A Kentucky Membership Certificate of Nonprofit or Non Stock Corporation is an official document that certifies an individual's membership in a nonprofit or non-stock corporation based in the state of Kentucky. It serves as evidence of ownership or vested interest in the corporation and provides certain rights and privileges to the holder. The Kentucky Membership Certificate of Nonprofit or Non Stock Corporation is primarily used to establish membership for individuals affiliated with a nonprofit organization or non-stock corporation registered in Kentucky. It is typically issued to members upon joining the corporation or after completing the required membership application process. The certificate contains pertinent information such as the name of the nonprofit or non-stock corporation, its registered address, and the designated member's name. Additionally, it may include the date of issuance, a unique certificate number, and the signatures of authorized officers of the corporation. The primary purpose of the Kentucky Membership Certificate is to demonstrate ownership or participation in the nonprofit or non-stock corporation. It signifies any entitlement to voting rights, participation in decision-making processes, receipt of dividends or profit distributions, access to financial records, and other privileges that may be granted by the corporation's bylaws. There are various types of Kentucky Membership Certificates of Nonprofit or Non Stock Corporations, depending on the specific structure and requirements of the organization. Some common types include: 1. Individual Membership Certificate: Issued to individuals who join the nonprofit or non-stock corporation as members. This type of certificate signifies an individual's affiliation and ownership stake in the organization. 2. Lifetime Membership Certificate: Granted to members who have demonstrated outstanding dedication or have made significant contributions to the nonprofit or non-stock corporation over an extended period. Lifetime membership certificates often hold special privileges or benefits. 3. Honorary Membership Certificate: Conferred upon individuals or organizations by the nonprofit or non-stock corporation to recognize their exceptional service or support without requiring monetary investment. Honorary members may not hold voting rights or other membership privileges. 4. Corporate Membership Certificate: Issued to corporations or businesses that seek to become members of a nonprofit or non-stock corporation. This type of certificate demonstrates the organization's affiliation with the corporation and its eligibility to exercise certain membership rights. It is essential to note that the exact format and information contained within the Kentucky Membership Certificate may vary across nonprofit or non-stock corporations. However, the underlying purpose remains consistent, serving as official documentation of membership status and associated rights within the organization.

Kentucky Membership Certificate of Nonprofit or Non Stock Corporation

Description

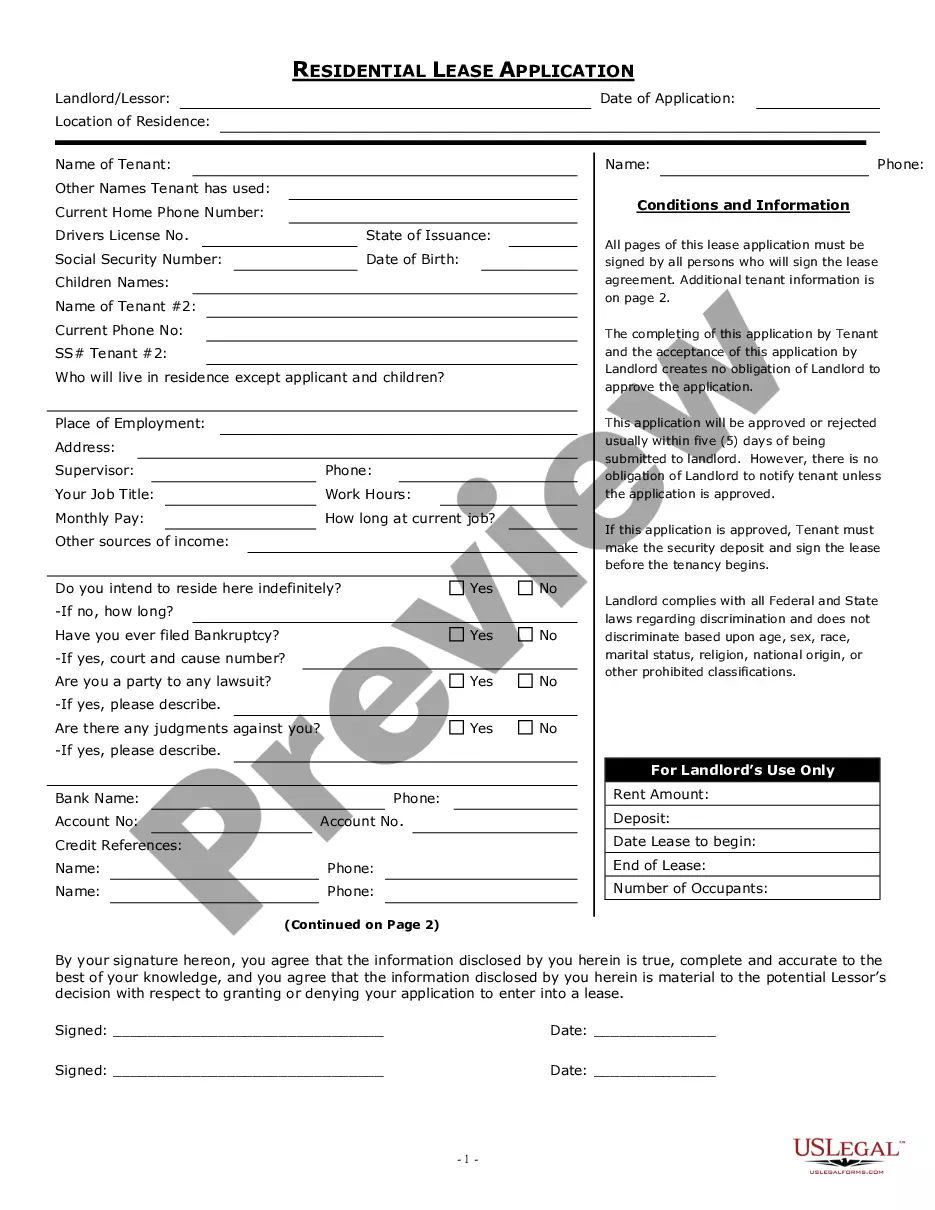

How to fill out Kentucky Membership Certificate Of Nonprofit Or Non Stock Corporation?

Are you in the position the place you will need files for sometimes organization or specific reasons nearly every day time? There are plenty of legitimate file web templates available on the Internet, but discovering versions you can trust isn`t effortless. US Legal Forms delivers thousands of type web templates, like the Kentucky Membership Certificate of Nonprofit or Non Stock Corporation, that happen to be published to meet federal and state requirements.

When you are already knowledgeable about US Legal Forms web site and get your account, just log in. After that, you can download the Kentucky Membership Certificate of Nonprofit or Non Stock Corporation format.

Unless you come with an account and would like to start using US Legal Forms, follow these steps:

- Discover the type you require and make sure it is for the correct city/state.

- Make use of the Review key to analyze the shape.

- Browse the information to ensure that you have chosen the appropriate type.

- If the type isn`t what you are looking for, make use of the Lookup discipline to discover the type that meets your needs and requirements.

- Once you find the correct type, click Purchase now.

- Pick the costs program you need, fill in the necessary information and facts to make your bank account, and purchase an order making use of your PayPal or Visa or Mastercard.

- Select a hassle-free paper file format and download your duplicate.

Locate all the file web templates you may have purchased in the My Forms menu. You can obtain a extra duplicate of Kentucky Membership Certificate of Nonprofit or Non Stock Corporation whenever, if necessary. Just click the necessary type to download or printing the file format.

Use US Legal Forms, by far the most comprehensive assortment of legitimate varieties, in order to save time as well as avoid mistakes. The services delivers expertly made legitimate file web templates that you can use for a variety of reasons. Make your account on US Legal Forms and initiate making your daily life easier.

Form popularity

FAQ

Costs of starting a new nonprofit in Kentucky Articles of Incorporation: $8. 501(c): $275 or $600 IRS fee.

The Internal Revenue Service (IRS) requires that all nonprofits registered at the federal level maintain a minimum of three members on the board of directors.

Apply for federal tax-exempt status You may apply for federal 501(c)(3) status for your Kentucky nonprofit LLC the way most tax-exempt organizations do: by submitting Form 1023.

While the IRS does not impose any maximum limitations, an efficient range for many nonprofits is between eight and 14 members. Some organizations have as many as 20 or more, but this is not ideal because it is difficult to govern this many individuals.

BOARD OF DIRECTORS The number of directors of a non-profit corporation shall not be less than 3. The directors constituting the first board of directors shall be named in the articles of incorporation and shall hold office until the first annual election of directors.

Directors make up the governing body of your nonprofit corporation and are stakeholders in your organization's purpose and success. You'll want to identify three, unrelated individuals to meet IRS requirements.

To start a nonprofit corporation in Kentucky, you must file nonprofit articles of incorporation with the Kentucky Secretary of State. You can file your articles online, by mail, or in person. The articles of incorporation cost $8 to file.

Any number of offices may be held by the same person unless the articles or bylaws provide otherwise, except that no person serving as the secretary, the treasurer, or the chief financial officer may serve concurrently as the president or chair of the board.