Stock Certificate Legend refers to wording found on the front or back of a stock certificate which serves as notice of and a brief explanation of certain restrictions affecting the stock shares represented by that stock certificate.

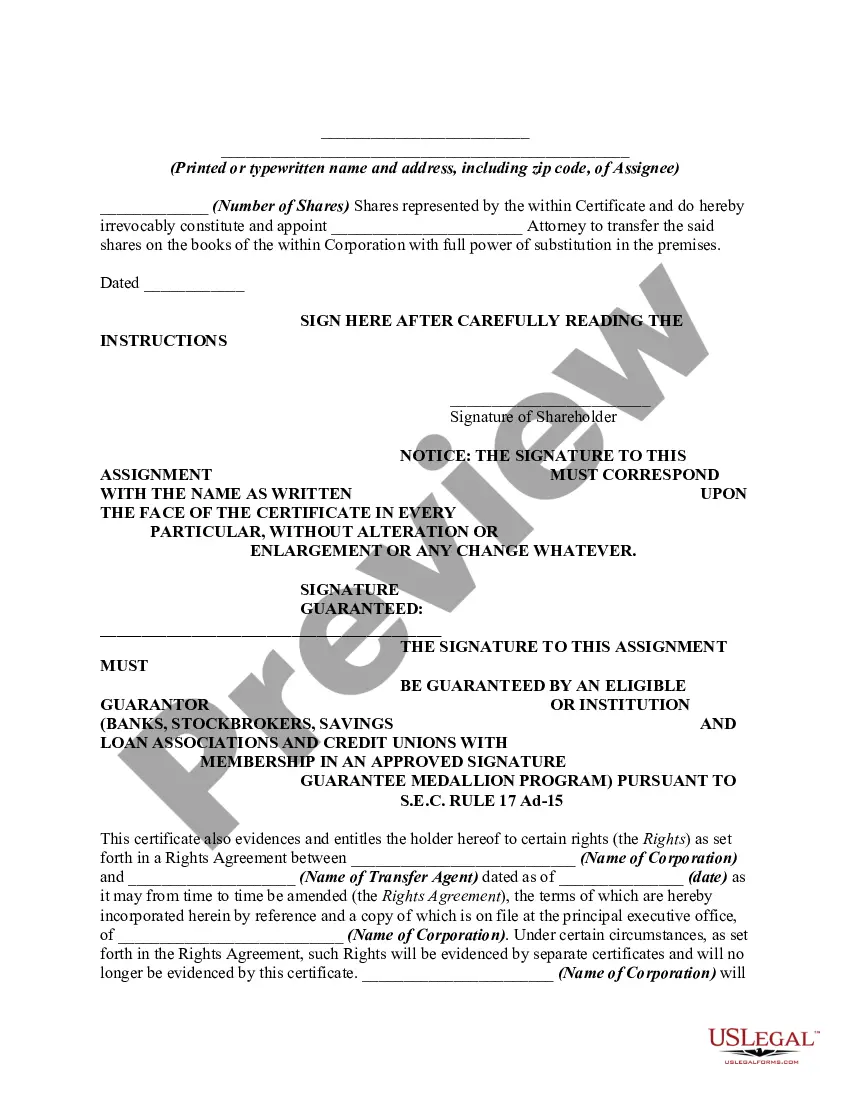

The reverse side of a stock certificate generally bears a form of assignment, which, when properly executed, transfers title to the stock represented by the certificate.

A Kentucky stock certificate legend for common stock is a statement appearing on the face of a stock certificate issued by a company in the state of Kentucky. This legend serves as a disclosure notice to inform investors and potential buyers of certain restrictions and provisions associated with the shares of common stock being issued. The Kentucky Stock Certificate Legend — Common Stock commonly includes the following keywords: 1. Kentucky: Refers to the state in which the stock certificate is issued and governed by the laws and regulations of the state. 2. Stock certificate: A physical document that represents ownership in a corporation and serves as evidence of shareholders' rights. 3. Legend: A statement, usually printed on a stock certificate, that contains legal or informational details. 4. Common stock: Denotes the most frequently issued and widely held type of equity ownership in a corporation. Common shareholders typically have voting rights and are entitled to a share in the company's profits. 5. Restrictive notice: Additional restrictions and provisions listed on the stock certificate, which may specify limitations on transferability, resale, or other conditions imposed on the common stock. Different types of Kentucky Stock Certificate Legend — Common Stock may vary depending on the specific company and its individual requirements. While the overall purpose of the legend remains the same, the content can differ. Some possible variations of the legend might include: 1. Voting rights: Specifies the number of votes each share of common stock carries, allowing the shareholder to participate in corporate decision-making processes. 2. Dividend entitlement: Indicates the rights of common stockholders to receive dividends or a share of the company's profits, if declared. 3. Transfer restrictions: Outlines any limitations on transferring or selling the common stock, such as preemptive rights, right of first refusal, or restrictions on transfer to certain parties. 4. Securities regulations: Discloses compliance with applicable federal and state securities laws, ensuring transparency in the issuance and trading of the common stock. 5. Redemption provisions: Specifies whether the company has the right to redeem the common stock, either at a specified price or at its discretion, allowing for potential future repurchase by the corporation. It's important to note that the specific content and language of the Kentucky Stock Certificate Legend — Common Stock may vary based on the company's legal counsel, the nature of the business, and any specific provisions or preferences outlined in the corporation's articles of incorporation or bylaws.A Kentucky stock certificate legend for common stock is a statement appearing on the face of a stock certificate issued by a company in the state of Kentucky. This legend serves as a disclosure notice to inform investors and potential buyers of certain restrictions and provisions associated with the shares of common stock being issued. The Kentucky Stock Certificate Legend — Common Stock commonly includes the following keywords: 1. Kentucky: Refers to the state in which the stock certificate is issued and governed by the laws and regulations of the state. 2. Stock certificate: A physical document that represents ownership in a corporation and serves as evidence of shareholders' rights. 3. Legend: A statement, usually printed on a stock certificate, that contains legal or informational details. 4. Common stock: Denotes the most frequently issued and widely held type of equity ownership in a corporation. Common shareholders typically have voting rights and are entitled to a share in the company's profits. 5. Restrictive notice: Additional restrictions and provisions listed on the stock certificate, which may specify limitations on transferability, resale, or other conditions imposed on the common stock. Different types of Kentucky Stock Certificate Legend — Common Stock may vary depending on the specific company and its individual requirements. While the overall purpose of the legend remains the same, the content can differ. Some possible variations of the legend might include: 1. Voting rights: Specifies the number of votes each share of common stock carries, allowing the shareholder to participate in corporate decision-making processes. 2. Dividend entitlement: Indicates the rights of common stockholders to receive dividends or a share of the company's profits, if declared. 3. Transfer restrictions: Outlines any limitations on transferring or selling the common stock, such as preemptive rights, right of first refusal, or restrictions on transfer to certain parties. 4. Securities regulations: Discloses compliance with applicable federal and state securities laws, ensuring transparency in the issuance and trading of the common stock. 5. Redemption provisions: Specifies whether the company has the right to redeem the common stock, either at a specified price or at its discretion, allowing for potential future repurchase by the corporation. It's important to note that the specific content and language of the Kentucky Stock Certificate Legend — Common Stock may vary based on the company's legal counsel, the nature of the business, and any specific provisions or preferences outlined in the corporation's articles of incorporation or bylaws.