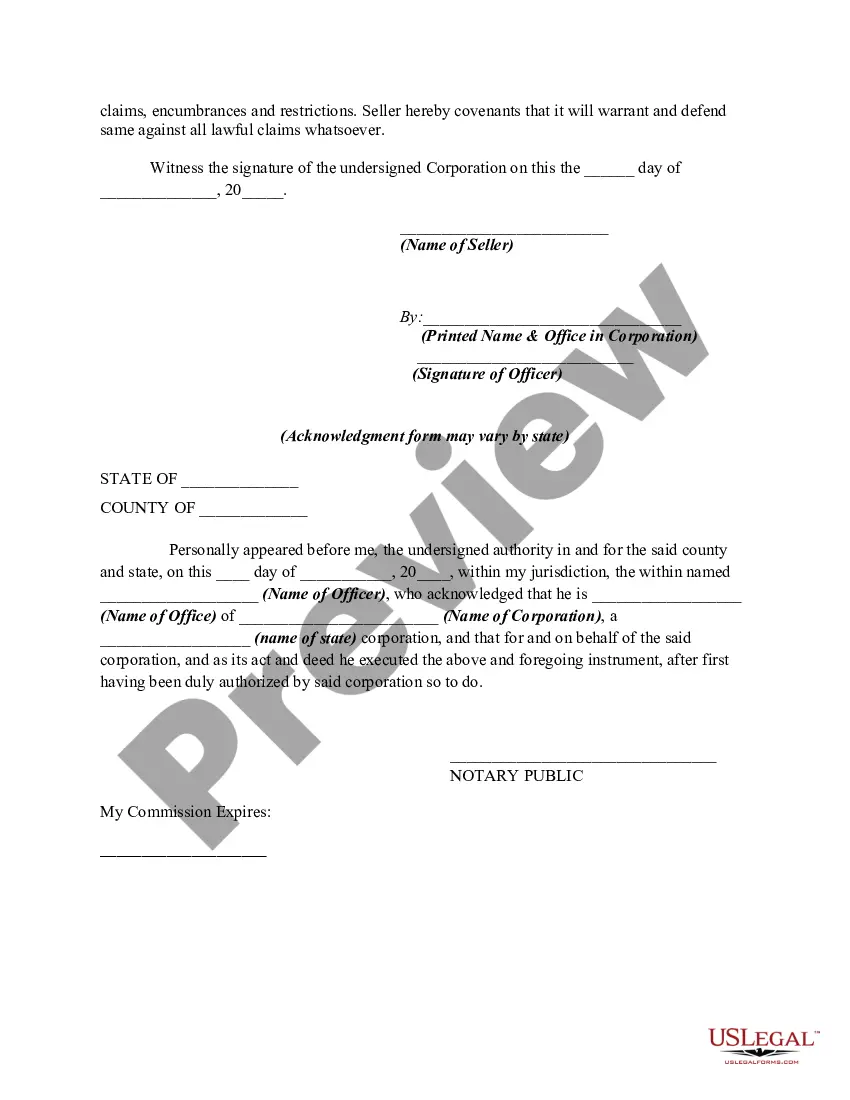

If you are a new user of US Legal Forms, here are simple instructions for you to follow: First, ensure you have selected the correct form for your locality. You can review the form using the Preview button and read the form description to confirm it is indeed the right one for you.

- The service offers thousands of templates, including the Kentucky Bill of Sale by Corporation of all or substantially all of its Assets.

- These templates can be used for both business and personal needs.

- All documents are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Kentucky Bill of Sale by Corporation of all or substantially all of its Assets.

- You can utilize your account to reference the legal forms you have previously ordered.

- Navigate to the My documents section of your account to obtain another copy of the documents you need.

Form popularity

FAQ

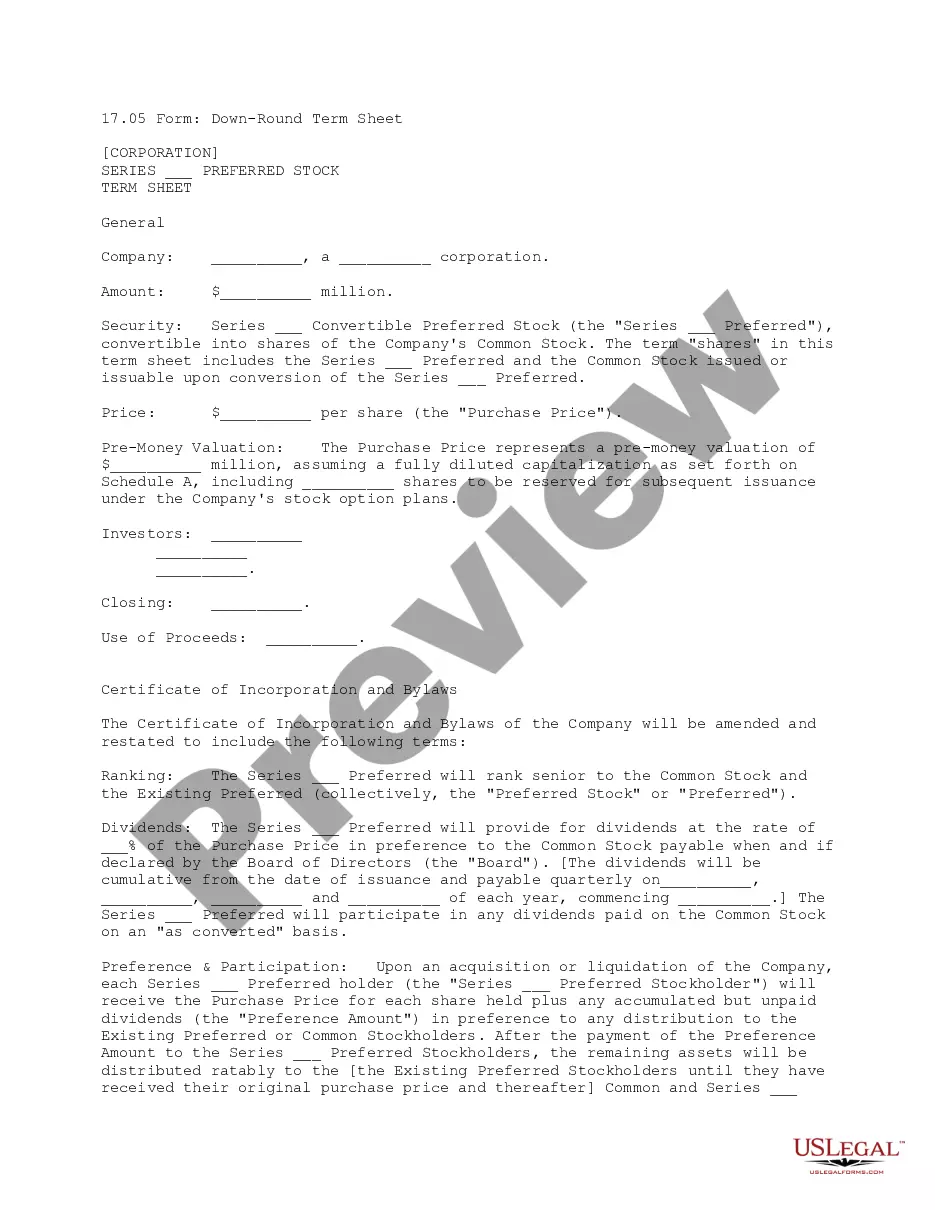

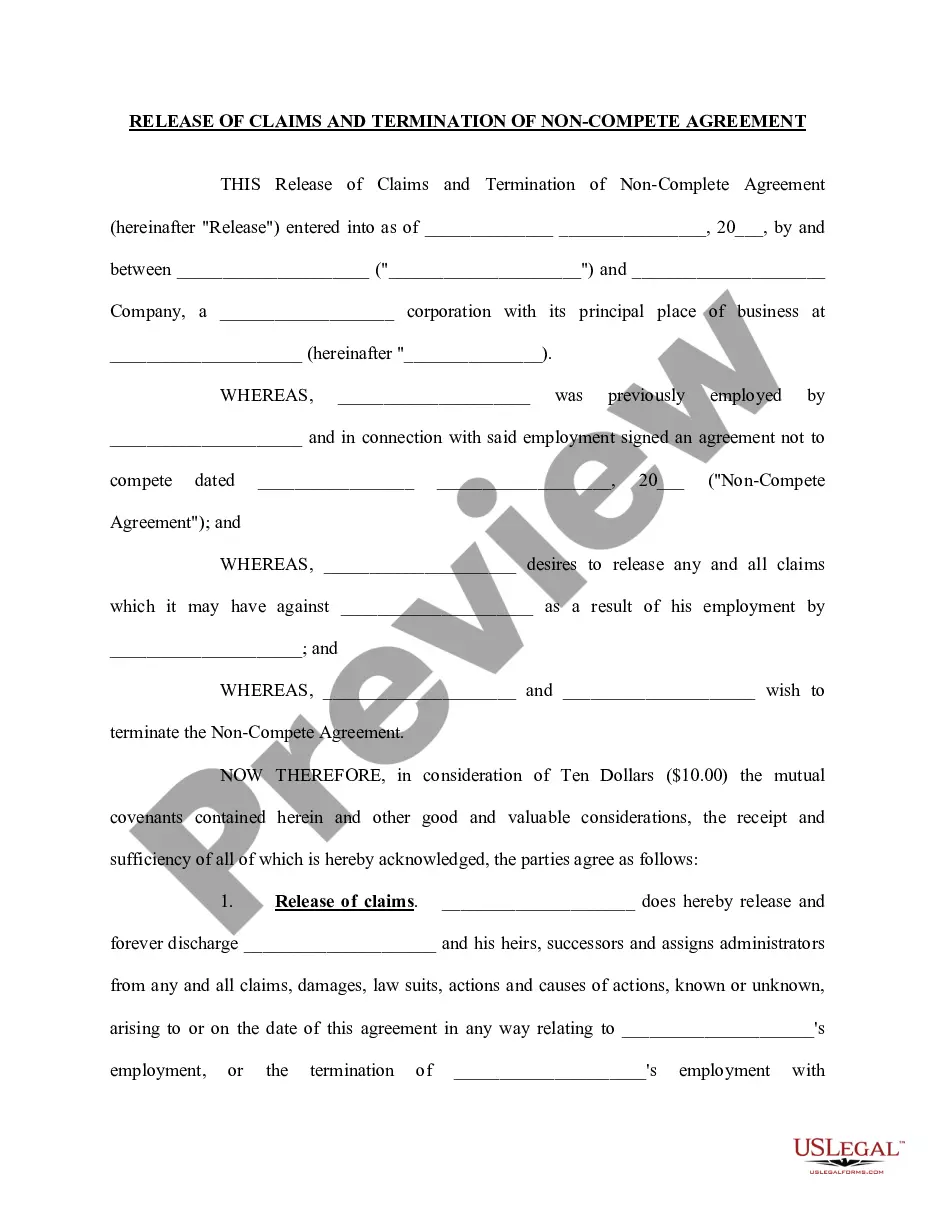

A sale of all the assets of a corporation generally requires approval from the board of directors and, in some cases, the shareholders. This approval process is crucial to ensure that all parties agree to the terms of the sale and that it aligns with the corporation's best interests. Utilizing a Kentucky Bill of Sale by Corporation of all or Substantially all of its Assets can facilitate this process by providing a clear, legally binding document outlining the transaction.

A sale of substantially all assets involves transferring ownership of a corporation's key assets to another party, usually as part of a strategic business move. This type of sale typically requires careful planning and legal writing, emphasizing the need for a Kentucky Bill of Sale by Corporation of all or Substantially all of its Assets. Engaging with professionals familiar with this process can help navigate legal complexities and protect your interests.

All or substantially all of the business refers to the majority of the assets, operations, and ongoing activities of a corporation. It implies that the selling entity is relinquishing control over the essential components necessary for the business's functioning. Accurately identifying these elements when creating a Kentucky Bill of Sale by Corporation of all or Substantially all of its Assets is vital for ensuring a smooth transaction.

The phrase 'all or substantially all' signifies a significant portion of the total assets of a corporation, rather than an absolute entirety. In legal terms, it encompasses the majority of the operational assets without needing to account for every single item. This concept often appears in sales transactions and is essential when drafting a Kentucky Bill of Sale by Corporation of all or Substantially all of its Assets.

The sale of substantially all assets in Delaware refers to the transfer of a corporation's major operational assets, usually as part of a business acquisition or liquidation. This process often includes extensive legal documentation, including a Kentucky Bill of Sale by Corporation of all or Substantially all of its Assets. Understanding this transaction is crucial, as it can impact stakeholders, including creditors and shareholders.

A Kentucky llet number is comprised of eight digits. This unique identifier is essential for tax purposes and ensures that your business is registered correctly with the state. Always verify this number to avoid discrepancies when preparing official documents, like a Kentucky Bill of Sale by Corporation of all or Substantially all of its Assets. You can find more details on the Kentucky Department of Revenue’s website.

Your Kentucky withholding account number is typically found on tax documents related to employee payroll, such as W-2 forms or business registration documents. You can also retrieve this number by contacting the Kentucky Department of Revenue directly. Keeping this number handy is particularly important when drafting a Kentucky Bill of Sale by Corporation of all or Substantially all of its Assets to ensure all taxes are correctly managed.

Llet, or Lexington Local Business License Tax, is a tax applicable to businesses operating in Lexington, Kentucky. This tax helps fund local services and infrastructure. Understanding llet is crucial for business compliance, especially when preparing legal documents, such as a Kentucky Bill of Sale by Corporation of all or Substantially all of its Assets. If you're new to this tax, consider consulting with a local expert to ensure you meet all requirements.

You can find your Kentucky llet account number on the documentation provided by the Kentucky Department of Revenue. Typically, this number appears on your tax registration details and any correspondence from the tax office. If you are unable to locate it, you can contact the department directly or visit their website for further assistance. Having this number is essential for completing a Kentucky Bill of Sale by Corporation of all or Substantially all of its Assets.

To obtain a Kentucky Corporation llet account number, you need to register your corporation with the Kentucky Secretary of State's office. This process involves completing required forms and providing necessary details about your business. Once registered, you can easily access your Kentucky llet account number, which is vital for tax and legal purposes, particularly for transactions like the Kentucky Bill of Sale by Corporation of all or Substantially all of its Assets.