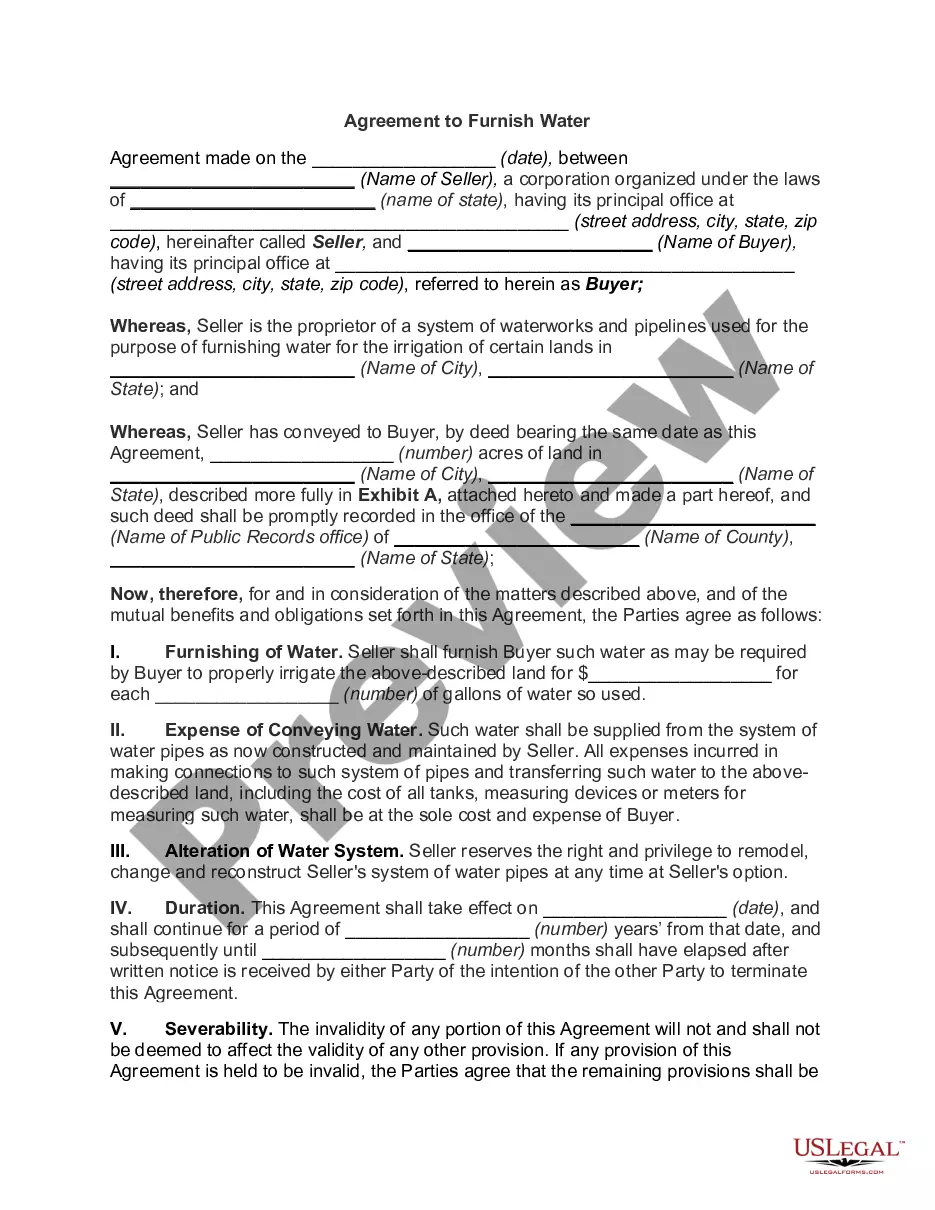

This form may be used to collect information necessary for the preparation of the most common forms of material contracts for a business. The term sheet may be used as a guide when conduct client interviews and should also be consulted during the drafting process. The items in the term sheet are also useful when reviewing contracts that may be drafted by other parties.

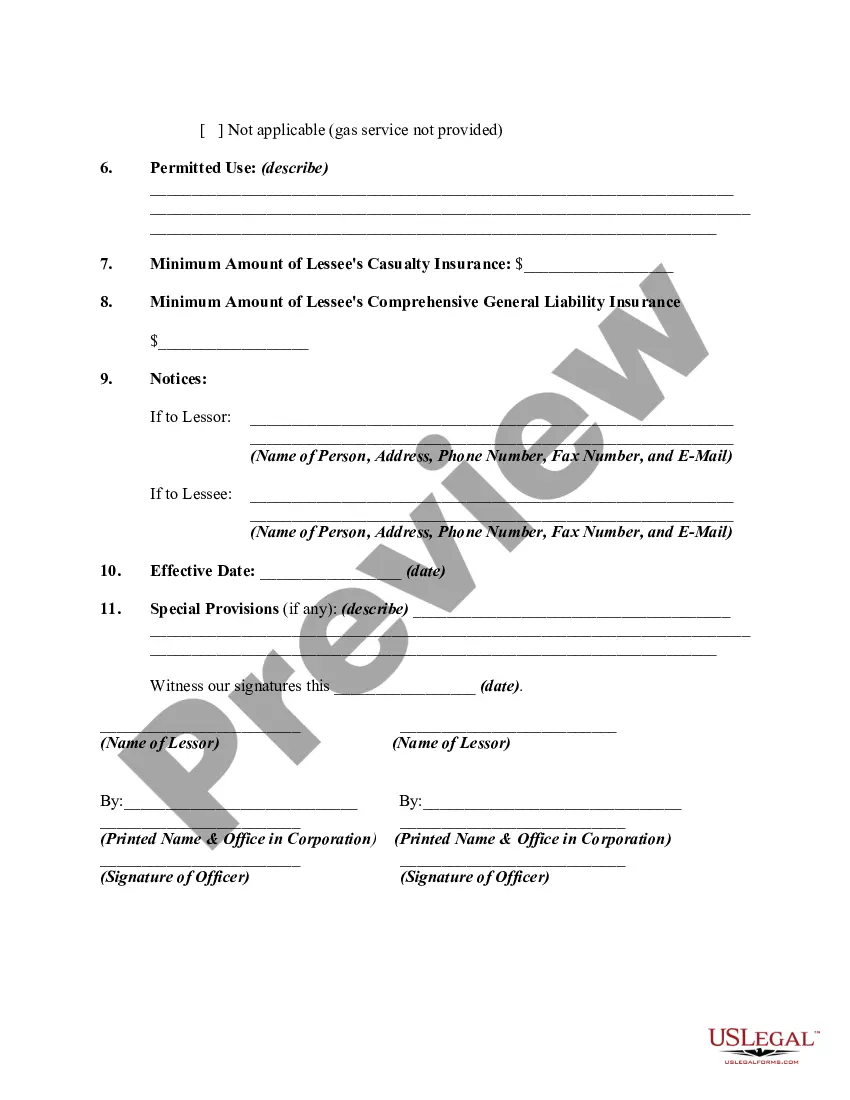

The Kentucky Terms Sheet for Commercial Lease Agreement is a crucial document that outlines the essential terms and conditions governing the lease of commercial property in the state. It serves as a preliminary agreement between the landlord and tenant, providing a clear understanding of the lease's key aspects before the actual lease agreement is formalized. These terms sheet contains several relevant keywords associated with commercial leasing in Kentucky. These terms typically include rent, security deposit, lease term, renewal options, permitted uses, maintenance responsibilities, insurance requirements, utilities, landlord's access rights, termination clauses, and dispute resolution mechanisms. Different types of Kentucky Terms Sheets for Commercial Lease Agreements may exist based on the specific requirements of the commercial property and the preferences of the involved parties. Some common variations include Triple Net (NNN) leases, Gross leases, Percentage leases, and Modified Gross leases. 1. Triple Net (NNN) leases: This type of lease typically shifts the expenses of property taxes, insurance, and maintenance to the tenant, in addition to the agreed-upon rent. 2. Gross leases: In a Gross lease, the tenant pays a fixed amount of rent, and the landlord covers all operating expenses, including taxes, insurance, maintenance, and utilities. 3. Percentage leases: Commonly used in retail spaces, this lease structure involves the tenant paying a base rent plus a percentage of their sales revenue to the landlord. 4. Modified Gross leases: Similar to Gross leases but with certain expenses shared between the landlord and tenant, such as utilities or common area maintenance charges. These different types of lease agreements offer flexibility for both parties, allowing them to tailor the terms sheet to their specific needs and preferences. It is important to note that while the terms sheet outlines key provisions, it does not constitute a legally binding agreement. Instead, it serves as a roadmap for drafting the final lease agreement, ensuring that all parties are aligned and reducing the likelihood of disputes during negotiations.