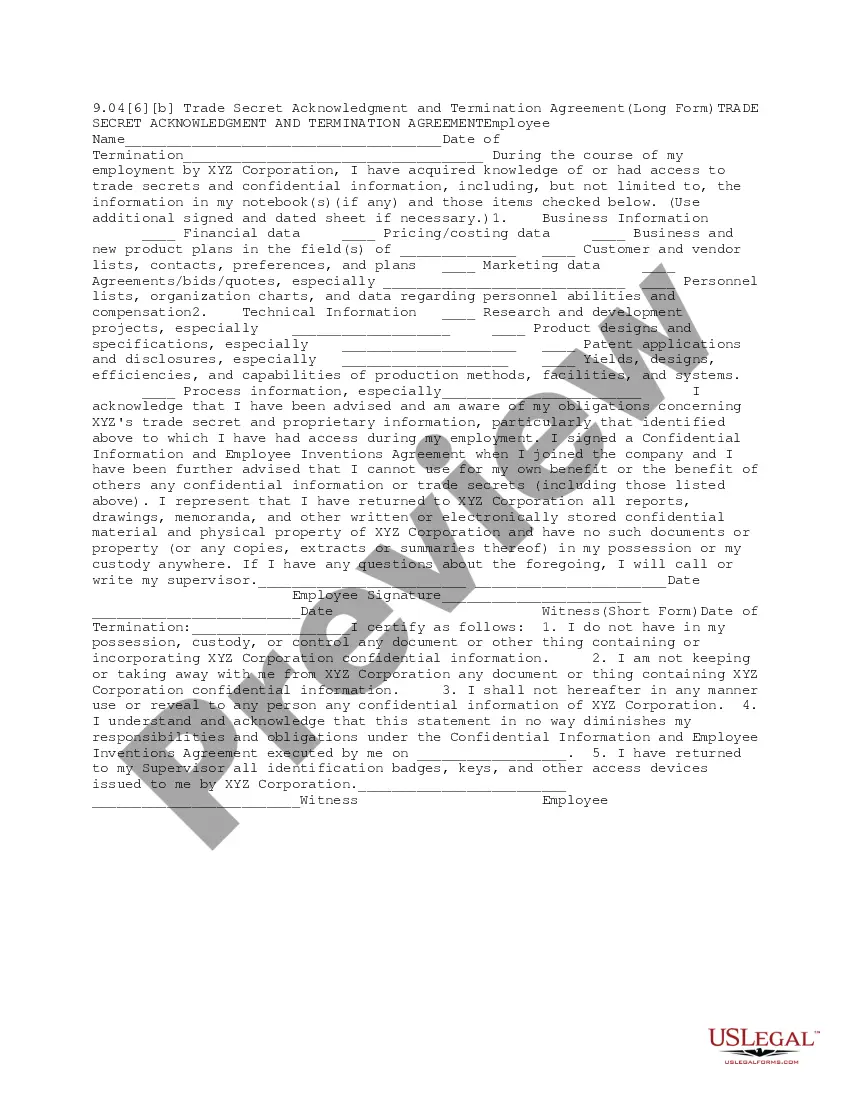

Kentucky Exit Procedure Acknowledgment Regarding Proprietary Information

Description

How to fill out Exit Procedure Acknowledgment Regarding Proprietary Information?

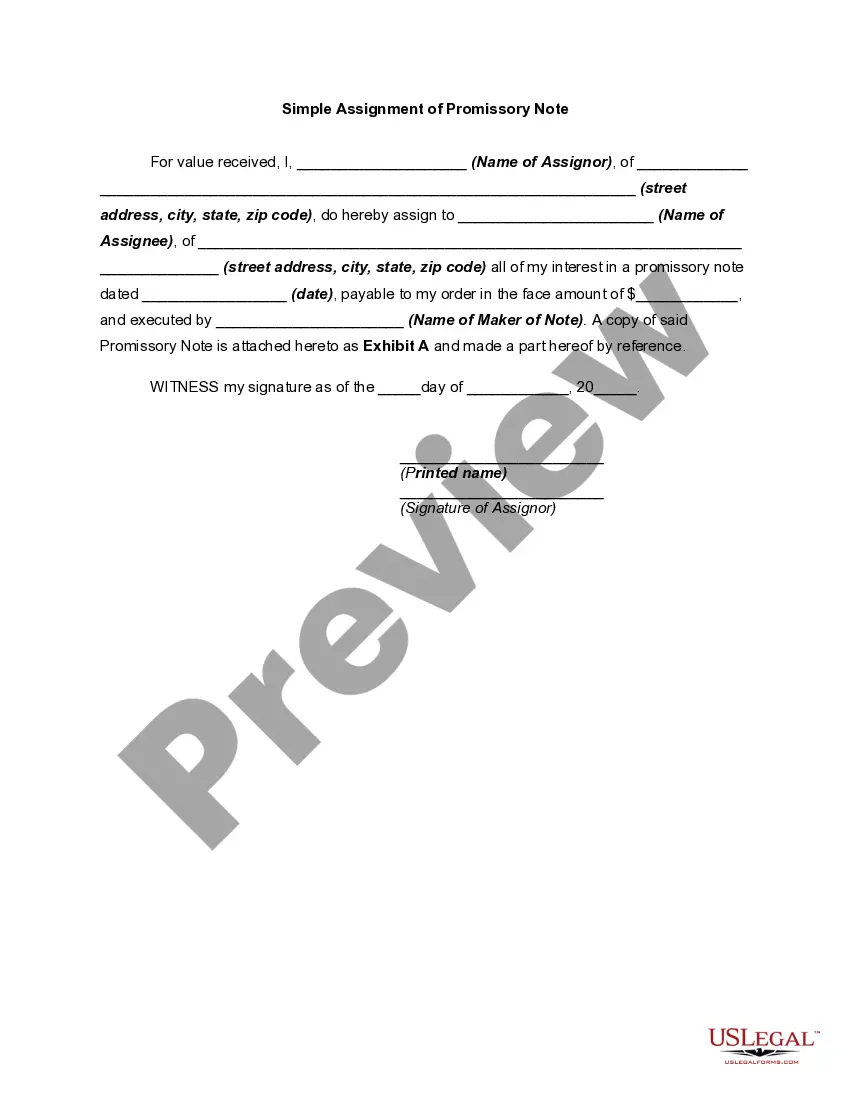

Selecting the appropriate legal document format can be a challenge.

Of course, there are numerous templates available online, but how can you find the legal form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Kentucky Exit Procedure Acknowledgment Regarding Proprietary Information, suitable for both business and personal purposes.

If the form does not meet your requirements, use the Search field to find the appropriate document.

- All documents are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Kentucky Exit Procedure Acknowledgment Regarding Proprietary Information.

- Use your account to review the legal documents you may have purchased previously.

- Visit the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure that you have selected the correct form for your city/state. Check the document using the Preview button and read the form summary to confirm this is indeed the one for you.

Form popularity

FAQ

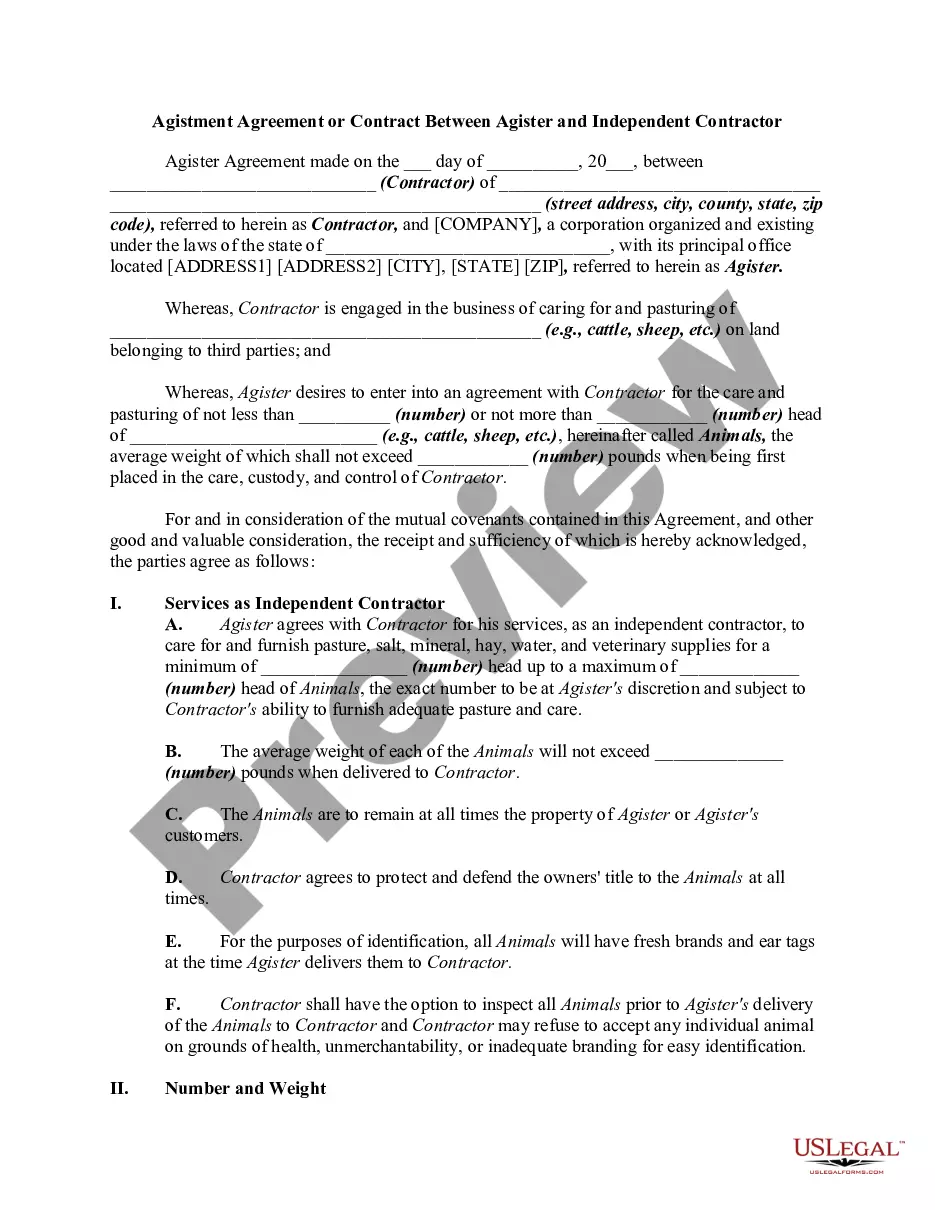

The five different filing statuses are 'Single,' 'Married Filing Jointly,' 'Married Filing Separately,' 'Head of Household,' and 'Qualifying Widow(er).' Each status has its own tax benefits and obligations. Knowing the differences is vital for making informed decisions, especially in relation to the Kentucky Exit Procedure Acknowledgment Regarding Proprietary Information.

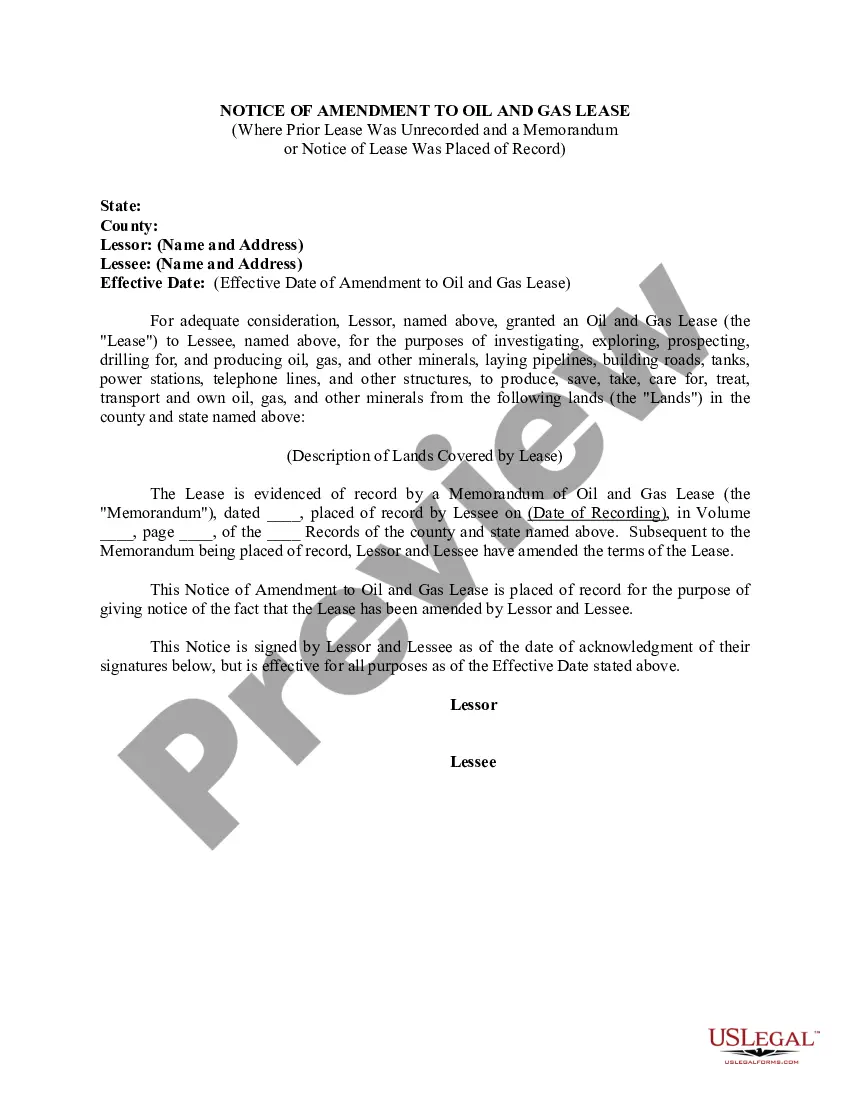

To amend articles of incorporation in Kentucky, you typically need to file an amendment with the Kentucky Secretary of State. This involves submitting a form that details the changes and paying any required fees. If your company is involved in discussions related to the Kentucky Exit Procedure Acknowledgment Regarding Proprietary Information, proper amendment procedures are essential to maintain compliance.

The Kentucky K4 tax form is used by employers to report withholding tax for employees. It outlines the amount of state income tax withheld from an employee’s paycheck. For individuals navigating the Kentucky Exit Procedure Acknowledgment Regarding Proprietary Information, understanding your K4 form can affect your end-of-year tax filings.

Kentucky recognizes several filing statuses: 'Single,' 'Married Filing Jointly,' 'Married Filing Separately,' 'Head of Household,' and 'Qualifying Widow(er).' Each status carries different tax implications and benefits. Be sure to select the one that aligns with your financial situation, especially when addressing the Kentucky Exit Procedure Acknowledgment Regarding Proprietary Information.

When determining your filing status, select the one that best reflects your personal situation, such as 'Single,' 'Married Filing Jointly,' or 'Head of Household.' Your choice impacts your tax calculations and potential refunds. This decision is particularly relevant if you are managing the Kentucky Exit Procedure Acknowledgment Regarding Proprietary Information.

The most favorable filing status is often considered 'Married Filing Jointly.' This status typically offers the lowest tax rates and the highest deductions. Understanding your options can significantly impact your tax obligations, especially when assessing the Kentucky Exit Procedure Acknowledgment Regarding Proprietary Information.

To qualify for the family size tax credit in Kentucky, you must meet specific income requirements and have dependents living with you. This credit aims to assist families with financial relief. If you are considering filing your taxes in conjunction with the Kentucky Exit Procedure Acknowledgment Regarding Proprietary Information, ensure you leverage this credit to maximize your financial benefits.

In Kentucky, filing status 4 refers to 'Head of Household.' This status is beneficial for individuals who are unmarried and can claim dependents. Properly choosing your filing status, such as Head of Household, can optimize your state tax benefits as you navigate through the Kentucky Exit Procedure Acknowledgment Regarding Proprietary Information.

In Kentucky, the Freedom of Information Act (FOIA) allows certain documents to be exempt from public disclosure. These exemptions include personal information, proprietary data, and records concerning ongoing investigations. Understanding these exemptions is critical for businesses that need to safeguard sensitive information, particularly when dealing with the Kentucky Exit Procedure Acknowledgment Regarding Proprietary Information.

Certain individuals and entities may qualify for exemptions from Kentucky income tax, including specific non-profit organizations and certain retirees. Additionally, individuals under a specific income threshold might also be exempt. Stay informed about these details, especially as they relate to the Kentucky Exit Procedure Acknowledgment Regarding Proprietary Information, using the resources found on uslegalforms platform.