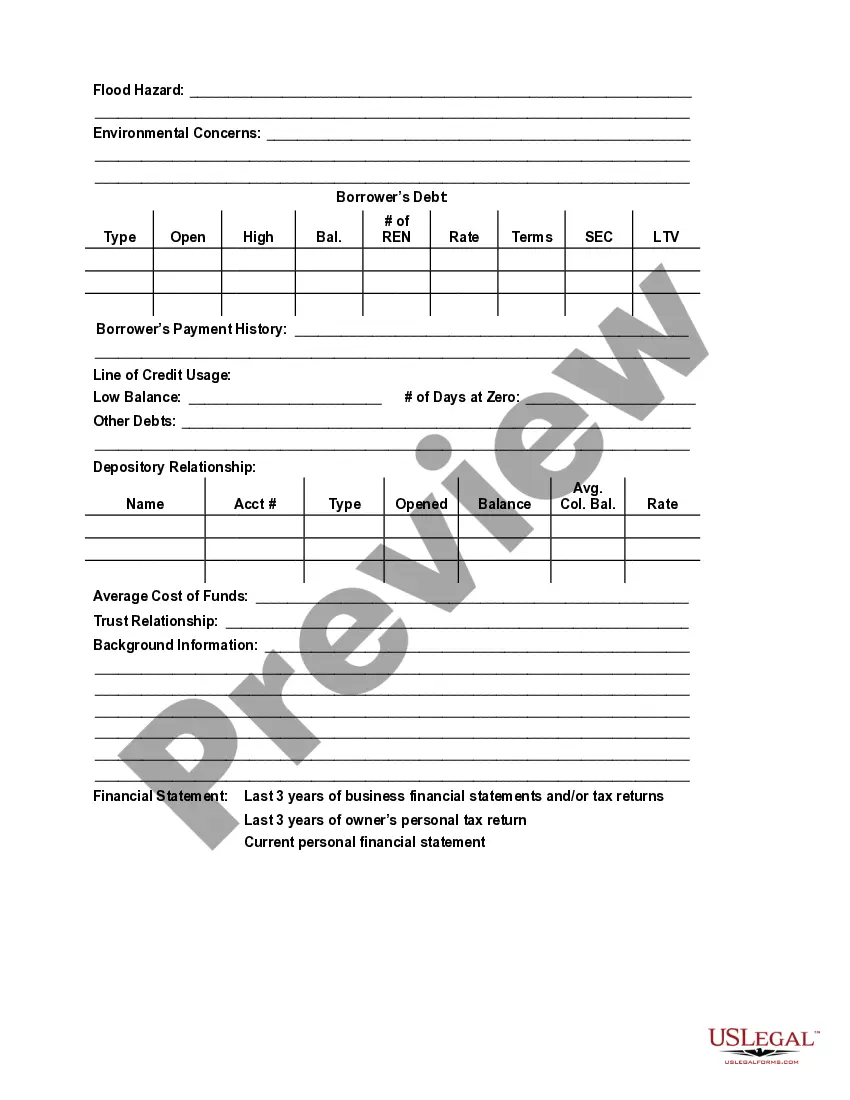

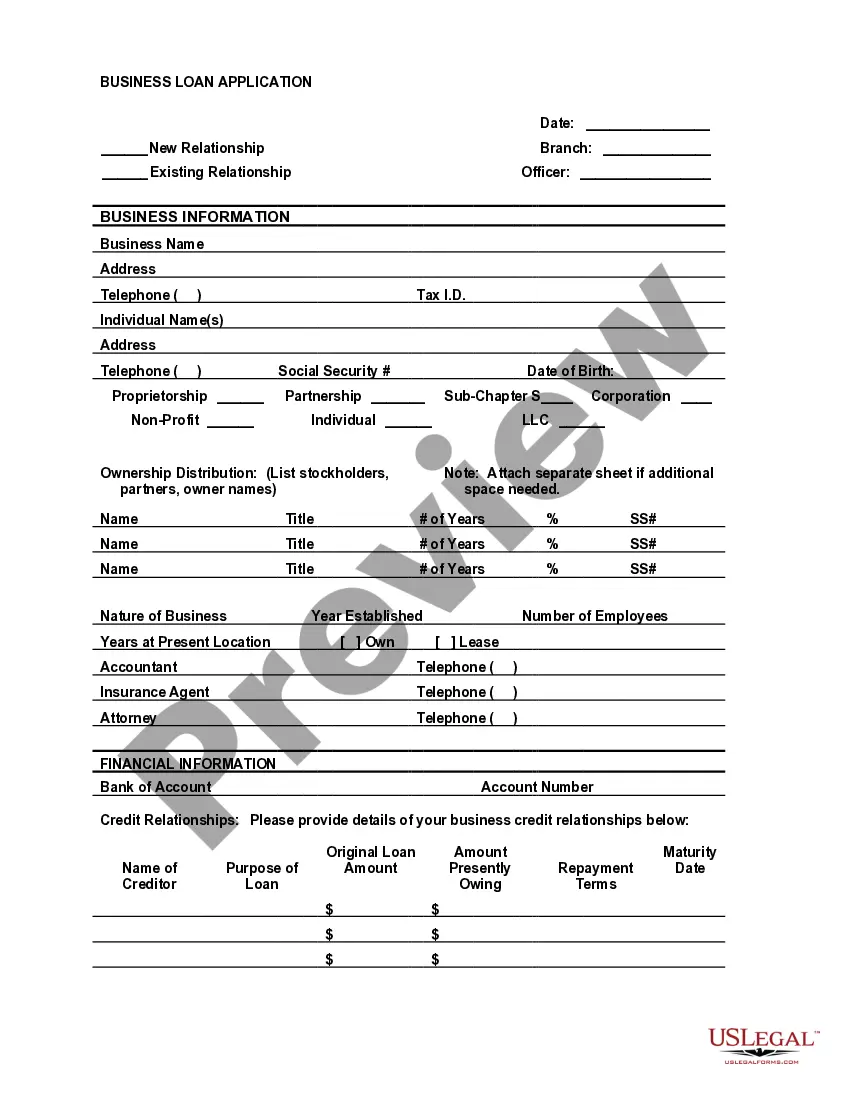

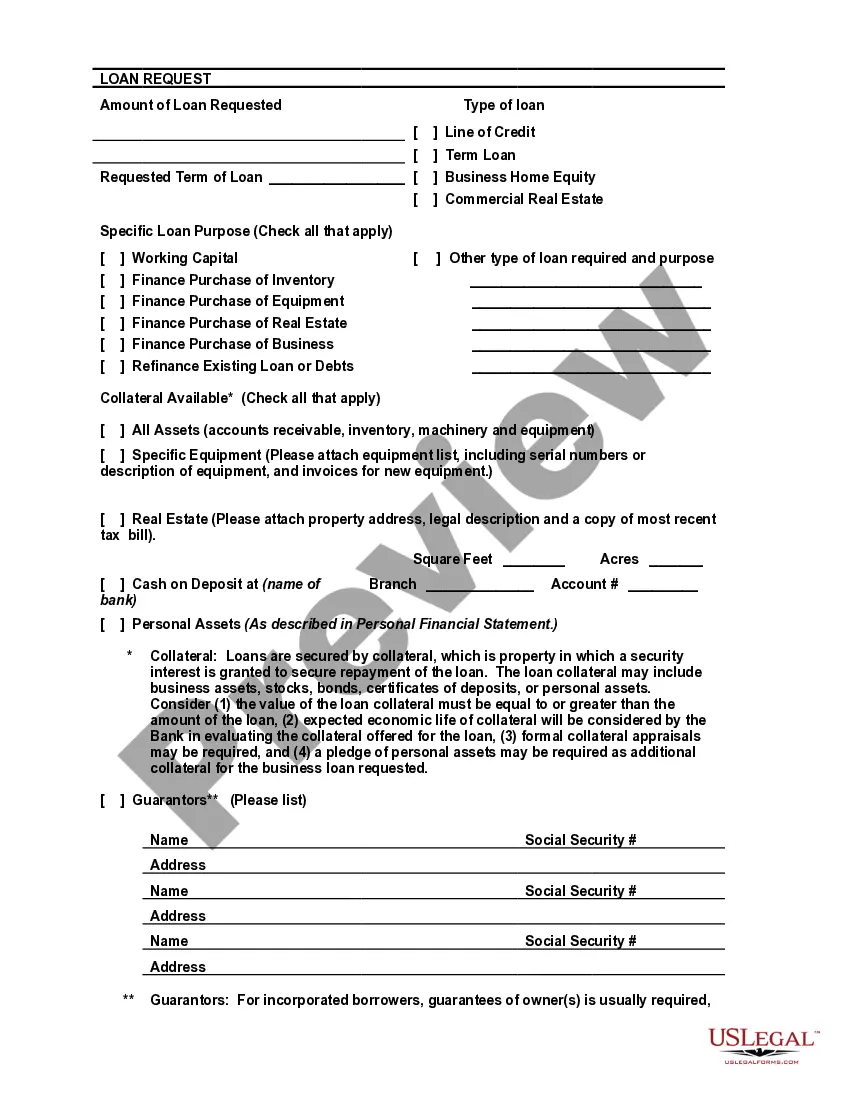

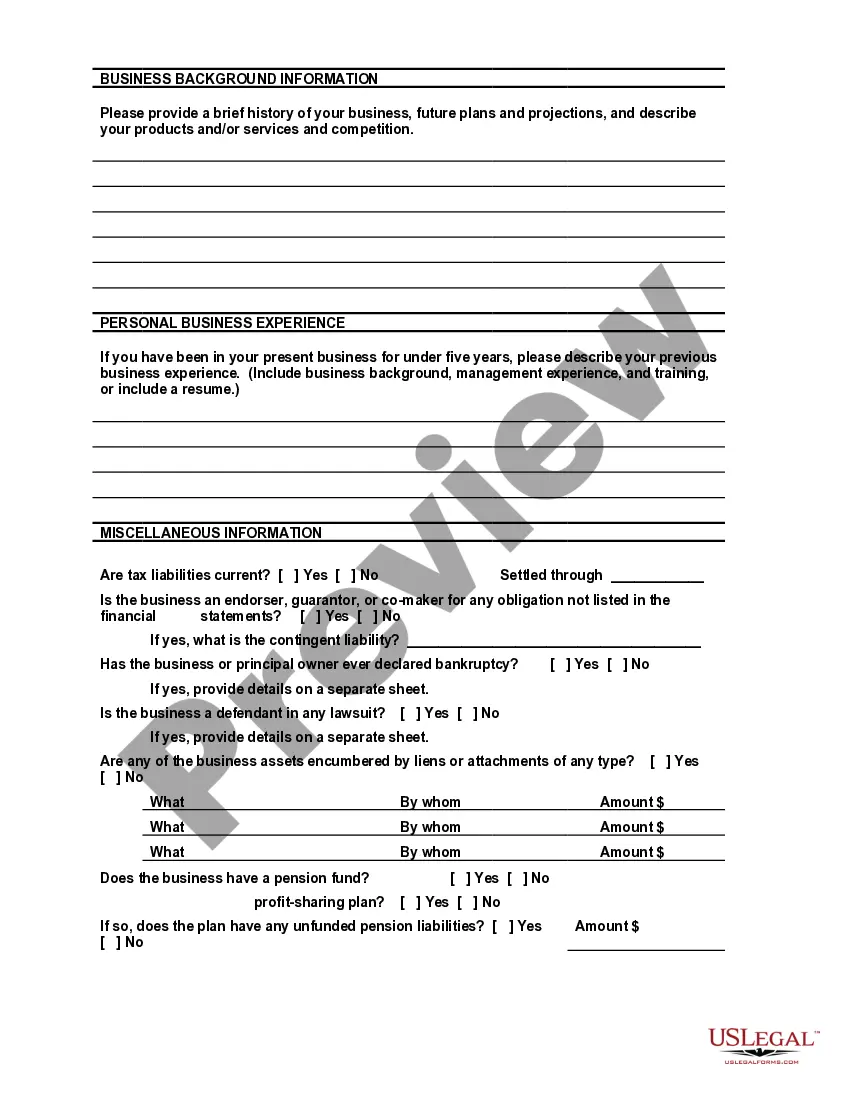

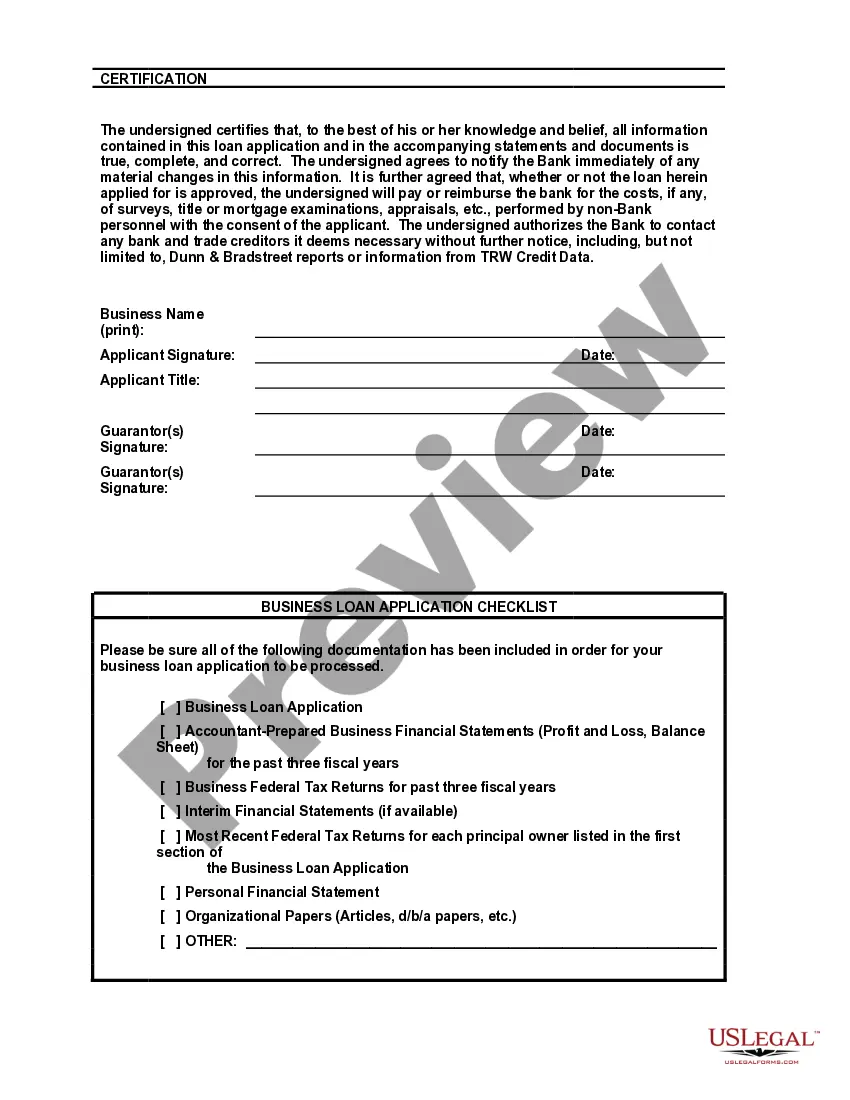

This document combines a representational bank loan application and the form used by a small community bank for an internal review of the application. Linking these two documents, may help you understand what information the bank wants from you as well as how the bank will use that information in making its decision on your business loan application.

Kentucky Bank Loan Application Form and Checklist - Business Loan

Description

How to fill out Bank Loan Application Form And Checklist - Business Loan?

If you want to comprehensive, acquire, or print lawful record web templates, use US Legal Forms, the greatest variety of lawful forms, that can be found on-line. Take advantage of the site`s simple and convenient search to get the documents you need. A variety of web templates for business and individual purposes are sorted by groups and suggests, or keywords and phrases. Use US Legal Forms to get the Kentucky Bank Loan Application Form and Checklist - Business Loan within a handful of clicks.

When you are presently a US Legal Forms consumer, log in in your bank account and then click the Download switch to obtain the Kentucky Bank Loan Application Form and Checklist - Business Loan. You can also access forms you formerly delivered electronically from the My Forms tab of your respective bank account.

If you work with US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the shape for the right metropolis/region.

- Step 2. Make use of the Review solution to look over the form`s content. Do not overlook to see the explanation.

- Step 3. When you are not happy using the type, take advantage of the Lookup industry towards the top of the display to discover other types in the lawful type format.

- Step 4. Upon having located the shape you need, click the Acquire now switch. Pick the pricing strategy you like and add your qualifications to register to have an bank account.

- Step 5. Approach the deal. You can use your Мisa or Ьastercard or PayPal bank account to finish the deal.

- Step 6. Pick the formatting in the lawful type and acquire it on your own product.

- Step 7. Comprehensive, modify and print or sign the Kentucky Bank Loan Application Form and Checklist - Business Loan.

Each and every lawful record format you buy is your own property forever. You have acces to each type you delivered electronically inside your acccount. Click the My Forms portion and decide on a type to print or acquire again.

Remain competitive and acquire, and print the Kentucky Bank Loan Application Form and Checklist - Business Loan with US Legal Forms. There are millions of professional and state-certain forms you may use for the business or individual requirements.

Form popularity

FAQ

But before you approach a bank for a loan, there are a few things you should do to prepare. Know what you need the loan for. ... Know how much you need to borrow. ... Know your credit score. ... Know your financial history. ... Know what collateral you can use. ... Know what interest rate you can afford. ... Know what terms you can afford.

How To Write A Loan Request Letter Add basic information about the business. The first step to drafting a communicative, informative and persuasive business loan request letter is to begin with a header and a greeting. ... Mention the purpose of the loan. ... Assure the lender of repayment. ... Closing the business loan request letter.

How to apply for a business loan in 7 steps Prepare documentation. ... Review your credit score. ... Gather financial documents. ... Create a business plan. ... Consider your collateral. ... Consider which loan to apply for. ... Assemble and submit your application.

Creditagreement_300ps. jpg Loan Application Form. Forms vary by program and lending institution, but they all ask for the same information. ... Resumes. ... Business Plan. ... Business Credit Report. ... Income Tax Returns. ... Financial Statements. ... Accounts Receivable and Accounts Payable. ... Collateral.

Here's everything you need to know about how to get a business loan from a bank. Check your business and personal credit scores. ... Calculate how much money you need ? and how much you can afford to repay. ... Choose a loan type. ... For secured loans, choose your collateral. ... Compare lenders. ... Prepare any documentation you need.

Loan proposal letter Include a brief description of who you are, your background and qualifications, the type of startup you want to create, and where the loan money will be used. And so forth. You can include a photo of yourself and links to your social media pages to personalize your proposal.

How to Write the Perfect Business Loan Proposal Personal information: 'all about you' ... Name and status of your business. ... Your existing assets and resources. ... Making your unique selling point clear. ... Your business goals. ... The purpose of the loan. ... Revenue and profit forecasts.

Financial documents Up to one year of business bank account statements. Personal and business tax returns from the most recent three years. Most recent and projected balance sheets. Income statement and cash flow statement.