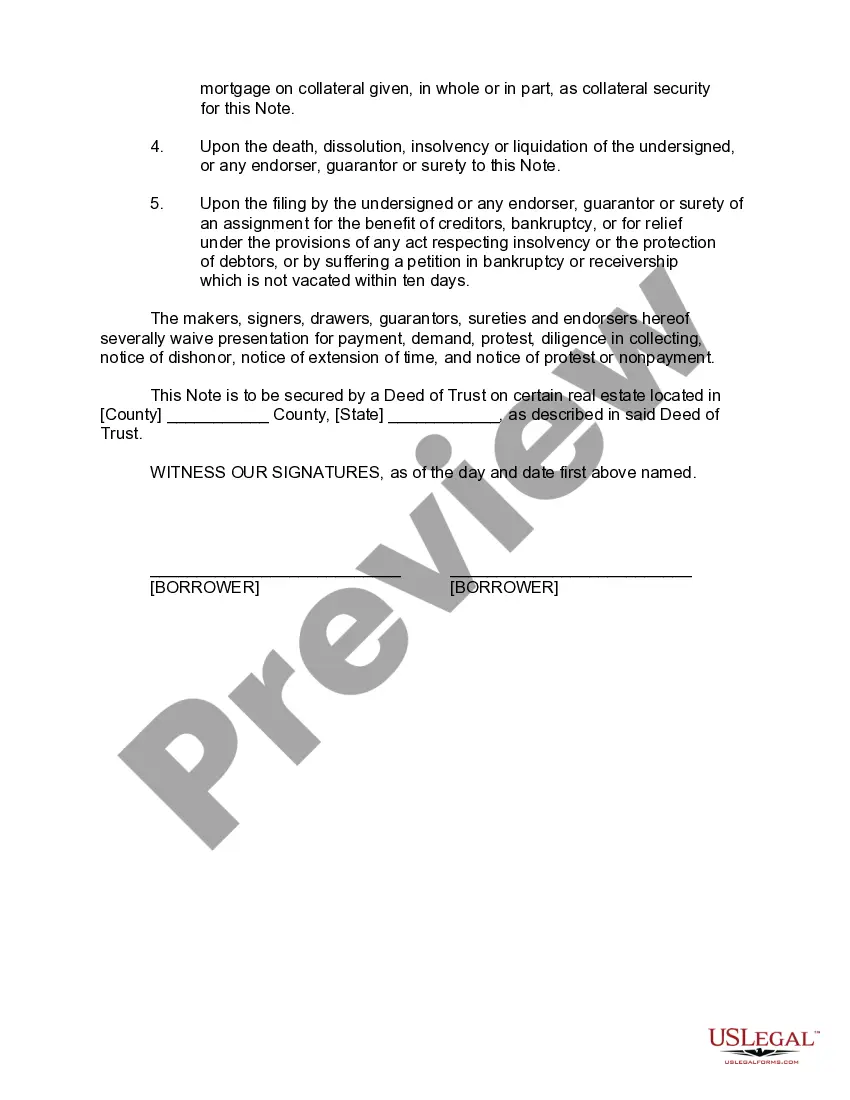

Kentucky Promissory Note - Long Form

Description

How to fill out Promissory Note - Long Form?

If you wish to total, obtain, or print out sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Make use of the site's straightforward and user-friendly search to find the documents you require. Various templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to acquire the Kentucky Promissory Note - Long Form with just a few clicks.

Every legal document template you purchase is yours indefinitely. You can access every form you have acquired in your account. Click on the My documents section to select a form for printing or downloading again.

Stay ahead and download, and print the Kentucky Promissory Note - Long Form using US Legal Forms. There is a wide variety of professional and state-specific forms that you can use for your business or personal needs.

- If you are already a client of US Legal Forms, Log In to your account and click the Download button to obtain the Kentucky Promissory Note - Long Form.

- You can also access forms you have previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct area/region.

- Step 2. Use the Preview option to review the contents of the form. Don't forget to read the details.

- Step 3. If you are not satisfied with the type, use the Search field at the top of the display to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Get now button. Choose the payment plan you prefer and provide your information to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify and print or sign the Kentucky Promissory Note - Long Form.

Form popularity

FAQ

You should file a Kentucky Promissory Note - Long Form in a secure place, such as a personal file or a secure digital storage solution. Ensure that both parties have access to a copy of the note for transparency, especially in case of disputes. Additionally, consider consulting with a legal professional for guidance on any specific requirements regarding filing.

A Kentucky Promissory Note - Long Form does not automatically appear on your credit record unless the lender takes specific action, such as reporting late payments or defaults. It’s essential to manage your payments responsibly, as this can affect your credit score. Documenting the promissory note and keeping it in good standing can help maintain a positive financial profile.

When dealing with a Kentucky Promissory Note - Long Form, tax reporting depends on whether you are the lender or borrower. If you receive interest on the note, you must report that income on your tax return. On the other hand, if you are the borrower, you typically do not need to report the principal as income, but keep accurate records for future reference.

To record a Kentucky Promissory Note - Long Form, visit your local county clerk’s office. Recording the note ensures public acknowledgment of the debt and can protect the lender’s interests. Some jurisdictions may allow you to file documents online, so check with your local office for their specific process. Make sure to keep a copy for your records.

Yes, there is a time limit on enforcing promissory notes in Kentucky. Generally, the statute of limitations for a Kentucky Promissory Note - Long Form is six years. After this period, the lender may no longer be able to take legal action to collect the amount owed. It's crucial to stay aware of these timelines to protect your interests.

The length of a promissory note varies based on the agreement made by the parties involved. In Kentucky, a Kentucky Promissory Note - Long Form can last from a few months to several years. It all depends on how the parties define the repayment terms. This adaptability makes promissory notes a useful tool for managing debt.

Promissory notes can be either short-term or long-term, depending on the agreement between the parties. Typically, a Kentucky Promissory Note - Long Form outlines a payment schedule that can extend over several years. It's essential to specify the time frame in the note to avoid confusion. This flexibility allows you to meet various financial needs.

In Kentucky, there is no specific maximum amount for a promissory note. Nevertheless, the amount should align with what the parties can realistically handle. The Kentucky Promissory Note - Long Form can accommodate large sums, making it essential to draft clearly defined terms. Always consider local laws and potential limitations before finalizing the amount.

Yes, a notarized promissory note is legally binding in the state of Kentucky. When you have a Kentucky Promissory Note - Long Form that is signed in front of a notary, it adds a layer of verification to the agreement. This notarization means the parties involved agree to the terms laid out. It is crucial to follow the legal standards to ensure enforceability.

To get a Kentucky Promissory Note - Long Form, consider using an established online resource that provides legal forms tailored to your needs. After selecting the appropriate template, you will input your unique information, such as the borrower’s and lender’s names and the terms of the agreement. This method is efficient and ensures you have all necessary components in place. Once completed, you can easily print and sign your promissory note.