A Kentucky Customer Invoice is a document used in the state of Kentucky to outline the details of a transaction between a business and its customer. It serves as an official record of the goods or services provided and the corresponding charges. This invoice is generated to facilitate the payment process and ensure transparency in financial transactions. The Kentucky Customer Invoice typically includes essential information such as the invoice number, date, and payment terms. It also provides details about the customer, including their name, address, and contact information. The invoice identifies the business issuing the invoice, including their name, address, and tax identification number. The invoice further itemizes the products or services provided, including a description, quantity, and unit price. The subtotal of each item is calculated, and any applicable taxes, such as Kentucky state sales tax, may be added. The invoice also shows the total amount due, which is the sum of the subtotal and taxes, minus any applicable discounts or credits. In Kentucky, there may be different types of customer invoices based on the nature of the transaction or industry. Some common variations include: 1. Retail Invoice: Used in the retail sector to capture sales of tangible goods directly to consumers. This type of invoice often includes product codes, descriptions, and prices. 2. Service Invoice: Utilized by service-based businesses where no physical goods are involved. It covers fees for professional services rendered, such as consulting, repairs, or maintenance. 3. Recurring Invoice: Generated for ongoing services or subscriptions requiring regular payments. Recurring invoices are typically issued at fixed intervals, such as weekly, monthly, or annually. 4. Proforma Invoice: Sometimes used to provide an estimated cost to the customer before finalizing the transaction. It outlines the prices and terms without actually demanding payment. 5. Commercial Invoice: Typically used for international transactions involving the export or import of goods. It includes additional information, such as harmonized system (HS) codes, customs details, and shipping terms. 6. Credit Invoice: Issued to rectify billing errors, returns, or to provide credits to customers. It states the adjustment made to the original invoice or the amount credited for future purchases. Kentucky Customer Invoices play a crucial role in maintaining financial records, tracking payments, and ensuring compliance with tax regulations. They provide a comprehensive overview of business transactions, making them an essential part of accounting processes and maintaining transparent relationships with customers.

Kentucky Customer Invoice

Description

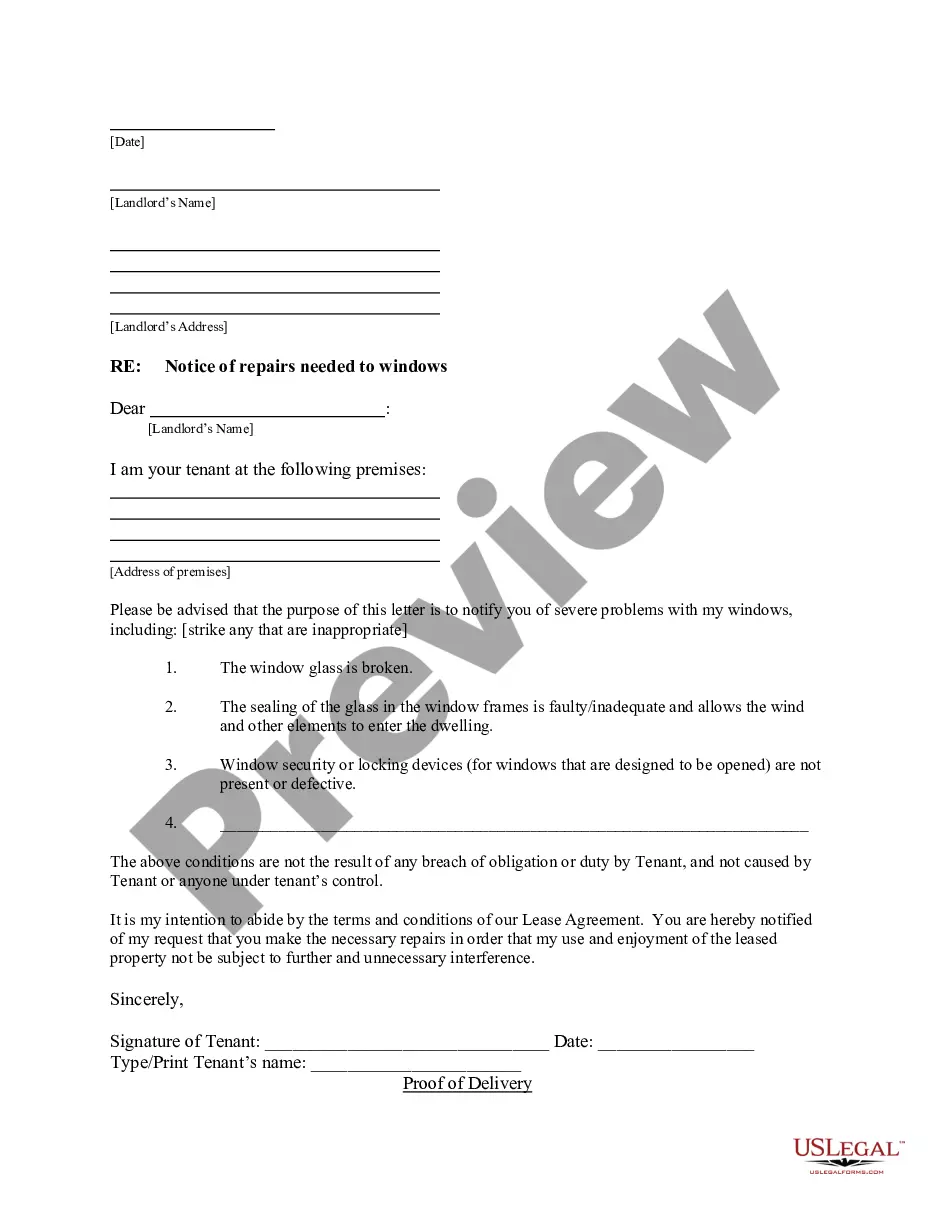

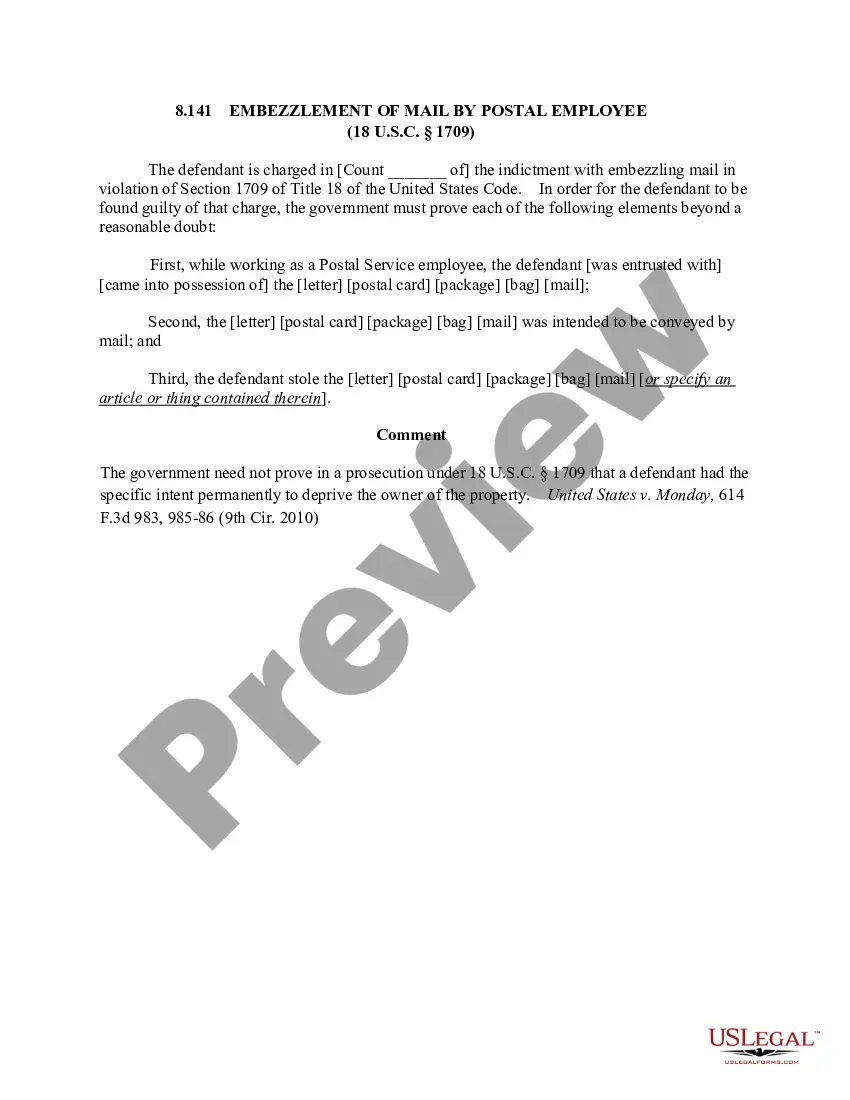

How to fill out Kentucky Customer Invoice?

Have you been within a place the place you need to have paperwork for either company or personal purposes virtually every day time? There are a lot of lawful record themes available online, but getting types you can trust isn`t simple. US Legal Forms delivers 1000s of form themes, such as the Kentucky Customer Invoice, which can be published to satisfy federal and state requirements.

If you are currently knowledgeable about US Legal Forms web site and get your account, merely log in. Following that, it is possible to download the Kentucky Customer Invoice design.

If you do not have an profile and need to begin to use US Legal Forms, abide by these steps:

- Get the form you want and make sure it is for your appropriate city/area.

- Utilize the Preview button to examine the shape.

- Read the description to ensure that you have chosen the right form.

- In case the form isn`t what you are looking for, utilize the Search field to discover the form that meets your requirements and requirements.

- If you find the appropriate form, simply click Get now.

- Opt for the costs prepare you want, complete the necessary details to generate your account, and purchase an order using your PayPal or Visa or Mastercard.

- Select a hassle-free document format and download your copy.

Discover all the record themes you possess bought in the My Forms menu. You can get a extra copy of Kentucky Customer Invoice whenever, if required. Just click the required form to download or produce the record design.

Use US Legal Forms, one of the most extensive collection of lawful kinds, to conserve time as well as steer clear of mistakes. The service delivers appropriately created lawful record themes that can be used for a variety of purposes. Create your account on US Legal Forms and commence generating your way of life a little easier.